Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 13 Apr, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

The outlook for the hospitality industry is brightening after more than a year of tumult, and consumers around the world are ready for a return to normal—on flights and at restaurants, hotels, and more. But while the global vaccine rollout is pointing toward a more positive future for lodging, travel and tourism, and food and beverage sectors, the recovery won’t be as smooth for those in Europe.

As the region is now less sensitive to the effects of social distancing restriction than it was last year, S&P Global Ratings expects the eurozone economy to grow 4.2% in 2021. However, the pandemic still imposes a threat. New nationwide lockdowns were implemented in France, Italy, and elsewhere in Europe as recently as last week to combat the spread of the pandemic. New cases of the coronavirus and its variants are increasing across the region, which has suffered from a stagnant vaccination strategy that has heightened both concerns over the safety of the AstraZeneca jab and hesitancy to get inoculated.

In the United Kingdom, Britons returned to activities that had been sequestered for months after the nation lifted its third lockdown yesterday. Pent-up demand may push people back to their favorite pubs, but S&P Global Ratings anticipates that the operating prospects for such establishments will remain tough over the medium-term. Larger pub chains are expected to experience a more rapid recovery over independents, and the entire sector may not see a return to pre-pandemic levels until 2023.

“The closures and restrictions that aimed to control the spread of COVID-19 have taken their toll on the hospitality sector. Pubs have not been able to stem their cash burn even after the support extended by the government (furlough and rates holiday), suppliers (who have taken on most of the burden of inventory impairments), and landlords (through rent waivers and deferrals),” S&P Global Ratings said in a recent report. “We expect many operators will take up to three years to rebuild their financial profiles to 2019 levels. Following the pandemic, customer behavior will continue evolving, so pub operators will have to be nimble with their offerings and formats to stay on top of fast-changing consumer preferences.”

European hotels may not see a complete recovery for a few years, as well. The lodging and travel sector could be the very last to enjoy a rebound in a post-pandemic global economy as social distancing and other restrictions continue. Most hotels and lodging companies in the region will struggle during the first half of this year, and if widespread vaccination continues to be delayed, the trouble could continue, according to S&P Global Ratings.

“Hotels and lodging companies generally generate the bulk of their revenues in the second and third quarters of a financial year, which means that vaccine delays could translate into a challenging 2021. We expect revenue could fall by 50%, with an EBITDA decline greater than 50% for 2021, reflecting the slow and fragile recovery for the sector,” S&P Global Ratings said, projecting that the full recovery for European hotels and lodging won’t materialize until 2023.

The health of Europe’s economy hinges on the health of its people. A frenzy of travel activity could return if Europe can vaccinate at least 70% of its population by September. Even then, European air passenger travel would be able to recuperate to just 30%-50% of pre-pandemic levels seen in 2019, according to S&P Global Ratings.

Today is Tuesday, April 13, 2021, and here is today’s essential intelligence.

Economic Research: U.S. Markets See Inflationary Ghosts; Macroeconomic Signs Disagree

As the U.S. economy looks set for its best year of growth since Beverly Hills Cop and the original Ghostbusters were battling for box-office dominance (that was 1984, for you young'uns), some financial market commentators are suddenly convinced that spiraling inflation is on the horizon--and that the Federal Reserve will be forced to tighten monetary policy sooner than it would like.

—Read the full report from S&P Global Ratings

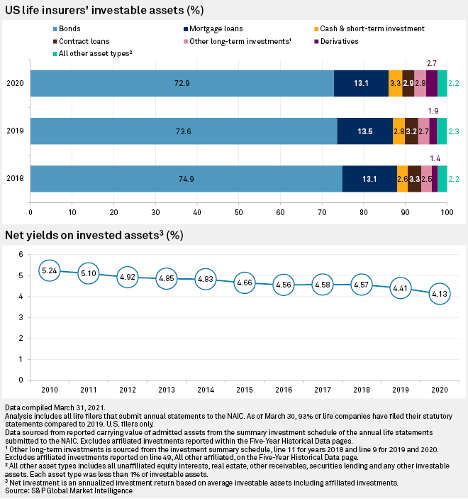

Life Insurers Turn to Cash Amid Pandemic, Tap Alternative Strategies for Yield

Life insurance companies increased their unaffiliated investment assets in cash and other short-term positions in 2020 as the coronavirus pandemic and subsequent economic downturn clouded longer-term outlooks, an S&P Global Market Intelligence analysis shows.

