Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 10 Feb, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Creating a sustainable future requires sustainable finance. The prospect of the former is becoming more of a reality as the latter becomes a mainstream market. Investors’ and companies’ appetite for and engagement with environmental, social, and governance (ESG) principles is reshaping global credit markets—from bond borrowing to debt downgrades.

After the global sustainable debt market reached a record $960 billion last year, S&P Global Ratings expects issuance to surpass $1.5 trillion in 2022 despite overall global bond issuance stagnating. This growth is likely to be driven by the expanded issuance of sustainability-linked bonds, which are instruments that achieve issuers’ predefined sustainability objectives; great growth in issuance of green bonds, which raise funds for projects with environmental benefits; and the diversification of social and sustainability bonds, which are respectively targeted to projects associated with positive social outcomes and projects with both environmental and social benefits. In just one area of the sustainable debt market, India and China’s net-zero ambitions could see the countries issue billions in green bonds this year, according to S&P Global Market Intelligence.

ESG factors have influenced approximately one in four potential bond downgrades on corporate, financial, or sovereign issuers rated 'AAA' to 'B-' by S&P Global Ratings with either negative rating outlooks or ratings on CreditWatch with negative implications—a trend that could continue.

“As 2022 begins, ESG considerations, especially in the continuing context of the pandemic, are more of a risk than an opportunity to credit quality,” S&P Global Ratings said in a report published last week. “Potential downgrades influenced by ESG factors were more than twice as likely to lead to a downgrade over the course of 2021. The sovereign sector has the highest share of potential downgrades influenced by ESG. Social remains the key ESG factor influencing rating changes, albeit governance is becoming an increasingly important factor for potential upgrades.”

Established and emerging industry players will need to manage the market’s growth to preserve the legitimacy of these financing instruments against concerns about greenwashing, and engage with clear standards and frameworks to protect the sustainable debt market’s integrity, according to S&P Global Sustainable1. A lack of transparency in instrument labeling, reporting, and data disclosure has prompted stakeholders to question whether greenwashing has dampened excitement surrounding the incredible recent growth in sustainable, green, social, and sustainability-linked bond issuance.

The sustainable debt market’s activity has “raised some concerns from market participants surrounding the legitimacy and credibility of instruments with a sustainable label. In particular, investors have expressed fears that sustainable debt instruments, which are labeled as such by their issuers, may not be much different from their vanilla counterparts due to inconsistent instrument labelling, reporting, and data disclosure,” S&P Global Ratings said in a report last month. “These concerns have led to a call for issuers to follow more robust governance and reporting practices when issuing a sustainable debt instrument to drive greater comparability and harmonization across the asset class.”

“Over time, we believe there is room for every issuer to tap the sustainable bond market, indicating the market has much room to grow,” S&P Global Ratings said in its sustainable finance 2022 outlook. “In the meantime, investor demand for more detailed and consistent ESG disclosure, greater participation of external reviewers, as well as increased regulatory scrutiny, will all benefit the market.”

Today is Thursday, February 10, 2022, and here is today’s essential intelligence.

