Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 2 Jun, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

What AI Development Means for Cybersecurity

From dystopian novels to Hollywood blockbusters, AI’s potential to hurt or help humanity has long captured the public’s imagination. Until recently, however, the technology’s capabilities didn’t match its hype. Then came large language models and AI’s ability to generate realistic human language.

“What that effectively means is we can create this new type of AI algorithm that can do so much more than we thought before,” Kensho Technologies CEO Bhavesh Dayalji said on S&P Global’s “The Essential Podcast” in May. Kensho is an AI and innovation hub at S&P Global.

New AI models such as ChatGPT are speeding up the potential for enterprises to process massive amounts of data, and this is generating a lot of interest from the cybersecurity industry.

OpenAI’s release of ChatGPT in November 2022 catapulted generative AI into the mainstream, despite ChatGPT not being the first of its kind, 451 Research analysts Nick Patience and Alex Johnston wrote in an April report. Since then, technology vendors have rushed to show they are ready to compete in the generative AI arena. At this year’s RSA Conference, a cybersecurity forum, AI was “by far the frothiest theme of the year,” 451’s information security analyst team wrote.

Microsoft’s use of partner OpenAI’s technology in the Big Tech company’s proprietary security software is one of the developments capturing attention, 451 Research analyst Scott Crawford wrote in an April report. Applying the large language model (LLM) technology underpinning ChatGPT and its successors to cybersecurity could be significant for the industry, Crawford said. Still, the 451 analyst predicts that human critical thinking will remain key as security operations centers embrace automation. Humans will be needed to ensure the effective and responsible use of LLM technology.

Crawford and 451 security analysts Garrett Bekker and Daniel Kennedy discussed the role of generative AI in security operations in a “Next in Tech” podcast in April. They agreed that AI could have a role in alleviating staffing crunches but would be unlikely to replace humans altogether.

A more sinister implication of generative AI for cybersecurity is that the technology is likely to be utilized by bad actors as well. The industry will need to adapt to prepare for this potential, Crawford and Kennedy said in April.

“As technologies become more directly integrated with each other, the likelihood that machines may be able to manipulate a wider range of security controls could raise the bar on definitions of ‘zero trust’ and proving the authenticity of interaction,” the 451 analysts said.

In terms of LLM technology’s potential for enterprise more broadly, Kensho’s Dayalji said much remains to be worked out. Powerful AI models can still make mistakes, and those mistakes can have consequences.

“It’s easy to be negative about the issues … But this is innovation,” Dayalji said. “Innovation happens with experiments and refining it and making sure that it's actually adding value to society and all of the workflows that we're trying to accelerate.”

Today is Friday, June 2, 2023, and here is today’s essential intelligence.

Written by Christina Mitchell.

