Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 26 Oct, 2021

By Adam Wilson and Kristin Larson, PhD

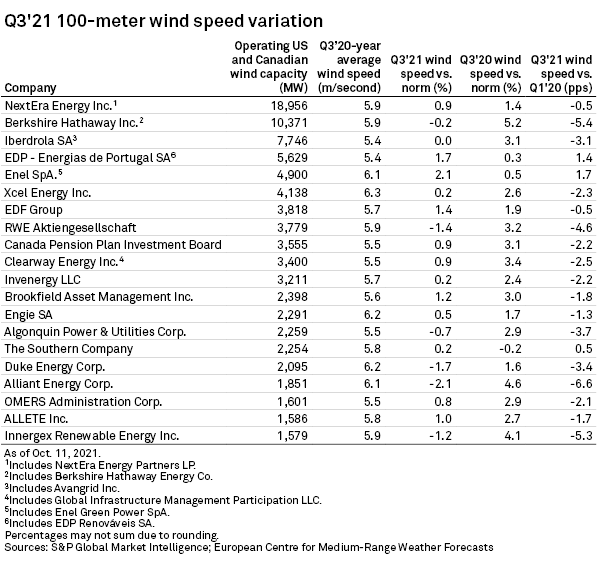

An S&P Global Market Intelligence analysis of hourly 100-meter wind speed data indicated that third-quarter portfolio-averaged wind speeds for 20 companies with the largest wind portfolios in the U.S. and Canada deviated approximately 2% above and below normal. Kansas and Colorado experienced above-average wind speeds, while Texas, Iowa and Minnesota exhibited below-average wind speeds, potentially impacting merchant generator quarter results. Among top companies, Alliant Energy Corp. observed portfolio-averaged wind speeds down the most at 2.1% while the Enel SpA portfolio sustained wind speeds 2.1% above normal.

The Take

Portfolio wind speeds could potentially hurt profits of companies owning significant wind capacity in states with below-average wind speeds, while the opposite is true for those who have larger portions of their operating fleet in locations with above-average wind speeds. Texas, the state with the highest wind capacity, experienced lower-than-average wind speeds in the third quarter. Wind speeds were generally close to the average for U.S. and Canada wind projects this quarter, with wind speeds within 3% of the 20-year average accounting for about 87 GW of projects.

Alliant Corp.'s wind portfolio exhibited a decline in wind speeds at a majority of its projects. Alliant owns 1,450 MW of wind capacity in Iowa with project sizes ranging from 100 MW to 299 MW. Deviations for the company's Iowa portfolio vary from less than 1% to -4% from average. Three projects, Franklin County Wind Farm (New Wind), Whispering Willow – East, and Whispering Willow Wind Farm - North (New Wind), have the highest deviations from the norm at almost 4% below normal. Minnesota also had lower-than-average wind speeds this quarter, impacting Alliant's 201-MW, Bent Tree Wind. Alliant's comparatively small portfolio in Wisconsin and Oklahoma experienced higher-than-normal wind speeds.

The opposite is true for Enel, with most of its projects experiencing higher-than-average wind speeds in the third quarter, driving a 2.1% increase across its portfolio. Enel's 1,600-MW Kansas portfolio registered wind speeds up to 7% above average, while its 1,150-MW Oklahoma fleet was up 3.3%.

In Iowa, Market Intelligence analysis shows projects held by EDP - Energias de Portugal SA, Iberdrola SA and NextEra Energy Inc. that have long-term, fixed contracts have wind deviations of -0.1% to -4.1%. Contract rates based on second-quarter 2021 data indicate that EDP project contract rates range from $22.18/MWh to $73.20/MWh; Iberdrola contract rates range from $16.78/MWh to $65.97/MWh; while NextEra contracts range from $13.65/MWh to $57.82/MWh. Iberdrola's projects with matching second-quarter contract data are all below 15 MW, whereas EDP and NextEra projects range from 66 MW to 186 MW. NextEra's Hancock County Wind Farm has contract rates between $18.40/MWh and $27.75/MWh with a wind speed deviation of -3.7%. Crystal Lake Wind III has a wind speed deviation of -3.5% and contract rates between $21.16/MWh to $26.21/MWh with NextEra offtakers.

In Texas, the state with the most installed wind capacity in the country, most project wind speeds departed negatively from the norm in the third quarter. The Texas wind speed decline was strongest on the Gulf Coast, where it impacted projects owned by RWE AG, EDP, EDF Group, Duke Energy Corp., NextEra, Engie SA, Algonquin Power & Utilities Corp., Canada Pension Plan Investment Board, Clearway Energy Inc. and Iberdrola. Texas Panhandle projects, however, saw above-average wind speeds in the third quarter, up to 2.23% at NextEra's Palo Duro wind Energy Center. Market Intelligence second-quarter transactions data denotes that Palo Duro Wind has a 20-year power purchase agreement with Southwestern Public Service Co. with a fixed transaction rate of $22.20/MWh.

