Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 29 Jun, 2021

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

The global economic recovery from the coronavirus-caused downturn is accelerating—but the rebound is uneven across regions.

Alongside their differing economic conditions, inflation may affect regions in different ways according to recent outlooks from S&P Global Economics. Asia-Pacific economies face transitory inflation risks that should ease, but a prolonged uneven global recovery could destabilize capital flows in the region. Although headline inflationary pressures will likely be higher in Europe this year, S&P Global Economics doesn’t expect core inflation in the area to reach 1.69% before year-end 2024. S&P Global Economics agrees with the Federal Reserve that price gains will likely be “largely transitory” and expects the U.S. central bank to next raise interest rates in the first quarter of 2023. Meanwhile, in Canada, consumer price inflation has already reached 3.6% this year and is expected to hover around 3% Across Latin America, inflation has surpassed expectations. Nonetheless, emerging market economies were the first to endure inflationary pressures and many have taken rate actions to respond.

Across the Asia-Pacific region, “the recovery still has a long runway, except for a few cases where output is either close to or above the pre-COVID trend” but “patchy performance in the second stage of the pandemic will mean its recovery remains unbalanced for a while longer,” S&P Global Ratings Chief Asia-Pacific Economist Shaun Roache and Asia-Pacific Economist Vishrut Rana said in a recent outlook.

S&P Global Economics forecasts regional growth to total 7.1% this year, with varying levels of expansion across the region due to the differing conditions: 8.3% in China, 9.5% in India, 2.5% in Japan, and 4.9% in Australia. “In most cases, activity remains well below our pre-COVID forecasts (which in normal times are often not far from the prevailing trend). This is a better measure of the recovery than comparing with the pre-pandemic level, since each economy's trend growth rate is different. Economies with high trend growth will reach pre-pandemic activity levels faster but would still be far away from their pre-COVID trend levels.”

In Europe, the recovery has transitioned from industry to services in a broad-based rebound, to the tune of potential overall GDP growth of 4.4% this year and 4.5% in 2022, according to S&P Global Ratings Chief EMEA Economist Sylvain Broyer and Senior Economist Marion Amiot.

“The main difference in our third-quarter projection compared with our second-quarter outlook is the rosier long-term outlook, now that we have more clarity about implementation of the Next Generation EU plan. In our view, the size of the plan will be enough to limit long-term scarring from this crisis as well as close the eurozone output gap by 2024,” the pair said in their recent outlook. “Implementation of the Next Generation EU plan also marks a shift in the nature of fiscal support. At the start of the crisis, governments concentrated on maintaining household incomes and companies' access to finance. Now, they are looking to restart growth through large investment programs. The focus of these investments on the green transition and digitalization also suggests a boost to the eurozone's long-term productivity prospects.”

The U.S. economy is “sizzling,” according to S&P Global Ratings Chief U.S. Economist Dr. Beth Ann Bovino, due to the improved vaccination outlook, states’ reopening, and the boost from the Biden Administration’s two stimulus packages. S&P Global Economics now expects the world’s biggest economy to grow 6.7% this year and 3.7% next year, marking an improvement from its March forecast of 6.5% and 3.1%, respectively. Still, the U.S.’s return to pre-pandemic employment won’t likely materialize until the fourth quarter of 2022, but the unemployment rate could stabilize under 4% by the third quarter of 2023. “For consumers, the party is only just getting started,” Dr. Bovino said in her latest forecast, detailing how she “expect[s] the U.S. economy to experience a summer boom, fueled by reduced virus fears, elevated savings.”

Risks to Canada’s economic recovery are balancing, and the country is set to enjoy improved GDP growth of 6.1% this year and 3.2% next, up from a previous outlook in March of 5.5% and 2.4% respectively, according to S&P Global Ratings Senior Economist Satyam Panday.

The recovery is developing more unevenly elsewhere in the Americas. Major Latin American economies are likely to grow 5.9% this year—a massive improvement from the previous March projection of 4.9% GDP growth due to surprising performance in the first quarter—but most economies across the region will suffer lower and slower growth in 2022, according to S&P Global Ratings senior Latin America economist Elijah Oliveros-Rosen. “On average, we expect GDP in the region to return to its pre-pandemic level in the middle of 2022. However, downside risks to our long-term growth outlook have risen, as less predictable policy actions amid higher social instability could dampen investment and lower productivity,” he said in his latest forecast.

