Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 24 Feb, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

HSBC Holdings is selling its struggling retail banking operations, with sights set on increasing returns by expanding its offerings elsewhere.

The U.K.-based bank confirmed its plans to restructure its global business by offloading its U.S. assets and prioritizing Eastern expansion, wealth management, and fee-income operations. Europe’s largest bank group by assets will "move the heart of the business to Asia," CEO Noel Quinn said when announcing the bank’s full-year results, according to S&P Global Market Intelligence. "It's coming from the west principally out of global banking and markets in the U.S. and continental Europe, which are low-return markets for us relative to the return opportunity in Asia. So we're in the process of running down part of our book in the U.S. and Europe, and reinvesting those saved risk-weighted assets into Asia.” This, in turn, could create an opportunity for growth in the Middle East and North Africa.

The move comes as British banks continue to confront the coronavirus crisis. Despite the pandemic having accelerated banks’ digital transformations, market participants say that overt reliance on out-of-date legacy technology and outsourcing heightens U.K. financial institutions’ risk of system disruptions and failures. Simultaneously, credit pressures in the country are likely to burden England’s banks with loan losses that could increase taxes and costs to cover state-backed loans.

As companies default, banks "will have to turn around and ask the government to reimburse them for a bad loan," Fahed Kunwar, an analyst at equity research firm Redburn, told S&P Global Market Intelligence. "The administrative burden on the banks—because they need to ensure they understand the nature of the defaults exposed and when to trigger a default and when not to—is going to mean banks' expenses go up."

Banks elsewhere in the world are, rather than revamping their business models, focusing primarily on recovering earnings from the COVID-19-caused losses experienced last year.

In the U.S., large banks’ earnings look set to improve this year, with lower credit loss provisions—but won’t return to pre-pandemic levels due to asset quality challenges and low net interest margins, according to S&P Global Ratings.

For banks in emerging markets, S&P Global Ratings sees the potential for financing conditions and overall recoveries to benefit from extraordinarily accommodative monetary policy deployed by developed markets' central banks alongside successful vaccine rollouts.

“We simulated how much in credit losses the top 41 rated banks in [emerging markets] can absorb under different scenarios, one focusing on banks' profitability and excess provision on existing nonperforming loans and one considering buffers exceeding our internal capital thresholds,” S&P Global Ratings said in a report this week. “Based on our calculations, the total credit loss absorption, before being in the red, ranges from $491 billion-$602 billion, depending on the assumptions.”

The analysis showed that some South American banks could absorb the most losses, while South Africa’s banks would tolerate the least.

Major emerging market economies like Saudi Arabia and China have diverging outlooks. Banks in the Middle Eastern nation may have difficulty maintaining profitability this year, according to S&P Global Ratings, as the Saudi Central Bank lifts its forbearance measures and interest rates stay within a low threshold. The Asian country’s banks are looking at an optimistic rebound, as a strong economic recovery in China buoys lending.

The optimism surrounding China’s recovery can only serve as a boon to HSBC, which said it plans to onboard more than 3,000 wealth managers in the country. The British bank already operates in 19 markets across Asia, and will now focus on driving growth in Hong Kong, mainland China, Southeast Asia, and India.

"Our international competitors lack our footprint and deep connection to Asia and our Asia competitors lack our international network," HSBC's Asia chief, Peter Wong, said on the earnings call, according to S&P Global Market Intelligence. "We will invest an additional $6 billion in the region over the next five years with half of it in south and Southeast Asia.”

Today is Wednesday, February 24, 2021, and here is today’s essential intelligence.

