Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 15 Dec, 2020

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

When China announced to the United Nations in September that the world’s most pollutant economy intends to become carbon neutral by 2060, President Xi Jinping’s target was greeted with both praise and skepticism. Because China accounts for roughly 30% of the world’s total carbon dioxide emissions, the country would have to confront a total transformation of its economy to achieve its goal.

Since then, China has increased its target—thus moving the goalposts for its own transition. President Xi said during a Dec. 12 speech at the virtual Climate Ambition Summit held on the fifth anniversary of the signing of the Paris Agreement that China’s goal to reducing carbon dioxide emissions will now be 5% higher than the previous target, now 65% by 2030 from 2005 levels. Alongside this accelerated goal, China will increase its share of non-fossil fuels in primary energy consumption to 25% and grow its installed capacity for wind and solar generation to 1,200 gigawatts.

"Guided by our new development philosophy, we will promote greener economic and social development in all respects while pursuing high-quality development," President Xi said, according to a transcript of the speech.

China has been looking to rebalance its economy in the coming decades. Driven by a shrinking workforce, lower productivity growth, and less investment, a group of experts from across S&P Global anticipate that the Chinese economy will undergo a series of dramatic shifts: from manufacturing to services; from capital-intensive to innovation-led and asset-light activity; from exports to domestic demand; and from investment to consumption.

“Economic rebalancing to consumption from investment can make a decisive contribution to China's efforts to become carbon neutral by 2060. China's carbon emissions could fall by about one-third if private consumption rises to 55% from 38% of GDP by 2040, bringing the country closer to high-income economies,” the researchers said in the Dec. 10 report. “Rebalancing with a more ambitious 2-degree scenario results in an even more dramatic 61% fall in emissions by 2040 and puts China firmly on the path to carbon neutrality.”

While this type of rebalancing is challenging, there are a number of interrelated factors that would make such a transformation possible. As China’s economic growth slows, its energy needs will stabilize instead of continually climbing. Consumer spending rising to 55% of total spending, rather than its current status of 40% of total spending, will drive the economy to become more services-based, which would ultimately reduce emissions.

“The pace of rebalancing will need to double over coming decades. The upcoming five-year plan will need to set out a clear roadmap to accelerate the energy transition,” the S&P Global researchers said in their report.

China will also need to change their energy mix away from their dependence on coal and begin large-scale carbon capture.

"The only way around this that I can see is carbon capture and storage and use (CCS/U)," Philip Andrews-Speed, senior principal fellow at the National University of Singapore’s Energy Studies Institute, told S&P Global Platts, commenting on China’s carbon neutrality announcement. "It is reasonable to assume that the next 40 years will see the commercialization of CCS/U technology. The challenge will be to scale it up to manage the vast scale of China's carbon emitting industries."

Despite the impressive commitment, China’s dependence on coal for power and steel production remains strong and pervasive. A multitude of new coal-powered plants have been added to the Chinese energy grid in the past 10 years and plans are currently in place to add several more. However, Beijing’s 14th Five Year Plan, set to be approved in March 2021 during the fourth session of the 13th National People's Congress, does contain ambitious—if vague—targets for carbon reduction.

"Given China's pledge to stop emitting more carbons annually beyond 2030 and the long-run target of achieving 'carbon neutrality' by 2060, it is essential for Chinese national oil companies to have a green energy strategy as soon as possible," Kang Wu, Platts Analytics' Head of Global Demand, Risk, and Asia, told S&P Global Platts. "The earlier they get involved in the process, the more they will be able to take advantage of their rich energy resources at hand to drive down the cost of transition."

Global carbon dioxide emissions are projected to decline 7% this year due largely in part to the pandemic’s implications for travel and industrial activity, according to data from the Future Earth's Global Carbon Project.

Today is Tuesday, December 15, 2020, and here is today’s essential intelligence.

