Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

8 Jun, 2022

By Bill Holland

Vehicles make their way down the 110 freeway toward downtown Los Angeles during a morning commute. Gas- and diesel-burning vehicles are a source of Scope 3 emissions, which include those caused by customers' product use.

Source: Mario Tama/Getty Images News via Getty Images

North American oil and gas producers have split from their European peers over how to handle the largest category of carbon emissions and how these releases are addressed will have multitrillion-dollar ramifications around the world.

|

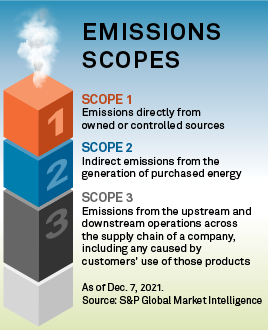

Scope 3 emissions — those released when consumers heat their building, drive or fly — make up the bulk of an oil and gas company's greenhouse gas impact and the largest amount of carbon emitted into the atmosphere.

European oil majors have all sworn to reach net-zero emissions of any kind by midcentury, the deadline scientists say will keep the temperature rise to less than 2 degrees C.

By contrast, U.S. oil and gas producers argue that customers need to be accountable for the carbon they emit by paying a tax on it. A carbon tax, the U.S. industry argues, would shape consumer behavior and naturally lead to less fossil fuel use because consumers will have to pay for the privilege. A tax could also put the nation on a path toward a price on carbon, an almost essential tool for technological advancement.

Trillions of dollars of value at stake

The stakes on the outcome are measured in trillions of dollars over the next 50 years.

Deloitte's Economic Institute calculated that a world temperature increase of 3 degrees C — essentially a business-as-usual scenario — could result in an economic loss of $178 trillion.

By contrast, shifting to a decarbonized economy and limiting climate change would create $43 trillion in new value before 2070, according to Deloitte.

"The problematic piece has always been the Scope 3 because of the double counting, because of who's responsible for that, and should you hold a company like ConocoPhillips responsible for a consumer's decision to buy a pickup truck versus a Toyota Prius," ConocoPhillips Chairman and CEO Ryan Lance told analysts on the company's May 5 earnings conference call.

European majors becoming energy providers

European majors, including BP PLC and Shell PLC, have pledged to reach net-zero Scope 3 emissions by 2050. They plan to tackle the problem by phasing out production of refined products while using cash flows from oil and gas to finance investments in renewable energy, primarily wind and solar.

Norwegian major Equinor ASA's strategy is typical of European plans to reach net-zero on a Scope 3 basis: Continue to produce hydrocarbons and use the cash to invest in renewables and low-carbon products. As low-carbon products gain share, the company plans to reduce hydrocarbon production while investing in offsets to be net-zero by 2050.

Of the 30 largest oil and gas companies sampled, all six European firms had Scope 3 net-zero-by-2050 goals. Across the ocean, only three of 24 North American firms had Scope 3 net-zero-by-2050 goals: Canadian oil sands producer Suncor Energy Inc., Occidental Petroleum Corp. and pipeline giant Williams Cos. Inc.

US producers push carbon tax

U.S. oil and gas companies have largely declined to make commitments around Scope 3 emissions, saying customers are responsible for those carbon emissions and need to bear the costs of using oil and gas. The U.S. industry argues that a carbon tax increases the cost of oil and gas to the user and is the best way to reduce demand.

None of the big three U.S. oil and gas producers made an executive available for an interview to discuss their stance on Scope 3 emissions.

Exxon Mobil Corp. referred all queries regarding Scope 3 emissions to the company's website. Chevron did not reply to several requests to discuss Scope 3 emissions. ConocoPhillips provided an update on Scope 3 in the context of a May 10 annual meeting where shareholders voted down proposals to limit Scope 3 emissions.

|

At that meeting, 41% of shareholders voted down the measure asking the company to set specific Scope 3 goals in line with the Paris Agreement on climate change.

Conoco spokesman Dennis Nuss said the company's current plan is adequate and vowed to continue to work with investors.

"While we recognize many stockholders are concerned about Scope 3 end-use emissions, the vote supports our view that setting a Scope 3 target is not the right solution for an E&P company with transition-oriented portfolio and production," Nuss said in an email after the vote.

ExxonMobil has said that forcing producers to account for Scope 3 emissions will hinder future emissions reductions. Producers can quickly lower emissions by selling unused assets to operators with lower environmental standards, Exxon argues.

The three supermajors' rationale for not setting a Scope 3 goal is echoed throughout the U.S. oil and gas industry, from the sector's largest trade group, the American Petroleum Institute, to small Appalachian shale gas producer CNX Resources Corp. CNX has said it has already reached net-zero Scope 1 and 2 emissions because of the amount of methane it removes from coal mines for other companies, although that claim has been met with skepticism from environmental groups.

Spending the global carbon budget

The stakes are too high not to move urgently to cut emissions, according to Mike Coffin, the head of oil, gas and mining at London-based think tank Carbon Tracker, which examines the financial impacts of the energy transition. The world has to act now to slow the rise in global temperatures, Coffin said.

"There's only a certain amount of CO2 and other greenhouse gases that can be emitted to the atmosphere if we're to remain below 1.5 [degrees C]," Coffin said. "Scope 3 emissions accounts for around 85% of total emissions that result from the use ... of fossil fuels, particularly oil and gas."

The simplest way to count them is from the output of thousands of oil and gas companies, rather than the millions of power plants and cars around the world, Coffin said.

Occidental is relying on carbon capture and storage as well as some of the first North American deployments of direct carbon capture plants, newer technologies that have been criticized as unproven at the scale the climate crisis demands.

Pipeline giant Williams sees emissions reductions as a profit center as the industry moves to lower carbon emissions. In contrast with its upstream peers, Williams has fewer Scope 3 emissions to account for.

Focusing on specific emissions goals misses the larger financial, political and technological changes that are occurring, according to Pavel Molchanov, director and oil, gas and renewables analyst for Raymond James & Associates Inc.

"Solely looking at who has or does not have net-zero targets would be an overly simplistic, narrow perspective," Molchanov said. "The U.S. is the world leader in carbon capture and sequestration. On the flip side, European oil and gas multinationals are much more active in investing in wind and solar. The point is that the targets tell only a portion of the story — we need to think about this more holistically."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.