Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 13 Sep, 2022

By Brian Bacon

Indianapolis and Dallas-Ft. Worth had the largest share of respondents indicating they subscribe to a virtual multichannel service among the top 25 U.S. TV markets at 18%, according to results from Kagan's US MediaCensus online consumer survey, completed in February. Interestingly, Indianapolis also had the lowest SVOD use among the top 25 TV markets. Only two of the top 25 TV markets had virtual multichannel penetration in the single digits, Sacramento-Stockton-Modesto at 9% and Boston (Manchester) at 6%. By comparison, respondents outside the top 25 TV markets were collectively more likely to subscribe to a virtual multichannel service at 14%.

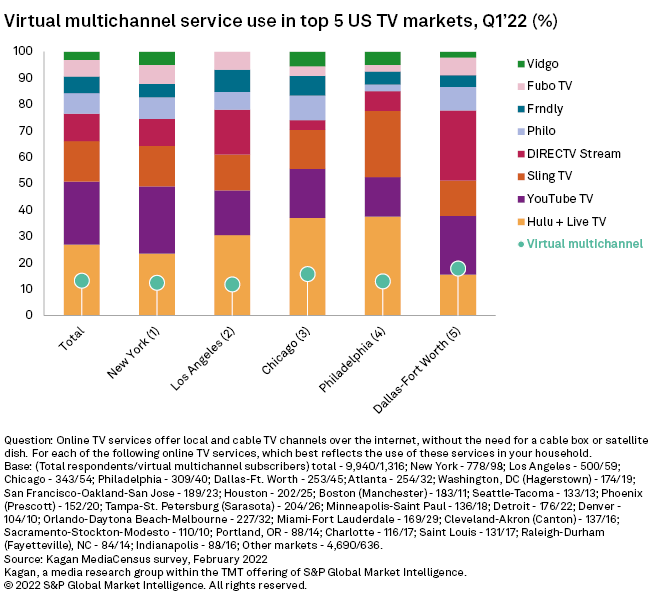

Looking at just the top five TV markets shows how these services are not uniformly popular across the country. Walt Disney Co.'s Hulu + Live TV had the smallest share of virtual multichannel subscribers surveyed in Dallas-Ft. Worth at 16%, less than half the largest share of 38% in Philadelphia. The largest share for Alphabet Inc.'s YouTube TV was New York at 26%, while the largest share for DISH Network Corp.'s Sling TV was Philadelphia at 25%. Among the top five TV markets, DIRECTV Stream's largest share was in AT&T Inc.'s home turf of Dallas-Ft. Worth at 27%. Philo Inc., Frndly TV Inc., fuboTV Inc. and Vidgo Inc. each represented less than 10% of virtual multichannel subscribers surveyed and didn't get above that point in any of the top five TV markets.

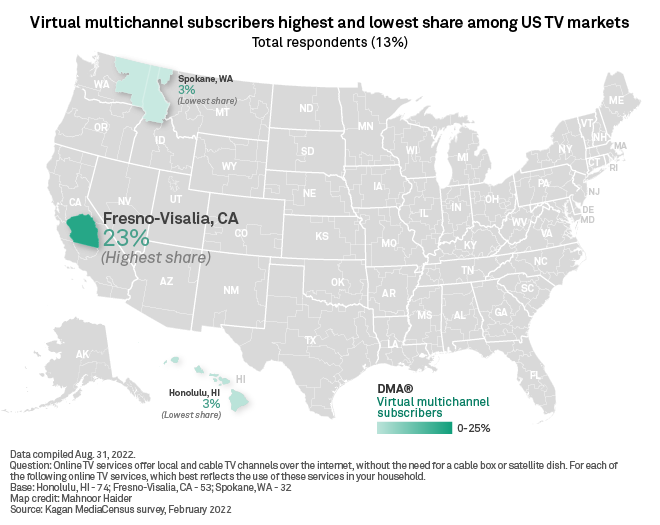

Among the 82 markets surveyed with a base of at least 30 respondents, Fresno-Visalia had the largest share of respondents indicating they subscribe to a virtual multichannel service at 23%, followed closely by eight other markets that had at least 20% of respondents indicating they subscribe to a virtual multichannel service. Meanwhile, 15 markets had less than 10% of respondents subscribing to a virtual multichannel service including Honolulu and Spokane, Wash., which had the smallest shares, both at 3%.

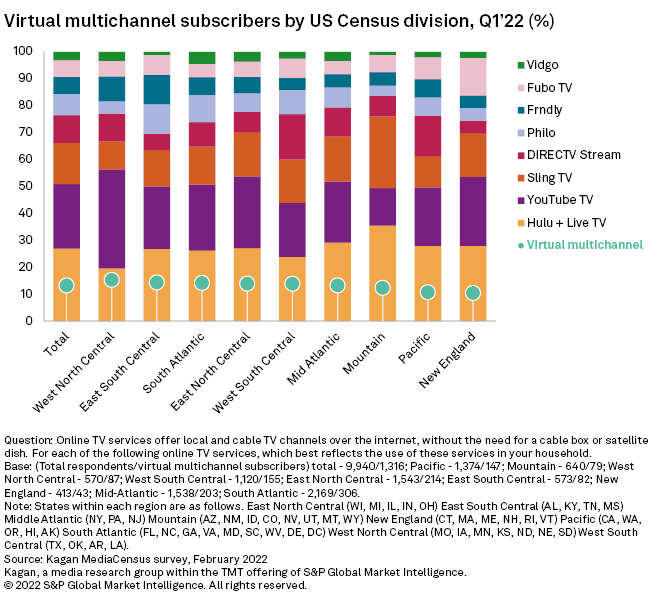

Examining virtual multichannel service use by U.S. Census division shows that respondents in the West North Central region were the most likely to use one of these services at 15%, while those in New England were the least likely at 10%.

The largest shares of virtual multichannel subscribers for Hulu + Live TV and Sling TV were in the Mountain region at 35% and 27%, respectively. The largest share of YouTube TV subscribers was in the West North Central region at 37%. East South Central had the largest shares for Philo and Frndly at 11% for both services. DIRECTV Stream had the largest share in West South Central at 17%, while Fubo TV's largest share was in New England at 14%.

Data presented in this article is from the general population sample of the MediaCensus survey conducted in February 2022. This sample included 9,940 U.S. internet adults matched by age and gender to the U.S. Census. The survey results have a margin of error of +/-0.98 ppts at the 95% confidence level. Survey data should only be used to identify general market characteristics and directional trends..

Consumer Insights is a regular feature from Kagan, a group within S&P Global Market Intelligence's TMT offering, providing exclusive research and commentary.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.