Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Mar 16, 2021

By Sam Pierson

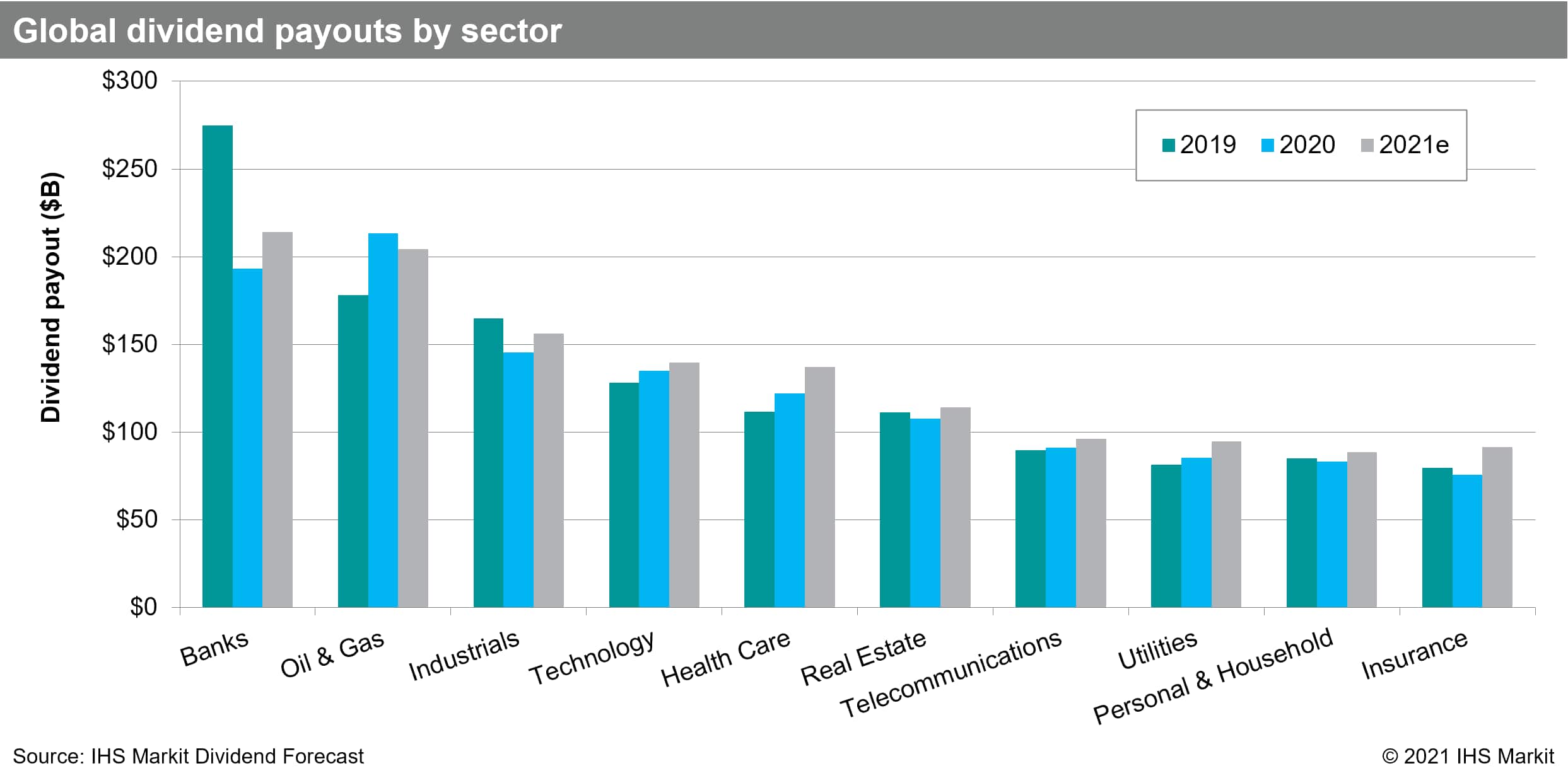

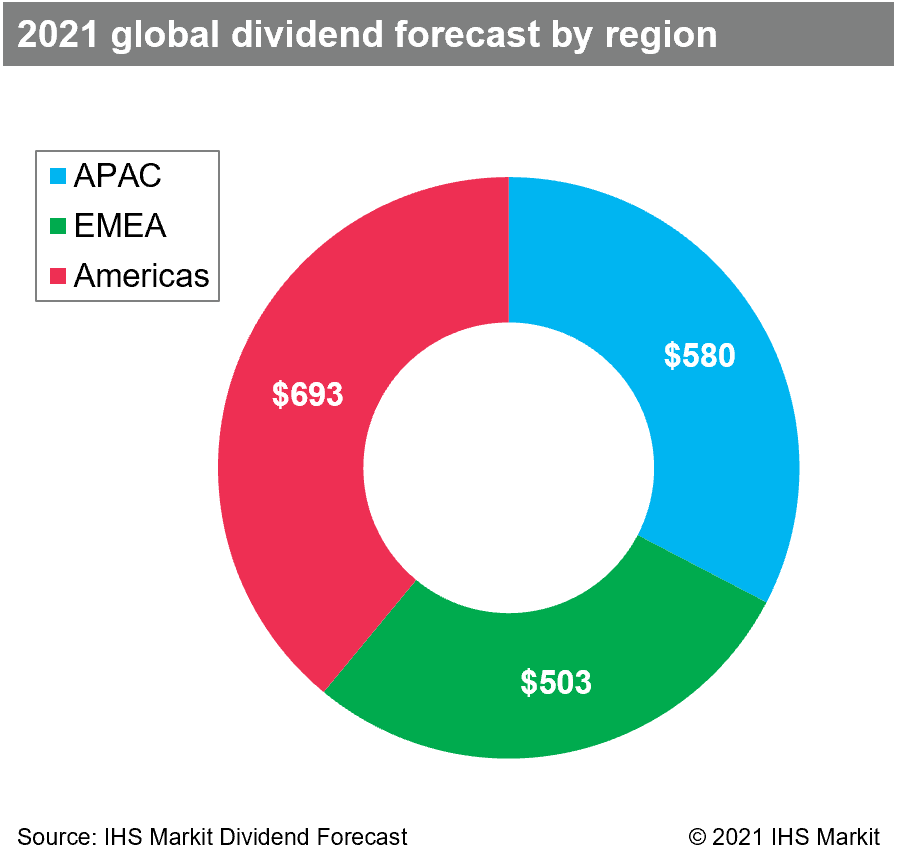

The recovery in dividend payouts is expected to vary across regions in 2021, per IHS Markit Dividend Forecast analysts. Global dividend payouts are forecast to reach $1.78T in 2021, a 6.5% YoY increase. Global Banks are forecast to retake the mantle of the most dividend paying sector globally, with payouts of $214B in 2021, an 11% YoY increase, though the sector will still fall 22% short of 2019 payouts. The global Oil & Gas sector is forecast to have the 2nd most dividend payouts in 2021, with $178B, reflecting a 4% YoY decrease. Oil & Gas is the only global sector forecast to see a decline in YoY payouts.

EMEA dividends are expected to recover unevenly, with the U.K. dividends leading the growth. Eurozone and the U.K. are expected to increase 22% and 30% YoY, respectively; however, payouts are not forecasted to exceed 2019 levels. Most sectors outside of Travel & Leisure and Automobiles are expected to see some level of recovery. Total EMEA dividends are expected to increase by $74B in 2021, a 17% YoY increase. Nearly 28% of EMEA dividends are forecasted to be paid out by emerging markets.

Dividends in Asia Pacific are expected to grow by 6.7% in 2021, with growth expected across all sectors excluding Travel & Leisure and Oil & Gas. China & Hong Kong SAR are both forecast to grow in 2021, increasing by 9% & 3% respectively. After declining 5% in 2020, dividends in Japan are forecasted to increase 5.6% in 2021, sufficient to notch a narrow increase compared with 2019.

There is forecasted to be a 0.4% decline in overall payouts for the Americas. Dividends in the U.S. are expected to fall 0.7% YoY, largely due to ongoing sluggish performance in Travel & Leisure and Retail sectors. The banking sector is also forecast to see a YoY decline, though, that is primarily concentrated in a single payer. Canada is forecast to deliver $54.5B in 2021 payouts, a 7% YoY increase, driven by the Oil & Gas and Banking sectors.

Conclusion:

The expected rebound in dividend payouts serves as another marker of the global economic recovery underway. Global dividends are forecast to increase markedly YoY overall and for many global markets. The forecast $1.78T in global payouts is 0.34% below the 2019 level, a most welcome return to form after the 6% decline in 2020.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.