Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — May 11, 2023

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

The week ahead sees a packed economic calendar with key releases due from the US to mainland China, notably for both including industrial production and retail sales figures. The eurozone also updates Q1 GDP alongside inflation and industrial production figures, while the labour market report is out from the UK. Central bankers in both the US and Europe will be watched for comments particularly with regards to the economic and monetary policy outlook.

The attention had recently been split between gauging economic performance, watching the US inflation data, and keeping an eye on US debt-ceiling discussions. As evident from the latest S&P Global Investment Manager Index, politics has emerged a top concern for money managers in May, outweighing jitters over monetary policy and macroeconomic implications for US equity market performance.

That said, while concerns over the US debt-ceiling linger into the coming week, we also have a series of economic data that will be worth watching, especially given the widening divergence between manufacturing output and services activity globally. US and mainland China retail sales and industrial production will be especially closely watched for official updates at the start of the second quarter. While services outperformance had been driven by consumer services demand, consumer goods have lagged according to the latest S&P Global Sector PMI.

Amid the divergence in inflation trends between manufacturing and services, eurozone, Japan and Canada inflation figures will also be scrutinised for any evidence of service-led inflation, especially as central bankers around the world mull the trajectory for monetary policy into the second half of the year. The data follow softer CPI and core CPI for April in the US.

Finally, April's UK labour market report will be released next Tuesday following early indications from the KPMG and REC Reports on Jobs showing that the labour market had cooled, especially in London. Official numbers will be watched for implications following the Bank of England meeting this week, notably in relation to wage pressures.

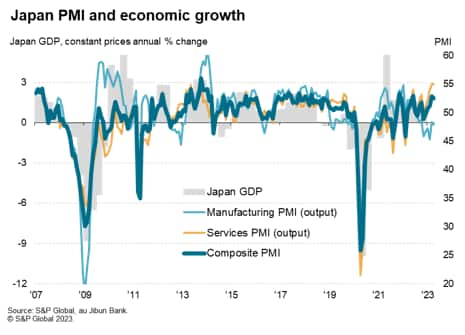

First quarter GDP data are published for Japan in the coming week, and we are expecting growth to have accelerated. According to Refinitiv, the consensus is for a mere 0.1% quarter-on-quarter gain after a flat fourth quarter of 2022, but PMI data have been encouragingly robust in recent months. The output index from the au Jibun Bank PMI, covering output across both manufacturing and services and compiled by S&P Global, averaged 51.6 in the first three months of the year. That was up from an average of 50.1 in the final three months of 2022.

The economic situation is by no means clear-cut, however, as there is an historically wide divergence between the manufacturing and services sectors. While service sector growth has been running at near record highs in recent months, including at the start of the second quarter, manufacturing remains in decline.

The ongoing plight of the goods producing sector is a concern, given the importance of manufactured exports to the Japanese economy. The PMI survey showed new export orders for Japanese goods falling for a fourteenth consecutive month in April. On the other hand, exports of services soared at the fastest rate since comparable data were first available in 2014. These exports in part reflect the reopening of economies after the pandemic, which has facilitated cross-border travel.

The question, of course, is for how long can this boom in service sector exports counter the drop in goods trade. Past experience suggests that these growth spurts prove short-lived, though this time hopefully there will not be another COVID-19 wave to take the wind out of its sails.

Monday 15 May

Japan PPI (Apr)

South Korea Trade (Apr)

Thailand GDP (Q1)

Indonesia Trade (Apr)

India Trade (Apr)

Eurozone Industrial Production (Mar)

Tuesday 16 May

South Korea Import and Export Prices (Apr)

China (Mainland) Industrial Production (Apr)

China (Mainland) Retail Sales (Apr)

China (Mainland) Unemployment (Apr)

United Kingdom Labour Market Report (Mar)

Germany ZEW Economic Sentiment (May)

Eurozone GDP (Q1, 2nd est.)

United States Retail Sales (Apr)

United States Industrial Production (Apr)

United States Business Inventories (Mar)

Canada CPI (Apr)

Wednesday 17 May

Norway Market Holiday

Japan GDP (Q1)

Japan Industrial Production (Mar)

Japan Capacity Utilization (Mar)

Singapore Non-oil Domestic Exports (Apr)

India WPI Inflation (Apr)

Australia WPI (Q1)

China (Mainland) House Prices (Apr)

Eurozone HICP (Apr)

United States Building Permits (Apr)

United States Housing Starts (Apr)

Thursday 18 May

Indonesia, Switzerland, Norway Market Holiday

Japan Trade (Apr)

Australia Employment Change, Unemployment Rate (Apr)

Philippines Interest Rate Decision

Hong Kong SAR Unemployment Rate (Apr)

United States Initial Jobless Claims (13 May)

United States Existing Home Sales (Apr)

United States Leading Index (Apr)

Friday 19 May

New Zealand Trade (Apr)

Japan CPI (Apr)

Malaysia Trade (Apr)

Taiwan Current Account (Q1)

Canada Retail Sales (Mar)

* Press releases of indices produced by S&P Global and relevant sponsors can be found here.

What to watch

Americas: US industrial production, retail sales data, Fed comments, Canada inflation

Following the weaker than expected CPI release this week, economic data including US industrial production and retail sales figures take the spotlight in the coming week. Consensus expectations point to better retail saes readings for April at 0.7% month-on-month (m/m). On the other hand, industrial production is expected to stall after a 0.4% m/m gain previously. This flat production reading runs counter to the indications from the S&P Global US Manufacturing PMI which showed the upturn in production at the fastest for close to a year, albeit modest overall. Also watch out for US data updates for inventories, housing starts, home sales and building permits. Besides economic readings, a series of Fed comments continued to be watched in the week for further insights into central bankers' views.

Canada inflation figures will also be due Tuesday.

Europe: Eurozone Q1 GDP, inflation and industrial production data, UK labour market report

The week ahead is packed with eurozone data releases including the second estimate of Q1 GDP as well as industrial production and inflation figures for April. Consensus expectations point to a slight uptick in the inflation rate from March, in line with the indications from the HCOB Eurozone Composite PMI for April.

Separately, the UK labour market report will be due Tuesday. According to the KPMG and REC, UK Report on Jobs, permanent staff appointments fell at the fastest pace in over two years as demand shifted to temporary staff, signalling growing uncertainty about the economic outlook.

Asia-Pacific: Mainland China retail sales, industrial production, Japan GDP and CPI, Thailand GDP, BSP meeting

In APAC, mainland China releases retail sales and industrial production figures for April. Consensus expectations point to strong retail saes performance and higher industrial production growth. This is in line with recent resurgence seen for service sector performance, according to the Caixin PMI, helping to drive economic growth in April, however. Japan's GDP and CPI will also be in focus in light of recent service sector strength (see box on page 1).

Inflation Trends Diverge as Service Sector Growth Spurt Drives Global Growth to 16-month High - Chris Williamson

Taiwan Economy Slumps into Recession - Rajiv Biswas

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.