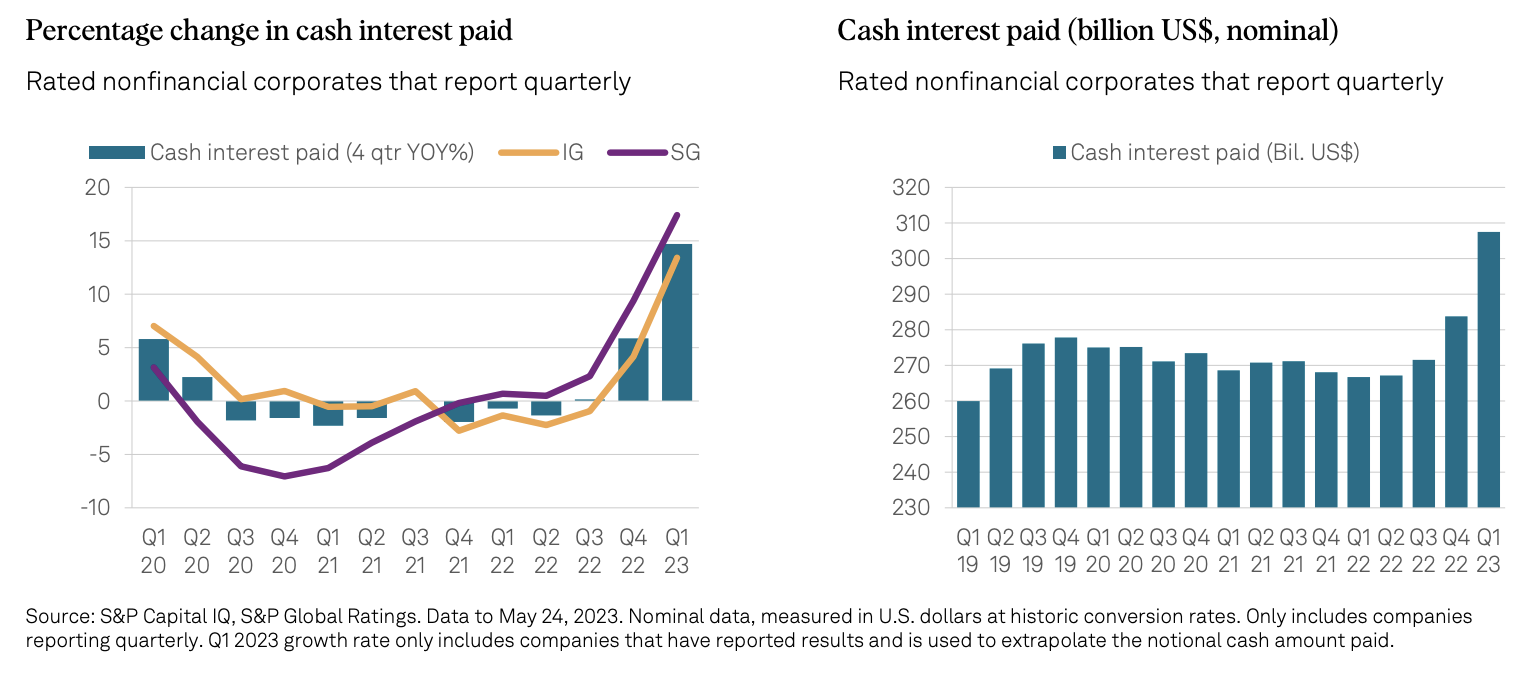

Global Nonfinancial Corporates: Interest-Rate Costs Start To Bite

Reported nonfinancial corporate cash interest payments surged 15% in Q1 2023, as interest rate increases start to bite. S&P Global Ratings estimates the median effective interest rate speculative-grade entities are paying globally will rise to 6.1% in 2023, its highest level since 2010. Interest cost pressures will build slowly but surely for all companies, but for weaker speculative-grade entities, reliance on floating-rate debt means declining EBITDA and higher interest costs is a more immediate and present threat to credit quality.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

Private Equity Investment In Global Commercial Real Estate Declines In 2022

Private equity and venture capital investment in the commercial real estate industry saw a 60% decline worldwide in 2022, according to S&P Global Market Intelligence data. In total, private equity and venture capital firms invested $20.73 billion in the sector in 2022, compared to $52.08 billion of investments in 2021. 2022 witnessed a total of 251 private equity-backed transactions, a drop from the 365 deals recorded in the whole of 2021, representing a 31% decline of the full-year total.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

Listen: Dark Ship-To-Ship Transfers Keep Russian Oil Flowing Despite Sanctions

More and more ships are turning off their transponders in the Black Sea in risky but lucrative trades. Deep discounts on Russia's main export crude, Urals and refined products such as gasoil and diesel are attracting strong market interest. And dark shipping in "no man's land" now appears to be another option for those willing to play the markets. In this episode of the Platts Oil Markets podcast, S&P Global Commodity Insights editors Max Lin, Luke Stuart and Natasha Tan join Joel Hanley to discuss Russia's new attempts to break through Western sanctions.