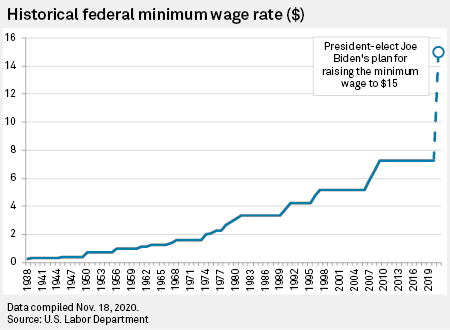

Biden's Push For a Minimum Wage Hike Could Prompt Bidding War at Retail

President-elect Joe Biden is pushing for a minimum wage hike that could ignite a bidding war over retail workers as major companies like Amazon.com Inc. have already bolstered their compensation and wield wage-setting power, according to policy and labor experts.

—Read the full article from S&P Global Market Intelligence

Debt-Laden 'Zombie Firms' Threaten to Disrupt Coronavirus Recovery – Group of 30

"Zombie firms" are coming, and these walking dead could threaten to undo the post-pandemic economic recovery as long as government intervention masks a coming corporate solvency crisis.

—Read the full article from S&P Global Market Intelligence

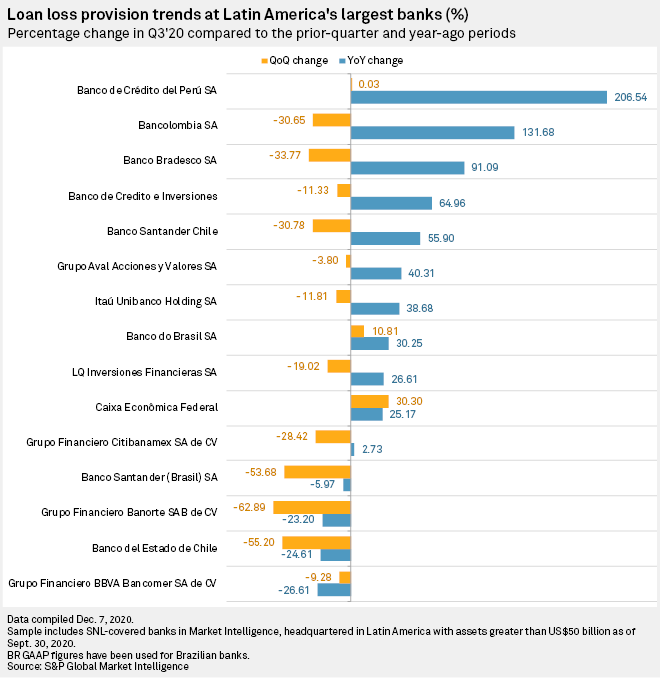

Latam Banking Majors Could be Turning The Corner as QOQ Provisions Slide

Most of Latin America's largest banks have accumulated enough reserves to see them through the rest of the coronavirus pandemic given the likely scenario of widespread vaccine distribution in 2021, analysts told S&P Global Market Intelligence.

—Read the full article from S&P Global Market Intelligence

Desire to Compete With Megabanks Driving More U.S. Regional Bank M&A – KBW CEO

The current environment is highlighting the value of scale and should encourage more bank M&A activity, including larger transactions, according to KBW CEO Tom Michaud.

—Read the full article from S&P Global Market Intelligence

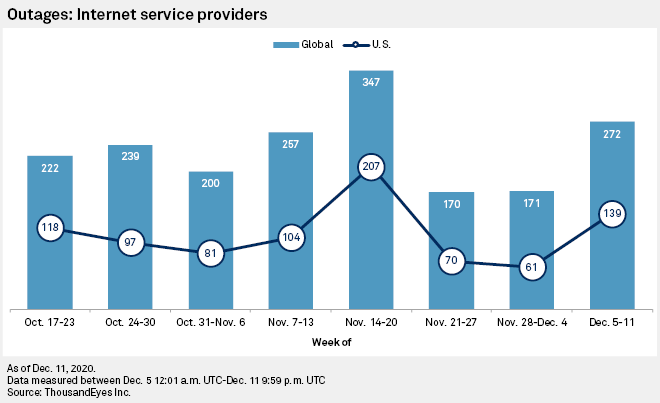

U.S. Internet Outages Jumped 128% in Early December, as Connections Broke Down

Brief outages at two highly connected network transit providers drove overall outages among internet service providers up 128% week over week in early December.

