Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 11 Jan, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Promising and Challenging Long-Term Trends in Latin America

While there was substantial variance by country and region, Latin America came through 2022 in remarkably good shape. Gross domestic product numbers were generally up, inflation was challenging but close to global averages and equity markets showed remarkable resilience compared with Europe and North America. However, social upheaval and environmental damage continue to drag on the long-term economic outlook across the region. A resurgent left wing may introduce redistributive policies, and political divisions are sharper than ever.

Across the region, Latin America enjoyed an estimated 3.3% GDP growth rate in 2022. S&P Global Market Intelligence expects that rate to slow in 2023 due to recessions in the U.S. and Europe, but it will stay on the positive side at 1.5% this year. M&A and funding deals in Latin America were down slightly last year from the high levels of 2021. However, Brazil remained a bright spot for deals, soaking up 56% of all deal volume in the region. Application software was the subsector that drew the highest deal volume and deal value for 2022, continuing the strong trend from 2021.

Inflation is expected to slow in 2023 across Latin America, with the possible exceptions of Suriname, Haiti, Cuba, Argentina and Venezuela. This will allow a loosening of monetary policy from central banks in the region. Food and energy prices are already beginning to moderate. Russian oil and gas supplies found a market in Latin America in 2022, although fear of sanctions limited imports. S&P Global Commodity Insights anticipates that this trade may increase in 2023. Government subsidies and price regulations in various Latin American countries have helped to moderate price volatility in 2022, particularly for oil markets.

Social protests remain challenging and potentially disruptive across the region, as evidenced by the riots this week in Brazil by supporters of former President Jair Bolsonaro. Property damage related to civil unrest in Colombia and rail disruptions in Mexico cost millions of dollars in 2022. Activists have begun blockading roadways, ports and project-specific locations to express grievances. In turn, violence against activists remains high. Of the lethal attacks against environmental activists in 2020 and 2021, 68% occurred in Latin American countries.

Environmental damage and regulation aimed at protection are flashpoints for conflict in the region. According to S&P Global Ratings, by 2050 about 3% of the population in Latin American countries may be forced to relocate because of climate change. With many countries in the region economically dependent on agriculture and fossil fuel extraction, regulation and renewable energy initiatives can drive social conflict. Mining and hydrocarbon projects are facing increasing community opposition across the region, particularly in hotspots such as Argentina, Colombia, Ecuador, Mexico and Peru. In Brazil, the new administration of President Luiz Inácio Lula da Silva is expected to crack down on illegal encroachment on protected lands in the Amazon by agribusiness interests. But renewable energy projects in countries such as Guatemala are also encountering opposition from Indigenous communities.

Today is Wednesday, January 11, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

