Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 11 Dec, 2020

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

The expansion of big technology companies across the digital ecosystem may decelerate as giants like Alibaba, Alphabet, Amazon, Apple, and Facebook are faced with antitrust scrutiny from regulators around the world.

This week, Facebook was slapped with two lawsuits from U.S. regulators—48 states, led by New York Attorney General Letitia James; and the Federal Trade Commission—accusing the company of engaging in illicit business practices to stifle competition. The antitrust suits pointed to Facebook’s $1 billion acquisition of the photo-sharing app Instagram and $19 billion purchase of the encrypted communication app WhatsApp, which have given the tech giant exceptional control over the intersecting digital worlds of social media and messaging, alleging that it’s impossible for other companies to challenge Facebook’s monopoly. Analysts believe that the lawsuits will result in Facebook paying fines, rather than significantly changing its business model.

The lawsuits followed an 18-month investigation into Facebook, and came just months after regulators pursued similar action against Alphabet and other big tech firms. In October, the U.S. Department of Justice (DOJ) and 11 states filed an antitrust lawsuit against Google, accusing the engine of engaging in "anticompetitive and exclusionary practices" that illegally monopolized general search and search advertising markets. Earlier that month, the U.S. House of Representatives released a 449-page report detailing that Alphabet's Google, Amazon, Apple, and Facebook are all monopolies or have “durable market power" following a separate 16-month antitrust investigation into those companies.

“In our view, the probability that today's controversial topics and investigations will have a serious impact on the big tech companies is low. However, the risk is higher now than in the past because of these companies' ever-expanding footprint in our global society and the bipartisan support to regulate them,” S&P Global Ratings said in an August report. “Over the longer term, we believe companies such as Apple, Alphabet, Amazon, and Facebook will accept more regulations and rules on the tech industry and its participants, as it will provide a clear operating framework.”

President-elect Joe Biden’s incoming administration may seize the opportunity to prioritize consumer privacy and end an era of relaxed antitrust enforcement. Bipartisan support for such action has swelled in recent years.

"I would expect the emphasis on tech to continue. I hope it broadens, because we shouldn't just be looking at four companies—we should probably be looking at a whole bunch more," Avery Gardiner, a senior fellow for Competition, Data, and Power at the non-partisan non-profit Center for Democracy & Technology and former DOJ lawyer who worked in the Antitrust Division, told S&P Global Market Intelligence this week.

Antitrust activity isn’t confined to the U.S., where the tech firms are headquartered. In Europe, regulators are accusing big tech firms of being monopolies with greater forcefulness than their counterparts across the Atlantic.

In the U.K., the country’s Competition and Markets Authority warned Facebook last month against integrating the animated-picture database Giphy, which it acquired in May, until the government concludes whether doing so would constrict competition. The European Commission accused Amazon in November of violating the bloc’s antitrust regulation by utilizing third-party sellers’ data from its platform to complete with the smaller sellers within its own marketplace.

"This is a continued theme, where the E.U. is more and more focused against Big Tech players with Amazon front and center, so it's not a shock to the Street that they continue to ratchet up the monopoly talk," Daniel Ives, an analyst with Wedbush Securities, told S&P Global Market Intelligence in an interview. "Ultimately, it's a harbinger of things to come when you look at what Amazon as well as every Big Tech company is facing, not just in the E.U. but in the U.S."

China, too, has indicated it will take on companies’ perceived anti-competitive business behavior. The massive online retailer and digital payments provider Alibaba is likely to be the target of the country’s focus. A Nov. 10 draft of regulations crafted by China’s State Administration for Market Regulation detailed prohibiting the misuse of consumer data, utilizing exclusive contracts, and operating with predacious pricing, among other practices.

"Stopping the Ant Group IPO was a strong signal from regulators that they want to maintain control over major domestic technology companies. The draft regulations are a further illustration of this goal," Benjamin Cavender, managing director at China Market Research Group, told S&P Global Market Intelligence.

