Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 11 Jun, 2020

By S&P Global

Hours after the Organization for Economic Cooperation and Development (OECD) warned that developed economies will suffer a staggered and painful recovery from the coronavirus crisis, the Federal Reserve projected a slow comeback for the U.S. from the pandemic-induced recession.

In its twice-yearly Economic Outlook, released yesterday, the OECD “present[ed] two possible scenarios: one where the virus continues to recede and remains under control, and one where a second wave of rapid contagion erupts later in 2020,” the organization’s chief economist, Laurence Boone, said. “Both scenarios are sobering, as economic activity does not and cannot return to normal under these circumstances. By the end of 2021, the loss of income exceeds that of any previous recession over the last 100 years outside wartime, with dire and long-lasting consequences for people, firms, and governments.”

In the “single-hit scenario,” with contagion contained, global economic activity will contract by 6% this year, while unemployment across OECD countries will skyrocket to 9.2%, according to the forecast. The second scenario, analyzing the outcome of a “double-hit,” in which there’s another surge of infections worldwide before the end of the year, suggests global economic output would tumble 7.6% by year-end and rise a marginal 2.8% next year. The second wave would send economies back into lockdowns, pushing global unemployment up to 10% with little hope of job recovery next year.

Both scenarios ensure the global community won’t return to the levels of the fourth quarter of 2019 for at least two more years.

“Our economic and social prospects in the coming decade depend on today’s policies. The recovery will not gain steam without more confidence, which will not recover without global cooperation,” Mr. Boone said. “Governments must seize this opportunity to engineer a fairer and more sustainable economy.”

Of all OECD countries, Spain is likely to suffer the biggest blow to output, down 11.1% in the “single-hit” scenario and 14.4% in the “double-hit.” The OECD expects the eurozone economy to contract 9.1% if the outbreak is quelled—and 11.5% under a second wave—and the U.S. economy to shrink 7.3% under the first scenario and 8.5% under the second.

Comparatively, the International Monetary Fund in April projected that the global economy would contract 3% this year and rebound by 5.8% in 2021.

“The extent of the downturn and the pace of recovery remain extraordinarily uncertain and will depend in large part on our success in containing the virus,” Fed Chairman Jerome said in prepared remarks at a press briefing following the U.S. central bank’s two-day policy meeting on June 10. “We all want to get back to normal, but a full recovery is unlikely to occur until people are confident that it is safe to re-engage in a broad range of activities. The severity of the downturn will also depend on the policy actions taken at all levels of government to provide relief and to support the recovery when the public health crisis passes.”

Fed officials see the world’s biggest economy contracting 6.5% this year, with unemployment settling at 9.3%. The forecast, the Fed’s first since December, sees unemployment falling to 6.5% and the economy expanding 5% next year.

The U.S. central bank didn’t change its benchmark interest rate, predicting it would remain close to zero through 2022, and said it will increase purchases of Treasuries to approximately $80 billion per month and around $40 million of mortgage-backed securities “at least at the current pace to sustain smooth market functioning.”

“Our country continues to face a difficult and challenging time … People have lost loved ones. Many millions have lost their jobs. There is great uncertainty about the future,” Mr. Powell said. “At the Federal Reserve, we are strongly committed to using our tools to do whatever we can, and for as long as it takes, to provide some relief and stability, to ensure that the recovery will be as strong as possible, and to limit lasting damage to the economy.”

He added that “there’s a possibility” that the labor market may have bottomed in May, with the potential for a recovery during the second half.

The U.S. Bureau of Labor Statistics reported on June 8 that the unemployment rate in May fell to 13.3% from the previous month’s 14.7%, as states restarted activity and employers brought Americans back to work, but cautioned that misreporting may mean unemployment was actually 3 percentage points higher.

“Unemployment has gone up more for Hispanics, more for African-Americans, and women have borne an extraordinary, a notable share of the burden beyond their percentage in the workforce,” Mr. Powell said. “So that’s really, really unfortunate, because if you just go back two months ... we had, effectively, the first tight labor market in a quarter century, and for the last couple of years before the pandemic hit, you were seeing wages go up the most for people at the lower end of the wage spectrum.”