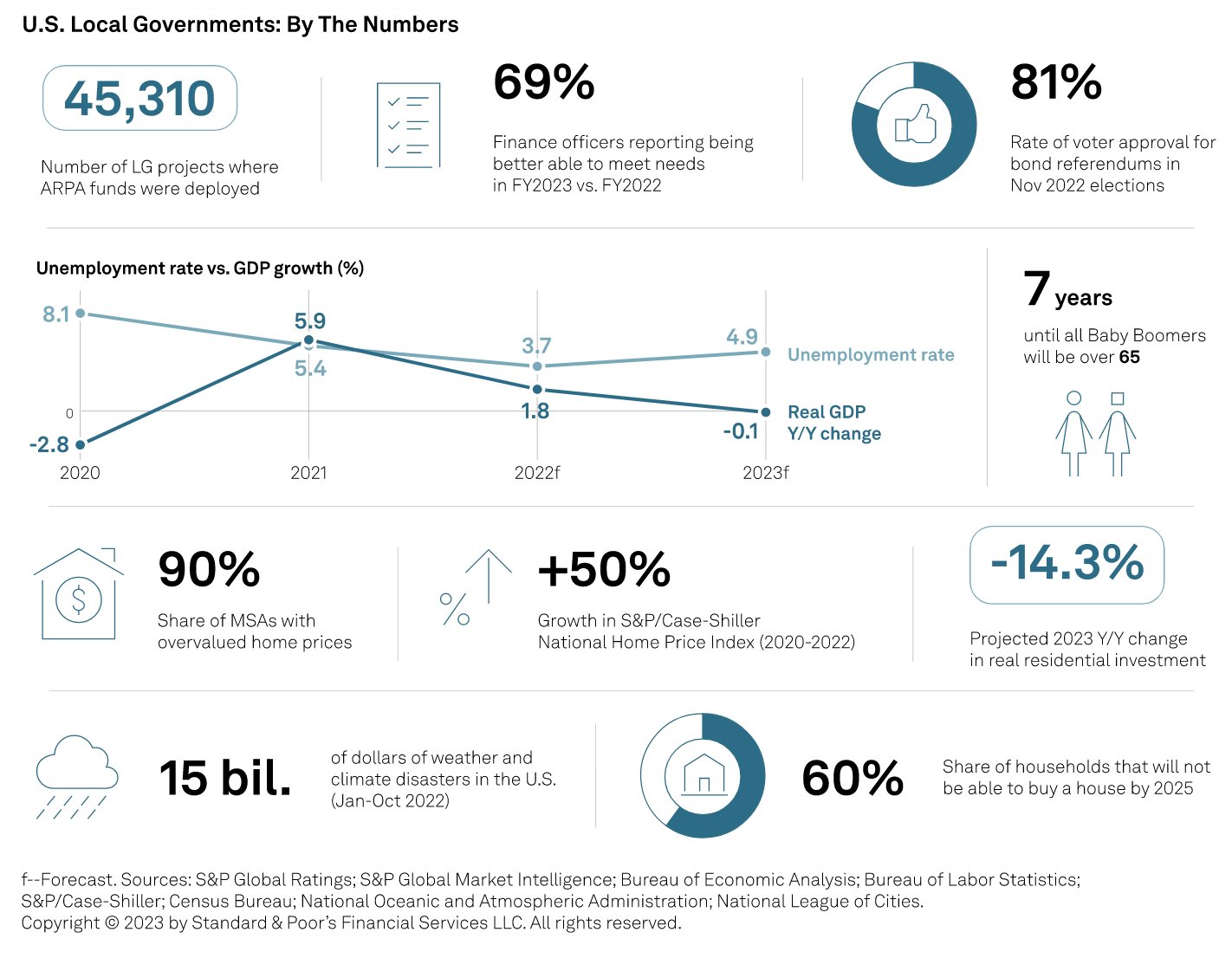

Outlook For U.S. Local Governments: Reserves And Agile Management Will Provide Stability In A Recession

With S&P Global Ratings’ baseline forecast for a recession in 2023, the local government sector's track record of active budget management will be the key to credit stability. S&P Global Economics' most recent forecast includes projections for a shallow recession in the first half of 2023. Regardless of how well-prepared governments are, a prolonged period of economic weakness can have a long-term effect on economic growth, including tax base expansion, a key driver for local governments that primarily rely on property tax and other locally sourced revenues. Reserves could be drawn down somewhat in the near term to offset revenue weakness; however, it does not necessarily view this as a credit stress given that starting reserve levels are elevated.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

Global Private Equity Entries Drop To Lowest Monthly Tally In December

Global private equity and venture capital-backed entries totaled 957 in December, down 58% from 2,253 in December 2021, according to S&P Global Market Intelligence data. December saw the smallest monthly deal volume in all of 2022 and was the only month during the year when deals fell below 1,000. The Asia-Pacific region contributed 361 transactions, while Europe and the U.S. saw 285 and 268 transactions, respectively.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

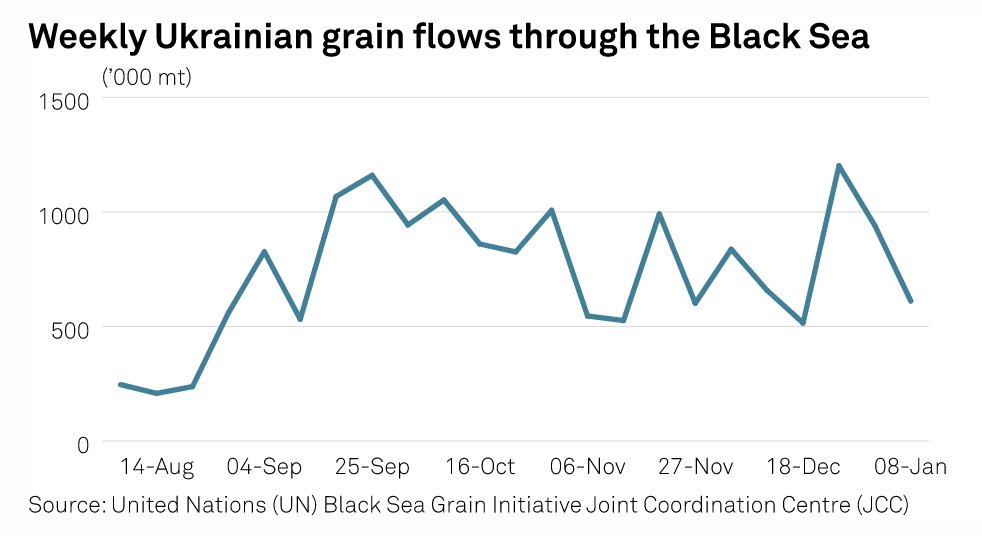

Black Sea Watch: Ukrainian Seaborne Grain Flows Retreat On Low Cargo Availability

