Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 14 Jul, 2020

By S&P Global

California introduced new statewide restrictions requiring bars to close and restaurants to end indoor dining, alongside barring gyms, places of worship, offices, and additional spaces from conducting indoor operations in 30 counties. Surging coronavirus cases led to the reversal of re-opening plans and activity for 80% of the state’s population.

Texas may also be forced to halt its re-opening plans. Sylvester Turner, the mayor of Houston, the state’s largest city, said on Twitter that he proposed to Governor Greg Abbott that the state needs at most “a two-week shutdown” and “at least [a] step back to state’s Phase 1… to reset and reassess.”

Florida reported more than 12,000 new cases of coronavirus on Monday, the second-highest single day total of any state since the start of the pandemic. Over the weekend, Florida confirmed more than 15,000 new cases, setting a shocking record. Governor Ron DeSantis said that the crisis in Florida has “stabilized” as “the percentage of people who are testing positive has finally started to decline,” but that “there’s a need for faster [testing] results.”

"The epicenter of the virus remains in the Americas, where more than 50% of the world's cases have been recorded," World Health Organization Director-General Tedros Adhanom Ghebreyesus said at a July 13 press conference. "It would appear that many countries are losing gains made as proven measures to reduce risk are not implemented or followed."

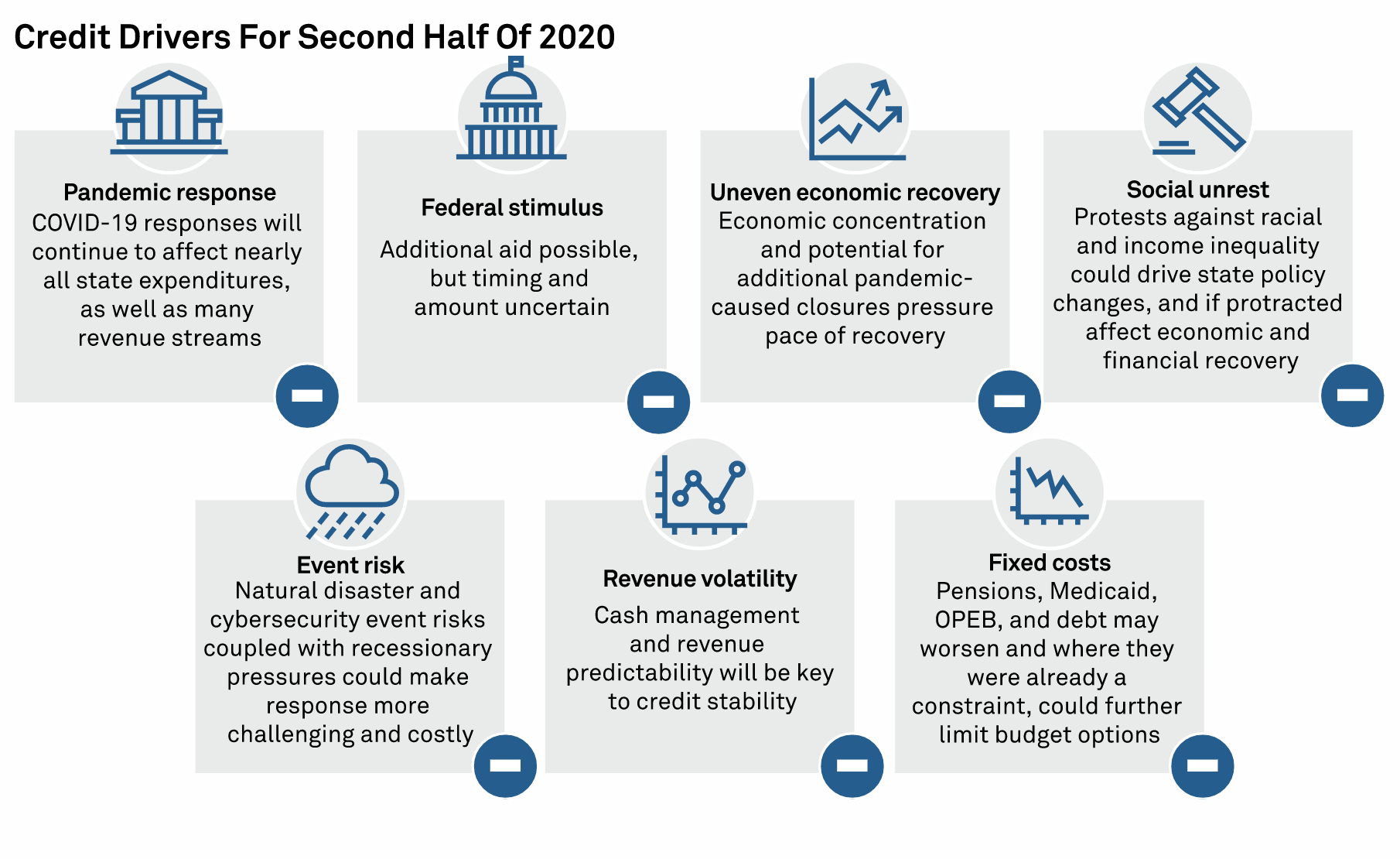

S&P Global Ratings expects the stability of U.S. state ratings in the second half of this year to remain negative due to the coronavirus-related recession, a propensity for revenue volatility, weaker rainy-day reserves, and elevated fixed costs. The current economic and political environment, the uncertainty surrounding the length and depth of the pandemic, and the lack of clarity around future federal aid will stress state budgets.

“Notably, states that experienced the sharpest rise in unemployment following COVID-19 lockdowns are not necessarily those facing the slowest path to recovery. States with more-concentrated economies, rather than those with the strictest social distancing measures, are more likely to experience the slowest economic growth,” S&P Global Ratings said in a report released yesterday.

A second wave of coronavirus in the U.S. will diminish investor’s capital. Corporate speculative grade defaults are likely to increase to 12.5% in the U.S, according to S&P Global Ratings.

