Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Dec 04, 2023

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

A busy build up to the holiday season includes worldwide services and sector PMI data and the November US labour market report in the week ahead, in addition to trade and inflation figures from mainland China. Central bank meetings in Canada, Australia and India will also unfold alongside third quarter GDP releases from the Eurozone, Australia, Japan and South Korea.

November's non-farm payrolls will be closely watched after flash US PMI data revealed that employment, across both manufacturing and service sectors, declined for the first time since June 2020. Any accompanying slowdown in wage growth will be a welcome development, especially with the market reacting positively towards any reminder of slowing inflation and possible Fed cuts going into 2024.

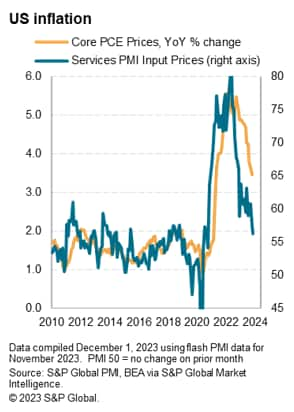

Separately, worldwide services and composite PMI data will be due December 5. Following indications of sustained weakness in the goods producing sector, services activity growth will be crucial in keeping the JPMorgan Global PMI business activity index, compiled by S&P Global, out of contraction territory. At the same time, price trends will be closely observed for any signs of sticky core inflation, after the G4 economies collectively revealed higher selling price inflation in the service sector via November flash PMIs.

Additionally, sector PMI, which follow on December 6, will shed light on whether sector convergences have further unfolded, especially after October figures revealed that the manufacturing malaise had spread to services. This will be due on the same day as eurozone retail sales numbers, whose trend has aligned with PMI figures to reveal reduced consumer spending on the back of cost-of-living pressures.

Central bankers in Canada, Australia and India meanwhile gather for their final monetary policy meetings of the year, though no changes are expected according to consensus. Taking the spotlight in the APAC region will instead be Q3 GDP data from Australia, while Japan and South Korea also update revised economic growth figures. Finally, mainland China's trade and inflation figures will be eagerly assessed, followed recent indications of improvements in the manufacturing sector according to the Caixin PMI.

An absence of supply chain pressures and lower oil prices meant input cost inflation in global manufacturing decelerated in November, according to the worldwide PMI surveys compiled by S&P Global.

The Global Manufacturing PMI Input Price index fell from 53.2 in October to 52.1, a three-month low. While the recent price gains contrast with falling prices seen in the three months to July, the rate of increase remains subdued by historical standards (the index averaged 55.6 in the decade leading up to the pandemic).

While the historical weak rate of increase for industrial prices bodes ill for corporate profits, as weak demand has encouraged greater price competition, it is good news for inflation. However, it is the upcoming week's services PMI price data that will be of more interest to policymakers, as these service sector costs and prices are more closely correlated with core inflation, and are more directly influenced by interest rates.

Monday 4 Dec

Germany Trade (Oct)

Switzerland Inflation (Nov)

United States Factory Orders (Oct)

Tuesday 5 Dec

Worldwide Services, Composite PMIs, inc. global PMI* (Nov)

South Korea GDP (Q3, final) and Inflation (Nov)

Japan Tokyo CPI (Nov)

United Kingdom BRC Retail Sales Monitor (Nov)

Philippines Inflation (Nov)

Australia RBA Interest Rate Decision

Singapore Retail Sales (Oct)

France Industrial Production (Oct)

South Africa GDP (Q3)

Brazil GDP (Q3)

United States ISM Services PMI (Nov)

United States JOLTs Job Openings (Oct)

Wednesday 6 Dec

Australia Judo Bank Australia SME PMI*, GDP (Q3)

Germany Factory Orders (Oct)

Taiwan Inflation (Nov)

Eurozone Retail Sales (Oct)

Eurozone HCOB Construction PMI* (Nov)

United Kingdom S&P / CIPS Construction PMI* (Nov)

United States ADP Employment Change (Nov)

Canada Trade (Oct)

United States Trade (Oct)

Canada BoC Interest Rate Decision

S&P Global Sector PMI* (Nov)

Thursday 7 Dec

Australia Trade Balance (Oct), Building Permits (Oct, final)

Philippines Unemployment and Industrial Production (Oct)

China (Mainland) Trade (Nov)

Switzerland Unemployment (Nov)

Germany Industrial Production (Oct)

United Kingdom Halifax House Price Index* (Nov)

France Trade (Oct)

Italy Industrial Production (Oct)

Eurozone GDP (Q3, 3rd est.)

United States Initial Jobless Claims

S&P Global Metal Users and Electronics PMI* (Nov)

Friday 8 Dec

Japan Current Account (Oct)

Japan GDP (Q3, final)

India RBI Interest Rate Decision

Germany Inflation (Nov, final)

Taiwan Trade (Nov)

United Kingdom KPMG / REC UK Report on Jobs* (Nov)

United States Non-farm Payrolls, Unemployment Rate, Average Hourly Earnings (Nov)

United States UoM Sentiment (Dec, prelim)

Saturday 9 Dec

China (Mainland) CPI, PPI (Nov)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

Worldwide services, composite and sector PMI

November's PMI releases continue with services and composite figures on Tuesday, Dec 5. Additionally, sector PMI data also get updated on Wednesday, Dec 6, ahead of metal users and electronics readings. After global manufacturing conditions softened again in November, services performance will be key in determining whether global growth tipped into contraction. This comes after the growth stalled at the start of the final quarter of 2023. Sector PMI will also shed light on key changes in performance on the detailed industry level, a key development of which had been the renewed decline in demand for consumer services in October.

Americas: US jobs report, services ISM/PMIs, Bank of Canada meeting

November's labour market report will be the highlight of the US week with the consensus at the time of writing pointing to higher job additions at 180K and the unemployment rate holding at 3.9%. Amid the first fall in US private sector employment since June 2020, observed via the S&P Global Flash US Composite PMI, the November release will be closely watched for signs of weakness or easing labour market conditions.

The Bank of Canada meets amid signs of inflation cooling closer to target, raising speculation of rate cuts in the new year. Recent PMI and GDP data have also been weak.

EMEA: Eurozone Q3 GDP (3rd est.), retail sales, Germany industrial production, trade, Turkey inflation

Besides PMI data, the final estimate for eurozone Q3 GDP and a series of tier-2 economic release will be due across the week. Retail sales from the eurozone will be keenly tracked alongside Germany's industrial production and trade figures as weakness in the region continued to show according to recent flash indications. The UK also sees house price and recruitment industry data releases.

APAC: RBA, RBI meetings, China trade and inflation figures, Australia, Japan, South Korea GDP readings

In APAC, central bank meetings in Australia and India are anticipated though no changes are expected. Trade and inflation figures from mainland China will meanwhile be economic releases to watch after Caixin Manufacturing PMI outlined fresh improvements in the health of the manufacturing sector though export conditions remained soft. Cost pressures meanwhile stayed subdued.

Global factory job losses continue as demand downturn persists in November - Chris Williamson

Singapore closes 2023 on a high note as manufacturing output surges - Rajiv Biswas

© 2023, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location