Global attention remains focused on emerging market economies, which continue to struggle with gaining control over the coronavirus crisis. Strong first quarter performance and an improving vaccine rollout prompted S&P Global Economics to raise its 2021 growth forecast for emerging markets economies, sans China and India, to 4.6% from 4.4% earlier this year.

“The top risk facing EMs is a slower-than-expected rollout of the vaccines,” S&P Global Ratings Chief Economist Paul Gruenwald said. “A second, partly exogenous, risk to EMs is an uneven recovery from the pandemic, featuring outsized U.S. growth and inflation leading to an early tightening of U.S. monetary policy.”

Today is Tuesday, June 29, 2021, and here is today’s essential intelligence.

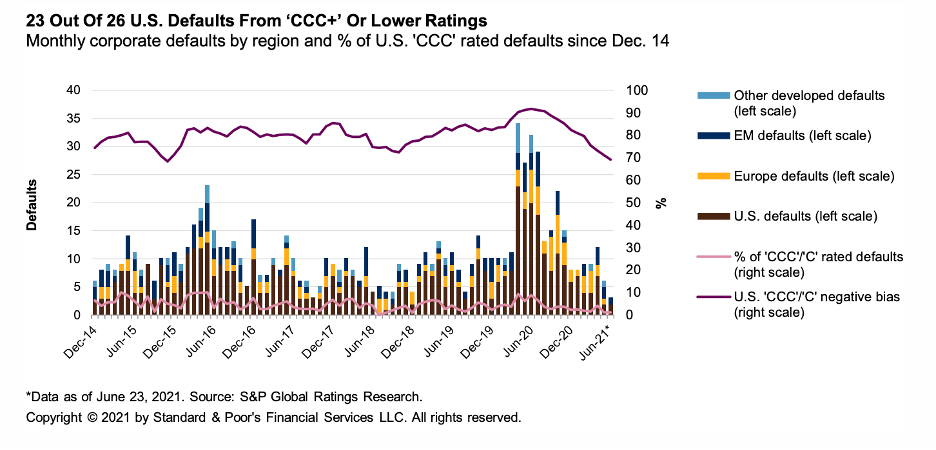

Default, Transition, and Recovery: About 90% of 2021 Corporate Defaults are From 'CCC+' or Lower-Rated Entities

The number of defaults so far in 2021 surpassed defaults at this point in 2018 (46) but remains lower than that in 2020 (120) and 2019 (60). Defaults so far in 2021 have largely come from 'CCC+' or lower ratings—at 92% globally and 89% in the U.S. region—as the lowest-rated issuers tend to be more vulnerable to external market pressures.

—Read the full report from S&P Global Ratings

IPO Would be 'Colossal Distraction' for $2B Pet Broker, but 'Never Say Never'

Technology-enabled pet insurance broker Bought By Many Ltd., valued at more than $2 billion after a recent $350 million funding round, has no plans to float on the stock market, according to co-founder and CEO Steven Mendel.

—Read the full article from S&P Global Market Intelligence

Mainland China, Hong Kong IPO Markets to Remain Strong In the Rest of 2021

Mainland China and Hong Kong, among the world's top listing destinations, are looking at a busy calendar for initial public offerings in the second half of 2021, after funds raised globally via share sales in the first six months surpassed the amount raised during any half-yearly period in the last five years.

—Read the full article from S&P Global Market Intelligence

Insurers Log Big Q1 Premium Growth In 'Increasingly Important' U.S. E&S Market

Of the 20 leading U.S. excess and surplus insurers, 15 posted double-digit year-over-year growth in direct premiums written during the first quarter, according to an S&P Global Market Intelligence analysis.

—Read the full article from S&P Global Market Intelligence

Insurance Companies Outperform Market Even as S&P 500 Hits Fresh Record Highs

Insurance stocks outperformed the broader market in a week that saw the S&P 500 record multiple all-time highs. The stock benchmark closed the week ending June 25 up 2.74% at 4,280.70, while the SNL U.S. Insurance Index rose 3.44% to 1,388.81.

