Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Feb 01, 2023

Global trade flows fell for an eleventh consecutive month in January, according to S&P Global PMI surveys, sending a signal that the global economy continues to face a potential recession risk. There was some encouraging news, however, in that the start of the year also saw rates of export losses moderate for almost all major trading economies.

One lingering concern is that the rate of export losses continued to worsen in Taiwan, long considered a bellwether of worldwide trade, deteriorating at one of the steepest rates seen over the past decade.

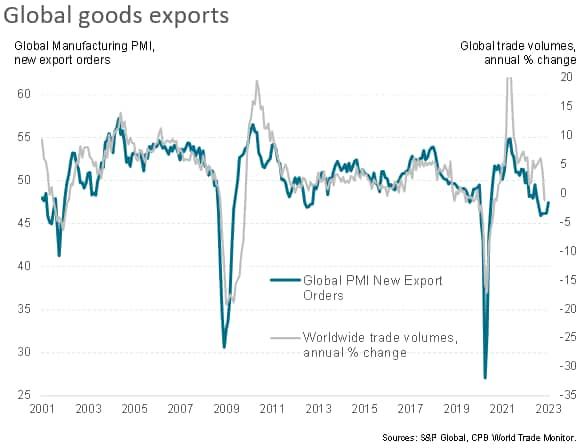

Global exports of goods fell for an eleventh successive month in January, according to the latest PMI surveys compiled worldwide by S&P Global, albeit with the rate of decline moderating to the slowest since last July in a sign that the worst of the downturn may have passed.

The global trade slump signalled by the PMI in recent months is only just being picked up by the official data, underscoring the leading indicator properties of the survey data. Hence, while the official data may worsen further in the coming months, the focus should be on where the survey data head from here - and in particular whether the easing in the rate of decline registered in January reflects a turning point whereby trade growth may soon resume.

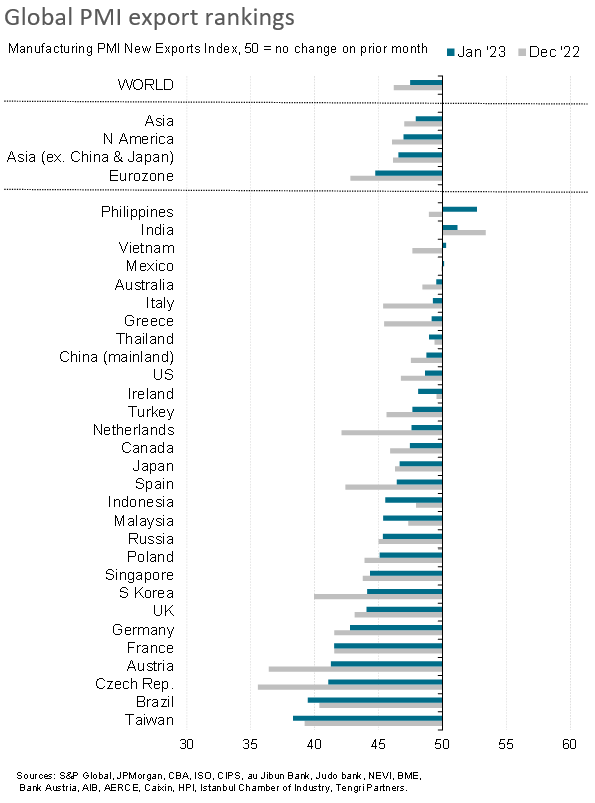

Looking into the detail of the latest export performance, only the Philippines, India and - to a lesser extent - Vietnam and Mexico reported a rise in exports during January. Regionally, the steepest contractions were recorded in Europe, with both the eurozone and UK seeing further significant declines, albeit with rates of contraction moderating in both cases. Cooling rates of decline were also observed in the US, Canada, Japan and South Korea, as well as on the Chinese mainland, the latter coinciding with loosened COVID-19 restrictions.

Arguably the broad-based nature of the easing in the global trade downturn suggests that underlying global trade fundamentals are starting to improve.

However, a concern persists in that Taiwan - often regarded as a bellwether of global trade - not only remained at the bottom of the PMI export rankings in January, but also saw its rate of export decline gather momentum again, albeit having seen a moderation in December. Of concern, the rate of trade collapse in Taiwan remains among the steepest recorded since the global financial crisis.

There is an expectation that reviving economic growth in mainland China, fueled by loosened pandemic restrictions, will help revive trade both for Taiwan and the broader global economy. On the other hand, manufacturers worldwide are seeing an ongoing downturn in order books growth and are deliberately winding down their inventory levels in the face of the demand downturn. Any meaningful return to growth for exports is therefore by no means assured.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location