Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Nov 11, 2024

By Sarah James and Mike Reynolds

"MediaTalk" is a podcast hosted by S&P Global Market Intelligence wherein the news and research staff take a deep dive into issues facing the evolving media landscape. The weekly podcast includes conversations with internal thought leaders alongside interviews with industry insiders and analysts.

Subscribe on Apple Podcasts and Spotify.

In this Halloween episode of "MediaTalk," host Mike Reynolds and Kagan Research Analyst Peter Leitzinger dive into the hotly contested 2024 US elections. With political ad spending projected to jump 17% from 2022 levels to $4.1 billion, local TV stations are set to reap the rewards as candidates ramp up their campaigns in swing states like Arizona, Georgia and Pennsylvania. The stakes are high, with pivotal races for the White House and control of Congress unfolding against a backdrop of pressing issues such as the economy and reproductive rights. Tune in as they break down the ad spending strategies of both parties, the key battlegrounds to watch and the potential for surprises in the final stretch.

Featured expert:

Peter Leitzinger, analyst at S&P Global Market Intelligence Kagan

Explore our full library of S&P Global Market Intelligence podcasts.

|

RELATED RESEARCH: Spotlight on cable news networks ahead of the 2024 US presidential election Broadcast political ad revenue expected to surge as tight races abound

|

An edited transcript follows below.

Mike Reynolds: Hi, I'm Mike Reynolds, a senior reporter covering the media industry with S&P Global Market Intelligence Tech, Media and Telecom news team. Welcome to "MediaTalk," a podcast hosted by S&P Global Market Intelligence, wherein the news and research staff explore issues in the ever-evolving media landscape. Today, I'm joined by S&P Global Market Intelligence Kagan Research Analyst Peter Leitzinger, who specializes in the broadcast industry with particular expertise in TV and radio political advertising, among other things.

How are we doing today, Peter?

Peter Leitzinger: I'm doing great. Thanks for having me.

Reynolds: This is the third time here. Peter and I spoke about the political ads landscape back in March, a couple of days after Super Tuesday. We then talked in late August after Vice President Kamala Harris and former President Donald Trump had been nominated officially by the Democratic and Republican National Conventions that were held in Chicago and Milwaukee, respectively. Now, we're in the home stretch of the 2024 political cycle. We're going to talk about the race for the White House and other key battles that could lead to control of the House and Senate going into 2025. And of course, political ad spending. Your thoughts, Peter, can you give us a table setter of sorts?

Leitzinger: Yeah, Mike. Certainly, there's plenty of political races across the country, in addition to the presidential race right now, that are at the top of the news cycle, and our political climate is intense with issues surrounding the economy, reproductive rights, immigration, and many others. There's a lot at stake for the major political parties, and control of the Senate is always drawing interest, especially as we get down to the wire in the next couple of weeks.

Reynolds: All right, before we get into a little bit more of a breakdown of the races and which broadcast station groups stand to benefit the most from political ad revenue, Peter, could you just give us a sense from Kagan and your projections for the TV station market overall for the 2024 cycle?

Leitzinger: Yeah, it was a soft year to start the political season this year due to a lack of competitive primaries in January, February and March. And that sort of led to a surplus of cash to spend later in the year from both the political parties and their PACs. The political environment has really heated up in the summer months right now, and spending has exceeded expectations for many of the TV station groups that we track. So our political revenue projections for this year include a bump up due to the circumstances of the late switch in the candidate from the Democratic side and the additional fundraising on the Democratic side. We have a more competitive swing state outlook, and because of that increased intensity of issue spending nationwide, our projections now account for a 17% increase in total TV political ad revenue over the amount reached in 2022 for a projected total of $4.1 billion this year in 2024.

Reynolds: Okay, and that's the local TV station side. This is not national. This is not national cable network.

Leitzinger: That's right. It's for local TV. That's excluding cable television networks.

Reynolds: Okay. Before we get to 2024 specifically, you guys have done some projections out to 2034, which I guess at that point is another presidential cycle. What are we looking at then, Peter?

Leitzinger: We have a ten-year political ad projection for broadcast TV. Those annual projections fluctuate based a little bit on a political year. When we look out to 2034, which is a non-presidential election, we project $4.2 billion. However, in the 2032 presidential election year, we project $4.5 billion for TV. So a significant increase, taking into account many different factors.

