Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 17 Jun, 2020

By S&P Global

Beijing officials raised the risk level of a new coronavirus outbreak in the Chinese capital to the second-highest category—subjecting residents of at least 27 neighborhoods to registration and temperature checks, imposing capacity restrictions on various venues, suspending school, and advising against non-essential travel. More than 100 infections were reported and 80 people were hospitalized after the largest wholesale market in the city was identified as the source of the new cluster.

The international community has watched China as an indicator of what a post-coronavirus economic recovery might look like, as the country was the first to implement containment measures and the first to emerge from lockdown, while many other nations report skyrocketing infections. This outbreak marks Beijing’s most significant since February, after 56 days without new cases.

“The epidemic situation in the capital is extremely severe,” Beijing city spokesman Xu Hejian said at a June 14 press conference. “Right now we have to take strict measures to stop the spread.”

Beyond China, several emerging markets, including Mexico and India lifted lockdowns and in recent days have reported record numbers of new cases. Across the U.S., Texas and Florida have also reported high numbers of new infections, but the states’ governments assured populations that lockdown measures wouldn’t be re-established. Contrasting coronavirus-containment measures across Europe have yielded drastically different results. Germany’s death rate due to the virus was dramatically lower than its peers’, and life in Iceland has returned almost to normal, while deaths in the U.K. continue to climb.

“All countries that have had some success at suppressing transmission [and] have been able to reduce transmission to a low level or eliminate it … need to remain at the ready, and so it's very important that countries have the systems in place to be able to quickly identify any suspect cases and test those cases and follow the same pattern of events that needs to happen—make sure we test, isolate, trace contacts, quarantine contacts—so that any resurgence can be picked up quickly and can be stamped out,” Dr. Maria Van Kerkhove, the World Health Organization’s technical lead for the coronavirus response, said on June 15. “All countries need to be prepared to be that epicenter and to prevent the possibility of becoming the next place where cases can resurge.”

Some six months since the coronavirus was first identified, the transition from pre-pandemic life to lockdown to a semblance of normalcy is neither smooth nor surefire. Weighing the costs of preserving public health and supporting economic growth isn’t a zero-sum game. A return to lockdowns everywhere seems unlikely despite experts’ beliefs that some will be necessary. How nations decide to move forward in both the immediate- and long-term will influence their recoveries as contagion cycles continue.

“Despite general agreement with lockdown decisions, there are now heated debates about what the new normal should be—and how to get there,” the Brookings Institution said in its June 16 Reopening the World: Saving Lives and Livelihoods report.

Countries’ differing responses to the pandemic are largely driven by societal and economic factors. Leaders that applied consistent directions for countries with cooperative populations appear to have controlled and minimized their outbreaks more so than nations with populist governmental leaders or pre-existing economic turmoil.

South Korean President Moon Jae-in was widely praised for the aggressive mass testing and contract tracing efforts that quelled the Asian country’s outbreak, the world’s second-worst outbreak outside of China at the onset of the crisis, three months ago. In a rapid response, when new clusters surged after crowded spaces were allowed to populate early in the post-acute phase, South Korea reinstated restrictions in May.

“Early, efficient, and creative measures taken by the government made a difference … Government efforts were led by science and expert opinions … [and] notwithstanding some controversy over personal privacy, transparency in government policy combined with open information sharing all helped nationwide policy implementation with people’s trust over government efforts,” according to the Brookings Institution. “As a result, South Korea has managed the epidemic without any physical lockdown in peoples’ lives. People are enjoying their normal lives with freedom of movement, job activities, and social lives.”

“From the far past and into the 21st century, South Korea has overcome numerous invasions, wars, and disasters. In particular, the Sewol ferry disaster in 2014 and the MERS outbreak in 2015 both shaped the current administration’s successful response to the COVID-19 pandemic,” Song Ho-chang, managing director of East Asia strategy for the software and data firm Fiscalnote and a former South Korean Congressman and member of President Moon’s Democratic Party, wrote in a Council of Foreign Relations essay in April.

Sweden did not impose a lockdown, leading to a different outcome for its population. Unlike most of Europe, the Nordic nation imposed containment measures that were considerably relaxed compared to many of its peers. Sweden’s measures—voluntary social distancing measures, coupled with self-isolation protocols for infected individuals and limitations on the size of group gatherings—have been celebrated by populists with rightwing ideologies worldwide and criticized by liberal leaders. Several top Swedish scientists expressed concern over the country’s lack of action while government officials defended the country’s path forward.

