Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 25 Feb, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Beyond the horrible human cost, the military conflict in Ukraine and the West’s sanctions against Russia may have significant and sustained effects on macroeconomic prospects, financial markets, and credit conditions in the region and around the world.

On the ground, fighting in Ukraine continues, and Western nations’ troops have been deployed to neighboring NATO nations. Russian troops have reportedly entered Ukraine’s capital, Kyiv, as Moscow makes demands to overthrow Ukraine’s democratic government. Ukrainian officials have instructed residents of the capital to prepare Molotov cocktails, as soldiers and civilians prepare for battle and others flee to neighboring European nations.

Outside the region, the international community and markets are reacting to the geopolitical shifts. The supply of commodities—including oil and gas; metals like palladium and titanium; agriculture such as grains and oils; and fertilizer—face the risk of disruption. The price of Dated Brent oil briefly surged to $106.52 per barrel on Feb. 24, up approximately $6 and marking the highest the global oil price benchmark had been assessed since July 29, 2014, according to S&P Global Platts. The price of gold, a typical safe-haven asset, rose in early Feb. 24 trading to near $1,980 per ounce from about $1,900, and the price of palladium, a key Russia-produced metal, surged from under $2,500 per ounce to more than $2,600, according to S&P Global Market Intelligence. The CBOE Market Volatility Index (VIX), considered to be Wall Street’s fear gauge, spiked to close just above 30 yesterday, according to S&P Dow Jones Indices.

Major geopolitical changes spurred by the situation could come in the form of energy-supply disruptions and/or price shocks; sustained inflationary pressures; a drag on economic growth and/or policy missteps by central banks; a migrant crisis in Eastern Europe; additional cyber attacks by Russia or other countries; risk-repricing that drives up borrowing costs or limits funding access; and profit erosion for certain sectors, according to S&P Global Ratings.

“We expect the Russia-Ukraine geopolitical shock to lead to slower growth and, in the short term, higher headline inflation—although the likely reduction in demand-led growth may alleviate some pressure on central banks to aggressively tighten monetary policy. It’s important to highlight that this shock is likely to be asymmetric across regions, with Europe, the Middle East, and Africa hit hardest overall—albeit unevenly across countries according to their dependency on Russian energy—and the U.S. less so,” S&P Global Ratings said in a report today on the macroeconomic and credit implications of the situation. “Russia’s military invasion into Ukraine from several fronts raises enormous questions about its political and economic stability, its integration into the global economy, the consequences for Europe (the destination of 45% of Russian exports), and the rest of the world.”

The U.S. and EU reportedly may soon impose a third round of more severe sanctions on Russian banks and on Russian President Vladimir Putin and Foreign Minister Sergei Lavrov’s assets. The EU approved today a preliminary package of sanctions on the country’s energy and transportation sectors. As the crisis has escalated, NATO allies levied sanctions on Russia’s sovereign debt, two biggest banks, oligarchs and their families, commercial shipping vessels, and the Nord Stream 2 pipeline—which the U.S. and EU followed on Thursday with additional sanctions obstructing the dollar-clearing capacity of several systemic Russian commercial banks.

“We have seen the markets settle down after the spike [in oil prices] we had yesterday ... the main negative driver today is the lack of sanctions that could impact flows of commodities, in particularly gas and oil," Ole Hansen, head of commodity strategy at Denmark-headquartered Saxo Bank, told S&P Global Platts on Feb. 25. "In the short term, medium term, we are still faced with an oil market that is tight and will remain tight, and the risk of potential new sanctions will keep market worrying.”

Sanctions had not previously included Russia’s oil and gas—highlighting the global importance of Russian exports of oil to the U.S. and natural gas to Europe. While S&P Global Ratings sees the exact impact of the evolving sanctions as difficult to estimate, several rated and active international banks with meaningful Russian or Ukrainian exposure could feel effects through cross-border payment and foreign trade channels.

“The imposition of strict sanctions on Russia, along with any countermeasures, will curtail business activities of those banks, companies, and individuals that are targeted,” S&P Global Ratings said. “Russia has been subject to a certain level of sanctions since its annexation of Crimea in 2014. It’s now evident that the prospect of tougher sanctions hasn’t deterred Russia from mounting a hostile invasion. However, over time, we believe the penalties will undermine the country’s longer-term growth prospects by making Russia less investable internationally, restricting access to cutting-edge technology required for innovation and development, and creating incentives for Europe to lessen its energy dependence on Russia.”