Reynolds: Yeah, things will be a little different ten years from now, but stations are still going to play an integral role in that election cycle. But getting back to the business at hand for 2024, Sinclair Inc. and The E.W. Scripps Co. projected toward record station political ad revenue during some of the earnings calls. Nexstar Media Group Inc. was also quite bullish. With its NewsNation (US) and some of its political fare on The CW (US), Peter, how do you see things mapping out for the publicly traded station group operators this time around?

Leitzinger: Yeah. So, for the big broadcasters, they're seeing a large uptick in political advertising, especially when Kamala Harris replaced Biden. Her campaign spending and what she inherited from the Biden campaign injected a swath of ad revenue into the presidential election and sparked the need for TV ads both locally and nationally. Broadcast group Sinclair recently increased their revenue expectations for political ad revenue for the third quarter of this year, expecting now $140 million to $145 million, and for the full year, $442 million to $469 million based off of those factors that I just mentioned. And then you have Nexstar, which is another one of the bigger TV station groups. Perry Sook, the CEO, said in a September conference that 2024 is going to be a record political year. He's expecting those political ad revenue amounts to exceed what he saw in 2022 and 2020. He jokingly said that he would bet the over on the political guidance for the years. So that just highlights some of the robust spending being seen in their television marketplace footprint.

|

EXPLORE: Our 2024: The Year of Elections page provides more coverage of the US elections' potential impacts on the risk landscape and policy environment. |

Reynolds: As you'd mentioned a while back, maybe spending was a little bit light earlier in the year because the primaries weren't all that competitive. Again, historically, Peter, as we look at this, what percentage of the political ad dollars are historically allocated between Labor Day and Election Day, which this year falls on November 5th?

Leitzinger: It's usually about 50% that is spent in the second half of the year leading up to Election Day. So, considering that in areas where politics might swing one way or another, the airwaves are going to be just packed to the gills with political advertising. This year, I wouldn't be surprised if that percentage increases based on the flow of the election cycle that I talked about earlier.

Reynolds: Okay. Let's get to the top of the ticket here. Peter, could you give us some sense for what the Harris-Walz and Democratic supporters stand relative to spending and fundraising? And obviously, there's a blitz to come as we get to the end here.

Leitzinger: Yeah, so for that information, we look to the FCC fundraising reports and their tracking data, which as of October 25th, the Democratic ticket holds about $360 million of cash on hand, while their PACs have about $180 million, and all of that is going to be spent in the next few weeks.

Reynolds: Gotcha. And similarly, how about what's going on in the Trump-Vance camp? Spending, fundraising, and no doubt, as when I discussed earlier, there's lots of ads we've been watching on national sports. So, I'm assuming there's going to be plenty of Trump and Vance ads to come as well.

Leitzinger: Oh yeah, definitely. The Republican side has cash on hand of $320 million and about $210 million additional from its PACs. So very close to equal when looking at the presidential election. Fundraising continues for both sides, but we're seeing a lot more national spending with an all-out blitz to get this cash on hand numbers down to zero before Election Day.

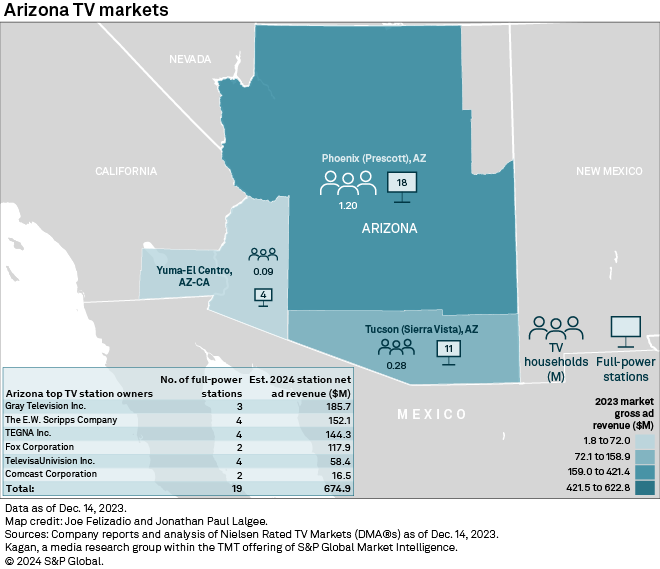

Reynolds: I gotcha. I guess this is becoming a broken record of sorts in recent election cycles, but the key swing states — Arizona, Georgia, Nevada, North Carolina, Michigan, Wisconsin, and Pennsylvania — they account for 93 of the 538 Electoral College votes. Is that where you expect a lot of the remaining presidential spending to take place, Peter?

