Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — May 12, 2021

By Michael Dall

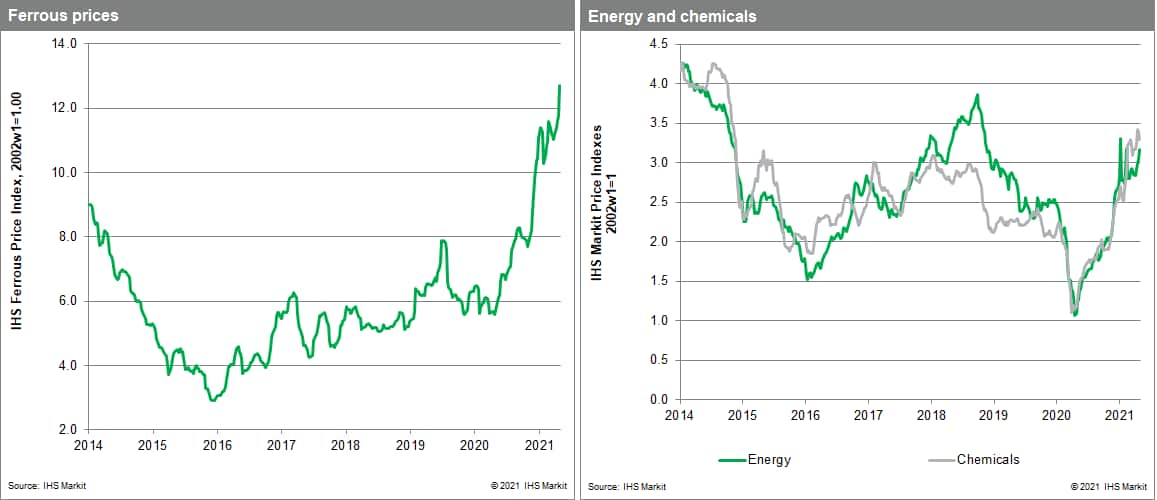

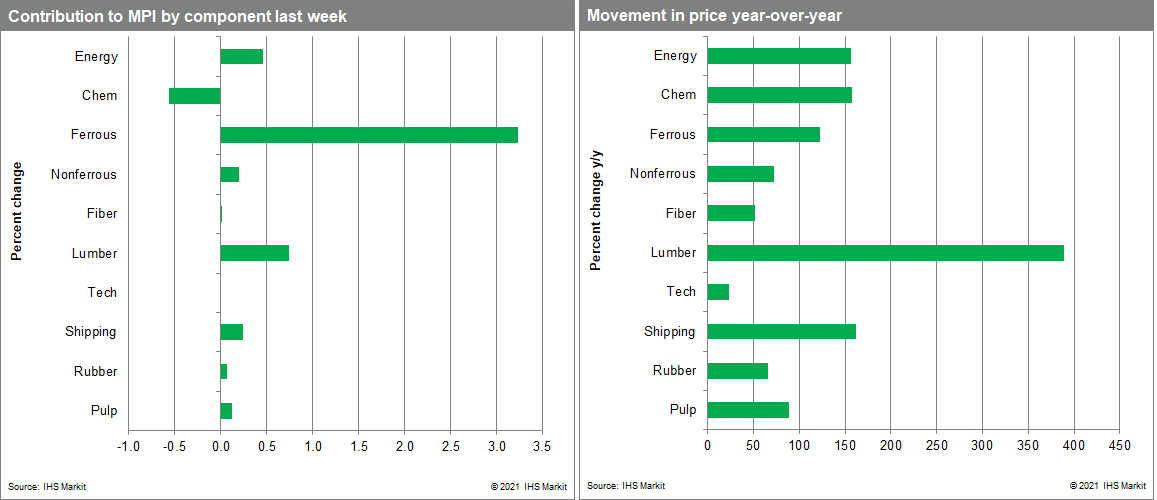

Our Materials Price Index (MPI) climbed 4.5% last week, following a 1.6% increase the previous week. This is the fifth consecutive weekly price increase and the latest move puts the index at its highest point since September 2011. Prices, as measured by the MPI, have increased by 128% since early May 2020.

Eight of the MPI's ten sub-components posted increases last week with industrial metals the largest contributors to the upward move. The steel-making raw materials index jumped 8% as the price of iron ore broke the $200 per metric ton barrier. This latest move was triggered, in part, by a rush from Chinese steel producers to secure iron ore ahead of potential trade restrictions between Australia and China. Chinese steel production continues to soar despite the Chinese government's efforts to curtail production to meet stricter environmental limits. The nonferrous metal index was up 2.6% last week as copper's rally continued. Strong demand from mainland China and an onerous new tax regime on the mining sector in Chile that passed the lower house of the legislature sent copper prices to $10,361 a tonne, a new record. Investor appetite was further fueled by expectations of a future rise in green infrastructure projects where copper will be an important raw material. The MPI's chemical index provided some price relief last week as supply issues improved. The global chemical industry was reeling from the winter storms in the US in February, but operating levels have now recovered, and the sub-index fell 2.8%.

It was a record week for equity markets with the S&P 500 closing at an all-time high. This was despite the US nonfarm payroll report coming in significantly below market expectations. However, US wage increases were strong and investors remain focused on the global economic recovery, which continues to support commodity prices. Commodities are also being used as a hedge against potential future inflation and with Chinese traders returning after the May Day holiday it was another bumper week on commodity markets. Notwithstanding these demand-side factors, it is the continuing disruptions in supply chains that remain the main issue reflected in surging prices. The only solace in looking toward the summer is that absent some new shock, IHS Markit believes supply-chain conditions during the second quarter are as bad as they will get. Assuming some improvement in delivery times and higher inventories, markets should begin to see some price relief in the second half of the year.

Posted 12 May 2021 by Michael Dall, Associate Director, Pricing and Purchasing, S&P Global Market Intelligence