—Listen and subscribe to Platts Oil Markets, a podcast from S&P Global Commodity Insights

Access more insights on global trade >

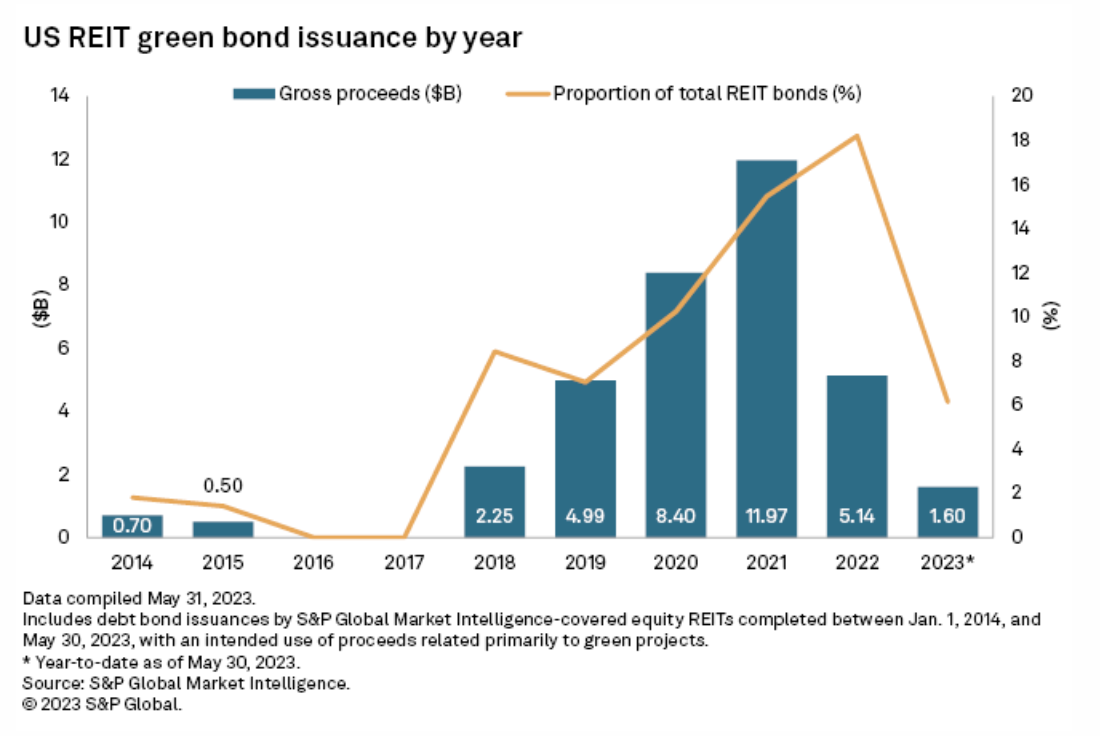

Green Bond Issuance By US REITs Slows In 2023 YTD

Green bond issuance by US real estate investment trusts has moderated in 2023 as interest rates continue to rise and the cost of debt becomes more expensive. S&P Global Market Intelligence identified just three green bond issuances from Jan. 1 to May 30, totaling $1.6 billion in gross proceeds. Office REIT Boston Properties Inc. completed the largest green bond offering thus far in 2023, at $750 million on May 4, and set to mature in January 2034. The bonds included a coupon rate of 6.5%, 3.2 percentage points higher than the comparable US Treasury note