Acknowledging the nationwide civil unrest and movement for racial equality, the Fed chairman said that “everyone deserves the opportunity to participate fully in our society and our economy” and that “there is no place at the Federal Reserve for racism, and there should be no place for it in our society.”

“The downturn has not fallen equally on all Americans, and those least able to shoulder the burden have been the most affected,” Mr. Powell said.

In contrast to the OECD’s pessimistic outlook and the Fed’s caution, U.S. Treasury Secretary Steven Mnuchin said in prepared remarks to Congress on June 10 that “we are well-positioned for a strong, phased reopening of our country” as “America’s economy has begun to rebound, and our recovery is underway.”

Today is Thursday, June 11, 2020, and here is today’s essential intelligence.

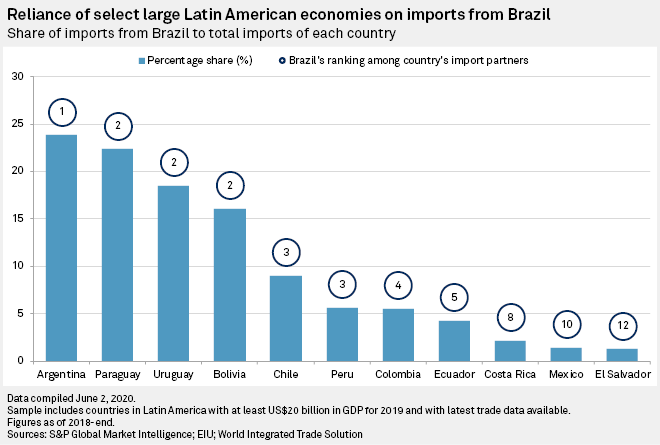

Brazil's economic plight could hinder a post-pandemic recovery in the region

The skyrocketing spread of the coronavirus in Brazil has thrust the country into what is likely to be its worst recession in more than 50 years. It also could threaten the economic prospects of its Latin American neighbors. Brazil now has the No. 2 highest number of confirmed COVID-19 cases and the No. 3 highest total of deaths related to the disease. The rapid accent of the coronavirus has spurred economic estimates increasingly lower for the country. The central bank now expects GDP to slide 5% in 2020. Others, including the World Bank are even more pessimistic, with contraction estimates closer to 8%.

—Read the full article from S&P Global Market Intelligence

Covenant-relief activity soars as US leveraged loan issuers seek flexibility

U.S. leveraged loan issuers continue to modify, waive, or suspend loan covenants amid the broader economic upheaval, with the number of covenant-relief deals in May hitting a record 43, according to LCD. This activity comes atop the 27 such deals struck in April, which broke the previous monthly record of 25 in March 2009, in the wake of the Great Financial Crisis. There were 80 covenant-relief transactions in the first five months of this year, just 17 shy of the total for the first five months of 2009. There have been twice as many this year as through May 2015, when a slew of energy issuers undertook these deals in search of financial headroom.

—Read the full article from S&P Global Market Intelligence

Pandemic And Recession Deal Blows To Credit Metrics Of U.S. Media And Entertainment Industry

The COVID-19 pandemic and subsequent global economic recession have severely harmed selected subsectors in the global media and entertainment sector, while affecting other subsectors to a lesser extent. S&P Global Ratings has taken rating actions including downgrades, outlook revisions, and CreditWatch listings on 50% of the rated U.S. media and entertainment portfolio. Given the significant number of ratings on companies with negative outlooks or on CreditWatch negative, it is likely S&P Global Ratings will take more downward rating actions in the coming months.

—Read the full report from S&P Global Ratings

Rebooting The U.S. Media Sector In A Post COVID-19 World

The COVID-19 pandemic has devastated many segments of the U.S. media and entertainment industry mostly due to social distancing measures and government-mandated closures. Live-events companies, travel-related companies, trade show and conference operators, theme park operators, film and TV studios, and movie exhibitors have suffered most from the pandemic's fallout. The timetable for recovery for these companies may lag both the general economic recovery as well as the end of formal social distancing measures. To assess the eventual pace of ad market recovery, we've examined key economic indicators, including GDP growth rate, consumer spending, and unemployment rates, as barometers of economic recovery and eventual ad agency growth. The industry's revenues and credit metrics will likely return to 2019 levels by 2021 (2022 for some subsectors), but issuer credits ratings may not recover at the same pace.

