Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

8 May, 2017 | 08:00

By Dan Lowrey

Highlights

A review of the complicated relationship between utility stock performance and interest rates.

The following post comes from Regulatory Research Associates, a group within S&P Global Market Intelligence. For further information on the full reports, please request a call.

On May 3, the Federal Reserve kept short-term interest rates unchanged after raising them in March to their current range of 0.75%-1%. That was only the third increase in interest rates after the Fed left them near zero for seven years following the global financial crisis.

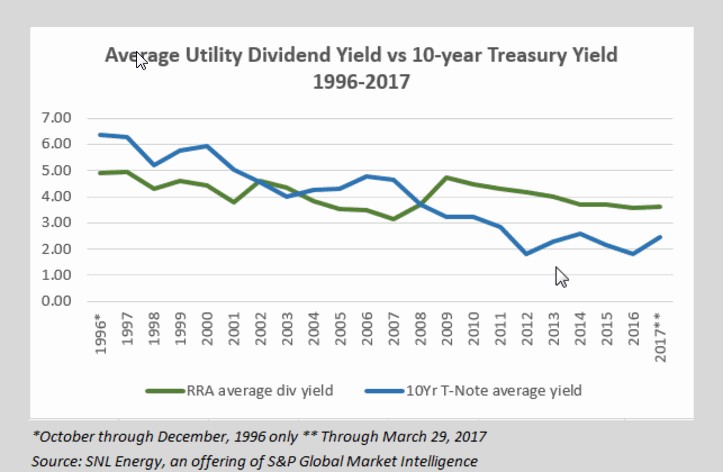

It remains unclear when the Fed plans to raise rates again, but it is clear we are in a rising interest rate environment. With higher interest rates looming, one might expect that investors would be moving away from the capital intensive, "interest rate sensitive" utility sector. However, utility stock indexes have been keeping pace or outperforming some broader market indexes year-to-date. Year-to-date through March 31, 2017, the DJ Utility Average is up 5.7%, compared to a rise of 4.6% for the DJIA and 5.5% for the S&P 500. A look at the historical trends confirms that interest rate stigma attached to utility stocks is somewhat of a fallacy.

As regulated monopolies with mechanics in place that provide for the recovery of costs, as well as the recovery of and on new investments, utilities are often seen as a lower-risk defensive investments, with a healthy cash flow and stable dividends. Rising interest rates can impact utilities more than other sectors because they can make bonds more attractive to conservative investors seeking that yield. The high capital cost/debt levels of operating a utility also increases borrowing costs with rising interest rates eating deeper into earnings.

But the relationship between interest rates and utility stock performance is far more complicated than one of seamless negative correlation.

For the typical pure-play utility, regulated utility earnings and corresponding equity performance are driven largely by rate base expansion and rates of return authorized by state regulatory commissions. RRA tracks annual average authorized ROES issued by PSCs with data back to 1988. Authorized ROEs track changes in interest rates fairly closely

As expected authorized ROEs and interest rates have a high positive correlation, while interest rates and utility stock indexes — for the aforementioned reasons — have a high negative correlation (see attached data sheet). When considering annual average data from 1988-2016, utility stock indexes are also highly correlated positively with broader equity markets as measured by the S&P 500 Index. Utilities tend to track broader equity markets, albeit at a more measured pace, returning lower highs but higher lows

Already a client? To read our Special Report on utilities and interest rates, click here.