Leitzinger: Yeah, not much has changed in that regard. I think the swing states that you just mentioned are still where the airwaves are going to be packed. There's going to be a surge of political spending in those regions. And both the presidential election and Senate seats in those states are incredibly important. And the ad dollars will bring in a ton of money to those TV stations in those states.

Reynolds: Relative to the presidential ad spending, has there been any kind of October surprise for you that you've seen as we get to the nitty-gritty here?

Leitzinger: I thought it was interesting to see that Trump's campaign is counting more heavily on the backing from a number of its super PACs to help him get elected compared to the Harris campaign. He's relying more on outside groups for traditional support across TV, radio, and digital platforms. The Trump-backing PACs have spent more money than the president's own campaign in the first few weeks of October. It's just a bit of a different approach from those that we've seen in past elections, but it could end up being effective.

Reynolds: Sure. And as you mentioned, the monies that are still left on both sides of the ticket are pretty equal. So, it's going to be tight, I think.

Anyway, let's look at the House. All 435 seats are up for re-election or election, as the case may be. The GOP holds a slight majority with 220 versus 212 for the Democrats. There are three vacancies. As Democrats look to make inroads, there are a couple of key races in New York. As a Metro New Yorker residing in Westchester County's Mamaroneck, I'm seeing plenty of spot ads across the region for New York's fourth congressional district between incumbent Republican Anthony D'Esposito and Democratic challenger Laura Gillen. There's another in the 17th congressional district that spans Rockland and Putnam counties and parts of North and Westchester and southeastern Duchess. There's a redistricting there, and now it's a swing district battleground where incumbent Republican Mike Lawler is trying to hold off Democrat Mondaire Jones. A lot of spot ads there. Peter, can you comment at all about how important those particular areas are in the upcoming election here?

Leitzinger: Yeah, it's looking like the battle for the House is taking place outside of those states labeled as swing states in the presidential race. And it's really focused on congressional elections in New York and California.

Reynolds: You've got one in your home state that's important too, right? In California?

Leitzinger: Yeah, there's quite a few in California as well. It's no surprise those were competitive states for Congress just two years ago. So, that bodes well for TV in both those states. The ad spots there will be in abundance with less crowding out from an oversaturation of political ads. In the last election, the New York GOP won enough seats in the blue state to secure a slim House majority. And I would say that if Republican incumbents in New York districts can hold their seats, New York could very well be the reason the GOP holds its majority in the House. So they're all important in New York, but the rematch of Anthony D'Esposito and Laura Gillen in the fourth district is drawing a ton of attention. And the 19th district rematch in upstate New York with Mark Molinaro and Josh Riley is also intensifying. And the 17th district is going to be an interesting one with Mike Lawler and Mondaire Jones running against each other. And there are some very hot topics being debated, such as abortion rights, immigration, and public safety there.

Reynolds: Yeah, again, the 19th kind of falls out of my TV-watching territory. So I haven't seen that, but the fourth and the 17th, these guys are going at it. What about in California, Peter? What are the big ones there?

Leitzinger: In California, there's five toss-up seats currently held by Republicans, two seats classified as leaning Democrat here. The polls are currently showing all these as very close races. Democrat Adam Gray is challenging John Duarte in Central California. That's a rematch of two years ago. And in California's 13th District, Republican Representative David Valadao is also in a 2022 rematch facing former Assembly member Rudy Salas. And in three Southern California districts, 27th, the 41st, and 47th are held by GOP representatives Mike Garcia, Michelle Steel, and Ken Calvert, respectively. All of those are viewed as toss-ups. Incredible. Competitive here in California. Biden won all but the 41st in 2020. That's a Democratic Palm Springs-based district. The 47th district that was left by Representative Katie Porter and the 49th district held by Andy Levin are viewed as lean Democrat. So with the size and population of those regions of Southern California, I expect the local TV stations to really bring in a hefty sum of political based on the premium they'll be able to charge for those ad spots there.