—Read the full report from S&P Global Ratings

AstraZeneca, Gilead deal speculation suggests post-COVID comeback for pharma M&A

A report that U.K. drugmaker AstraZeneca PLC considered Gilead Sciences Inc. an acquisition target has spurred speculation that M&A activity could be making a comeback in the pharmaceutical sector after a pandemic slowdown. Although experts disagree about the potential of such a deal, AstraZeneca's reported approach hearkens back to predictions from 2019 that M&A would rise because of attractive valuations and the amount of cash that pharmaceutical companies had in their coffers. With Gilead's market value at just under $97.3 billion, according to S&P Global Market Intelligence data, any takeover of the company would be one of the biggest in the industry's history.

—Read the full article from S&P Global Market Intelligence

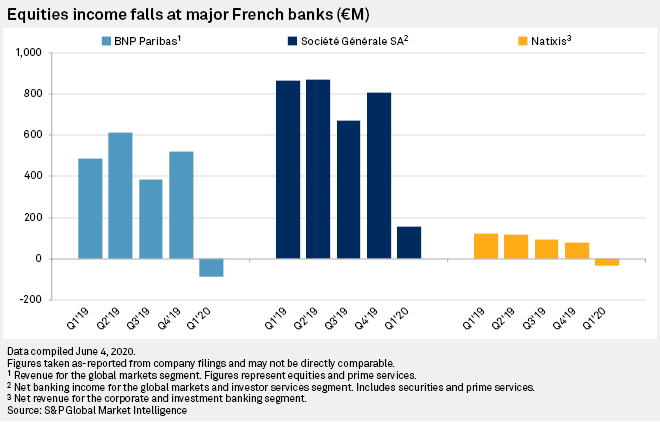

SocGen, BNPP trading rout highlights derivative risk, IB weakness

BNP Paribas SA and Société Générale SA's first-quarter equity trading rout highlights how much their flagship derivative products expose the lenders to risk and the difficulty they have competing with U.S. investment bank giants, analysts say. While their expertise in exotic investment products pays off in the good times, it puts them in the red in the bad. The coronavirus-induced first-quarter market slump will likely lead to a review of both banks' trading strategy, according to experts.

—Read the full article from S&P Global Market Intelligence

Post-COVID-19 change in banking regulation 'inevitable': Credit Suisse CFO

The COVID-19 pandemic is the "first real stress test" for banking capital regulation reform made following the global financial crisis, and will inevitably trigger revisions in regulators' approach, David Mathers CFO of Credit Suisse Group AG said June 10. Some regulations may be reviewed following the experience of the past few months during which global watchdogs eased capital requirements to help banks offset increased procyclicality effects, Mathers said, speaking at the Goldman Sachs European Financials Conference 2020. Increased procyclicality is in focus due to the interaction between the Basel III capital framework, and post-financial crisis accounting standards, which state that banks must make provisions for expected rather than incurred losses and mean provisions spike during a downturn and fall in good times.

—Read the full article from S&P Global Market Intelligence

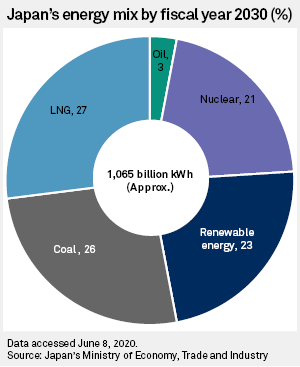

Japanese megabanks face growing investor pressure to fight climate change

Japanese megabanks are under growing pressure from activist investors to fight climate change more aggressively, but the country's continued reliance on coal makes the mission more difficult than it could be. In what was Japan's first shareholder-led climate change resolution on a listed company, Kiko Network, an activist group that owns 31,000 shares in Mizuho Financial Group Inc., filed a shareholder motion in mid-March to force the megabank to rein in lending to coal companies. A month later, Mizuho said it would stop issuing loans to new coal-fired plants from June and that it aimed to exit coal financing completely by 2050.