—Read the full article from S&P Global Market Intelligence

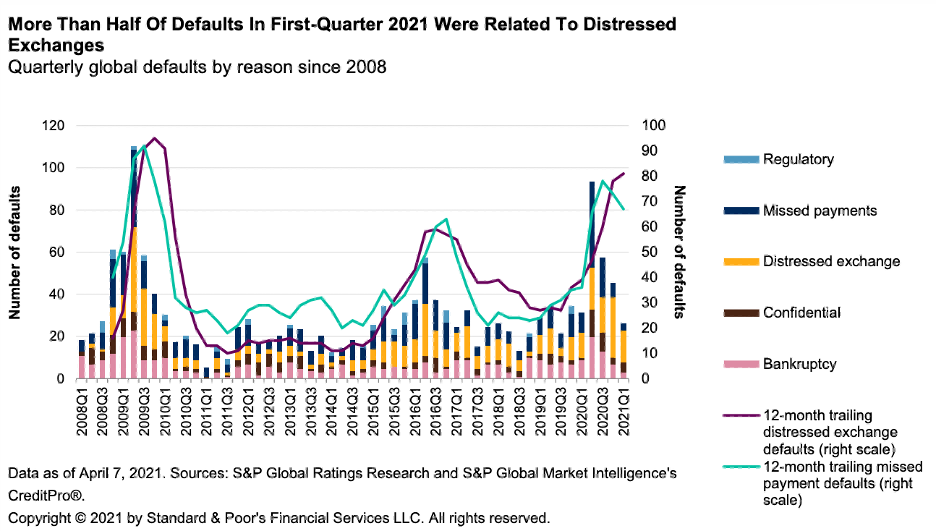

Default, Transition, and Recovery: Distressed Exchanges Account for Over Half of 2021 Defaults

The 2021 global corporate default tally has reached 26 after S&P Global Ratings’ added one confidentially rated default in a monthly reconciliation process.

—Read the full report from S&P Global Ratings

Sector Roundup Asia-Pacific Q2 2021: The Climb Back is Steeper For Some

The damage from the COVID-19 crisis continues to weigh on issuer financials in Asia-Pacific. S&P Global Ratings’ ratings on a net 16% of issuers have negative outlooks or are on CreditWatch with negative implications. While this ratio is a slight improvement over recent months, it still implies a significant likelihood of downgrades or defaults in 2021. The economic recovery in Asia-Pacific indicates an upside to revenue in 2021. However, the substantial hit to borrowers' financials in 2020 means that a full recovery to 2019 credit metrics is unlikely for the majority of issuers until well into 2022.

—Read the full report from S&P Global Ratings

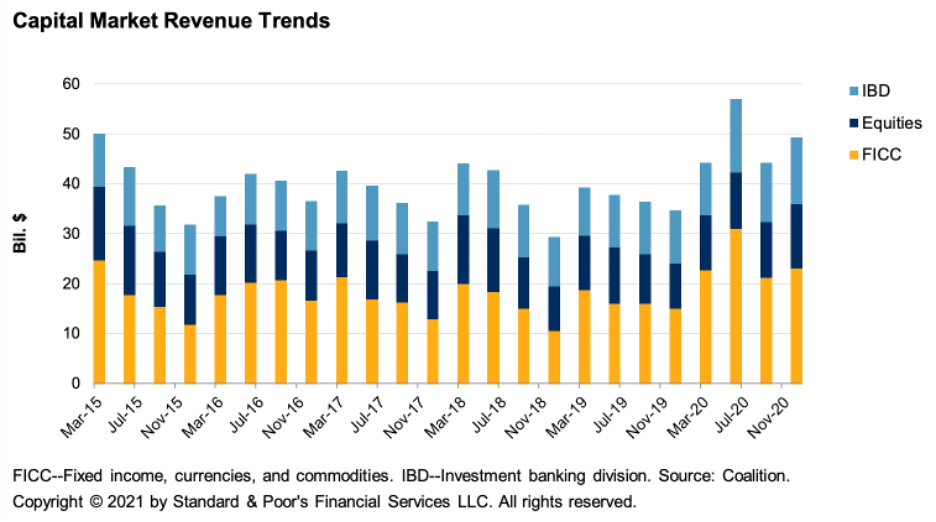

Capital Markets Revenue Should Remain Robust for Global Banks In 2021 Despite Risks

S&P Global Ratings projects capital markets revenue to remain robust this year but to decline by 5% to 10% from 2020's elevated levels.