By early June, Sweden’s death rate per capita was one of the highest in the world.

Sweden’s state epidemiologist Anders Tegnell, the top scientist behind the no-lockdown strategy, said in a June 3 Swedish Radio interview that “if we were to encounter the same illness with the same knowledge that we have today, I think our response would land somewhere in between what Sweden did and what the rest of the world has done.”

Despite the high death rate, “it’s too early to draw any definitive conclusions about the success of our strategy,” Swedish Prime Minister Stefan Lofven told state broadcaster SVT on June 15. “We’ve followed the same main strategy as others, which in other words means keeping the contagion at levels that the health-care system can handle.”

Elsewhere in Europe, Germany’s re-opening is contingent on “finding and maintaining the delicate balance between saving lives and saving the economy” and “preserving the ability to treat the country’s preexisting conditions, notwithstanding its much-praised resilience in the first two months of the crisis: a political order in transition, an economy that despite its wealth faces significant structural and technological hurdles, and an increasingly unfavorable strategic environment,” the Brookings Institution said. “Because of Germany’s relative political weight and its importance as a large anchor economy in the middle of Europe, the consequences of its success (or failure) extend well beyond the country’s borders.”

One of the only nations that has eradicated the virus entirely from its population is New Zealand, which enacted a stringent lockdown on March 25 that was loosened in phases over the following two months. Prime Minister Jacinda Ardern frequently referred to the country’s population as a “team of five million” that needed to work together to control the virus’ spread. Declaring the country’s return to normalcy after the “go hard, go early” coronavirus-containment protocol, by allowing close contact between people and crowded restaurants and spaces, Ms. Arden said on June 8 that “while the job is not done, there is no denying this is a milestone.”

“The virus will be in our world for some time to come,” Ms. Arden said. “We are confident we have eliminated transmission of the virus for now, but elimination is not a point in time; it is a sustained effort.”

Today is Wednesday, June 17, 2020, and here is today’s essential intelligence.

US, Asian stocks bounce back from coronavirus bottom while Europe flounders

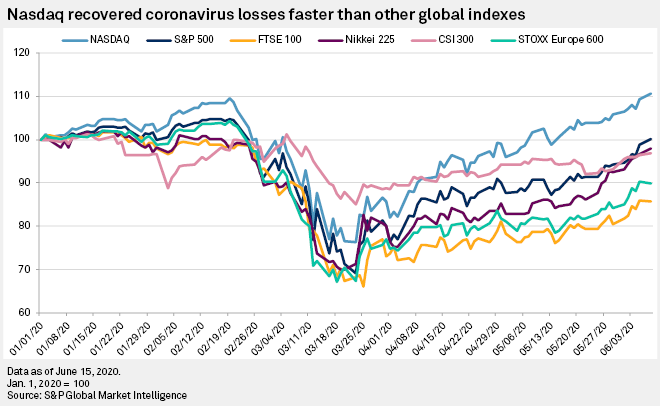

U.S. and Asian equities have largely roared back to recover their losses from the peak of the COVID-19 pandemic, spurred by massive federal intervention in the case of the U.S. and effective pandemic control in Asia, leaving their European counterparts mired in the doldrums. The tech-focused Nasdaq index fell 23.5% from Jan. 1 to a nadir of 6,860.7 on March 23. By May 7, these losses had been recouped, and the index has roared to record high levels, breaching 10,000 points for the first time June 10. The S&P 500 was down by more than 30% year-to-date March 23 before recovering all of its losses by June 8. The index was off 5.1% year-to-date through June 15 after a down week amid fears of rising numbers of coronavirus cases.

—Read the full article from S&P Global Market Intelligence

From COVID-19 to U.S.-China Tensions, What to Expect Next for Chinese Equities

On May 29, 2020, S&P Dow Jones Indices’ Priscilla Luk joined S&P Global’s The Essential Podcast, “A View to the Future – China Beyond the Pandemic,” to discuss the Chinese equity market’s performance and the macroeconomic trends during and beyond the COVID-19 pandemic. This blog includes some key highlights discussed in the podcast, along with the related index performance observed in the Chinese equity market.