Today is Friday, December 11, 2020, and here is today’s essential intelligence.

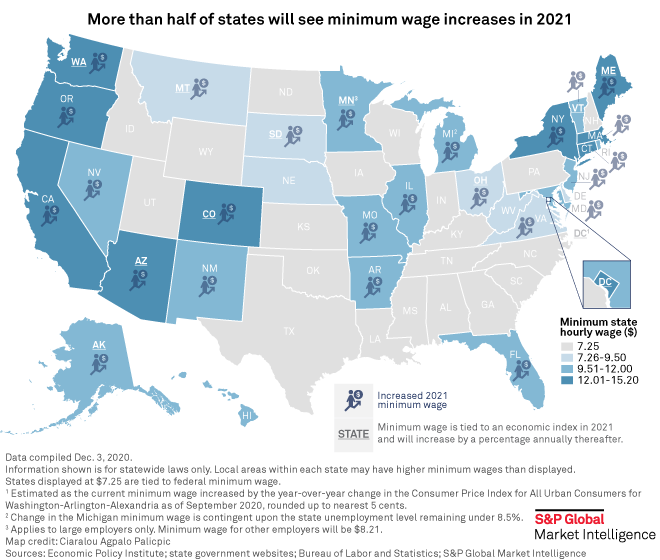

U.S. Restaurants Face Higher Costs Under Biden Plan to Boost Federal Minimum Wage

U.S. President-elect Joe Biden's support for a higher federal minimum wage could raise the cost of doing business for restaurants as the pandemic continues to eat into industry profits and put pressure on its workforce, experts say.

—Read the full article from S&P Global Market Intelligence

ECB Expands Pandemic Stimulus by €500b, Cuts 2021 Growth Outlook

The European Central Bank bolstered its coronavirus quantitative easing program and recalibrated other monetary policy instruments at its December meeting as it downgraded growth forecasts for 2021 amid a resurgent pandemic.

—Read the full article from S&P Global Market Intelligence

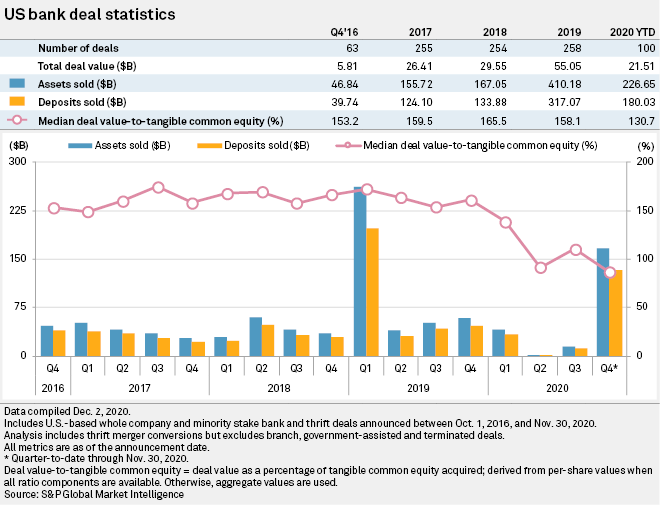

Bank M&A 2020 Deal Tracker: Only 4 Deals Announced in November

U.S. banks and thrifts announced only four deals in November, the lowest monthly total since May during the depths of the initial COVID-19 shutdowns.

—Read the full article from S&P Global Market Intelligence

As BBVA Quits U.S. Retail, Pressure Mounts on European Peers to do Likewise

Unable to generate the level of profits enjoyed by their U.S. rivals, some of Europe's large lenders are exiting or scaling back their stateside retail operations.

—Read the full article from S&P Global Market Intelligence

Crédit Agricole's 'Intelligent' Italian Deal Offers SME, Asset Management Boost

Crédit Agricole SA's acquisition of Credito Valtellinese SpA would strengthen the lender's foothold in Italy and bolster its position in lucrative small and medium-sized enterprise lending and in asset management at a relatively cheap price — if it can get it.

