Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 1 Jul, 2021

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Credit conditions worldwide are on the fast track to recovering alongside the global economy’s rebound.

“Credit trends are improving rapidly, albeit with significant differences across regions and sectors. The primary positive drivers remain intact: rebounding economies, vaccination progress, plentiful liquidity, and a strong appetite for risk even at the weakest end of the credit spectrum,” S&P Global Ratings Global Head of Research Alexandra Dimitrijevic said in her latest global credit conditions report. “The global corporate net negative outlook bias—a measure of future downgrade risk—has continued to decline. It’s now just 14%, down from a high of 37% a year ago, and defaults are trending down from their pandemic peak.”

This year there have been three times as many corporate ratings upgrades than downgraded, with lower-rated companies in the ‘B’ and ‘CCC’ categories accounting for the majority of upward movement. Overall funding conditions remain exceptionally supportive, with spreads on corporate debt notably tight, according to S&P Global Ratings.

In Asia-Pacific economies, rating trends are diverging—positively for those in East Asia who have controlled the spread of the coronavirus and negatively for countries across South and Southeast Asia fighting renewed outbreaks. Europe’s policy interventions have protected the eurozone economy from severe credit deterioration. Across North America, corporate borrowers in a plethora of sectors rated by S&P Global Ratings may return to pre-pandemic levels sooner than expected due to the U.S. and Canada’s booming economic recovery.

Global growth is accelerating, too. S&P Global Economics expects global GDP to expand 5.9% this year, up from forecast of 5.5% growth from the second quarter.

“The script for the economic recovery from COVID-19 has flipped from damage control to driving toward the endgame,” S&P Global Ratings Chief U.S. Economist Paul Gruenwald said in the third-quarter global economic outlook. “The combination of vaccines (leading to opening up) and better management of the economic impact of the virus (where there are no vaccines yet) has led to stronger-than-expected performance so far this year. Growth was almost universally better than anticipated in the first quarter across both advanced and developing economies.”

Risks to both global credit conditions and economic expansion are concentrated in emerging market economies. Although such developing economies are experiencing strengthening macroeconomic and credit conditions, slow and uneven vaccination deployments will determine how soon they realize a new normal.

These countries “remain a [global] concern given that it could take another year to achieve widespread vaccination in those countries,” Ms. Dimitrijevic said. “Vaccine-resistant variants remain the primary risk to global normalization, given their potential to undermine even the most successful rollouts and potentially force the reimposition of restrictions.”

Emerging market (EM) economies’ falling too far behind advanced economies could exert inflationary pressures on interest rates from developed markets’ enjoying fast-resuming activity, according to Ms. Dimitrijevic. This could hurt emerging market sovereigns that are reliant on foreign funding to meet their financing needs and weigh on the debt-servicing capacity of governments that have increased their debt burdens over the past year.

“While macro developments in EMs are looking up, they will lag the advanced economies in the rebound from COVID-19, which creates its own risks. The slower pace of vaccinations [in such economies] both reduces the speed of reopening (including an overhang of uncertainty holding down consumption and investment) and increases the risk of further waves of infection as variants of the virus continue to spread,” Mr. Gruenwald said. “EMs are also relatively more exposed to spillovers—both positive (demand for commodities) and negative (risk-sensitive financial flows and conditions). Faster vaccination therefore becomes the top priority.”

Today is Thursday, July 1, 2021, and here is today’s essential intelligence.

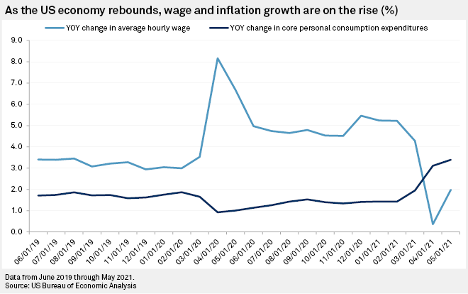

U.S. Wages Expected to Jump In June, but Will Not Make Up for Inflation

U.S. workers' wages are on the rise, but so is inflation, which means rising prices of gasoline and groceries are effectively canceling out any gains for employees' wallets.

—Read the full article from S&P Global Market Intelligence

European Retailers Seek to Reopen Their Doors to Usher In the Post-Pandemic Recovery

Buoyant e-commerce and the reopening of nonessential stores have boosted retail sales on the back of higher volumes. Furlough and state-support schemes have helped augment household savings, as have lower spending on travel and out-of-home leisure activities. The Consumer Confidence Index has increased in recent months, both for the eurozone and the U.K., having been at low levels since March 2020, signalling a boost in consumers' confidence toward the economic situation over the next 12 months.