—Read the full article from S&P Global Market Intelligence

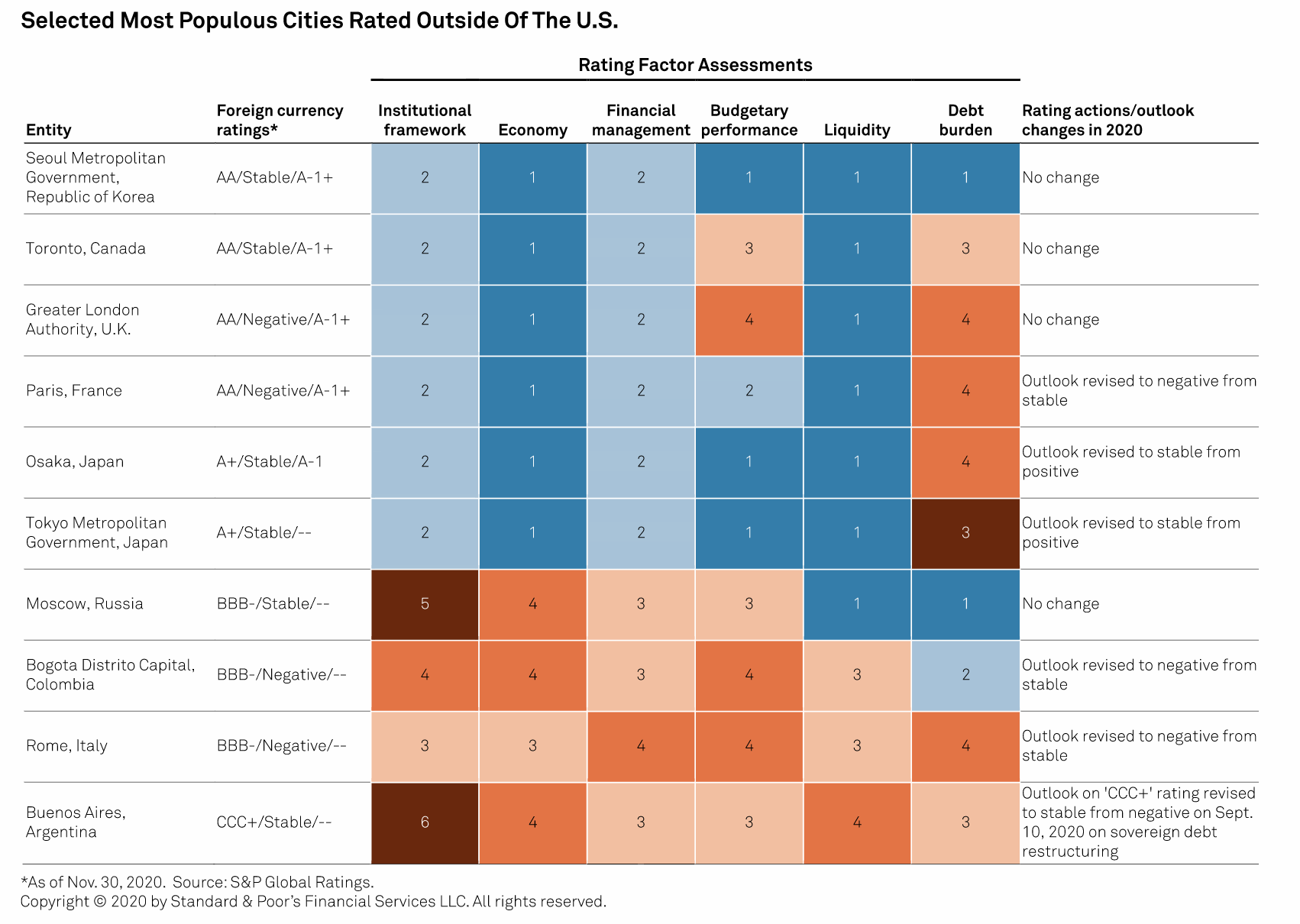

Major Capital Cities Must Be Vigilant About Rising ESG Risks As They Look To A Post-Pandemic World

Governance will be key to counteract the elevated social risks experienced by local and regional governments globally and maintain credit quality. Rating stability remains uncertain with the full social and economic consequences of COVID-19 in major cities still unknown, especially after the resurgence of new cases in some countries.