“If the basics aren't followed, there is only one way this pandemic is going to go: It is going to get worse, and worse, and worse," Dr. Ghebreyesus said. "There will be no return to the old normal for the foreseeable future. But there is a roadmap to a situation where we can control the disease and get on with our lives."

Today is Tuesday, July 14, 2020, and here is today’s essential intelligence.

U.S. States Mid-Year Sector View: States Will Continue To Be Tested In Unprecedented Ways

States have a long history of managing through volatile economic periods, but this does not guarantee rating stability. S&P Global Ratings has observed many improvements to budget structures, reserve policies and debt management over time that, in S&P Global Ratings’ view, significantly improve the state sector's ability to manage through cycles. Even with extreme COVID-19 related stress, many state ratings will likely remain stable. However, S&P Global Ratings changed all U.S. public finance sector outlooks (macro, forward-looking view on where we see credit trends in the year ahead), including for states, to negative on April 1, 2020, reflecting an expectation of a swift and sharp decline in the economy and uncertainty regarding the timing of recovery.

—Read the full report from S&P Global Ratings

US auto sales drop by a third in Q2 over coronavirus impact

U.S. auto sales declined 33.3% in the second quarter of 2020 from a year earlier due to the coronavirus pandemic that forced consumers to stay at home. An S&P Global Market Intelligence analysis found that overall nonseasonally adjusted U.S. vehicle sales for the period totaled 2.95 million units, down from the 2019 figure of 4.42 million units. Passenger car sales declined 46.9% during the period to about 685,168 units from 1.29 million vehicles in the second quarter of 2019. Sales of trucks, minivans and SUVs for the quarter dropped 27.7% to 2.26 million units, compared to 3.13 million in the year-ago period.

—Read the full article from S&P Global Market Intelligence

COVID-19: Lessons Learned From Rated Airlines And The Implications On The Unrated Universe

The credit quality of airlines have been significantly impacted due to the disruption caused by COVID-19 and quantifying the impact on credit risk has proven to be a key topic of debate amongst market participants. Assessing the second-order effects of the slowdown to stakeholders has proven to be particularly challenging due to the impact not being limited just to the airlines industry, but to the global economy. Different institutions and market experts are sharing their views, with some preoccupied by the impact on tourism and travel industry especially for countries who are highly dependent on this sector. Others are more concerned about the impact on global cooperation and “National self-interest over cooperation”