—Read the full report from S&P Global Ratings

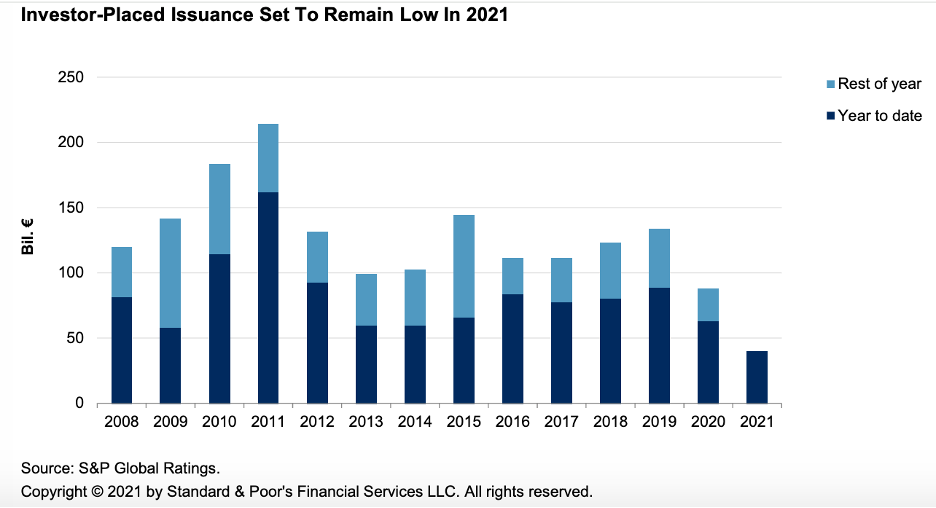

Covered Bonds Must Adjust to A New Reality After COVID-19

The unprecedented policy response to the COVID-19 pandemic depressed covered bond issuance but supported underlying asset performance. Some of these policies will be unwound once the economic recovery gathers pace, others will remain for longer, but most will have long-term consequences for the covered bond market.

—Read the full report from S&P Global Ratings

Global Sovereign Rating Trends Midyear 2021: Recovery Will Be Uneven As Pandemic Risks Linger

S&P Global Ratings’ sovereign ratings are showing signs of stabilizing after a wave of negative rating actions last year. S&P Global Ratings expect uneven recovery among regions as pandemic-related risks linger. These risks include slow vaccination rollouts, new virus strains, stimulus considerations, inflation, and social tensions.

—Read the full report from S&P Global Ratings

Asia-Pacific Sovereign Rating Trends Midyear 2021

Most Asia-Pacific sovereign credit ratings should remain unchanged in the next one to two years despite the continued pressures posed by COVID-19.

—Read the full report from S&P Global Ratings

EMEA Emerging Markets Sovereign Rating Trends Midyear 2021

Seven of the 53 emerging market (EM) sovereigns S&P Global Ratings rates in EMEA carry negative outlooks, down from 12 at end-2020. No sovereign rating is on positive outlook.

—Read the full report from S&P Global Ratings

U.S. State Fiscal 2022 Budget Negotiations are More Manageable Than Last Year Given the Stronger Economy

The accelerating pace of the economic recovery and extraordinary federal resources has given U.S. states a reprieve from pandemic headwinds.

—Read the full report from S&P Global Ratings

COVID-19’s Wake-up Call for Supply Chain Credit Risk

The impact of COVID-19 on the global economy is unique as it has not only affected demand, like crises of the past, but has also severely restricted cross-border supply chains. The disruption to the global supply chain will be another critical factor that will weigh on the creditworthiness of some sectors. This disruption will be evidenced by reductions in worldwide import and export volumes, alongside diminishing financial performance of firms and the market’s negative sentiment towards some private and public companies.

—Read the full article from S&P Global Market Intelligence

Stocks Surge, Comfort Grows as Market's Fear Gauge Falls to Pre-Pandemic Levels

Wall Street's fear gauge has tumbled to pre-pandemic levels, an indication that equity investors have grown relatively comfortable that stocks will keep climbing even after a stretch of acute market volatility, market analysts said.

—Read the full article from S&P Global Market Intelligence

Metal Price Assumptions: Prices Stay Hot, but no Signs of A Melting Point

S&P Global Ratings has once again raised its price assumptions for all metals covered for 2021 and for most of them for 2022. This is in line with updated views of a stronger recovery worldwide, driven by government stimulus, vigorous spending on infrastructure and electrification, as well as the resurgence of trade and economic activity as the pandemic effects fade.

