Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jun 29, 2023

By Chris Rogers

The annual Wimbledon tennis tournament uses 55,000 of the more than 300 million tennis balls made globally. UK sourcing of tennis balls has shifted, yet still faces significant ESG issues such as supply chain labor rule violations, carbon footprint challenges and recycling issues.

Tennis ball supply chains

The All England Lawn Tennis Club World Championships, aka Wimbledon, uses 55,000 tennis balls per year and draws annual attention to the sport. Like many leisure activities, tennis products experienced supply chain disruptions during the past three years.

While operational conditions in most supply chains have returned to normal — as outlined in "Right place, right time: Supply chain outlook for third quarter 2023" — supply chains for tennis have longer-term challenges to address around sourcing and sustainability.

The value of UK imports of tennis rackets and balls jumped by 42% year over year in 2022, S&P Global Market Intelligence data shows. Inflation likely played the main part in the higher value of imports. The average import price per tennis ball imported rose by 32% year over year in 2022.

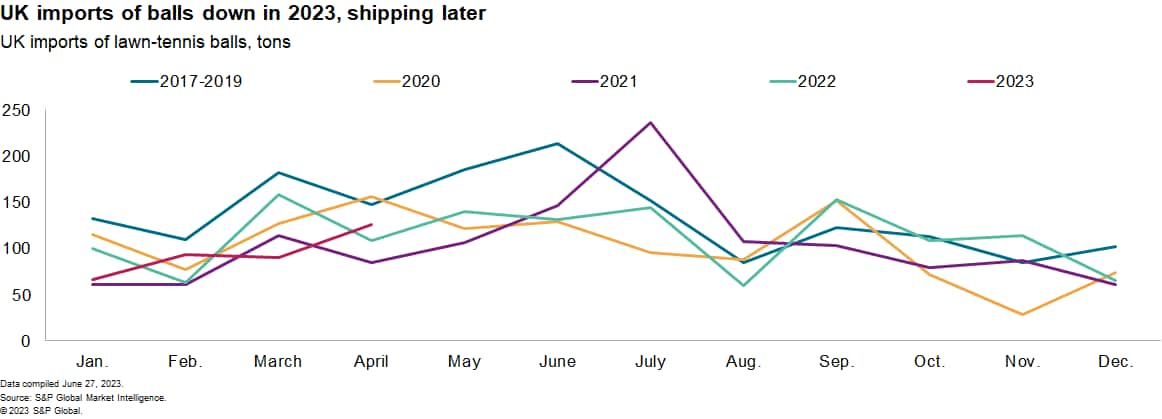

Shifting seasonality may also play a role in shipments in 2023, which fell in the first four months of the year. In 2023 so far there are also signs of later shipments than in prior years, which may reflect excess purchases in 2022.

UK sourcing of tennis balls has changed over the past two years. Imports from mainland China accounted for 51% of shipments in 2022, up from 40% a year earlier and 46% over the prior five years. Imports from Thailand and Pakistan have increased, while those from the Philippines and EU have declined.

Labor, carbon and recycling: Supply chain challenges

Sourcing tennis balls is not simply a matter of volume, timing and price. There are also at least three ESG supply chain issues to address.

International Tennis Federation-compliant tennis balls contain a mixture of 72:28 natural to synthetic rubber in their production as well as a variety of other natural and synthetic compounds.

While synthetic rubber can be sourced locally via petrochemical production, there are limited sources of natural rubber. Global natural rubber exports in 2022 were dominated by Thailand at 36% of global exports according to Market Intelligence data, with Indonesia at 25%. Shipments from Cote d'Ivoire have expanded rapidly.

Sourcing challenges for natural rubber include US government claims of the use of child labor in Cote d'Ivoire, Indonesia and Vietnam. The Zoological Society of London has also raised concerns over deforestation and a wider lack of supply chain transparency in reporting by rubber product manufacturers.

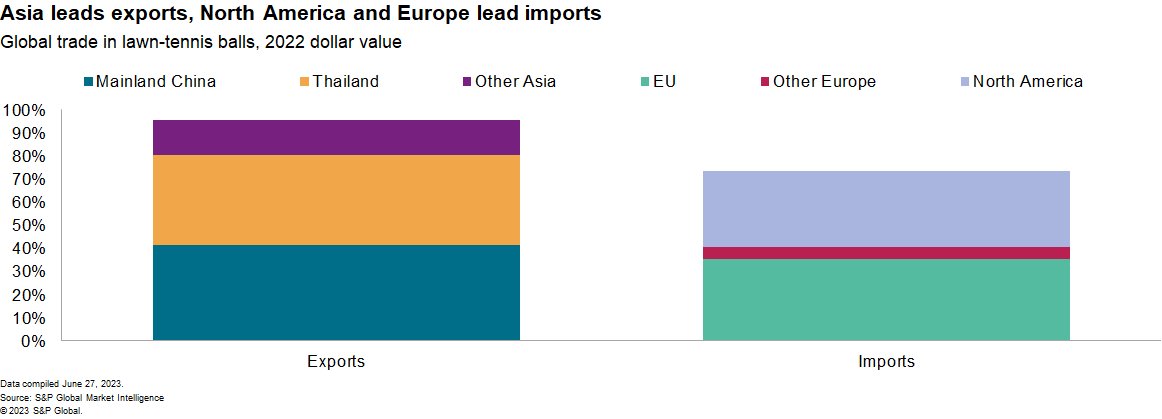

A second issue is the carbon footprint of tennis balls. The finished product is bulky, being air-filled spheres that have to be packed into cuboid packaging. Long-haul shipping is highly prevalent, with 96% of global exports coming from Asia while 73% of global imports head to Europe and North America.

A third challenge comes from tennis balls being a disposable product. There's a global challenge with around 300 million balls produced annually, while in the United States 125 million balls reportedly go to landfills each year.

The rubber recycling industry is growing rapidly, though that's focused mostly on the tire industry. India accounted for 82% of UK scrap rubber exports in 2022, while the UK represented 34% of India's scrap rubber imports, according to Panjiva data.

However, the mix of rubbers in tennis balls make material separation for recycling challenging. That's led the industry to pursue reuse rather than recycling strategies, including the start of shredding balls for use in floor surfaces in France and the United States.

Subscribe to our Supply Chain Essentials newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.