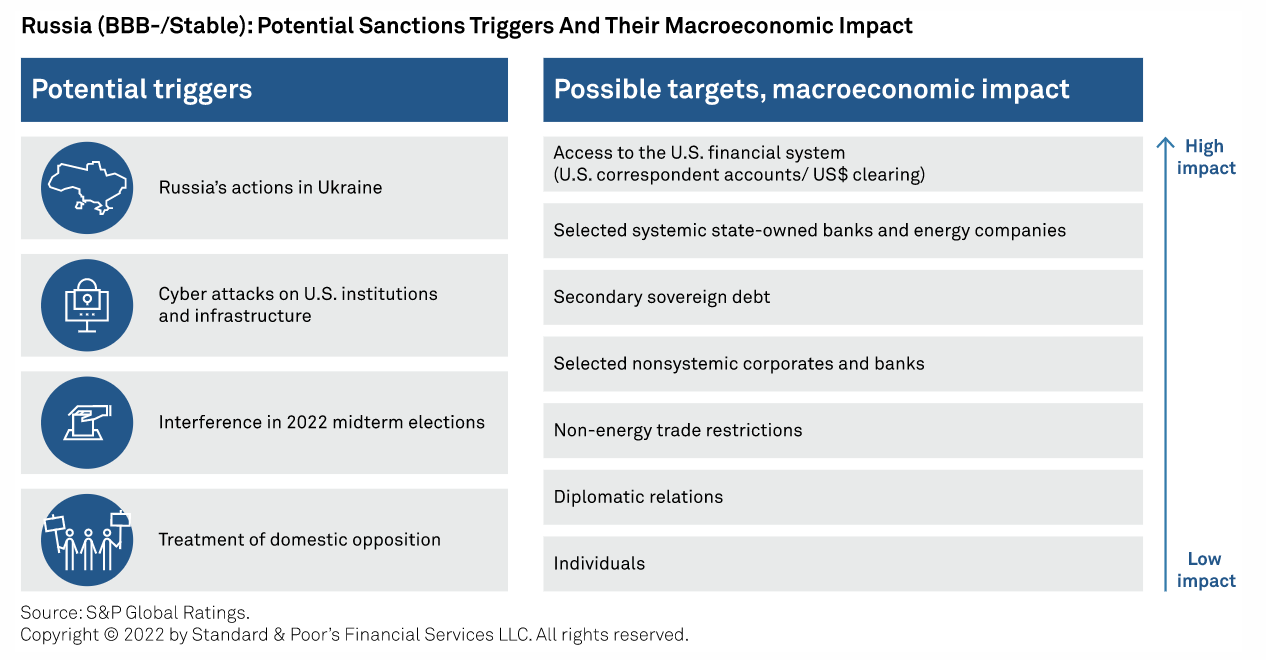

Possible Credit Consequences Of Escalating Russia-West Tensions Over Ukraine And Further Sanctions Against Russia

The escalation of tensions between Russia and the West over Ukraine and potentially retaliatory sanctions could have a destabilizing effect on Russia's economy. However, in S&P Global Ratings’ base case scenario, it expects those to be initially manageable given Russia's conservative policy framework and its strong fiscal and external balance sheets. Nevertheless, a more severe series of events, in a worst-case scenario, could result in harsher sanctions to Russia's main exports and a global energy price shock. The geopolitical stakes and the likelihood that they will persist suggests that strong sanctions on Russia will remain a risk undermining its long-term growth prospects.

—Read the full report from S&P Global Ratings

Access more insights on the global economy >

A Credit-Cycle Turn Could Expose Vulnerabilities In The Middle Market

The U.S. market for private debt has enjoyed a boom in recent years and it seems clear why: It is relationship-based lending, the deal execution is relatively swift, there is better documentation, and periods of distress can be relatively painless and quick to work through—as seen during the pandemic. Still, it remains difficult to assess just how much long-term risk exists and how vulnerable the borrowers would be in the event of a credit crisis. A slowdown in economic growth coupled with inflation pressures and rising interest rates—and the consequent pressure on margins—could weigh heavily on some weaker companies with low coverage ratios.