—Read the full article from S&P Dow Jones Indices

US high-yield bond market eyes record June as Fed-fueled debt issuance rolls on

Issuance in the U.S. high-yield bond market is tracking at its busiest pace for any June on record, with $23.88 billion priced through June 12, according to LCD. The impressive figure follows a strong lead-in from May, which wrapped with a record-setting total for that month, and the third-highest issuance ever for April. Year-to-date volume was $176.8 billion at the close on June 12, up 56% year over year, according to LCD. The Federal Reserve’s April 9 announcement that it would be including coronavirus-era fallen angel credits in its corporate liquidity facilities has helped to settle market jitters, and pump up issuance.

—Read the full article from S&P Global Market Intelligence

June retail market: US sales rebound in May; 6 retailers go bankrupt

U.S. retail sales rebounded in May after three consecutive months of decline as the coronavirus lockdowns eased, but experts say the path to economic recovery would be long and full of uncertainties. "The economy kicked off in May as retailers and other businesses reopened and both stimulus money and supplemental unemployment checks fueled spending driven by pent-up demand from two months of shutdowns," Jack Kleinhenz, chief economist at the National Retail Federation, said in a June 16 statement. "But full recovery is still a long way off."

—Read the full article from S&P Global Market Intelligence

Europe's Construction And Building Materials Sector Should Hold Up Better Than After The Last Crisis

The European building material and construction sector is among those taking a midsize hit from pandemic-induced shocks and should gradually recover in 2021 and 2022. S&P Global Ratings anticipates revenue declines of 15%-20% in 2020 for rated companies, with a rebound to pre-pandemic levels in late 2022. S&P Global Ratings believes that a recovery will be faster than after the financial crisis but uneven, with companies focused on innovative and energy saving building products rebounding faster and large companies in the green building products segment better able to innovate. S&P Global Ratings has taken negative rating actions on about one-third of the sector--largely outlook revisions to negative and mostly on speculative-grade companies in the 'B' rating category—a smaller share than for the transportation and retail sectors.

—Read the full report from S&P Global Ratings

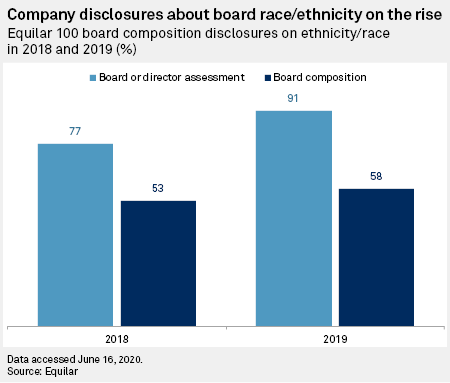

Amid racism protests, companies take to social media to disclose diversity

More companies are publishing race metrics in response to a social media campaign urging them to publicly report the number of black employees and executives in their organizations. This signals potential momentum in the historically slow pace of companies disclosing diversity information and offers further evidence of a rising emphasis on the "S" in the environmental, social and governance movement. Corporate America reacted to the death of George Floyd and subsequent nationwide protests with statements condemning racism and pledging support for the black community. An Instagram account, @pullupforchange, called on companies to go a step further and "Pull up for Change" by posting information about their workforces.

—Read the full article from S&P Global Market Intelligence

Remote working could amplify exclusive behaviors, 'bro culture' in finance

Prolonged working from home could reinforce exclusive behaviors and biases and undermine inclusive workplace cultures, which experts warn could have long-term implications for organizations that do not pay attention to the risks. Lockdown measures in response to the coronavirus radically changed the way bankers work, and the timeline for a complete return to normal is uncertain. Royal Bank of Scotland Group PLC has said it will keep more than 50,000 staff at home at least until September, while Citigroup Inc., Goldman Sachs Group Inc., HSBC Holdings PLC, JPMorgan Chase & Co. and Morgan Stanley have told employees their current remote working arrangements will remain in place for the foreseeable future. That poses a growing risk to workplace culture.

—Read the full article from S&P Global Market Intelligence

UK oil & gas industry pledges CO2 curbs in appeal for government help

The UK's upstream industry body Oil & Gas UK committed June 16 to halving the sector's greenhouse gas emissions by 2030 and to a 90% reduction by 2040, as it begins talks with the government on measures to mitigate the impact on the industry of recent market turmoil. Outlining the new goals, intended to fend off environmental criticism and align the oil and gas sector with the UK's goal of net zero emissions by 2050, OGUK emphasized the blow inflicted by the coronavirus and collapsing oil prices.