Economic Research: Delay Risk on The Rise for Southeast Asia's Recovery

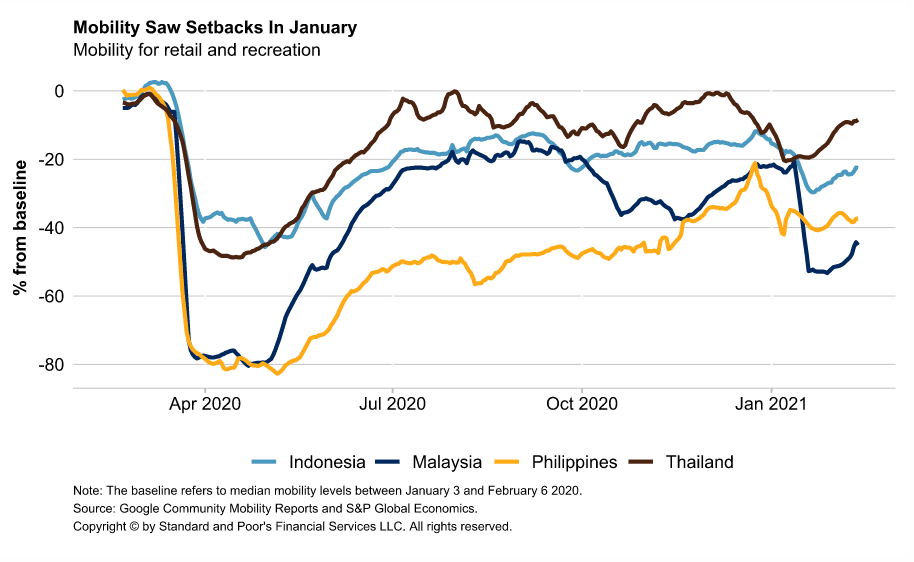

Lingering COVID-19 outbreaks in Southeast Asia threaten to delay recoveries in sequential growth rates. A two-month delay would reduce S&P Global Ratings’ Southeast Asia growth estimate by 1 percentage point in 2021, to 5.2%, and further delays would lead to higher permanent economic losses. S&P Global Ratings’ base case still assumes vaccines should be widely distributed by the second half of 2021, ushering in robust activity.

—Read the full report from S&P Global Ratings

Economic Research: Europe’s Housing Market Will Chill In 2021 as Pent-Up Pandemic Demand Eases

Europe's housing prices should grow more slowly in 2021 after a strong 2020, as pent-up demand from lockdowns last year is absorbed, affordability worsens, and economic activity remains subdued. Prices in 2020 were more dynamic than in 2019 because of strong demand and worsening constraints on supply--despite the biggest economic contraction in decades. We see reinvigorated demand for housing and housing price growth beyond 2021 after a likely easing of pandemic-related restrictions toward end-2021. This should pave the way for a sustained recovery in the economy and employment.

—Read the full report from S&P Global Ratings

Default, Transition, and Recovery: Revenue Pressures Continue To Weigh On Consumer-Related Weakest Links

The global weakest links tally has declined since our last report to 466 as of Jan. 31, 2021, but it remains well above its December 2019 level of 282.

—Read the full report from S&P Global Ratings

Political Risk Coverage for U.S. May be Live Issue After Riots Shake Country

Companies that do business or are based in the U.S. could be taking a harder look at insurance for political risks such as government actions and political violence in light of recent events. Political risk insurance covers businesses and financial institutions at risk for financial losses due to political events such as government actions against private property, political violence and acts of terrorism or war.

—Read the full article from S&P Global Market Intelligence

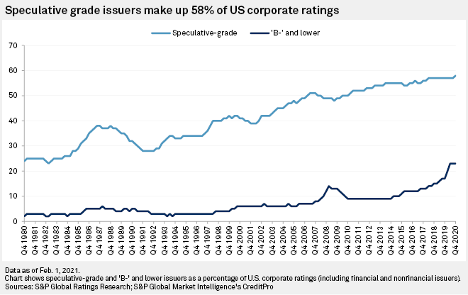

Corporate America Not Likely To Unwind COVID-19 Debt Buildup Despite Credit Hits

Corporate America levered up in 2020 as the coronavirus pandemic threatened revenues. But even with ample cash on hand, companies are likely in no hurry to unwind that buildup of debt.

—Read the full article from S&P Global Market Intelligence

Tracking Credit Risk at a Major U.S. Retailer

This article discusses how the S&P Global RiskGauge model could have been applied to help track J.C.Penny’’s credit risk before and during the COVID-19 pandemic, and act as an early-warning signal of a bankruptcy event.

—Read the full article from S&P Global Market Intelligence

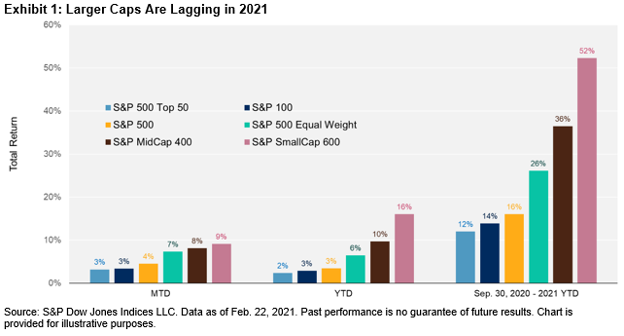

Man Bites Dog: The Year for Active Management?