—Read the full article from S&P Global Market Intelligence

South Korea's hydrogen ambitions propel Hyundai Motor into top gear

South Korea's ambitions to make hydrogen a part of its transport fuel mix is garnering support from its auto makers such as Hyundai Motor, as it looks to gain ground in a space that is being hotly pursued by other Asian countries. Hyundai Motor, South Korea's leading auto maker, is looking to expand the fuel's scope by setting up infrastructure, a stepping stone in realizing the government's hydrogen blueprint that was unveiled last year. The country aims to sharply increase production of hydrogen-powered vehicles and electricity generation by hydrogen, in an effort to use hydrogen as a major energy source for transportation and power generation.

—Read the full article from S&P Global Platts

German cabinet approves hydrogen strategy, sets 14 TWh target by 2030

The German cabinet has approved a national hydrogen strategy focused on support for electrolysis, targeting 14 TWh of renewable hydrogen production by 2030, it said June 10. The strategy makes no mention of specific support for carbon capture and utilization (CCU) which would help conventional production of hydrogen to decarbonize. It does, however, talk of a "stakeholder debate" with energy-intensive sectors such as the chemical, steel, logistics and aviation industries on possible decarbonization methods other than green hydrogen.

—Read the full article from S&P Global Platts

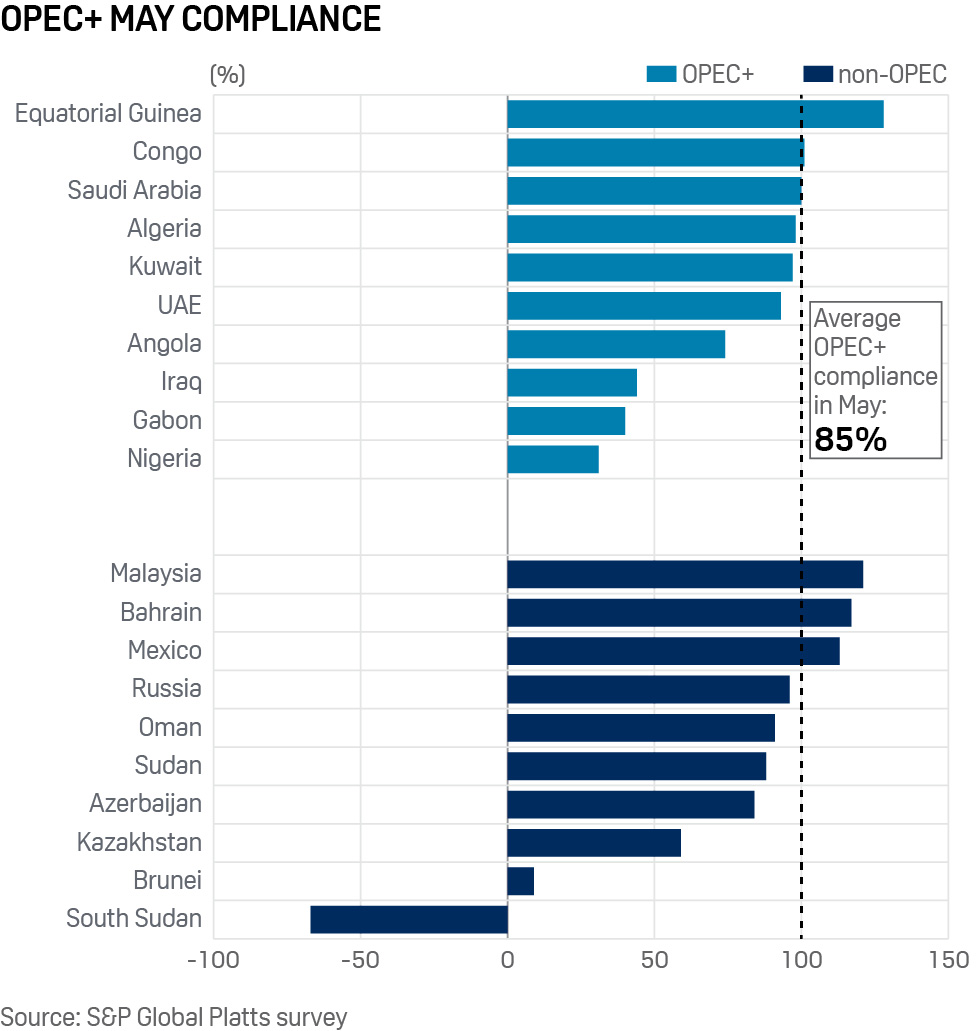

OPEC+ delivers 85% compliance on oil output cuts in May: S&P Global Platts survey