—Read the full report from S&P Global Ratings

European Banks' Loan Loss Provisions Set to Decline In 2021 After 2020 Peak

Loan loss provisions at major European banks should record a moderate decline in 2021 after peaking in the immediate aftermath of the COVID-19 outbreak in 2020, but are not likely to drop below pre-pandemic levels before 2022, credit rating analysts said.

—Read the full article from S&P Global Market Intelligence

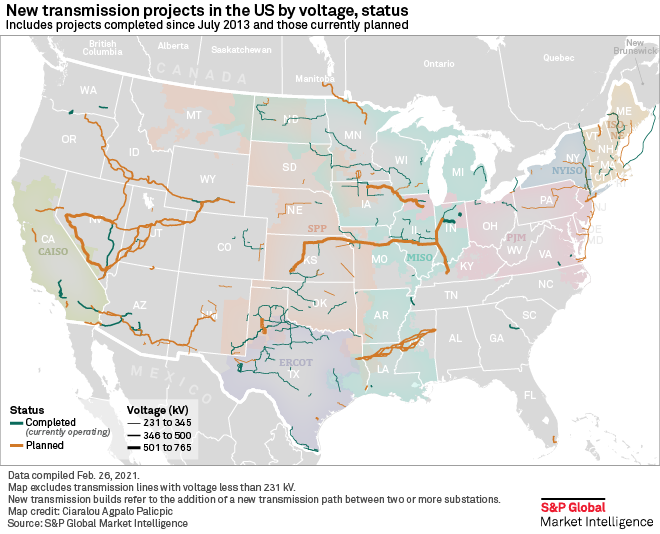

Transmission Strategy Takes Shape as Congress, FERC Press Ahead With Reforms

A package of far-reaching reforms to expand the nation's high-voltage electric transmission system is coming into focus as congressional Democrats begin drafting legislation in line with U.S. President Joe Biden's $2 trillion infrastructure vision.

—Read the full article from S&P Global Market Intelligence

Hydrogen Spot Markets A Decade Away, but Costs Falling Fast: Hydrogen Council

The scale of ambition in nascent hydrogen markets was huge but spot markets for the energy carrier were at least 10 years away, the head of the Hydrogen Council told S&P Global Platts.

—Read the full article from S&P Global Platts

Dakota Access Pipeline Fate Up to Judge After Army Corps Lets It Stay Open for Now

The fate of the Dakota Access Pipeline is in the hands of a federal judge after the U.S. Army Corps of Engineers said April 9 it will not independently order a shutdown of the primary Bakken Shale crude artery.

—Read the full article from S&P Global Platts

Active 2021 Hurricane Forecast a Familiar Threat to U.S. Oil, Gas, Power Industries

The 2021 Atlantic hurricane season will be another busy one, with an elevated probability for major hurricanes to make landfall along the continental U.S. coastline, according to an early forecast from Colorado State University.

—Read the full article from S&P Global Platts

Watch: Market Movers Asia, Apr 12-16: Increased Mobility Drives Gasoline Demand

In this week's S&P Global Platts Market Movers Asia, with Associate Editor Parisha Tyagi: driving activity – a proxy for gasoline demand – is increasing; markets await cues on China's crude and steel demand, oil product exports.

—Watch and share this Market Movers video from S&P Global Platts

Trade Review: China's Policies Cast Shadow Over Price Strength of Iron Ore

This report is part of the S&P Global Platts Metals Trade Review series, where S&P Global Platts digs through datasets and digest some of the key trends in metallurgical coal, iron ore, scrap and alumina.

—Read the full article from S&P Global Platts

Oil, Gas Deal Tracker: Q1 M&A Activity Surged as Billion-Dollar Deals Multiplied

Oil and gas M&A deal-making in the first quarter of 2021 rebounded from year-ago levels as supermajors like Exxon Mobil Corp., Royal Dutch Shell PLC and Equinor ASA divested assets and corporate consolidation continued, according to S&P Global Market Intelligence data.

—Read the full article from S&P Global Market Intelligence

Argentina's Vaca Muerta Faces Oil, Gas Production Decline as Protest Hits Sixth Day: Sources

Argentina's oil and natural gas output could begin to fall in the next few days if protesting health workers and truckers continue to block access to fields in Vaca Muerta, a shale play that has been driving growth, sources at two production companies there said April 12.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language