Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 13 Apr, 2020

This report is the fourth of five global mobile reports posted during Kagan's Mobile Week 2020.

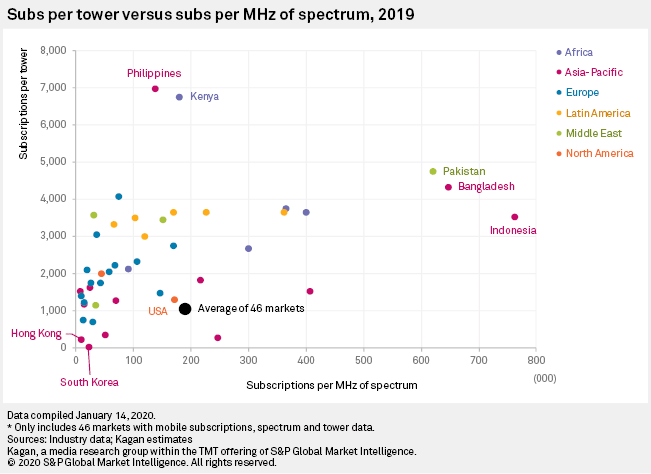

Kagan measured the congestion of mobile networks in 46 key mobile markets worldwide by calculating how many subscriptions are serviced per MHz of spectrum and how many are serviced per tower.

Click here (only for clients) to see the full report and detailed data in Excel format.

Overall, mobile networks became less congested in 2019 as both 4G expansion and 5G anticipation prompted the release of much-needed additional spectrum and towers. For perspective, the U.S. has a more congested tower network than the global average, but this is already an improvement from the previous year due to the recent allocation of new millimeter-wave spectrum for 5G.

Most nations with the least-congested spectrum networks, such as Finland, Hong Kong and Norway, have already released new 5G spectrum in mid-bands or mmWave bands.

The opposite is true for the massive mobile markets of India and mainland China. India, for instance, has the fifth-smallest spectrum portfolio in our list, but it has the second-largest mobile user base. China fares slightly better due to the recent awarding of new 5G spectrum, but this is still significantly congested by global standards. India's spectrum network may see some respite in 2020 if the planned 5G auction is a success.

Switching to towers, the Philippines has the most congested towers. We discussed in an earlier report (only for clients) that the national telco regulator plans to build 50,000 more towers within 10 years through a tower-sharing policy.

While efforts are underway to decongest the tower networks in other markets, there is not much push to do so in Kenya and Pakistan. Instead, operators divest their towers to get rid of debt and opt instead to rent shared towers. Kenyan operators, with the help of Alphabet Inc. subsidiary Loon, are also experimenting with stratospheric balloons (only for clients) as cost-effective alternatives to terrestrial towers.

At the other end of the list, South Korea's heavy reliance on small cells (only for clients) made it the least crowded market. Small cells also helped decongest the tower networks of Hong Kong, Japan and Taiwan.

Similar to our previous (only for clients) analysis, we plotted both spectrum and tower congestion metrics on a scatter plot to see which markets need to allocate more spectrum and which need to build more towers. Spectrum-starved India and mainland China are clear outliers, so we excluded them from the analysis to get a better picture of the rest of the markets.

The Philippines and Kenya sit at the top-left of the chart, which means they have to build more towers to complement their current spectrum levels. For Bangladesh, Indonesia and Pakistan at the far right, spectrum and tower congestion are both high, but they could focus more on expanding their spectrum portfolio. Hong Kong and South Korea are the least-congested markets, both sitting at the bottom-left corner of the chart.

Markets from the same region seem to flock together, perhaps because similar topographic, demographic and regulatory situations result in similar congestion levels. Latin American markets, for example, have roughly similar tower congestion levels due to the presence of large, multinational operators across the region. European markets, on the other hand, have uncluttered spectrum networks due to the coordinated release of spectrum led by the Radio Spectrum Committee of the European Commission.

Wireless Investor is a regular feature from Kagan, a media market research group within S&P Global Market Intelligence's TMT offering, providing exclusive research and commentary.

Events

Blog