OPEC and its allies slashed almost one-fifth of their crude oil production in May, the first month of their landmark supply accord, according to the latest S&P Global Platts survey of the group's output. Prodded by the coronavirus pandemic and oil market meltdown to implement an unprecedented 9.7 million b/d in collective cuts, the 23-country OPEC+ coalition mostly delivered. OPEC's 13 members dropped their output to 24.32 million b/d, for a compliance rate of 82% with their prescribed cuts, the survey found. Russia and nine other partners performed better, pumping a combined 13.89 million b/d and making 91% of their cuts, bringing the whole OPEC+ group's collective compliance to 85%, according to Platts calculations.

—Read the full article from S&P Global Platts

ANALYSIS: US commercial crude stocks hit record high amid weak refinery demand, exports

US commercial crude inventories climbed to a record high last week amid moribund refinery demand and falling exports, US Energy Information Administration data showed June 10. Commercial crude stocks surged 5.72 million barrels to 538.07 million barrels during the week ended June 5, according to EIA data. The build pushed stocks to 13.5% above the five-year average and put commercial inventories at the highest on record dating back to 1982. However total US inventories, inclusive of the Strategic Petroleum Reserve, were last higher in June 2017.

—Read the full article from S&P Global Platts

Crude oil prices could hit $50 per barrel or higher by year's end, analysts say

Having rallied more than $75 from historic lows in April, the oil market is expected to take a breather before beginning the next leg of its journey back to the $60 per barrel level seen earlier in the year, according to analysts. Assuming inventories fall, petroleum demand continues to claw back, countries comply with OPEC+ output cuts and a second wave of COVID-19 is avoided, oil prices could top $50/bbl and even approach $60/bbl before the year is out, Bernstein senior analyst Neil Beveridge said during a June 9 webinar.

—Read the full article from S&P Global Market Intelligence

Insight from Washington: Trump uses oil diplomacy, executive orders to aid US producers

A day after US light crude futures took an unprecedented dive into negative territory, President Donald Trump promised to deliver federal relief to domestic oil and gas producers just like the US Congress had approved for airlines and a host of other industries as the pandemic wreaked havoc on the US economy. “We will never let the great US Oil & Gas Industry down,” Trump said April 21 on Twitter. “I have instructed the Secretary of Energy and Secretary of the Treasury to formulate a plan which will make funds available so that these very important companies and jobs will be secured long into the future!” No direct aid has materialized yet, and analysts expect Democrats in Congress to block any further attempts, as they did when the Department of Energy (DOE) sought $3 billion to buy US crudes to fill the Strategic Petroleum Reserve (SPR). But that doesn’t mean the White House isn’t finding ways to sweeten the outlook for the industry, whose workforce he wants to vote for him in November.

—Read the full article from S&P Global Platts

'Bumpy few months' await US industry as upstream output resumes: ConocoPhillips CEO

The US oil and gas industry is likely to experience a "bumpy few months" ahead as producers begin to bring their output back online after shutting in large swaths of it in May and June to cope with low demand amid the coronavirus pandemic, a top upstream company CEO and industry veteran said June 10. Supply and demand are likely to be difficult to balance, resulting in temporary overhangs on both sides as oil and gas producers, refiners and consumers begin to lift fuel production and usage, ConocoPhillips CEO Ryan Lance said during an Independent Petroleum Association of America webcast.

—Read the full article from S&P Global Platts

Gas market to experience 'largest demand shock on record' in 2020: IEA

The global gas market is expected to experience its "largest demand shock on record" in 2020, the International Energy Agency said June 10, with consumption set to fall 4% on the year as the coronavirus pandemic hits an already weakened market. In its latest annual gas report, the IEA also said that while gas demand was expected to recover gradually in 2021, the medium-term impact of the virus would dent gas demand growth. "As of early June, all major gas markets are experiencing a fall in demand or sluggish growth at best as is the case of China," the IEA said. The agency said that although lockdown measures are being gradually lifted, its forecasts do not assume that economies will recover promptly, leading to 150 Bcm of lost demand this year, or a 4% decline.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language