—Read the article from S&P Global Market Intelligence

Access more insights on sustainability >

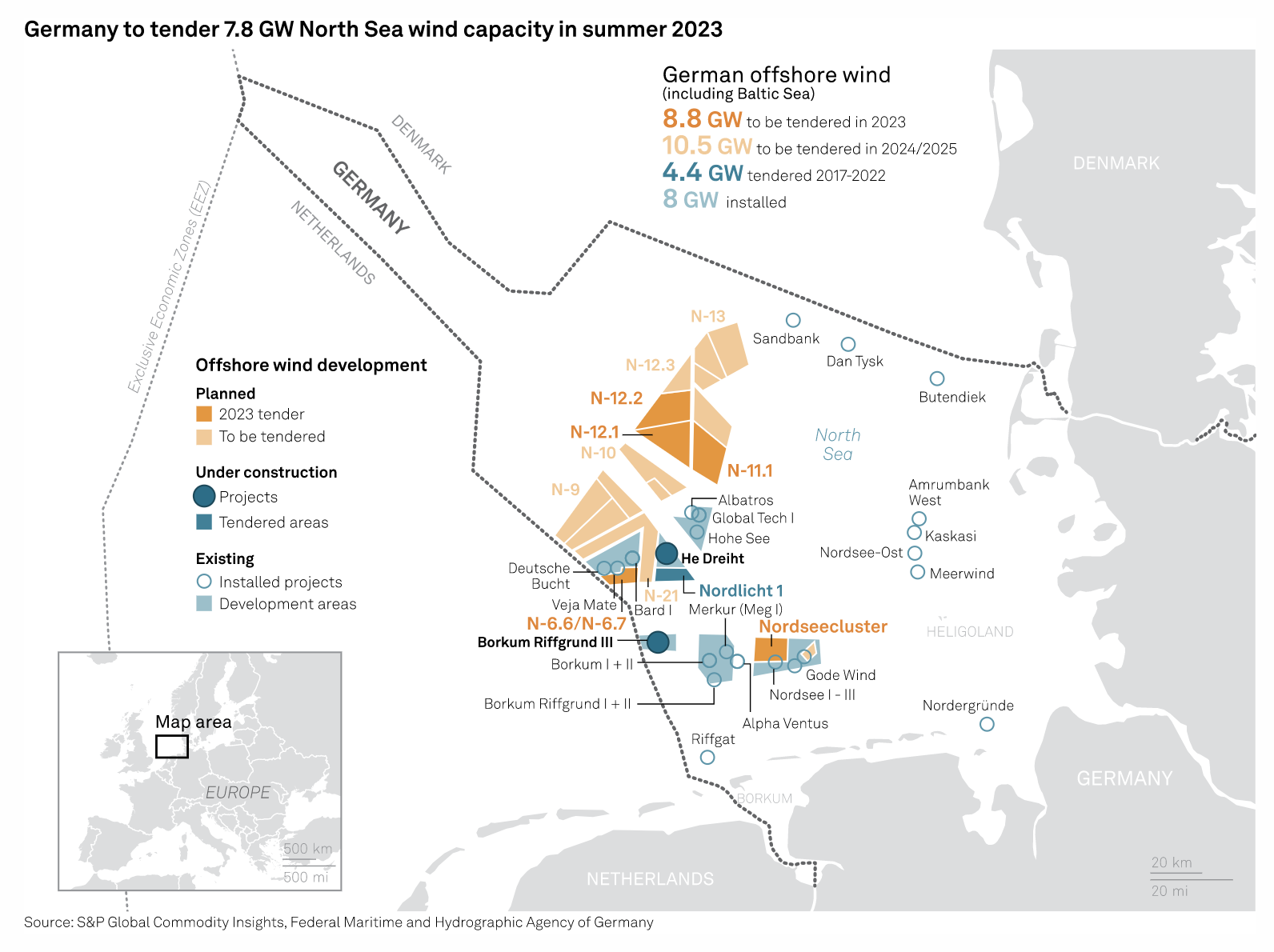

German Offshore Wind To Enter New Era As 7 GW Auction Closes

Germany's biggest ever offshore wind auction is to close June 1 with 7 GW of capacity on offer in a process likely to attract some of Europe's largest utilities, developers and oil majors. Three 2-GW wind farms in the North Sea and a 1-GW concession in the Baltic Sea are being tendered. For the first time, the auction is for areas of the seabed without any previous site investigation, but concessions include a grid connection guarantee for 2030. At stake is investment of up to Eur20 billion ($21 billion), based on recent capital expenditure costs for 900-MW offshore wind projects in Germany as well as larger ones elsewhere in the North Sea.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Transformation In Manufacturing

While this podcast has talked a lot about the general aspects of digital transformation, in manufacturing there are an additional set of concerns and benefits. Consulting analyst David Immerman joins host Eric Hanselman to explore where technology improvements are improving efficiency and how they’re looking at addressing a set of new challenges. Adoption of new technologies is more complex than in the IT world and issues like sustainability weigh heavily.

—Listen and subscribe to Next in Tech, a podcast from S&P Global Market Intelligence