Seaborne Ukrainian grain flows through the Black Sea retreated on the week to reach just below 611,000 mt during the Jan. 2-8 period, with the average cargo size at over 38,000 mt, holding 36% above average levels, an analysis of UN's Black Sea Grain Initiative Joint Coordination Centre data by S&P Global Commodity Insights showed Jan. 9.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

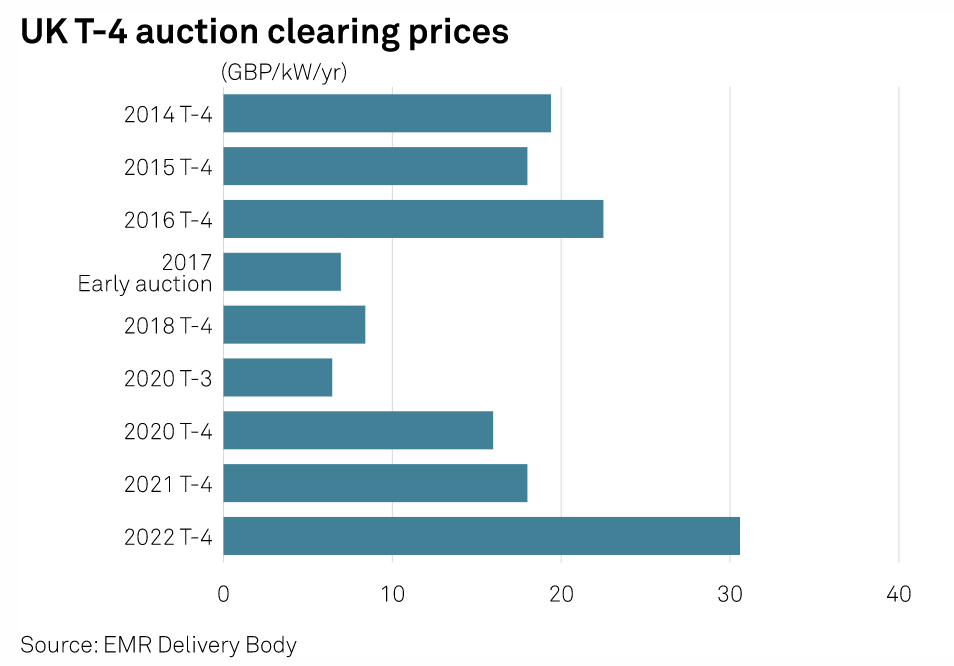

U.K. Government Proposes Low-Carbon Reforms To Capacity Market

The U.K. government is consulting on proposed reforms to the electricity generation capacity market in Great Britain, with an emphasis on incentives for low-carbon technologies and "robust" energy supply. The proposed reform is to ensure the capacity market keeps pace with the transition to a decarbonized electricity network by 2035, the U.K.'s Department for Business, Energy and Industrial Strategy said in a statement Jan. 9.