—Read the full article from S&P Global Market Intelligence

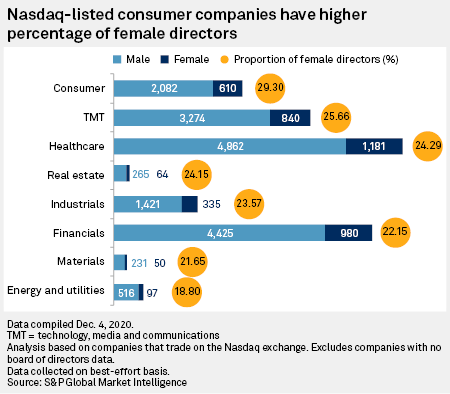

Nasdaq Diversity Proposal Puts Thousands of Company Boards on Notice

A Wall Street gatekeeper is challenging corporate America to diversify its boardrooms in a proposal that could have profound implications for leadership at thousands of U.S. companies.

—Read the full article from S&P Global Market Intelligence

Blackrock to Ratchet up Climate, Diversity Pressure on Companies In 2021

With $7.808 trillion in assets under management at its back, the world's largest investor will engage with more than 1,000 companies on climate-related risks in their businesses, push companies in the U.S. to disclose the ethnicities of their board members and press for political activity disclosures from companies, according to BlackRock's 2021 stewardship report.

—Read the full article from S&P Global Market Intelligence

Consumers Can Help Deliver A Carbon Neutral China

Economic rebalancing to consumption from investment can make a decisive contribution to China's efforts to become carbon neutral by 2060.

—Read the full report from S&P Global Ratings

China's Long March to Zero Carbon

At a virtual meeting of the UN General Assembly in September 2020, Chinese President Xi Jinping said the country planned "to have CO2 emissions peak before 2030 and achieve carbon neutrality before 2060"—Beijing's first formal announcement of a long-term plan to lower carbon emissions within a fixed timeline. If the pledge is translated into a plan and executed successfully, it has potential to be the most significant development in the energy and fossil fuel markets in decades, but China—a country that still depends on coal for more than half its primary energy—has a big gap to bridge between current reality and stated ambition.

—Read the full article from S&P Global Platts

European Commission Sees Maritime, Aviation Sector Hardest to Decarbonize Amid Fresh Targets

The European Commission has set out new targets for decarbonizing transport, highlighting that aviation and waterborne transportation face greater decarbonization challenges because of a lack of market-ready zero-emission technologies. It comes amid industry concerns about regional climate regulations.