—Read the full article from S&P Global Platts

EC to unveil EU hydrogen strategy on July 8 to drive demand

The European Commission will present an EU hydrogen strategy on July 8 as part of EU efforts to become climate neutral by 2050, EU energy commissioner Kadri Simson said on June 16. The strategy is to look at how to drive demand in a range of sectors, including heavy industry and transport, which are more difficult to decarbonize than power generation, for example. The aim is to "fully exploit the potential of this promising energy carrier," Simson said in remarks published after taking part in an informal EU energy ministers' meeting by video on June 15. The ministers agreed that hydrogen—particularly from renewable sources—was one of the key innovative energy technologies for helping the EU decarbonize and maintain competitiveness, according to the meeting's conclusions.

—Read the full article from S&P Global Platts

Global solar growth to dip 4% in 2020 to 112 GW on coronavirus restrictions

Global 2020 solar PV capacity additions are set to dip 4% from a record high in 2019 due to the coronavirus, but economic stimulus programs could mean strong growth returning over coming years, according to a June 16 report by Solar Power Europe. Due to the extended lockdown of the global economy, the solar market will experience a contraction in 2020 with its base-case scenario predicting 112 GW of new capacity instead of the 144 GW projected in last year's forecast. This decline is due to reduced demand and restrictions on labor as well as supply chain issues, it said.