Today is Friday, February 25, 2022, and here is today’s essential intelligence.

Written by Molly Mintz.

Factbox: Commodity Markets Rattled As Russia 'Invades' Ukraine

Crude prices on Feb. 24 surged over 7% hours after Ukraine officials announced Russia had launched a "full-scale invasion," triggering concerns over potential disruptions to supply of energy and resources from oil to grains. At 10:06 GMT, the ICE April Brent futures contract was up $7.95/b (8.21%) from the previous close at $104.79/b, while the NYMEX WTI April light sweet crude contract rose $6.66/b (7.23%) to $98.80/b. Russian gas exporter Gazprom said Feb. 24 that its shipments of Russian gas via Ukraine to Europe are continuing as normal, hours after officials in Kyiv said Moscow had launched an invasion.

—Read the full article from S&P Global Platts

Access more insights on the global economy >

European Bank Stocks Sink Amid Russia-Ukraine Conflict

European bank stocks slumped amid a global equities sell-off Feb. 24 following Russia's launch of military operations in Ukraine. Of the major foreign lenders with operations in Russia, Austria's Raiffeisen Bank International AG suffered the biggest decline with its shares down 25% near the close of trading. Almost 30% of the bank's branches are in Russia and Ukraine, S&P Global Market Intelligence data shows. A spokesperson for RBI told Market Intelligence that it would be premature as of now to assess the economic impact of the situation, but its operations in both countries are "well-capitalized and self-financing."

—Read the full report from S&P Global Ratings

Access more insights on capital markets >

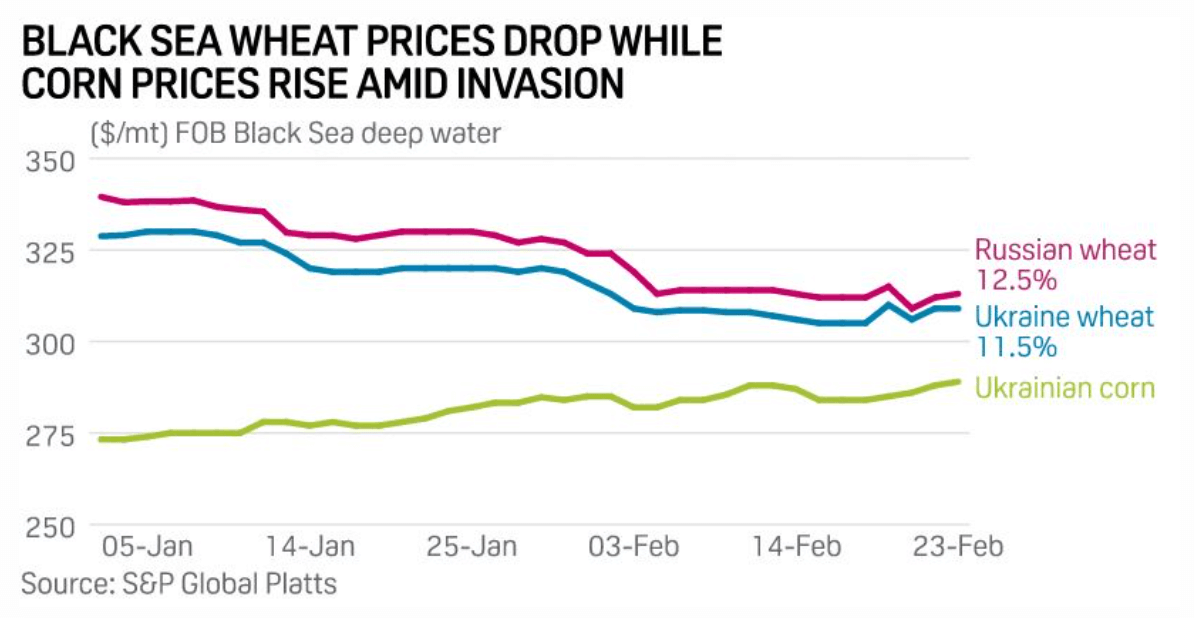

Factbox: Russia’s Ukraine Invasion Seen Disrupting Vegetable Oil, Grain Trade Flows