—Read the article fromS&P Global Commodity Insights

Access more insights on sustainability >

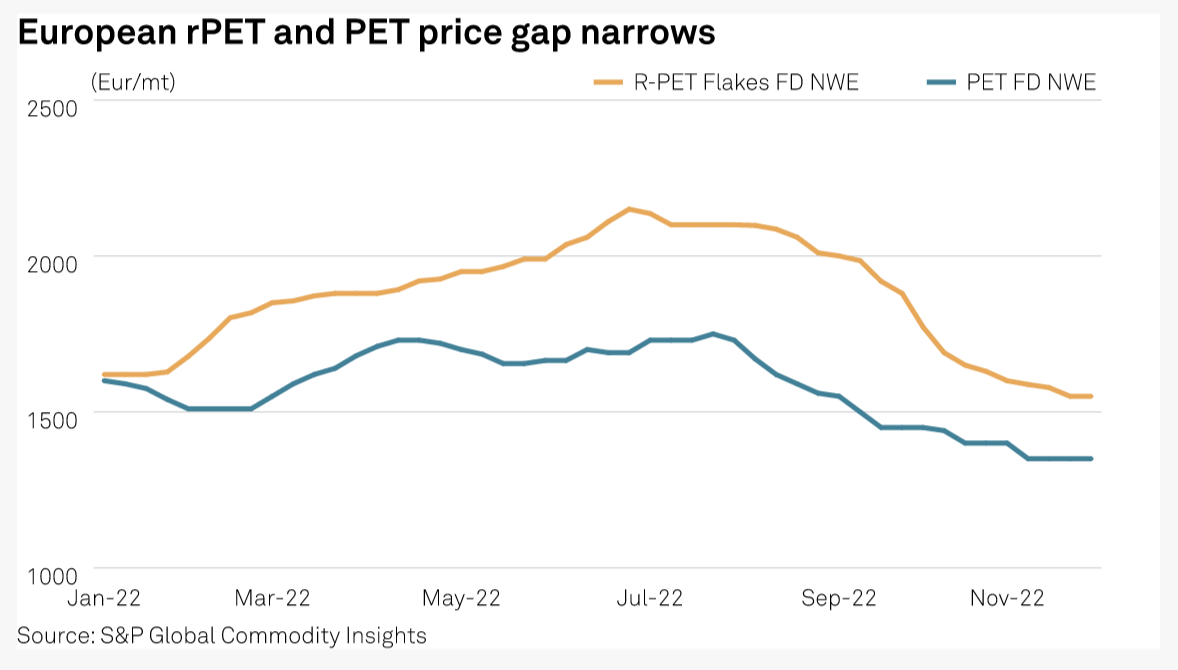

Chemical Trends H1 2023: Challenges Abound As Markets Brace For Another Rough Year

S&P Global Commodity Insights takes a closer look at the trends shaping key chemical markets in the months ahead. After grappling with logistical issues, war, low demand and oversupply in 2022, the market’s focus has pivoted to the easing of COVID-19 restrictions in China, with participants looking for signs the demand-supply balance is getting back on track in the first half of 2023.

—Read the report from S&P Global Commodity Insights

Access more insights on energy and commodities >

Brand Loyalty Finally Improves Month-Over-Month; But Will It Continue?

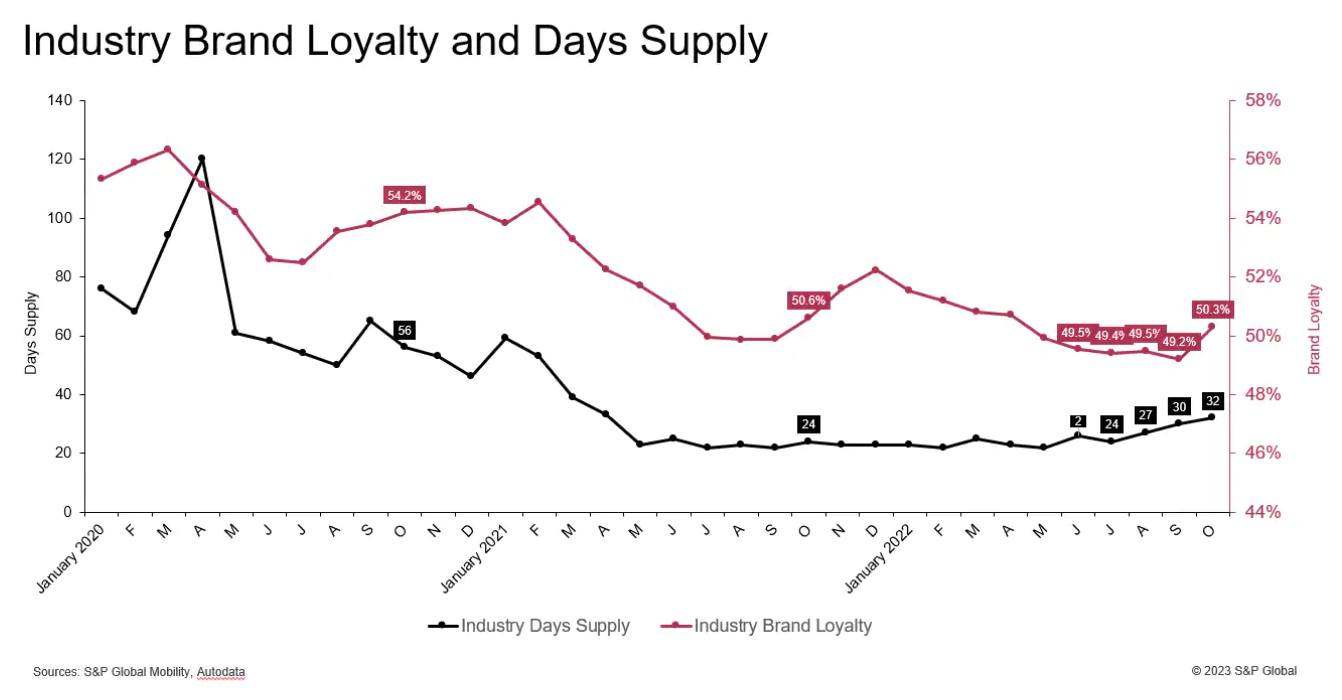

Brand loyalty in the U.S. light vehicle market rose from 49.2% in September 2022 to 50.3% in October, the first significant increase since January (putting aside the slight improvement from July to August). October also is the first month since April in which this metric has surpassed 50%. Looked at from a broader perspective, brand loyalty has been declining since March 2020 when it stood at 56.3%, immediately before the start of the pandemic and the start of the supply chain challenges.

—Read the article from S&P Global Mobility