Wind speeds at Iberdrola's nearly 1,200-MW Texas portfolio varied negatively from the norm in the third quarter, ranging from about 1% at the 120-MW, KP-9015 Barton Chapel Wind down to 7% at the 380-MW, Karankawa Wind Project.

RWE also experienced below-average wind speeds for its 2,600 MW Texas portfolio, with a negative wind speed variation of 1.1% at Doug Colbeck's Corner Wind Farm (Grandview II) to 7.5% at Papalote Creek Wind Facility. The company's 1,200 MW Midwest wind portfolio experienced above-average wind speeds, but RWE's overall portfolio-weighted average wind speed varied negatively from the norm. Its best wind speeds were at the in Pennsylvania, with a deviation of 7% above normal.

By contrast, Iberdrola has a bigger fleet in states with higher-than-average wind speeds, which includes Kansas, California, Illinois, Colorado, New York, Pennsylvania and Ohio. Approximately 3,800 MW of Iberdrola projects saw positive wind speed deviations in the third quarter, including 2.4% at its plant in California and 6.6% in its Blue Creek I & II Wind Farm (Paulding Wind) in Ohio. Market Intelligence second-quarter contract data shows the Blue Creek I&II Wind Farm has a long-term contract with Ohio State University Research Foundation, with a fixed transaction rate of $54.48/MWh.

Although EDP's projects in Texas experienced below normal wind in the third quarter, the company's portfolio-weighted average is still at +1.7% compared to the norm given that the majority of its portfolio is in states with better-than-average wind speeds. Its Timber Road Wind projects (Timber Road Wind Farm (Paulding Wind Farm), Timber Road IV Wind Farm, Timber Road III Wind Farm (Amazon Wind Farm US Central)), Timber Road II Wind Farm) in Ohio all have better wind speeds, varying from 7% to 7.2%.

More than half of Duke's wind capacity is in Texas, leading to its portfolio averaged wind speed deviation of 1.7% below normal. Most of Duke's projects outside the state experienced higher-than-average speeds, including North Allegheny Wind at 5.3% in Pennsylvania and Cimarron II Wind Plant at 4.7% in Kansas. Duke Energy Renewables Inc. owns 25.5% of Cimarron II Wind. Based on Market Intelligence data, the plant has a long-term contract with Evergy Metro Inc. with a fixed transaction rate of $31.50/MWh.

Innergex Renewable Energy Inc., with projects in Canada, Idaho and Texas, exhibited a portfolio-wide wind speed deviation of 1.2% below normal in the third quarter. The Dokie Wind Energy in British Columbia had wind speeds 10% above average in the quarter. According to Market Intelligence data, Innergex owns 25.5% of operating capacity at the plant. Wind speeds at the company's approximately 800-MW Texas wind portfolio decreased on average, while 86 MW of projects in Idaho were 1.8% above average. Innergex’s portfolio of approximately 700 MW in Quebec saw average wind speeds ranging from 3.4% below normal (Gros-Morne (Cartier Wind)) to 2.2% above average (Viger-Denonville Community Wind Farm).

Xcel Energy Inc.-owned wind projects in Colorado had winds more than 3% higher than average, while the company’s Minnesota projects experienced below-average wind speeds. Xcel's Texas projects underperformed, while projects in North Dakota and South Dakota were above average. Overall, Xcel saw a positive 0.2% change in wind speeds in the third quarter.

Wind speeds for projects in Illinois, Indiana, Ohio, Pennsylvania and West Virginia were higher than average for the quarter ended Sept. 30. The 750 MW of Fowler Ridge Wind Farm and Amazon Web Services Wind Farm (Fowler Ridge IV Wind Farm) had wind speeds more than 6% above average. The Fowler Ridge IV wind farm has a fixed contract rate of $38.86/MWh, according to Market Intelligence second-quarter transactions data. BP PLC owns 500 MW of the Fowler Ridge projects, and showed a 3.7% increase in wind speeds across their 1,249 MW portfolio. BP also owns part of the Goshen North Wind Project (Phase II) in Idaho that had wind speeds 5.8% less than usual.

Wind speeds were generally close to average for U.S. and Canada wind projects in the third quarter. Projects with wind speeds within 3% of the 20-year average accounted for about 87 GW of projects.

This article is a continuing series that analyzes quarterly average wind speeds in areas with operating wind projects. The third-quarter wind speed data for individual wind units is available here. The second-quarter report can be found here.

Products & Offerings