—Read the full article from S&P Global Platts

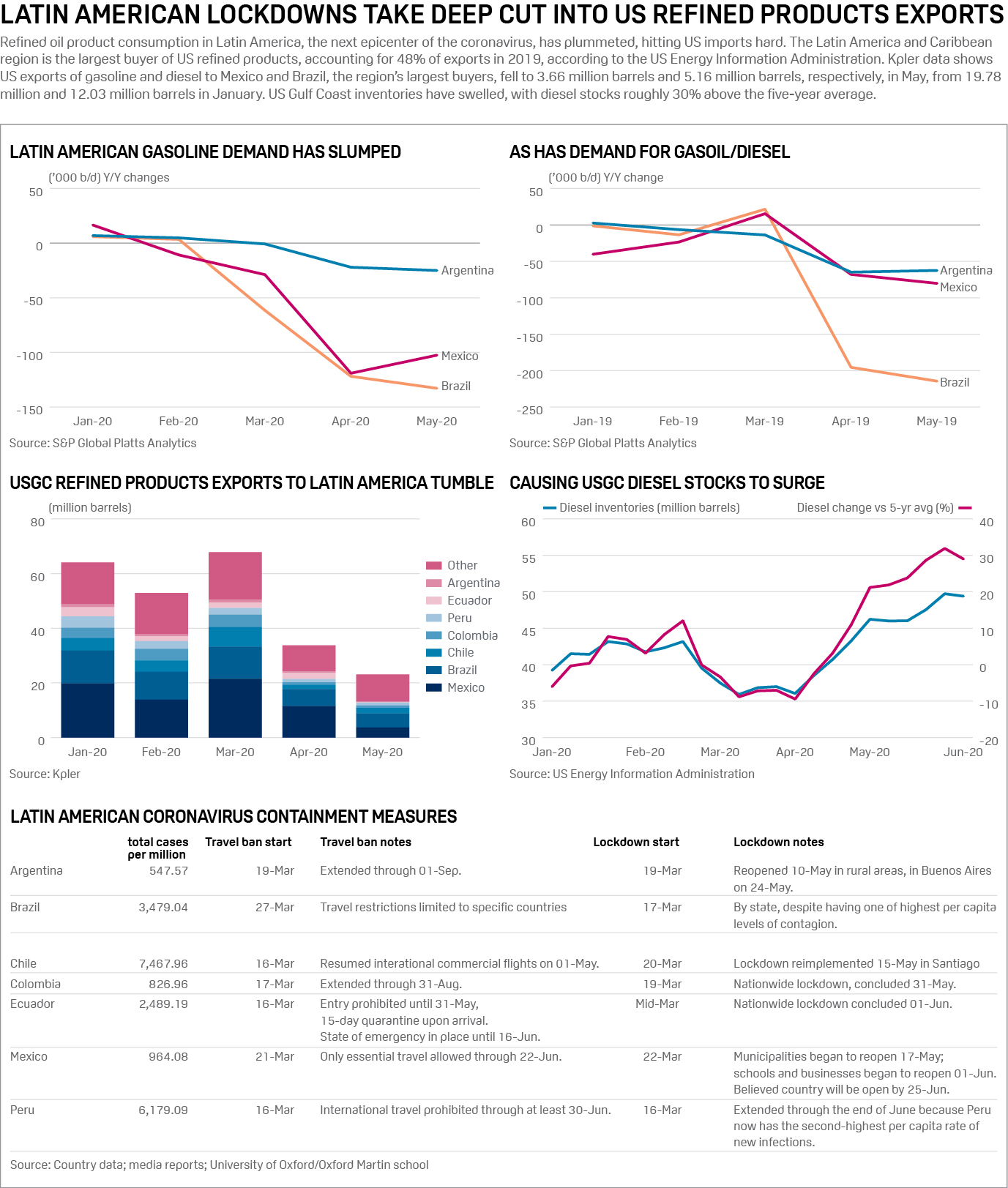

Infographic: Latin American lockdowns take deep cut into US refined products exports

Refined oil product consumption in Latin America, the next epicenter of the coronavirus, has plummeted, hitting US imports hard. The Latin America and Caribbean region is the largest buyer of US refined products, accounting for 48% of exports in 2019, according to the US Energy Information Administration.

—Read the full article from S&P Global Platts

Crude futures pare back overnight gains amid fresh COVID-19 outbreaks

Crude oil futures were trading lower in mid-morning trade in Asia June 17, after settling higher overnight, as reports of fresh COVID-19 outbreaks continued to weigh on hopes of economic recovery. At 10 am Singapore time (0200 GMT) June 17, ICE Brent August crude futures were down 64 cents/b (1.56%) from the June 16 settle at $40.32/b, while the NYMEX July light sweet crude contract was 78 cents/b (2.03%) lower at $37.60/b.

—Read the full article from S&P Global Platts

OIL FUTURES: Crude rally on bullish economic news tempered by Beijing outbreak escalation

Crude futures settled higher June 16, although heightened coronavirus response measures in Beijing tempered earlier gains from bullish demand projections from the International Energy Agency and stronger-than-expected US retail sales data in May. NYMEX July WTI settled up $1.26/b at $38.38/b while ICE August Brent rose $1.24 cents/b to $40.96/b, again crossing the $40/b threshold. NYMEX WTI initially spiked by nearly $2/b, rising above $39/b after the IEA said it saw global demand growth of 5.7 million b/d next year, and revised its 2020 demand growth up by almost 500,000 b/d. Still, that left 2020 demand at a 8.1 million b/d deficit to 2019. But the rally lost steam after Beijing raised its COVID-19 emergency response level and ordered schools closed.

—Read the full article from S&P Global Platts

OPEC+ may be able to ramp up oil production in 2021: IEA

Faster oil market rebalancing could present OPEC and other producers with an opportunity to ramp production in 2021, the International Energy Agency said in its latest monthly report, as it revised up its demand expectations for 2020 and signalled ongoing supply weakness in US shale. The IEA predicts oil demand will grow 3 million b/d more than supply in 2021, as it released its first estimates for next year in its June 16 outlook, which would mean shifting some of the huge stock overhang that has built up.

—Read the full article from S&P Global Platts

COVID-19 Impacts — Contrasting Fortunes For Iron Ore And Steel In Asia

The coronavirus pandemic has triggered mixed fortunes for iron ore and steel in Asia. Buoyed by the removal of lockdown measures, Chinese demand for iron ore has been resurgent in the past few months. The Chinese restocking boom has driven benchmark iron ore prices to US$107 per tonne as of June 8 as steel production expands to meet pent-up demand. The Chinese recovery contrasts with almost everywhere else, however; steel production in ex-China Asia has been scaled back aggressively in response to the global pandemic's recessionary impacts on local demand and wider global trade.

—Read the full article from S&P Global Market Intelligence

Copper rally may hit 'summer pause' after surprising rebound, analysts say

The pace of copper's rebound from the price lows it hit in March came as a surprise, according to analysts, who said Chinese demand was the main driver of the rally. Prices of copper, a key industrial metal, slumped earlier this year amid global action to curb the coronavirus pandemic. In early January, copper traded for more than US$6,000 per tonne, but by mid-March, the price had fallen below US$5,000 per tonne and remained at that level until early April as investors fretted over the economic impact of the virus and policy responses to the pandemic. But since late April, the price of copper has regained some of the ground it lost this year, trading for as much as US$5,885 per tonne June 10.

—Read the full article from S&P Global Market Intelligence

Written and compiled by Molly Mintz.

Content Type

Location

Language