Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 18 May, 2022

By Seth Shafer

Apple TV+ joined the likes of Prime Video, Paramount+ and Peacock in April when it launched its first foray into live sports with weekly "Friday Night Baseball" MLB double-headers. With most live sports programming still found on linear TV networks, live sports availability on general entertainment subscription video on demand services remains limited and likely not a major driver in acquiring new subscribers. Sizable overlap in sports interest and SVOD viewing households could, however, point to streaming sports as an important factor in keeping current SVOD subscribers happy and a key reason Amazon.com Inc., Comcast Corp., Walt Disney Co., Paramount Global and other operators are making expensive programming bets on the appeal of streaming sports.

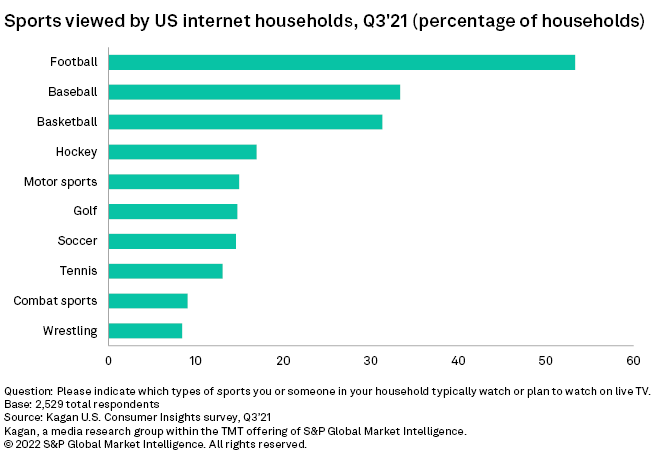

* Roughly half of U.S. internet households polled in Kagan's Q3'21 Consumer Insights survey reported watching football, while about one-third watch baseball and basketball.

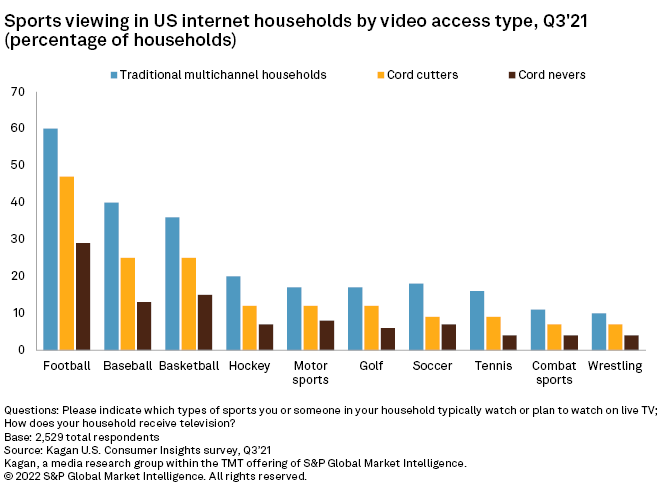

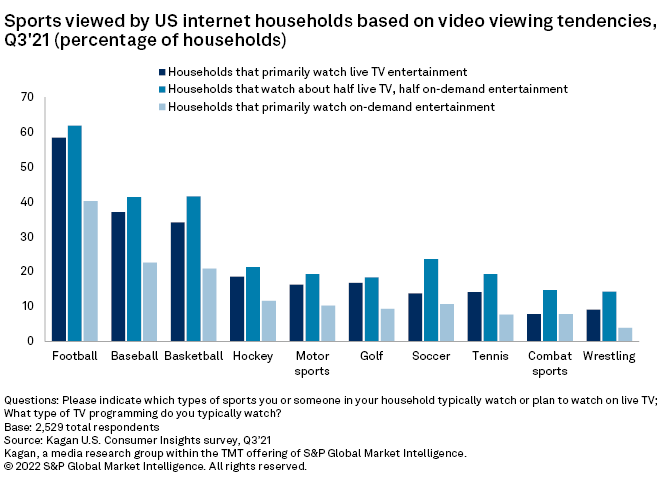

* Sports viewership drops off dramatically across all sports for cord-cutter and cord-never households compared to traditional multichannel homes. Homes that watch a roughly equal mix of live TV and on-demand content tend to be more avid sports viewers than households that primarily watch live TV.

