Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 22 Aug, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

The Growth of Generative AI

The rapid advance of artificial intelligence since the release of ChatGPT in November 2022 is stirring discussion about AI in a wide range of industries.

While early iterations of ChatGPT focused on generating text, businesses are increasingly experimenting with how the technology could be used to create other forms of content, including images and videos. Concerns about these applications are one of the reasons Hollywood writers and actors are striking this summer: Union workers want more assurances that they will be compensated for potential digital derivatives of their work.

While the future of AI in Hollywood remains a subject of debate, many other industries are exploring ways to apply the technology to make workflows more efficient, including directing mining operations and targeting marketing materials.

451 Research, a part of S&P Global Market Intelligence, projects that revenues from generative AI will exceed $36 billion in 2028, compared with expected revenues of about $3.7 billion in 2023. While most generative AI tools focus on text, 451 expects that image, video and audio generation tools will experience significant growth, lagging only code generation, which is anticipated to be the fastest-growing generative AI category, wrote Nick Patience and Alex Johnston, data, AI and analytics analysts with S&P Global Market Intelligence.

In a July “Next in Tech” podcast about changing attitudes toward AI, S&P Global Market Intelligence analysts noted that the most useful applications of the technology still involve humans, but there are opportunities to streamline workflows to make human decision-making more efficient. How the technology is trained to produce content is also important to ensure that AI is not introducing incorrect or irrelevant information.

“ChatGPT is great, but it’s trained on the whole of the internet,” said Eric Hanselman, chief analyst of technology, media and telecom at S&P Global Market Intelligence. “You need to understand that if you’re going to put this to work, targeted, focused model development is really the key to making this more usable, and to ensure that it doesn’t go far astray.”

In a June “Fixed Income in 15” podcast, Alexandra Dimitrijevic, global head of research and development at S&P Global Ratings, suggested that how companies utilize AI is likely to become an increasingly important part of assessing corporate risk. Companies must ensure they are using the technology in a way that does not run afoul of privacy or intellectual property rights, for example.

As companies look to address AI risks, 451 Research expects that a growing need for AI governance tools will drive a wave of M&A in the software market, senior research analyst Krishna Roy wrote in a June report.

“AI needs to be developed and rolled out in a responsible, corporate-compliant and legal way,” Roy wrote. “The dangers of not doing so are high, involving financial risk, brand and reputational risk, and threats to customer trust and engagement.”

Today is Tuesday, August 22, 2023, and here is today’s essential intelligence.

Written by Christina Mitchell.

