Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

8 Jun, 2020

By Charlotte Cox and Jason Lehmann

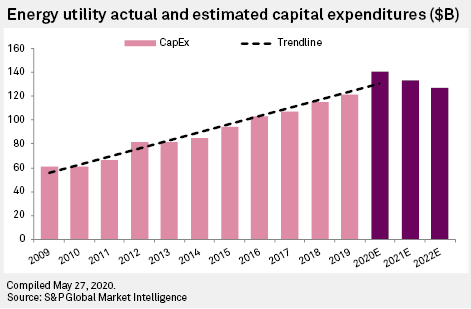

Projected 2020 capital expenditures for the energy utilities universe currently stands at roughly $140.9 billion, well above 2019's $121.3 billion in capital investment.

Energy capital expenditures in 2019 were a record high and were 5% above the $115.1 billion posted in 2018. If current projections hold, 2020 will be yet another record year, although there is reasonable uncertainty regarding the impacts of the coronavirus pandemic on supply chains. In addition, local and state government office closures may impede the permitting process, and mandatory social distancing — if implemented — at construction sites could slow construction progress.

Although 2021 and 2022 forecasts show a decline in capital expenditures, we anticipate both will rise as companies' plans for future projects solidify and new opportunities arise, which has been the case over the last several years. Considerable motivations exist for spending to remain elevated, including pent-up demand to replace and modernize aging infrastructure.

Across the small investor-owned water utility sector, total capex grew 7% year over year to $2.9 billion in 2019. American Water, which represents over 55% of the sector's capex, experienced a year-over-year growth in capex spending of 4%. Total-sector capex is expected to increase 16.5% in 2020, including the additional investment Essential Utilities Inc. will make in the recently acquired People's Natural Gas.

The nation's electric and gas utilities are investing in infrastructure to upgrade aging transmission and distribution systems, build new natural gas, solar and wind generation, and implement new technologies, including smart meter deployment, smart grid systems, cybersecurity measures and battery storage. We expect considerable levels of spending to serve as the basis for solid profit expansion for the foreseeable future.

Spending on renewables is expected to total over $13 billion across our coverage universe in 2020. A number of factors will provide the impetus for ongoing electric utility renewable energy development, including falling technology costs, state policy and renewable portfolio standards, customer demand, and environmental, social and governance considerations, amid a broader trend toward utility sector decarbonization.

From a natural gas perspective, many utilities are participating in the sizable and ongoing expansion of the nation's gas midstream network. In addition, replacement of mature gas distribution infrastructure has gained widespread momentum and is likely to continue at material levels for many years, considering state and federal mandates to address safety.

For additional detail, see the full report and associated data tables.

Regulatory Research Associates is a group within S&P Global Market Intelligence.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Global Market Intelligence Energy Research Library.