For at least five years, SPDJ noticed that, despite historical performance, active managers regularly proclaim that this year will at last be the time when active management shows its value.

—Read the full article from S&P Dow Jones Indices

Neobanks Need Innovative Products to Challenge The Might of Australia's Big Four

Australia's neobanks need to find new profitable products and steady revenue streams to be able to make a dent in a market dominated by existing lenders, experts said after the abrupt exit of one player and the acquisition of another within weeks of each other rattled the fledgling industry.

—Read the full article from S&P Global Market Intelligence

How Big Tech's Fight Down Under Could Transform Social Media's Future

Big tech's clash with the Australian government is far from over and could provide a foretaste of what is to come globally, analysts said.

—Read the full article from S&P Global Market Intelligence

Amazon Could See Revenue More Than Double by 2025 as Retail Business Grows

Incoming Amazon.com Inc. CEO Andy Jassy will take the reins of an e-commerce company that could see revenue more than double by 2025, largely driven by the company's collection of retail and cloud computing services but also potential new business categories, analysts said.

—Read the full article from S&P Global Market Intelligence

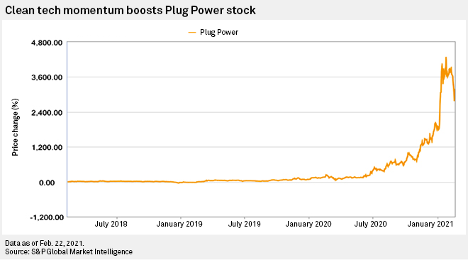

A Stock In Vogue, U.S. Hydrogen Player Plug Power Eyes European Expansion

Recent months have brought a surge of industry and investor enthusiasm for hydrogen technology companies such as Plug Power Inc.

—Read the full article from S&P Global Market Intelligence

Curtailment Tracker: Solar, Wind Generation Curtailments Fall 55% Year on Year

California Independent System Operator wind and solar generation curtailments started the year 55% lower than a year ago as localized curtailments accounted for 75% of the generation curtailed in January, according to grid operator data.

—Read the full article from S&P Global Platts

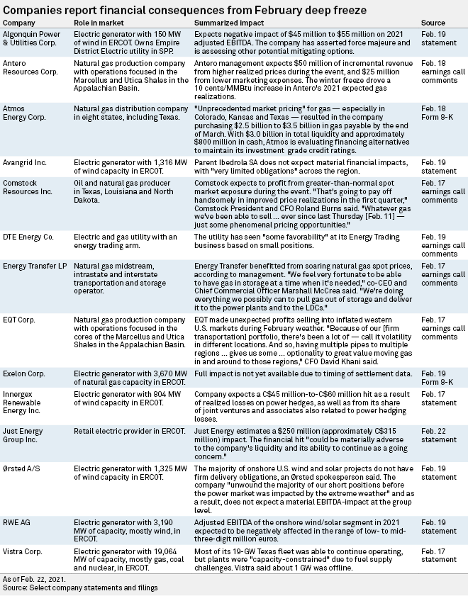

Chartwatch: Companies Tally Millions In Gains, Losses From Grid-Crippling Freeze

Several electricity and natural gas providers have warned of significant financial impacts from the deep freeze that swept across the Western U.S., while other energy companies expect to benefit from the supply constraints and related price hikes.

—Read the full article from S&P Global Market Intelligence

Yamani, Who Wielded Saudi Arabia's Muscle as Oil Minister, Left Legacy of Market Activism

Sheikh Ahmed Zaki Yamani, the former long-serving Saudi oil minister who died Feb. 23, helped bring the kingdom onto the world stage as an oil superpower but also gave OPEC a reputation for geopolitically weaponizing the market that it has struggled to shake for decades.

—Read the full article from S&P Global Platts

Global Oil Demand Likely To Rebound To Pre-COVID Levels by End-2021: Analysts

Global oil demand is expected to recover to pre-COVID-19 levels of around 100 million b/d by the end of the year driven by a strong rebound for gasoline, diesel and fuel oil, several analysts said Feb 23.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language