Week Ahead Economic Preview: Week Of August 21, 2023

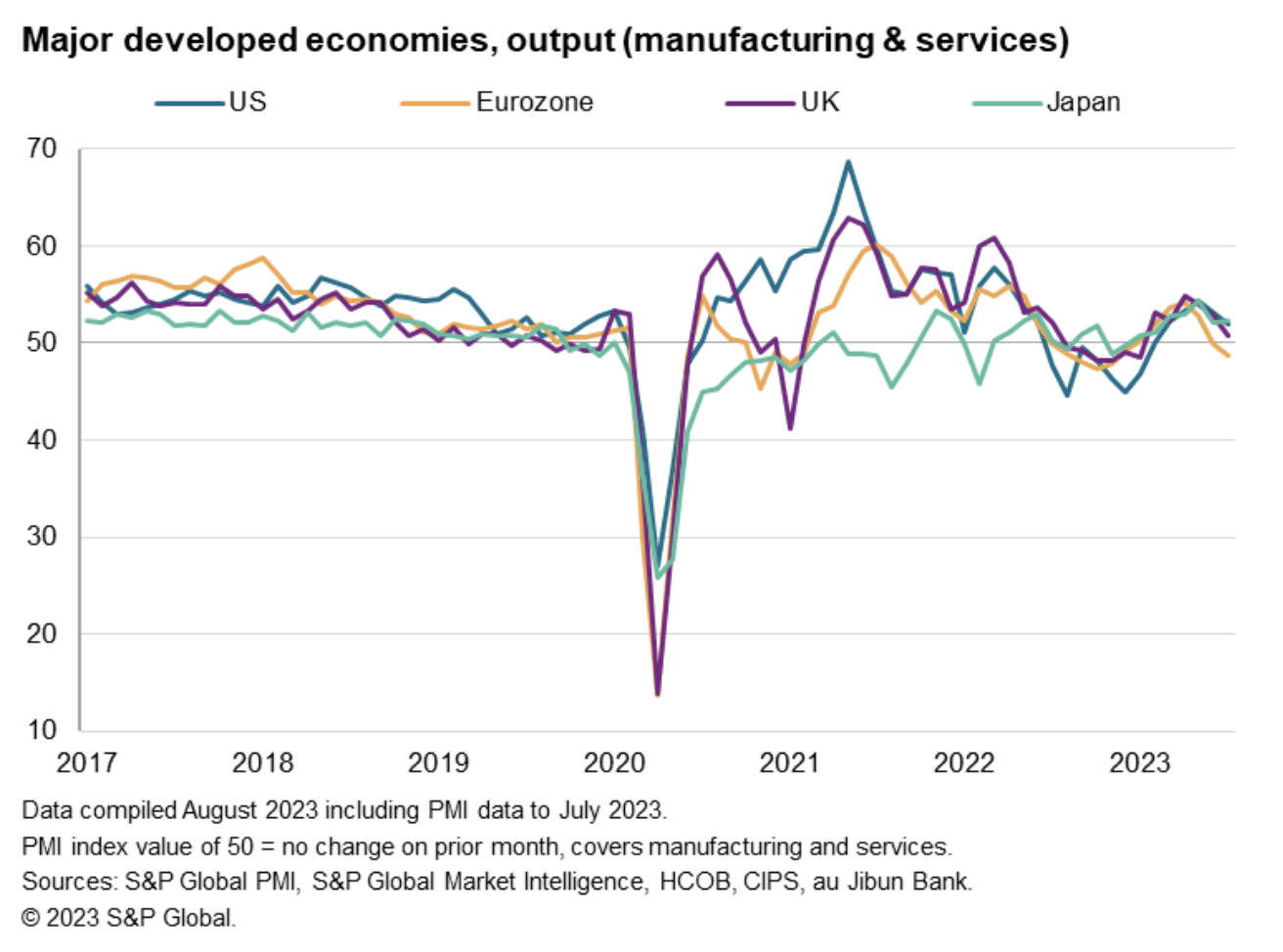

August flash PMI data will be unveiled next Wednesday for the earliest insights into economic conditions across major developed economies midway into the third quarter. On the central bank front, the Fed's Jackson Hole symposium will be eagerly anticipated for further Fed updates while monetary policy meetings also unfold in South Korea and Indonesia. Other highlights to watch on the economic calendar include US durable goods data, GDP from Germany and Thailand and CPI readings in APAC economies.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Default, Transition, And Recovery: The European Speculative-Grade Corporate Default Rate Could Rise To 3.75% By June 2024

S&P Global Ratings expects the European trailing-12-month speculative-grade corporate default rate to reach 3.75% by June 2024, from 3% in June 2023. Higher interest rates are forcing firms to spend more of their declining sales on debt servicing while the economy is resilient but slowing. A prolonged growth slowdown or recession could push the default rate higher — to 5.5% in its pessimistic case. This could arise if core inflation remains elevated and central banks are forced to push rates higher for even longer.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

Russia's New Arctic Crude Shipments To China Delayed By Thick Ice

Two of Russia's first Urals crude shipments from its Baltic Sea export terminals to China via the Arctic have been held up due to thick ice, according to tanker-tracking data, highlighting the challenges Moscow faces in promoting a faster transit route to Asia after sanctions shut off its crude flows to Europe. Navigation via the Northern Sea Route — which allows vessels to travel east from the Barents Sea through the Bering Strait and then down to the Pacific Ocean during summer months — was first tested in 2010 helped by receding Arctic ice levels due to global warming.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: Brewing Up Sustainability: Decarbonizing Beer And Other Industries Reliant On Steam

This episode of the Energy Evolution podcast by S&P Global Commodity Insights focuses on decarbonizing New Belgium's beer brewing operations. In addition to speaking with Andy Collins, the utilities and carbon neutral engineer at New Belgium, podcast host Taylor Kuykendall interviews Addison Stark, the CEO of AtmosZero. Backed by the US Department of Energy, AtmosZero recently introduced a carbon-neutral electrified boiler that decarbonizes process steam used in various industrial applications across multiple industries.