—Read the full report from S&P Global Ratings

Trudeau's Ambitious Climate Plan Stokes Optimism in Clean Energy Sector

An aggressive emissions-reduction strategy unveiled by Canada's government is being hailed as "historically and globally significant" by climate and clean energy industry groups.

—Read the full article from S&P Global Market Intelligence

EU Energy Ministers Agree Hydrogen, Offshore Wind Conclusions

EU energy ministers have agreed framework policy conclusions to promote a European hydrogen market and foster offshore wind cooperation, German energy minister Peter Altmaier said Dec. 14 after a virtual meeting.

—Read the full article from S&P Global Platts

UK Emissions Trading System to be Ready For Exit From EU: Government Whitepaper

The system underpinning a UK Emissions Trading System is on track to be ready for the country's exit Jan. 1, 2021, from the EU's own ETS, the UK government said Dec. 14 on publication of an Energy White Paper.

—Read the full article from S&P Global Platts

Japan to Push Back Issuing First Sovereign Green Bond Despite Emissions Goal

Japan is unlikely to tap into the sovereign green bond market for at least a few more years despite its recent pledge to go carbon neutral by 2050, experts say, citing the high cost of launching such a program and persistent budget deficits.

—Read the full article from S&P Global Market Intelligence

Exxonmobil Sets New Emission Reduction Plans; Anticipates Meeting 2020 Goals

ExxonMobil said Dec. 14 it has added reductions in greenhouse gas emissions over the next five years to support Paris Agreement climate change goals.

—Read the full article from S&P Global Platts

Watch: Market Movers Americas, Dec 14-18: Crude Moves Higher, But Caution Required Amid Vaccine Hopes

In this week's Market Movers Americas, presented by Sergio Alvarado: Crude prices higher but caution is required; Crude structure strengthens amid vaccine hopes; Grain markets digest WASDE report; Aframax freight sees upside ahead of holidays.

—Watch and share this Market Movers video from S&P Global Platts

Global Oil Demand Rebound to Accelerate in Second Half 2021: S&P Global Platts Analytics

Global oil demand will rise in 2021, but not enough to surpass 2019 levels as the coronavirus pandemic continues to weigh on transportation fuel demand, especially jet fuel, according S&P Global Platts Analytics.

—Read the full article from S&P Global Platts

OPEC Report Shows Room to Raise Output With Allies While Keeping Oil Market Balanced

OPEC's analysts on Dec. 14 painted a much gloomier view of the oil market in 2021 -– and yet indicated that the bloc and its allies can afford to be more aggressive with their planned increase in crude production in the months ahead.

—Read the full article from S&P Global Platts

Oil, Gas Deal Tracker: M&A Activity Slowed Significantly in November

Large-scale oil and gas M&A deal-making tapered off significantly in November following a tidal wave of consolidation activity in October.

—Read the full article from S&P Global Market Intelligence

Some U.S. Refinery Shutdowns Could Be Permanent as Margins Stay 'in The Gutter'

After the coronavirus pandemic-induced oil price collapse and resulting volatility, the integrated oil and gas majors have not been alone in making difficult choices.

—Read the full article from S&P Global Market Intelligence

Listen: What the OPEC+ Deal Means For Market Volatility, U.S. Crude Production

Ed Moya, senior market analyst at OANDA, which focuses on currency data and analytics, discusses what the OPEC+ deal means for market volatility, its impact on rebounding U.S. crude production, and what effect the incoming Biden administration could have on the group's thinking next year.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language