Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Feb 07, 2024

By Jingyi Pan

The following is an excerpt from the monthly S&P Global Monthly Global Trade Monitor, produced with GTAS Forecasting. Read the latest on Connect™ by S&P Global.

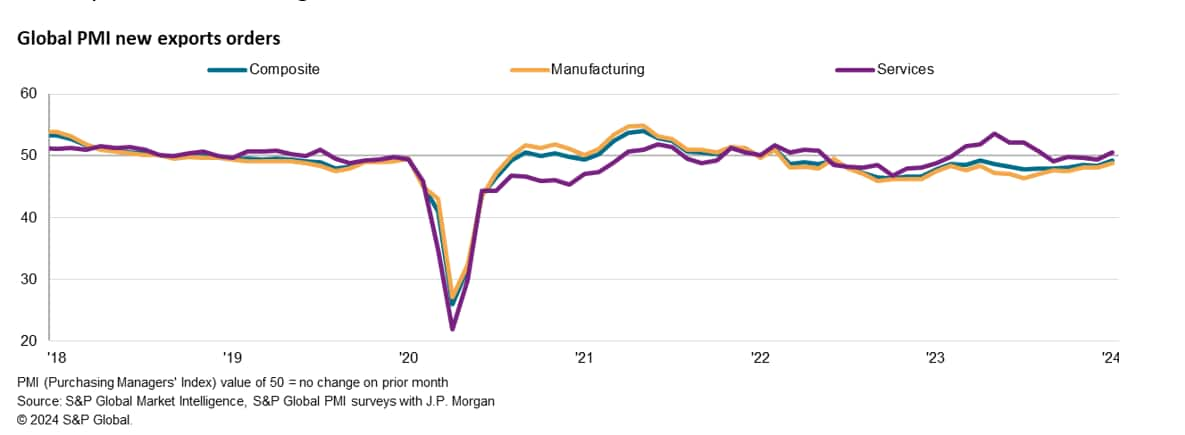

The worldwide Purchasing Managers' Index (PMI) surveys compiled by S&P Global Market Intelligence indicated a further deterioration of global trade in December, thereby extending the sequence of decline to nearly two years. That said, the rate of contraction eased to the weakest in nine months and was only marginal despite heightening disruptions around the Red Sea at the start of the year. The seasonally adjusted PMI New Export Orders Index posted 49.2, up from 48.4 in December, rising to a level just below the long-run average.

The manufacturing sector continued to lead the downturn in global trade at the start of 2024, albeit with the rate of decline moderating. In contrast, the exchange of services improved marginally in January after deteriorating for four successive months.

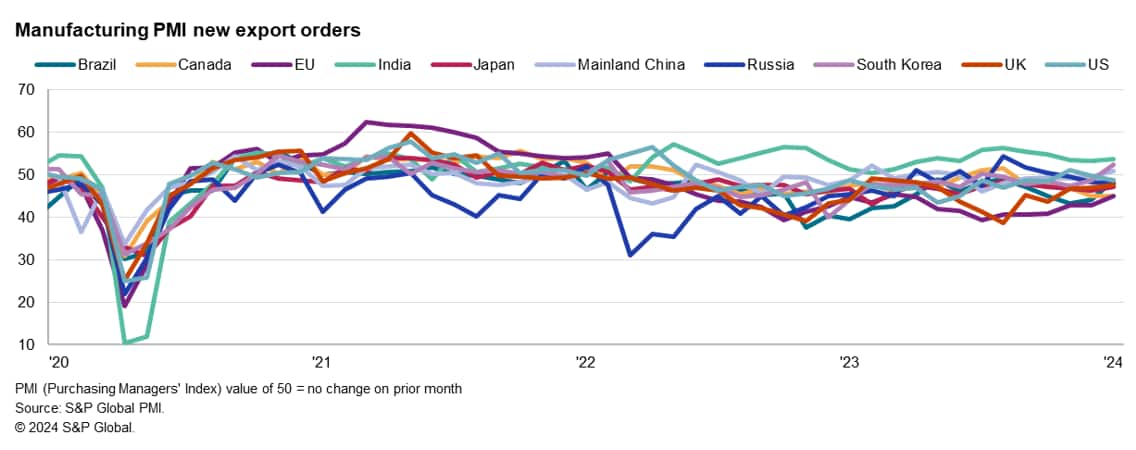

Manufacturing new export orders extended the sequence of decline to 23 months in January, though the rate at which export demand fell was the slowest since June 2022. This was amidst improvements in overall demand conditions, with worldwide manufacturing total new orders (including domestic sales in each economy) near-stabilising in January. Furthermore, optimism among manufacturers rose at the beginning of 2024 with the manufacturing sector's PMI Future Output Index posting the highest reading in nine months. Although a Red Sea crisis-driven renewed worsening of lead times was observed, hopes for better manufacturing sector conditions in the 12 months ahead were buoyed by rate cut prospects and the reduced drag from destocking efforts.

By broad product category, only the intermediate goods sector saw the rate of export order contraction slow from December. Both the consumer and investment goods sectors saw quicker falls in new orders from abroad, hinting at subdued final demand for goods, though the rates of decline remained marginal overall.

