Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jul 01, 2022

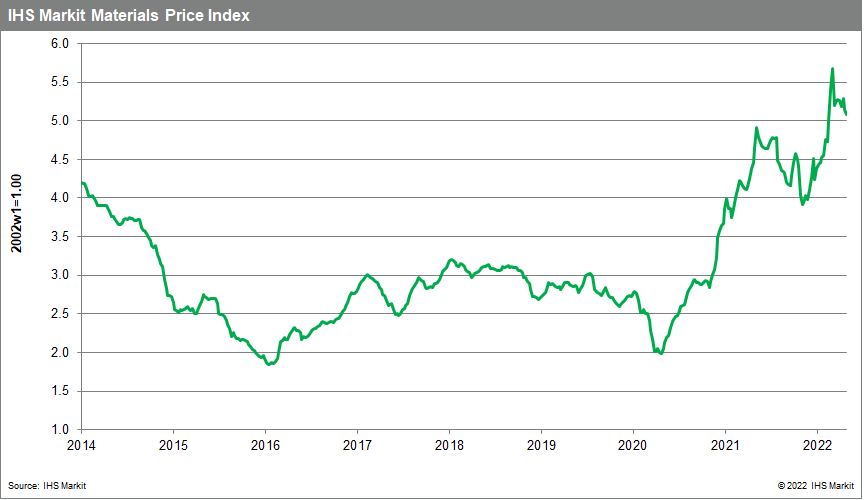

Materials Price Index (MPI) fell 0.8% last week, building on the 1.3% decline in the previous week. Prices declined in eight of the ten subcomponents of the index, highlighting widespread weakness around growing recession fears. The general direction of commodity prices has been down since their recent peak in early March, though the MPI is still up 15% year-to-date, and 5.1% year-over-year.

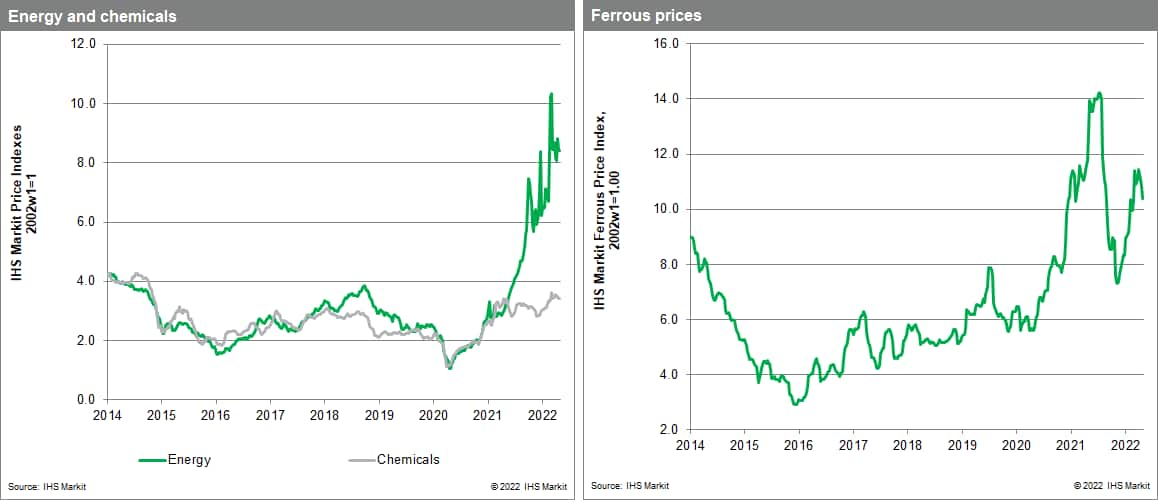

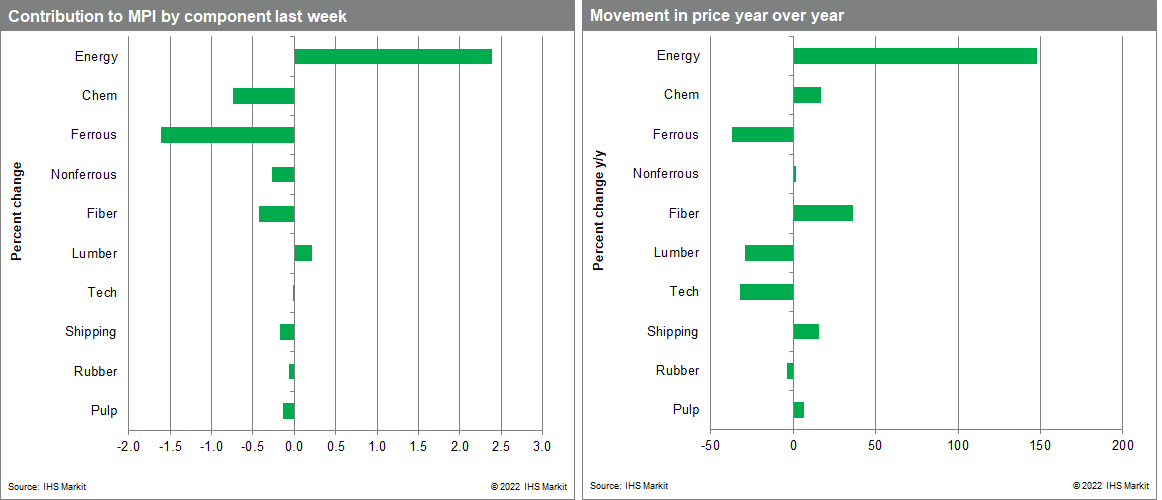

Energy and lumber prices were the only subcomponents to register increases. The 9% climb in energy prices was driven by large increases in natural gas prices in Europe and Asia. Both regions are scrambling for LNG imports to make up for the loss of Russian supply or deal with surging demand. Coal prices were also up due to strong power demand. Lumber prices jumped 10.1%, with the market continuing to show week to week volatility. This said, the market is on a downward trend - lumber prices peaked in February at $1,400 per 1000 board feet (mbf); they stood at just $612 mbf even after last week's increase. Across subcomponents, fiber prices registered the largest decline in last week, falling 7%. The decline was driven by a steep drop in cotton prices; the US market gave up three months of gains in a week, dropping 14.4% amid poor demand sentiment. Another noteworthy mover was the 5.5% decline in ferrous metals prices, driven by both iron ore and scrap prices. Weak demand for steel is weighing on the upstream inputs. Ferrous metals prices have generally turned lower since the first week of April as demand globally has deteriorated.

Aside from energy prices, the developing theme continues to be weakening demand and the growing fear that central banks worldwide will not be able to avoid recessions as they work to tame inflation. The early flash PMI data indicated slowing economic growth in the US, Europe, and UK, with manufacturing output in these large economies slipping slightly into contraction territory for the first time since May 2020. The good news in the recent correction in commodity markets is that these price declines are now migrating downstream in supply chains, promising to slow goods price inflation in the second half of the year. The open question, however, is whether this slowdown in manufacturing activity and goods prices will be enough to begin to slow top-line consumer price inflation before year-end.

Posted 01 July 2022 by Thomas McCartin, Senior Economist, Pricing & Purchasing, S&P Global Market Intelligence

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.