—Read the full report from S&P Global Ratings

Access more insights on capital markets >

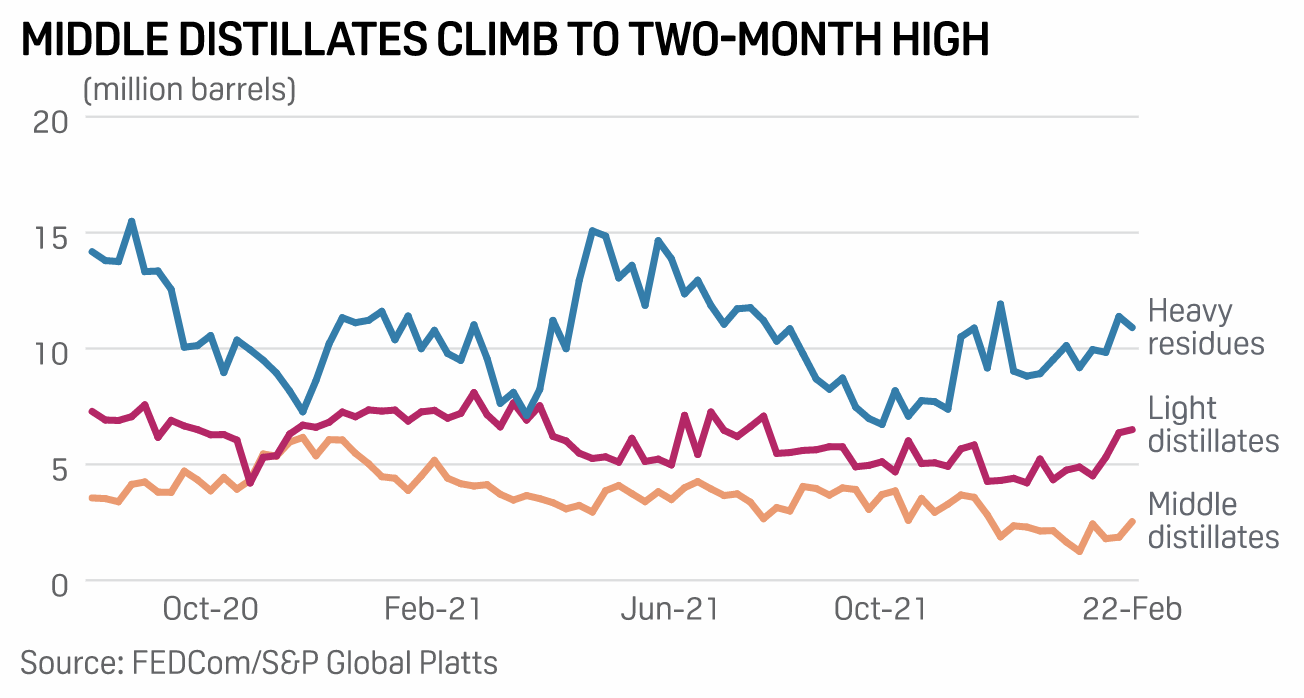

Fujairah Data: Oil Product Stocks Extend Gains As Middle Distillates Surge 36%

Oil product inventories at the UAE's Port of Fujairah rose for a fourth consecutive week as of Feb. 7, led by a 36% jump in middle distillates, such as jet fuel and diesel, according to Fujairah Oil Industry Zone data shared exclusively with S&P Global Platts on Feb. 9. Total stockpiles stood at 19.933 million barrels as of Feb. 7, up 1.7% from a week earlier and extending the highest level since Nov. 15, according to the data provided to Platts since January 2017. Middle distillates rose to 2.529 million barrels, the most since Nov. 22.

—Read the full article from S&P Global Platts

Access more insights on the global trade >

Listen: Battery Pack Costs On The Rise: Will It Slow Down EV Adoption?

For the first time in over a decade, battery pack costs started to increase—even in the low-cost segment. Battery packs are the main cost component in an electric vehicle, meaning that this uptrend should either squeeze manufacturers' margins or lead to higher EV price tags. Henrique Ribeiro from S&P Global Platts and Alice Yu from S&P Global Market Intelligence discuss how surging battery metals prices, particularly lithium, are playing a key role in the recent battery market developments.

