Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 22 Dec, 2022

Highlights

With many Asia-Pacific markets having already launched 5G, fixed wireless access, or FWA, based on 5G can become a lucrative killer application that can help operators monetize 5G.

FWA has seen usage in rural broadband connectivity, but operators worldwide seem to be keener on using it to augment their 5G offerings.

The current attitude of operators toward 5G FWA seems to be merely a stepping stone toward other services such as 5G mobile or fixed broadband, but the future success — or failure — of 5G FWA pioneers could change this.

One of Asia-Pacific's largest telecommunications conferences, Telecoms World Asia 2022, came back after two years with an in-person event in Bangkok on Nov. 2-3, with a renewed perspective on the state of the world's telecommunications industry.

* With many Asia-Pacific markets having already launched 5G, fixed wireless access, or FWA, based on 5G can become a lucrative killer application that can help operators monetize 5G.

* FWA has seen usage in rural broadband connectivity, but operators worldwide seem to be keener on using it to augment their 5G offerings.

* The current attitude of operators toward 5G FWA seems to be merely a stepping stone toward other services such as 5G mobile or fixed broadband, but the future success — or failure — of 5G FWA pioneers could change this.

While the last in-person event in 2019 had an exploratory and anticipatory perspective on 5G, this year's gathering had discussions with commercial 5G services[1] already a reality in mind. Panelists at the conference shifted their view toward the next steps after 5G such as network digitalization through various technologies such as open architecture, cloud-native networks and edge computing, as well as 5G monetization through killer applications.

One such killer application that speakers and panelists focused on at the conference is fixed wireless access, or FWA, essentially the technology that connects two fixed points using wireless radio connectivity. Being fixed, FWA connectivity is meant to be used within the premises of users, for example, within residential or commercial buildings, as opposed to mobile connectivity like in cellular networks where users can hop from one coverage area to another. Being wireless, FWA allows the transfer and receipt of data without the need of laying down fiber and cables. This gives FWA an advantage in areas where building such wired infrastructure would be costly or simply infeasible due to geography.

FWA for rural broadband connectivity

FWA, however, is not new technology. FWA has been around for decades, and 4G FWA networks have been deployed in some areas of Asia Pacific. Dileep Agrawal, managing director at Worldlink Communications Pvt. Ltd., shared one use case of using 4G FWA to bring broadband connectivity to Karnali, a remote province in Nepal.

Worldlink's venture into FWA was borne out of the company's lack of access to the copper cable infrastructure of other operators in Nepal. Covering a remote and sparsely populated region like Karnali using fiber or traditional macro-tower infrastructure would be costly, and the high altitude of Karnali — which is situated atop the Himalayas — only complicated things. The cheapest alternative, therefore, was to deploy FWA. This entailed drawing connectivity from fiber infrastructure in the nearest urban area and extending it using wireless technologies.

Agrawal mentioned, however, that Worldlink's success in deploying 4G FWA is due to the confluence of several conditions, specifically access to long-term capital or low-cost financing, inexpensive right of way, and financial support from the government.

Deploying FWA using 4G has another limitation since 4G has spectral inefficiency. In other words, there has to be a lot of spectrum available to handle a large bandwidth of data at a speed comparable to that of fixed broadband.

Without all of these, Agrawal said that "rural broadband [using FWA] does not work." In fact, this is the reality in many Asia-Pacific markets: the business case for rural 4G FWA simply does not add up, which led to some markets experimenting with other technologies for rural connectivity, such as Vietnam with fixed broadband and Australia with satellite broadband.

5G changes the game for FWA

The entry of 5G, however, changed all of this, with operators loosening their pockets to acquire large swathes of new spectrum, and with government support as 5G became a national endeavor for many governments.

5G also offers a range of advantages over 4G that FWA can make use of. Spectral efficiency is at the top of the list, as the 5G New Radio or 5G NR standard allows more efficient transfer of large amounts of data per unit of spectrum than 4G LTE. 5G also makes use of entirely new bands of spectrum called millimeter waves that can be useful in certain settings such as indoors. 5G also introduces innovations such as MIMO and beamforming that can be useful in improving coverage.

Panelists at the conference, therefore, see 5G as a boon for FWA in Asia-Pacific, and both the demand and supply sides support a business case for this. On the demand side, consumers in Asia-Pacific have developed a large appetite for data consumption in recent years thanks to wide 4G adoption, cheap handsets and a broad offering of value-added services from operators. The entry of 5G would only serve to intensify this demand as 5G would enable larger data throughput than 4G. On the supply side, poor fiber and cable infrastructure in many markets in the region has prompted regulators and operators alike to start exploring FWA as a cheaper alternative to fiber and satellite backhaul to support more data-intensive applications of 5G.

Southeast Asia, for example, has become a leader in adopting 5G FWA in Asia-Pacific. Globe Telecom Inc. in the Philippines was the first in the region to launch 5G FWA in June 2019. Other operators in the region have since followed, with some opting to launch 5G FWA first before 5G mobile such as PLDT Inc. and Dito Telecommunity in the Philippines, PT Telekomunikasi Selular in Indonesia, and Advanced Info Service PCL and True Move Co. Ltd. in Thailand.