Reynolds: I gotcha. There are other important races, I think, in Maine and a couple of other states. If you can just address those quickly, Peter.

Leitzinger: Yeah. In Maine, the second congressional district where Republicans have been trying to unseat Democratic incumbent Jared Golden and Republican Austin Theriault. That has been a very close race. And then you have to look at Pennsylvania's eighth district, the race there between Matt Cartwright and Rob Bresnahan. That race is also still very close, coming down to the wire there.

Reynolds: We're going to go to the upper chamber now where you wrote in your most recent report that the fight for Senate control is playing out almost entirely in democratically held seats this year. The Democrats are trying to defend their 51 to 49 seat majority. I think you looked at four key races in particular. Let's start in West Virginia, if you will.

Leitzinger: Yeah. In West Virginia, where Joe Manchin's exit has left a competitive open seat for Democrat Glenn Elliott and Republican Jim Justice, the seat there was seen as a challenge for Democrats.

Reynolds: Let's go big sky country. Montana is a key race.

Leitzinger: Yeah, the Montana race between Jon Tester and Tim Sheehy. The influx of the new Republican residents there makes things a little bit difficult for Tester, and add to the fact that the state has been a strategic success for Republicans in the last two elections. That makes this race very close.

Reynolds: All right. Ohio always seems to be in the middle when it comes to politics. No exception this time around in the Senate race.

Leitzinger: Yeah, it seems like Ohio is almost always a toss-up state, and the Cook Report rates this race as a toss-up as well. It's been one of the most expensive Senate races in terms of ad dollars this year. Sherrod Brown is the only Democrat holding a statewide office in Ohio, and he has spent hefty amounts trying to keep it that way. Bernie Moreno has had some criticisms about his business past and stance on hot topics there. And Brown has tried to capitalize on those nuances, but this is a very important Senate seat that will come down to Election Day and be decided on just a small amount of votes there.

Reynolds: And in the desert in Arizona.

Leitzinger: Yeah, Arizona. In the race for the seat there that was vacated by Democrat Kyrsten Sinema, both candidates, Ruben Gallego and Kari Lake, are very well-respected, have good credentials, making this a very close race. But a win for the Democratic side would be a huge plus there and it would be a block, and not flip the Senate seat in the swing state. Republicans were very hopeful to flip this race.

Reynolds: Again, as we mentioned before, it's 51-49. So turning things around, it'll come down to one or two seats.

Leitzinger: Yeah, for Democrats to hold the Senate, the party would likely need all of its incumbents to win. And that means candidates would need to prevail in open seats in Arizona, Michigan, and Maryland. And I know it won't be that simple, but as we're already seeing what looks to be some of these races going in different directions, Democrats are also up for reelection in the two states that Trump won in 2020; and in another six states, Democrats are fighting to hold on to control. So it's going to be very tight.

Reynolds: We're getting to the end here, Peter. Let's go back to the top of the ticket. Every day, and you and I have talked about this, reading stories indicating Harris is in front, or Trump is gaining, or vice versa. One candidate is making waves in all the swing states, while the other articles maintain that the purported leader is buttressing perhaps a slight advantage. Anyway, I'm confused and intrigued. What about you, Peter? What do you make of all this?

Leitzinger: Yeah, it's very tough to predict, and the polls tell one story about voters' favorites, and the election is always going to come down to the Electoral College, and the outcome is never certain with states shifting based on many different factors. The polls I've seen show a close one or two percentage point difference, meaning that it's really too close to call. In battleground states, where things get decided, it's even closer. So, it's about a dead heat, and it's going to be exciting.

Reynolds: All I know is I'm going to be flipping the channels for election updates and results on the night of November 5th. How about you, Peter?

Leitzinger: Yeah, I will be as well. And I think it's going to be all eyes on the TV coming up to Election Day. It'll be a defining moment for a country that I won't miss. And there's just so much that goes on in the lead-up before Election Day. But what's great is that the people of our country get to be the deciding factor.

Reynolds: That concludes this episode of MediaTalk on Halloween. For me, politics is always a little spooky, but the third time was definitely a political ad spending charm. I hope it was for you too, Peter. I appreciate you joining us again.

Leitzinger: Appreciate it, Mike. Thanks for having me.

Reynolds: And thanks to all of you for listening. This is Mike Reynolds. We'll catch up on the next edition of " of S&P Global.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.