—Listen and subscribe to Future Energy, a podcast from S&P Global Platts

EIA Projects Coal, Renewables To Generate Equal Stack Shares In 2022

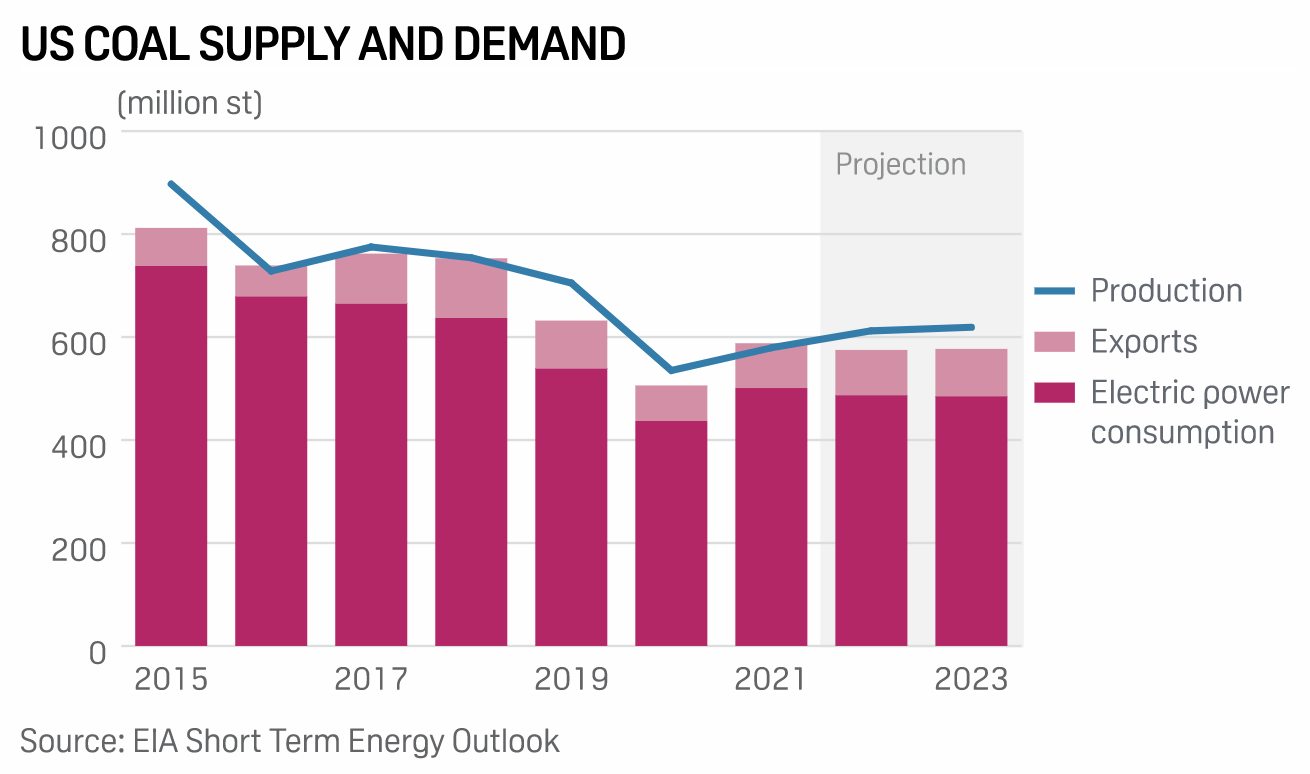

Coal and renewables both are projected to generate 22% of the total power generation stack in 2022, the U.S. Energy Information Administration said in a Feb. 8 report. Coal is expected to have a 22% generation share in 2022 and a 21.7% generation share in 2023, down from 22.6% in 2021. Renewables are projected to generate 22% of the total stack in 2022 and 24% in 2023, up from 20% in 2021. The U.S. is estimated to produce 611.6 million st of coal in 2022, up 5.6% from 2021. The 2022 projection was flat on the month. The 2023 production estimate also was flat on the month at 619.4 million st, up 1.3% from the year-ago period.