Russia's invasion of Ukraine sent agricultural commodities spiraling Feb. 24 following monthslong tensions in the Black Sea region that kept prices of key grains such as wheat highly volatile. As both Russia and Ukraine command clout in global trade flows of grain and vegetable oil, rising uncertainty in the region around port closures and blockages on vessel navigation are expected to keep prices of commodities such as sunflower oil, corn, and wheat elevated in the near term. While commercial movement in the Azov Sea stands closed, markets await clarity on whether the invasion is only restricted to the two contentious provinces as navigation in the Black Sea still remains open.

—Read the full article from S&P Global Platts

Access more insights on global trade >

Listen: Bonus Episode A Sneak Peek At Greenbiz, One Of The Biggest U.S. Sustainability Conferences

This bonus episode of the ESG Insider podcast takes listeners on the road to the big U.S. sustainability conference GreenBiz22. Hear from Joel Makower, chairman and co-founder of GreenBiz Group, which produces the three-day event bringing together sustainability professionals from many of the largest U.S. companies. The event is an opportunity to take the pulse of the corporate world on topics ranging from net zero to biodiversity to social equity. As Joel says in the interview, it's also a chance to hear how a diverse group of companies across sectors are handling the explosive growth in the ESG movement.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Sustainable1

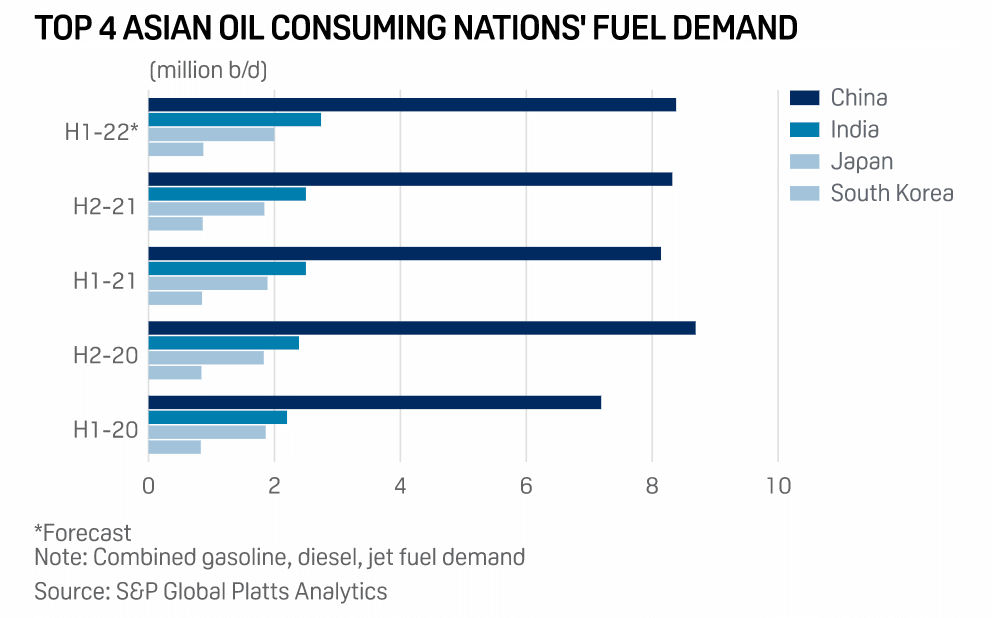

$100/B Oil Aggravates Pain From Asia’s Acute Oil Addiction

There's always a price to pay when one doesn't have an immediate alternative to cure one's addiction — and for Asian oil importers, it's no different. Asia's top oil buyers are dependent on imports for 70%-100% of their needs. With high oil prices — ICE Brent crude topped $100/b in Asian trade Feb. 24 as Russian President Vladimir Putin announced military operations in Ukraine — the pain is felt not just by refiners and consumers. It's also a burden that forces governments to alter fiscal policies to cushion the blow from massive foreign exchange outflows.