—Listen and subscribe to Energy Evolution, a podcast from S&P Global Commodity Insights

Access more insights on sustainability >

Inflation Reduction Act: A Pragmatist's Guide

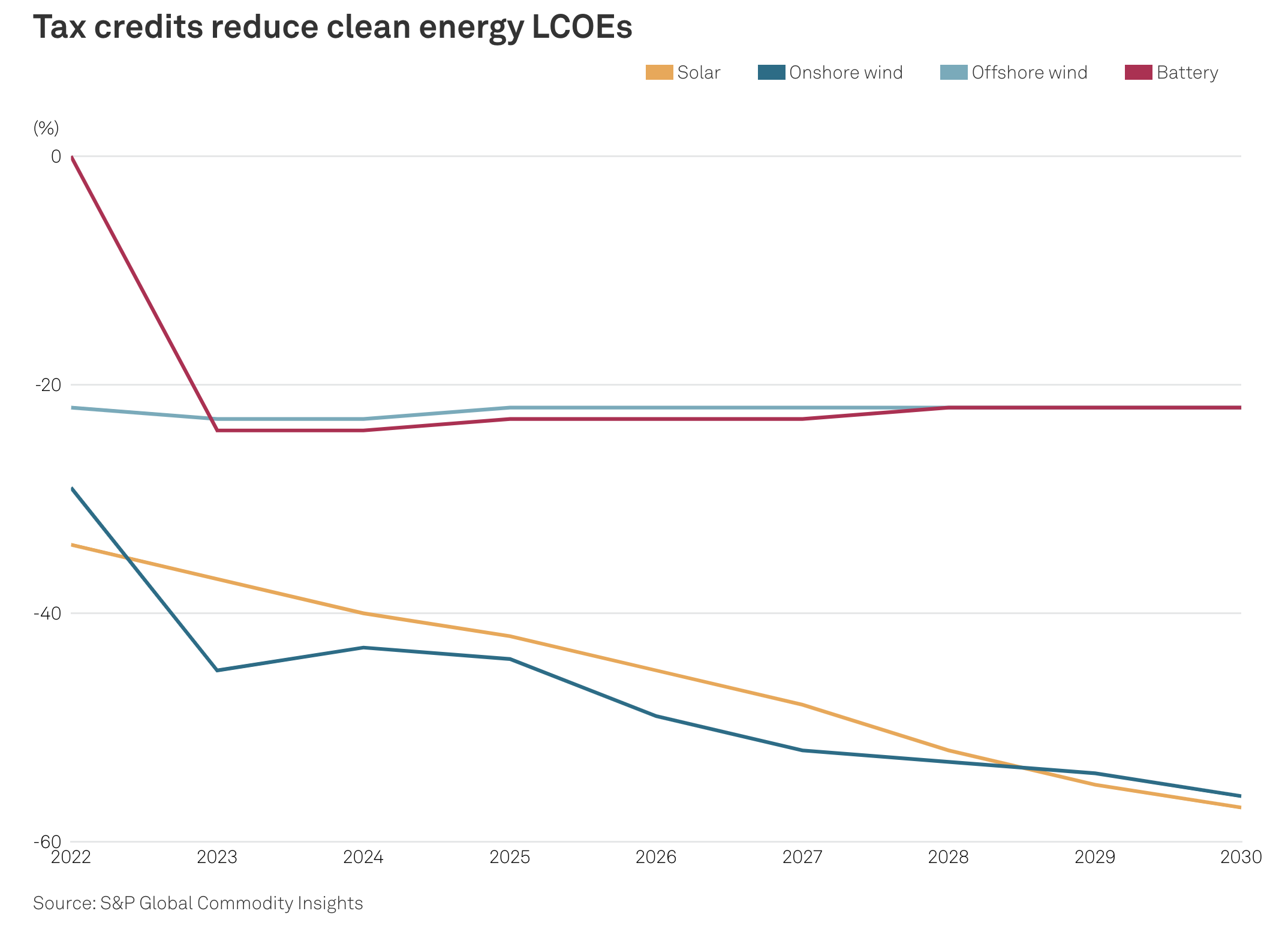

The Inflation Reduction Act of 2022 (IRA), signed into law by US President Joe Biden on August 16, 2022, contains an array of energy-related tax incentives aimed at combating climate change, as well as other measures aimed at reducing the federal deficit and reducing prescription drug prices. The IRA has been heralded as a massive boon for the energy transition, but is it enough to achieve economy-wide, or even power-sector carbon net-neutrality?

—Read the report from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: Next In Tech | Episode 129: Semiconductors In The AI Age

In one of the faster swings of the technology pendulum, semiconductors are back into a very bright spotlight. John Abbott returns to discuss the phoenix-like rise of high-performance silicon devices, like GPU’s, with host Eric Hanselman. New architectures aim at challenges presented by generative AI and large language models (LLM). Performant access to larger volumes of data are pushing levels of integration and chiplet approaches. The ecosystems to support them are ever more critical.

—Listen and subscribe to Next in Tech, a podcast from S&P Global Market Intelligence