More detailed sector data showed the beverage & food sector experiencing the fastest rise in export orders, likely linked in part to improvements also observed in the tourism & recreation services sub-sector. On the other hand, various industrial sectors remained under pressure, but it was the automobiles & auto parts sector that saw the sharpest fall in export orders among all the monitored segments.

Meanwhile services trade improved for the first time since last August. Although marginal, the latest uptick in services new export business was slightly faster than the pre-pandemic average to indicate above-average growth. Overall services activity had also grown at the start of 2024 owing to higher new orders and better confidence within the sector. Additionally, cost pressures have reduced in the service sector with charge inflation sinking to the lowest level in three years and closing in on the long-run average in January, boding well for further near-term growth.

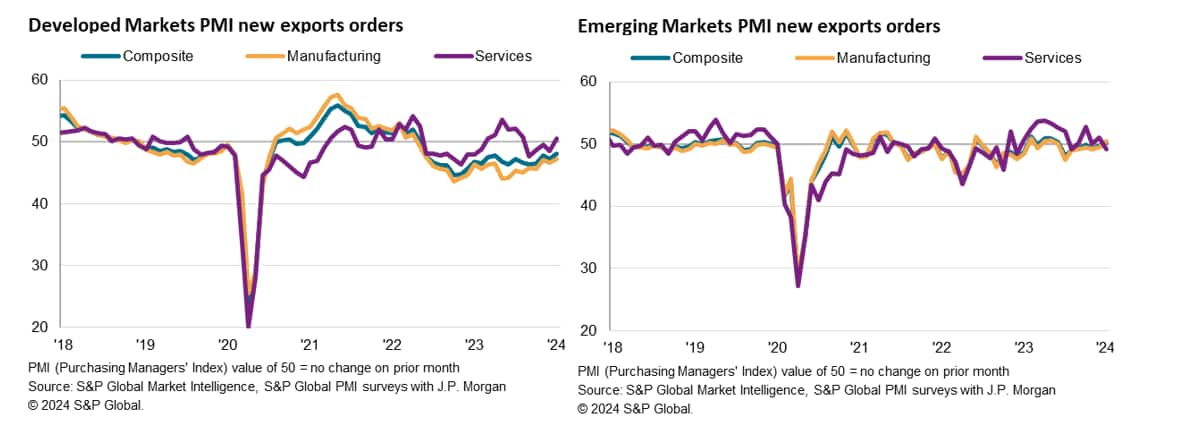

While developed markets recorded a twentieth monthly declined in trade activity, the pace of decline eased to the slowest in the current sequence and was only modest overall. Services export business notably returned to expansion in January, though failed to offset the still-solid fall in manufacturing export orders for developed nations. In contrast, emerging markets export business returned to growth for the first time in seven months, as a renewed goods export order expansion countered a marginal decline in services export trade.

Measured across both goods and services, trade mainly improved in two APAC economies - namely India and mainland China. Most developed nations meanwhile continued to see trade conditions weaken though a near-stabilisation of conditions was observed in the UK.

Canada and the EU recorded sharp and almost comparable rates of new export orders decline in January, though both regions saw the situation ameliorate slightly compared to the end of 2023. A more pronounced downturn in manufacturing export orders continued to be observed in Canada as compared to services. Likewise for the EU, the manufacturing sector export order contraction was historically marked despite the pace of decline easing for a sixth successive month in January. France and Germany continued to record especially sharp falls new export business led by their respective goods producing sectors. While the EU saw visible impact from disruptions in the Red Sea across the globe, the lack of new work, including from abroad, continued to act as a bigger dampener for activity in the region.

Meanwhile the UK saw new export orders stay broadly unchanged at the start of 2024, marking a relative improvement in trade conditions from the end of last year. The improvement was services-led while exports of goods continued to deteriorate. The UK notably experienced a more material impact compared to the rest of the world in terms the disruptions from the Red Sea on both supply chain and prices, though data also suggested that manufacturers expect these issues to be temporary.

Finally, the US saw only a marginal contraction in overall export orders. The rate of decline was little changed from December, but masked sector variations as a renewed improvement in service sector export business contrasted with a sharper drop in goods export orders. Anecdotal evidence suggested that the weakness in manufacturing exports stemmed from reduced demand across Europe and Canada.

Focusing on emerging markets, India remained the only economy to see a solid improvement in trade conditions at the start of 2024, leading the growth in the emerging market space, though export orders also rose to a lesser degree in mainland China for the first time since June 2023.

Faster expansions in both manufacturing and services export business were observed at the start of the year for India, with the rate of manufacturing sector export orders growth notably outpacing that of services to run against the global trend. This is reflective of the Indian manufacturing economy's strength with manufacturing PMI sub-indices further showing purchasing activity growth and better optimism to outline the likelihood for continued improvements in the near term.

Mainland China meanwhile recorded the first new export business expansion in seven months, buoyed by a renewed growth in manufacturing export orders. This was set against a third consecutive monthly expansion of manufacturing sector output in the mainland as business confidence hit its highest in nine months.

Finally, Brazil and Russia recorded moderate declines in overall export orders at the start of the year. Contrasting trends were observed, however, with Brazil seeing a marked easing of export business decline led by a shallower fall in manufacturing export orders, while the deterioration in trade conditions for Russia worsened through faster goods exports decline.

Access the Global PMI press release.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location