—Read the full article from S&P Global Platts

Access more insights on energy and commodities >

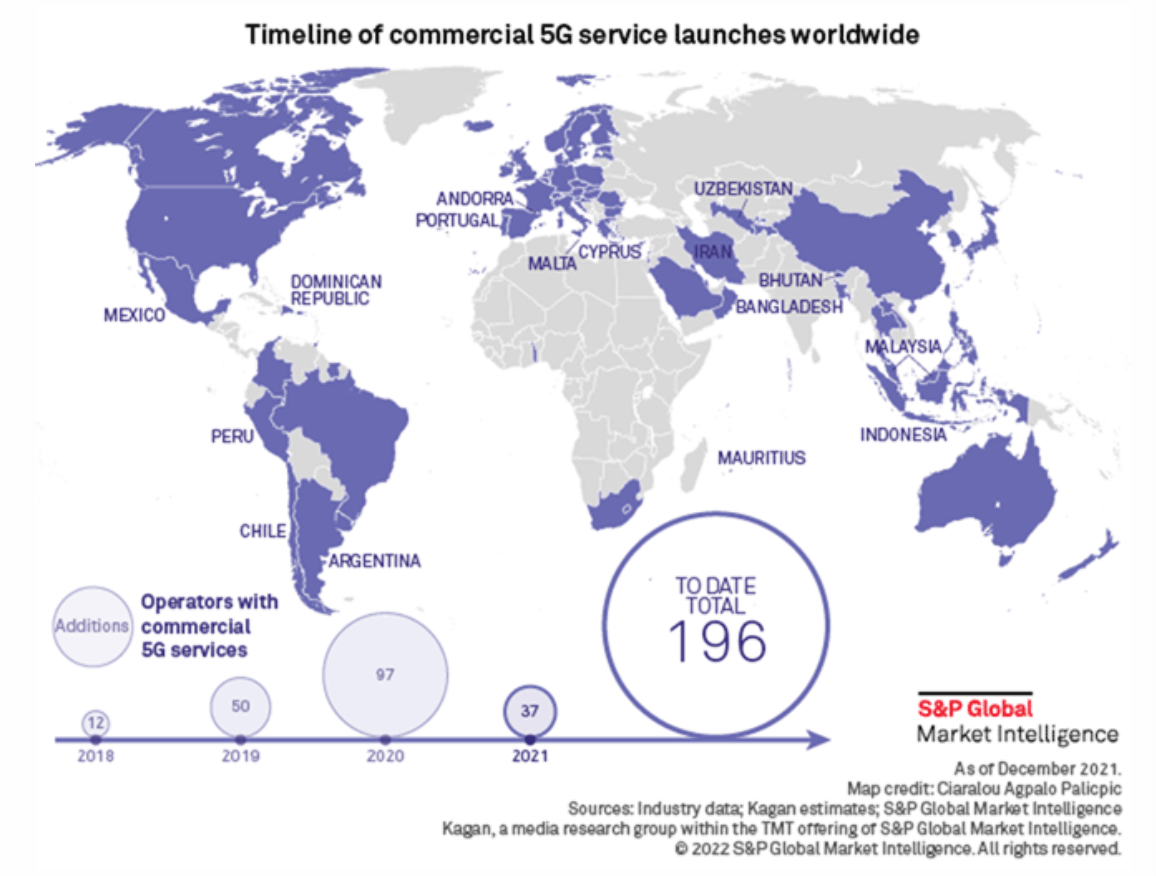

5G Tracker: 79 Markets Worldwide Have Commercial Services

After a significant ramp-up of launches in 2020, commercial 5G network introductions numbered just 37 in 2021 compared with 97 launches in 2020, according to Kagan data. Unlike 2020, which saw big carriers roll out 5G networks in major international markets, 2021 can be characterized as 5G networks trickling down into smaller countries. Some of these countries had seen a delay in spectrum auctions thanks to the COVID-19 pandemic, while carriers in other countries had not seen a competitive or cost necessity to roll out 5G until later. 5G networks came to 16 new countries in 2021. In all, operators around the world have deployed 196 5G networks in 79 markets, according to Kagan estimates.

—Read the full article from S&P Global Market Intelligence