—Read the full article from S&P Global Platts

Access more insights on energy and commodities >

Federal, State, Community Leaders On Divvying Broadband Infrastructure Billions

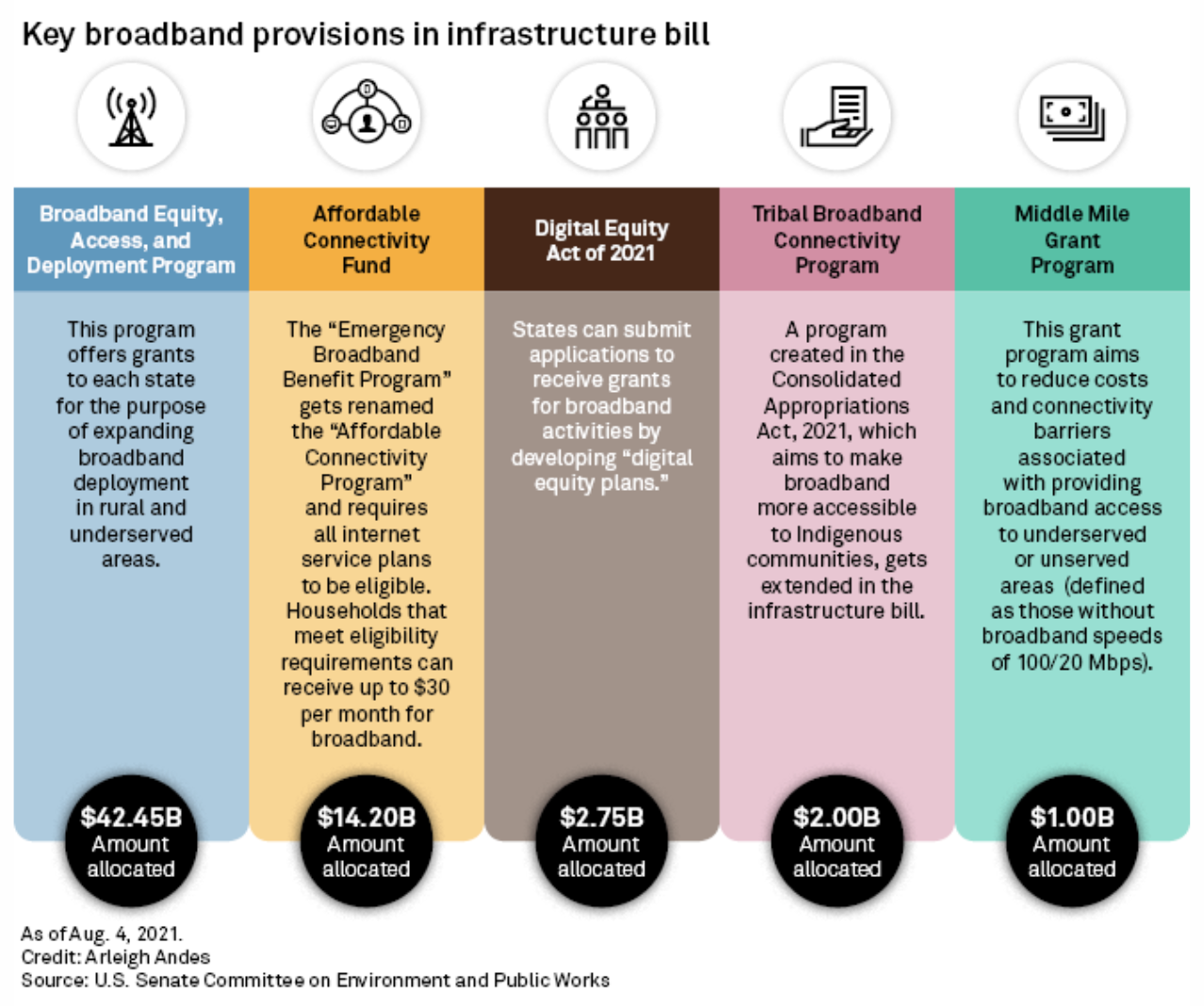

Republicans and Democrats agreed last year to spend tens of billions of dollars on building out internet service, but how and where to spend that money remains hotly debated. At the Feb. 8 INCOMPAS 2022 policy conference, experts from Capitol Hill and independent U.S. agencies congregated to discuss how to best use the $65 billion allocated to broadband deployment in the bipartisan infrastructure act. The National Telecommunications and Information Administration is responsible for handling approximately $48 billion of the $65 billion from the infrastructure legislation, and nearly 90% of that NTIA allotment is to be used for grants in states and U.S. territories to fund high-speed broadband deployment.

—Read the full article from S&P Global Market Intelligence

Access more insights on technology and media >

Written by Molly Mintz.