—Read the full article from S&P Global Market Intelligence

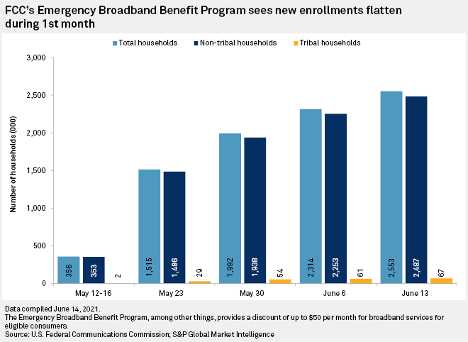

COVID Broadband Subsidy Program Sees 'Strong Start,' but More Outreach Needed

Just one month in, more than 2.5 million American households had taken advantage of a federal broadband subsidy program aimed at blunting the effect of the coronavirus pandemic. But millions more eligible households have yet to sign up, experts say, meaning more outreach is needed.

—Read the full article from S&P Global Market Intelligence

Google, Hyper-Scalers Leading Charge In Industry Push to go 24/7 Carbon Free

In May 2021, Alphabet Inc. subsidiary Google LLC announced a partnership with The AES Corp. to supply 24/7 carbon-free energy to Google's data centers in Virginia and in doing so provided a glimpse into its strategy of being carbon-free on an hourly basis globally by 2030.

—Read the full article from S&P Global Market Intelligence

ESG Brief: Cyber Risk Management In U.S. Public Finance

As cyberattacks increase in sophistication and frequency, U.S. public finance issuers must embed cybersecurity into their comprehensive risk-mitigation strategies.

—Read the full article from S&P Global Market Ratings

Turmoil Casts Doubt on Latin America's Mining of Energy-Transition Minerals

Latin America could be on the verge of a mining bonanza. Governments and businesses all over the world are rushing to cut their greenhouse gas emissions, and the region is a critical supplier of the minerals that underpin solar panels, wind turbines and electric vehicles. But extracting those minerals is expensive and creates its own set of environmental and social consequences.

—Read the full article from S&P Global Market Intelligence

Recognizing Limitations and Potential Of REDD+ Credits May Offer Way Out of A Destructive Debate

Carbon finance has just started to become a mainstream concept in business and industry, but it has for some time been at the center of very emotional debates, especially when it comes to carbon credits based on the protection of endangered forests.

—Read the full article from S&P Global Platts

FERC Repeats It Cannot Assess Gas Project's Climate Impact In Expanded Review

The U.S. Federal Energy Regulatory Commission has released the draft version of an additional climate review of a pending Columbia Gulf Transmission pipeline project in Louisiana, finding once more that agency staff could not draw conclusions about the significance of natural gas projects' contributions to climate change.

—Read the full article from S&P Global Platts

Listen: Extreme Weather, Cyberattacks Demand Stronger Energy Resilience

As extreme weather events continue across the U.S., they're disrupting energy supplies and demanding more planning for the future. Economist and energy expert Paul Sullivan says our society and energy systems are a lot more brittle and vulnerable than most people think. Sullivan is the lead of the Energy Industry Study at the National Defense University and a lecturer at Johns Hopkins University, where he teaches a class on energy and environmental security.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Platts

Watch: Market Movers Europe, Jun 28-Jul 2: OPEC+ to Ease Output Cuts, Carbon Prices Reach All-Time Highs

In this week's highlights: Oil markets watch for the OPEC+ group's plans to ease output cuts; carbon prices rebound to test an all-time high; all eyes are on the auction for Ukrainian gas transit capacity; and steel markets expect Russia to impose a new export tax.

—Watch and share this Market Movers video from S&P Global Platts

Niger Delta Militants Threaten to Resume Attacks on Nigeria's Oil Installations

Nigeria has been shaken by new threats made by Niger Delta militants to renew attacks on oil installations and cripple output in OPEC's largest African producer. The Niger Delta Avengers (NDA) -- a group of rebels responsible for the bulk of the attacks on Nigeria's oil infrastructure -- have vowed to commence bombing of oil installations across the Niger Delta to protest the government's neglect of the region.

—Read the full article from S&P Global Platts

Australia Tips Oversupply In Global LNG Market Through to 2023

The global LNG market is likely to be marked by a surplus of supply over the next couple of years, which will place downward pressure on prices, Australia's Department of Industry, Science, Energy and Resources said in its Resources and Energy Quarterly released June 28.

—Read the full article from S&P Global Platts

Shift to Steel Imports 'Urgent' for Brazilian Capital Goods Sector Operations: Abimaq

The Brazilian capital goods industry will be able to maintain its focus on exports if it significantly steps up use of imported steel products, thus diversifying supply channels amid costly and short domestic material availability, sources said.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language