—Read the full article from S&P Global Market Intelligence

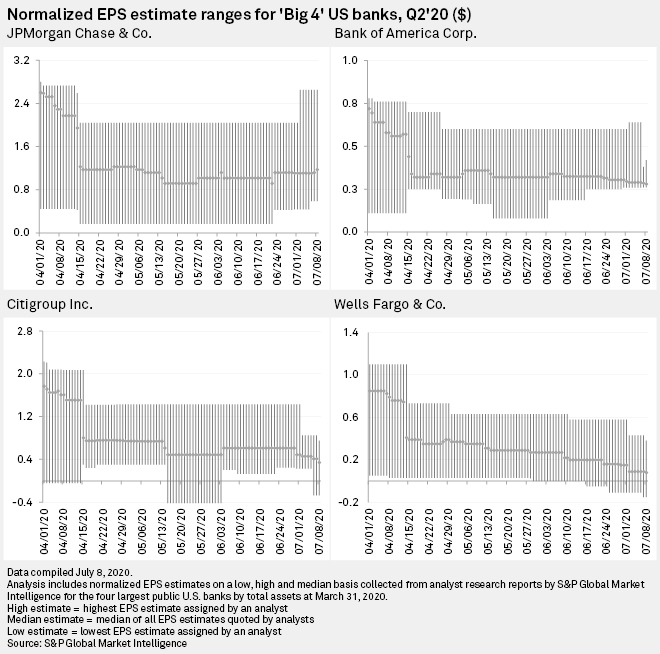

Credit quality unknowns remain focus for US bank Q2 earnings

Once again, all eyes will be on credit quality when large U.S. banks report second-quarter earnings. But just as first-quarter results failed to provide clarity, analysts are expecting to leave earnings season with plenty of outstanding questions about loan losses brought on by the coronavirus recession. With COVID-19 cases spiking in much of the country, economic activity remains muted. Expanded unemployment benefits are due to expire at the end of July and many businesses are still using funds from their Paycheck Protection Program loans, essentially masking the true level of economic pain.

—Read the full article from S&P Global Market Intelligence

COVID-19 pandemic derails de novo banks

COVID-19 has thrown a wrench in some hopeful de novo banks' plans. Proposed banks that were in the organization process before the novel coronavirus began spreading throughout the U.S. are experiencing various impacts from the pandemic. The Federal Deposit Insurance Corp. returned one bank's application in order to get an update on its projections, and another bank is waiting to refile its application until regulators are less busy with COVID-19 response. One proposed bank that received its conditional approvals will not open after the pandemic stifled its capital-raising efforts.

—Read the full article from S&P Global Market Intelligence

NIMs expected to 'get whacked pretty good' on Q2 earnings

Analysts are anticipating banks' net interest margins to fall in the second quarter due to the incorporation of a full quarter of fed funds rate cuts and an increase in liquidity. The Federal Reserve dropped rates to zero on March 15 in order to help the economy through the COVID-19 pandemic. But low rates, combined with increased liquidity as banks received deposits from Paycheck Protection Program loans and line drawdowns, will hurt banks' margins. "[NIM] will probably get whacked pretty good," said Nathan Race, an analyst with Piper Sandler Cos., in an interview.

—Read the full article from S&P Global Market Intelligence

Where Europe's banks stand on capital, liquidity ahead of Q2 earnings

European banks are heading toward second-quarter earnings results having suffered near-universal falls in key capital levels, threatening their ability to lend, while most also saw their liquidity capacity to meet financial obligations weakened. Research by S&P Global Market Intelligence looked at the common equity Tier 1 and liquidity coverage ratios at 21 leading banks across major European economies, to gauge how they have coped as the pandemic took hold. CET1 measures the amount of capital banks retain compared to risk-weighted credit exposures, while the LCR is a measure of banks' ability to meet short-term financial obligations.