—Read the full report from S&P Global Ratings

U.K. Small Caps: Mind the Gap!

A gap between the 12-month performances of the S&P United Kingdom SmallCap and S&P United Kingdom SmallCap Select Index hints at a “junk rally” in U.K. stocks, but the longer-term data suggests that those looking to participate in an ongoing recovery in the world’s fourth-largest economy might be wise to maintain a selective approach.

—Read the full article from S&P Dow Jones Indices

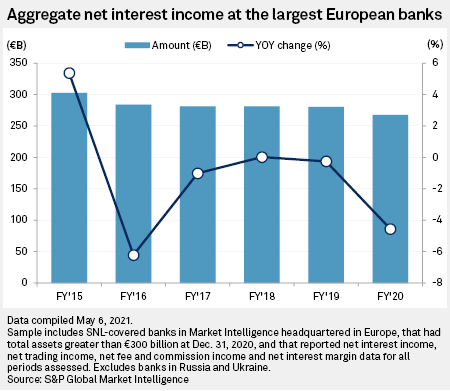

Negative Rates: European Banks Must Reinvent Themselves In Quest for Profit

To achieve long-term profitability, European banks must shake off their dependence on net interest income as several years of low and negative interest rates have threatened the viability of traditional business models, according to market observers.

—Read the full article from S&P Global Market Intelligence

Negative Rates: Margin Pressure Could Incite More Risk-Taking Among Banks

The collapse of U.S. family office Archegos Capital and trade finance firm Greensill Capital (UK) Ltd. earlier this year sent shock waves through the banking sector, markets and politics, raising questions about operating models and risk appetite.

—Read the full article from S&P Global Market Intelligence

The Top 10 Management Characteristics of Highly Rated State and Local Borrowers: Through the ESG Lens

Although S&P Global Ratings' rating criteria for state and local governments is founded in quantitative measures, the importance of management and governance as part of the qualitative factors that S&P Global Ratings analyzes heavily informs its credit analyses.

—Read the full report from S&P Global Ratings

DOE's Granholm Highlights Need for 'Place-Based' Climate Investments

U.S. Energy Secretary Jennifer Granholm signaled that the federal government would consider locally developed solutions as the Biden administration endeavors to make massive investments in climate and infrastructure programs.

—Read the full article from S&P Global Market Intelligence

Canadian, U.S. Graphite Hopefuls Need Cost Efficiency to Take on Chinese Producers

To compete in the China-dominated graphite market for electrical vehicles, would-be Canadian and U.S. producers must match prices on value-added products that are key to battery-making, industry experts said.

—Read the full article from S&P Global Market Intelligence

UK Brings Coal Exit Forward One Year to October 2024

From 1 October 2024 Great Britain will no longer use coal to generate electricity. However, coal accounted for only 1.8% of the UK's electricity mix in 2020, compared with 40% almost decade ago.

—Read the full article from S&P Global Platts

Watch: Market Movers Americas, June 28-July 2: US crude exports poised to rise on weaker USGC prices

In this week's Market Movers Americas, presented by Meghan Gordon: US crude exports poised to rise on weaker Gulf Coast prices; ConocoPhillips' market update puts Permian in focus; US LNG utilization rebounds on strong prices; NYMEX gas prices rise as traders expect restocking.

—Watch and share this Market Movers video from S&P Global Platts

Conocophillips Outlines 10-Year Plan, Reduces 2021 Capex 4% to $5.3 Billion

Nearly six months after closing its acquisition of Permian Basin operator Concho Resources, ConocoPhillips June 30 set out an ambitious 10-year operating plan June 30 that aims to grow oil production about 3%/year and deliver superior returns at an average breakeven cost slightly under $30/b.

—Read the full article from S&P Global Platts

Nigeria Backs OPEC+ Oil Supply Boost to Keep Prices Affordable

Africa's largest crude oil producer and an OPEC member -- is backing an easing of output cuts by the producer group to push prices lower and more affordable for key consumers.

—Read the full article from S&P Global Platts

Still Hazy on the Oil Market's Outlook, OPEC+ Prepares to Negotiate August Output Quotas

OPEC and its partners are poring over oil market forecasts and scenarios, buoyed by what Secretary General Mohammed Barkindo called an "overall brighter picture" in the world's battle against COVID-19 but without a consensus so far on how to set August production levels.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language