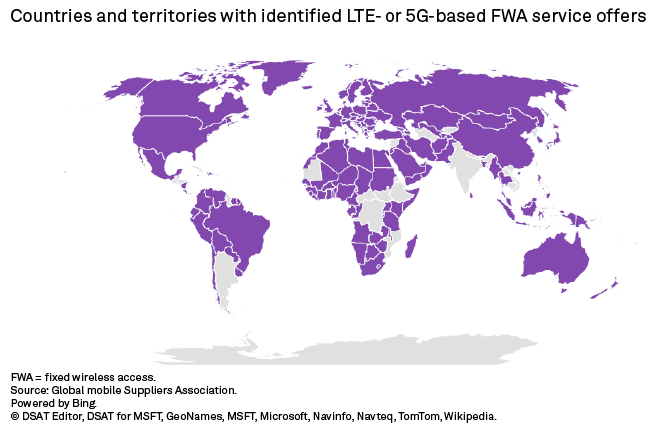

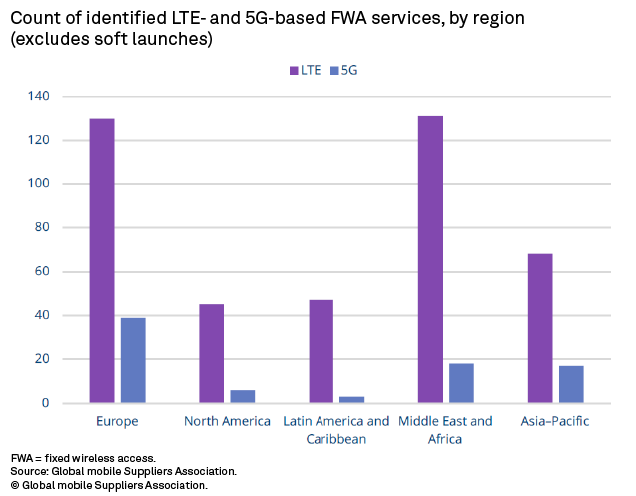

A report from the Global mobile Suppliers Association, or GSA, as of June 2022 noted that at least 421 operators worldwide have launched 4G FWA, while 83 have launched 5G FWA.

Thiaw Seng Ng, adviser at GSA, said in a panel discussion that operators launching FWA in the region offer it at a lower price and larger data allocation than existing plans. While this serves to attract new customers, Ng says that operators do this because they also want data-heavy users to be in the FWA network and not cause congestion on mobile or fixed networks. For example, in Indonesia, operators give generous data allocation and cheap top-ups to FWA plans to keep mobile networks uncongested.

In the Philippines, FWA is offered at the same price and speed as fiber, but customers are still buying it due to the slow rollout of fiber, according to Ng. FWA, therefore, is thought of not as the final product but only as a stopgap towards traditional fixed and mobile networks. Ng noted that in Malaysia, FWA is offered as an introductory plan to new users, who are then subsequently lured back to other plans after six months.

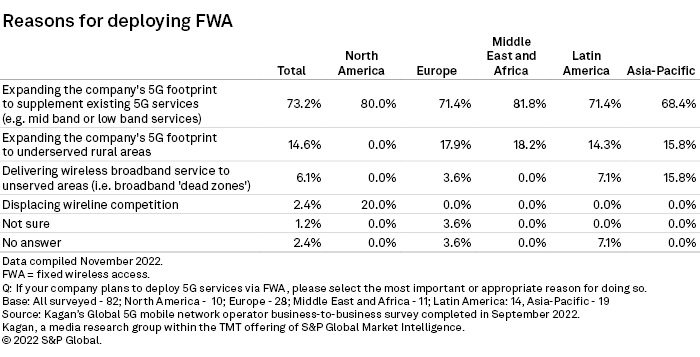

This appears to be consistent with the results of Kagan's Global 5G business-to-business survey conducted last September 2022 where we asked 82 telco executives worldwide about their plans for FWA deployment. 73.2% of our respondents said that they strategize FWA deployment to augment existing 5G capacity to support existing 5G services.

Asia-Pacific's plans are closely aligned, at 68.4%. Interestingly, only 15.8% of Asia-Pacific respondents said they plan to use FWA for rural connectivity, while another 15.8% expressed plans of delivering FWA broadband to unserved areas. This suggests that the future of 5G FWA in Asia-Pacific would more likely be in urban areas where 5G is already present, instead of rural areas where 4G FWA is used.

For additional survey results, see Global 5G survey: Fixed wireless access, connected home lead consumer use cases[2].

Concerning the coexistence of 4G FWA and 5G FWA, AIS Head of Enterprise Telecom Technology Product Asnee Wipatawate suggests a use-case-dependent differentiation between the two technologies. Usual consumer use cases involving low bandwidth and latency-insensitive applications can be serviced by 4G FWA but latency-sensitive and high bandwidth applications should be reserved for 5G FWA.

Wipatawate gave an example of 5G FWA being used in remote crane operation in Thailand's logistics industry as a backhaul technology for fiber. Remote crane operation requires high bandwidth since the operators only see the crane through video, as well as low latency since there should be a minimal delay between crane operation and movement. In such factory settings, 5G FWA was able to achieve the 20-millisecond latency requirement, according to Wipatawate.

Despite this, Wipatawate stressed that 5G FWA remains in its infancy as no economies of scale justify its cost over 4G FWA. 4G customer premises equipment, or CPE, is cheaper at $20 to $30, whereas 5G CPE can range from $200 to $300, while industrial-grade 5G CPE can reach up to $2,000, according to Wipatawate.

In terms of spectrum, Wipatawate noted that mid-band 5G CPE is still considerably cheaper than millimeter wave 5G and notes that there is still no strong business case to invest in millimeter wave 5G FWA. Ng agreed, saying that monetization of 5G and spectrum investments should be the priority of operators and FWA would be a good start to do this since it is one of the most ubiquitous 5G use cases right now. Ng projects 5% to 10% growth in FWA in the next few years for leader markets such as the Philippines and Indonesia and 1% to 2% growth for follower markets such as Thailand.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

RESEARCH

Segment