—Read the full article from S&P Global Market Intelligence

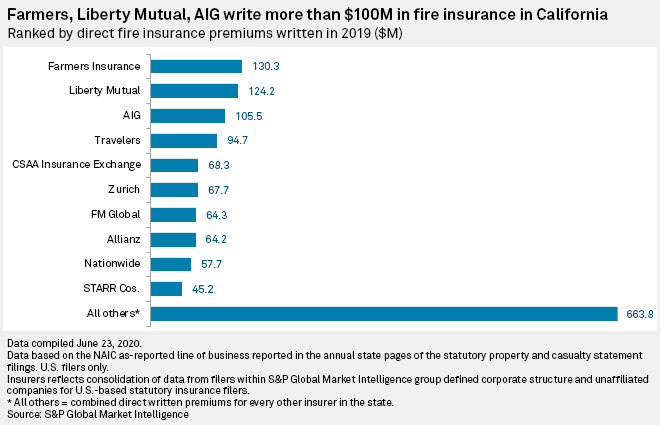

Pandemic adds another hazard for California officials' wildfire preparations

Administrators and emergency responders in California are preparing for another potentially severe wildfire season while trying to minimize the effect the COVID-19 pandemic could have on those plans. Hot and dry weather has contributed to severe drought conditions throughout the Golden State, heightening the threat of an active season. As state and local officials update their safety plans, they have to add now-familiar precautions related to COVID-19, particularly social distancing, when arranging shelter for evacuees.

—Read the full article from S&P Global Market Intelligence

EC consults on methane leaks in push to clean up EU gas imports

The European Commission is seeking views on how to reduce leaks of potent greenhouse gas methane from oil, gas and agricultural sectors as part of the EU's efforts to become climate-neutral by 2050. Most of the methane leaks from fossil gas production and transport happen before the natural gas or LNG reaches the EU, so a new EU policy on methane emissions could have far-reaching impacts on the global gas market.

—Read the full article from S&P Global Platts

EU carbon prices hit 12-year high above Eur30/mt

EU carbon allowance prices rallied July 13 to their highest since 2008, with bullish sentiment continuing to dominate as participants look ahead to upcoming market reforms and focusing on the need for non-power sector emissions reductions. EU Allowance futures contracts for December 2020 delivery on the ICE Futures Europe exchange surged as high as Eur30.80/mt ($34.45/mt) July 13 -- the highest price for the front-December contract since 2008, and up from Eur29.02/mt at the close July 10.

—Read the full article from S&P Global Platts

Watch: Market Movers Americas, July 13-17: NYMEX RBOB returns to backwardation, but coronavirus threatens gasoline demand recovery

In this week's Market Movers: NYMEX RBOB returns to backwardation, but the coronavirus threatens gasoline demand recovery; US biofuel markets await key announcements from the EPA; and open season begins for shipping on Brazil's largest natural gas import pipeline.

—Watch and share this video from S&P Global Platts

INTERVIEW: UK's Wentworth eyes gas demand growth in core Tanzania market

Tanzanian gas demand is set to rise in the coming years on the back of higher consumption in the power sector, as the government looks to provide more access to electricity for the southeast African country's growing population, the head of producer Wentworth Resources said in an interview. Wentworth is a partner in Tanzania's onshore Mnazi Bay gas field, which produces some 65-75 MMcf/d (1.8-2.1 million cu m/d) of gas and provides around 70% of the country's gas supply. Wentworth CEO Katherine Roe told S&P Global Platts that gas demand was expected to rise further as Tanzania builds out its Kinyerezi power station complex near the capital Dar es Salaam.

—Read the full article from S&P Global Platts

Analysis: US aluminum premium steady as market eyes possible tariffs

CME Group's AUP Midwest aluminum premium forward curve held steady this week, although some spreads tightening slightly, as the market awaits the possibility of tariffs on imports from Canada and also eyes the supply overhang not just in the US but globally. The futures contracts traded on CME Globex and CME Clearport and settle on a monthly basis, based on Platts' US Aluminum transaction premium. The CME July contract settled at 9.174 cents/b on July 13, up 0.174 cent/lb from July 6 on a 0.25 cent/lb uptick in the Midwest spot premium.

—Read the full article from S&P Global Platts

COVID-19 Mining Impacts — Mining Projects With At-Risk Production

S&P Global Market Intelligence’s series tracking COVID-19 impacts to mine site closures has identified 275 disrupted mining operations across the world, as at 25 June 2020. The top three most impacted commodity-focused mines were gold (111 mines), silver (101 mines) and copper (51 mines). The Latin America region was the most impacted—Peru, Chile and Mexico were the top three countries with the highest revenue at-risk globally. In all, the total revenue at-risk of impacted mining projects worldwide, was estimated to be over US$8.83 billion.

—Read the full article from S&P Global Market Intelligence

Written and compiled by Molly Mintz.

Content Type

Location

Language