—Read the full article from S&P Global Platts

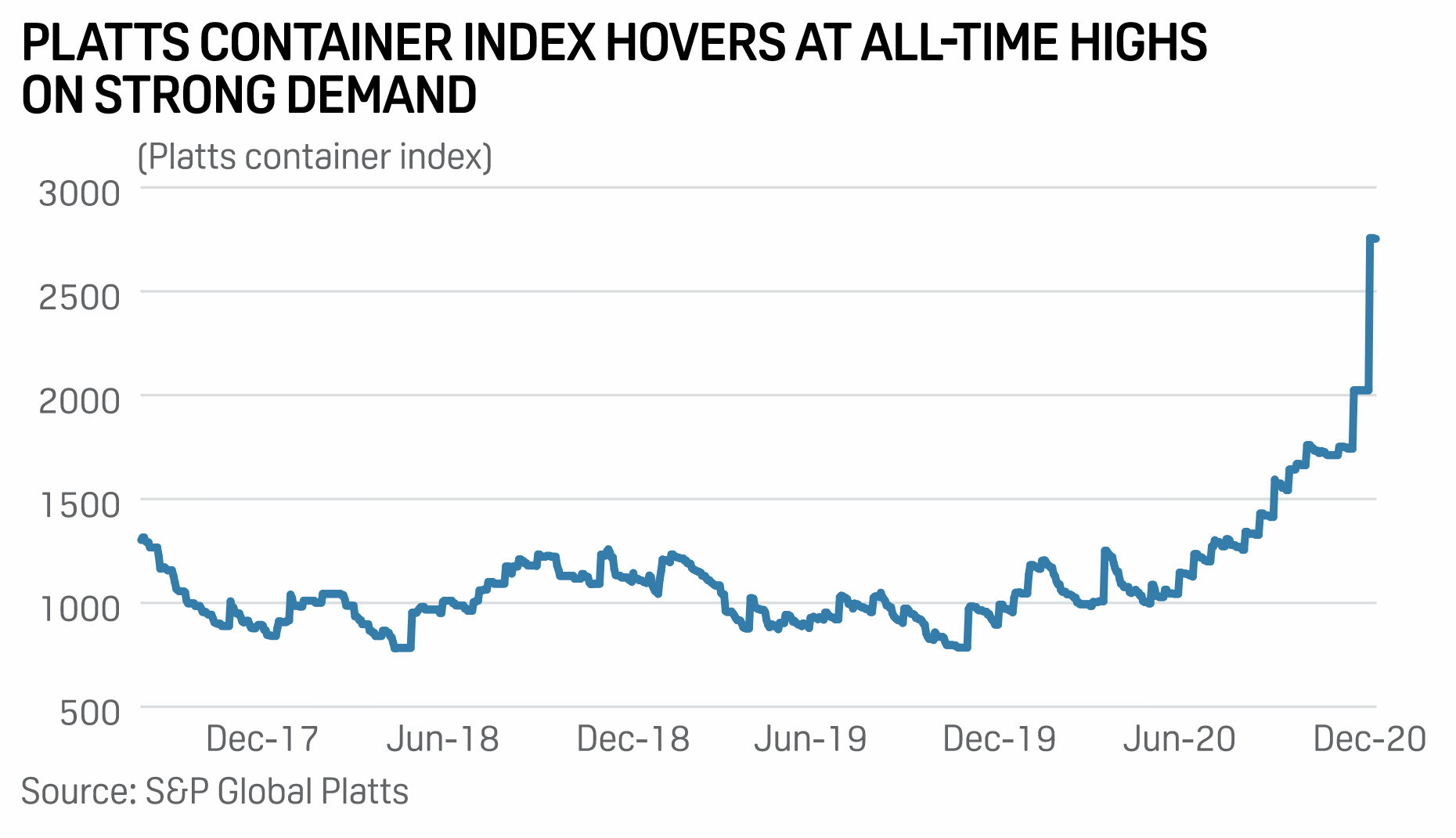

Container Freight Rates: Fresh Surge in Prices Propels Key Commodity Markets to Record Highs

A fresh surge in container freight rates toward year end – on the heels of a bullish run-up since the second quarter – is having a ripple effect across commodity markets including metals, petrochemicals and agriculture in December, posing logistical challenges and spurring sharp rises in product prices.

—Read the full article from S&P Global Platts

New North American LNG Projects Hindered by Dearth Of Contracting, Climate Concerns

Who is in, who is out among North American liquefaction developers? That is perhaps the biggest unanswered question for the global supply market in 2021.

—Read the full article from S&P Global Platts

Listen: For Flagship U.S. Crude, 2020 Has Been a Year of Challenges, Changes

Following significant growth of US crude exports before the pandemic and then the April 20 price collapse of the NYMEX WTI contract, S&P Global Platts launched its AGS assessment for waterborne cargoes of WTI Midland loading on the US Gulf Coast. Then just last week, Platts captured the global oil industry's attention with its proposal to include WTI Midland in the Dated Brent global benchmark beginning in March 2022. This episode reviews how Platts AGS has performed since its launch in June amid challenging fundamentals for global oil markets.

—Listen and subscribe to Global Oil Markets, a podcast from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language