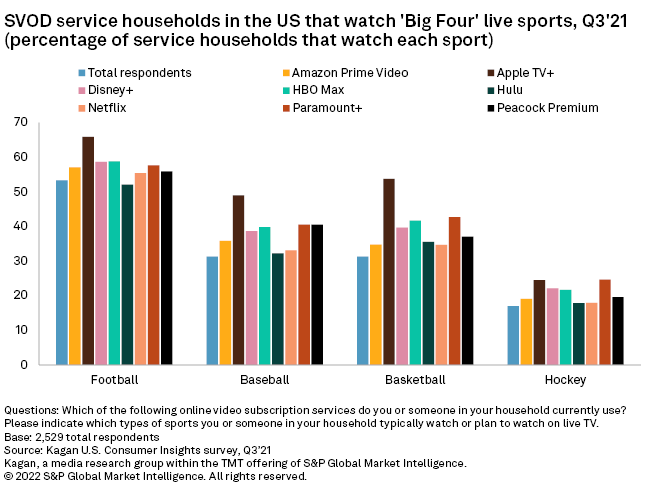

* Apple TV+, HBO Max, Paramount+ and Peacock have some of the highest concentrations of sports fans among current users across many sports. Incorporating or expanding live sports availability could help differentiate their offerings in a crowded market.

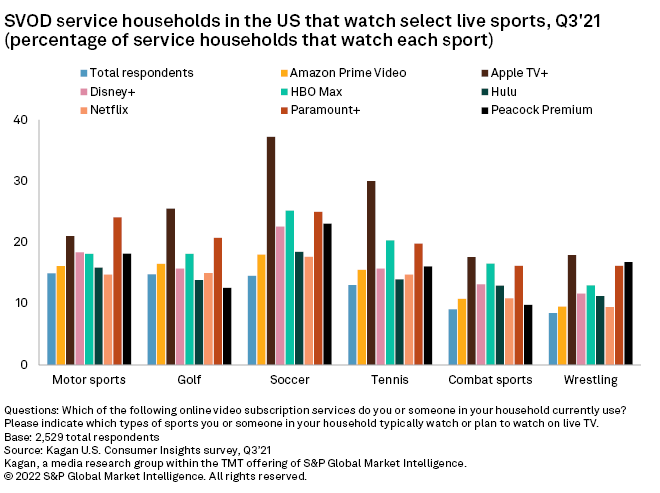

Kagan's Consumer Insights survey of 2,529 U.S. internet adults conducted in September 2021 showed consumer interest in sports is both deep and wide. While the majority (53%) of U.S. internet households reported watching football, other major sports including baseball (33%), basketball (31%) and hockey (17%) were also widely popular. Outside the Big Four sports, about 13% to 15% of households reported viewing motorsports, golf, soccer and tennis.

Amazon's $11 billion, 10-year deal with the NFL to be the exclusive home of "Thursday Night Football" highlights the potential costs involved, although other streaming sports agreements have come with more affordable price tags. Apple Inc. will pay an estimated $55 million annually for rights to its Friday night MLB games, while Warner Bros. Discovery Inc.'s eight-year deal with U.S. Soccer for rights to U.S. Women's and Men's soccer matches came with an estimated total price tag of $200 million.

Access select survey data discussed in this article in Excel format here.

Segmenting sports viewed by traditional multichannel households, cord cutters and cord-nevers highlights the fact that many sports fans still rely on pay TV to watch their favorite team in action. Sixty percent of multichannel homes reported watching football versus 47% of cord-cutter households and less than one-third of cord-never households. Whether due to general lifestyle or a relative dearth of streaming live sports availability (or a combination thereof), cord-cutter and cord-never households were far less likely to report watching any of the

Breaking down respondent households based on type of video entertainment viewed — live TV versus on-demand — and sports interest adds another wrinkle to the fit of live sports and SVOD. Homes that primarily watch live TV unsurprisingly view a wide range of sports, but they are consistently outpaced in sports viewing by households that watch an equal mix of live TV and on-demand entertainment. Similar to cord-never households, homes that primarily watch on-demand entertainment lag significantly in sports viewing except for combat sports — likely due to very limited linear TV airing of boxing and mixed martial arts contests.

Switching to households using top SVOD services and the sports they watch, most major services are already home to an above-average percentage of live sports viewers when compared to total survey respondents. Among viewing of the Big Four sports (football, baseball, basketball and hockey), only Hulu households lagged total respondents in watching any sport while Apple TV+ consistently topped the field.

Services with no live sports whatsoever — such as Netflix Inc. and Disney+ — also reach a sizable number of sports-viewing households, due in large part to overlapping demographics of typical sports viewers and SVOD users. Multichannel TV households (the most likely home for sports viewers) also tend to be heavy SVOD users, watching an average of 4.2 SVOD services versus 3.7 services for cord-cutter households and 2.5 services for cord-never homes.

Analyzing smaller niche sports produces similar trends, with Apple TV+, HBO Max, Paramount+ and Peacock Premium each home to comparatively high concentrations of viewers of most sports. Paramount+ and Peacock offer the widest slate of sports programming among major SVOD services, while HBO Max has announced plans to begin streaming U.S. Women's and Men's National Team soccer matches in 2023 and could expand into additional sports that Warner Bros. Discovery holds rights to.

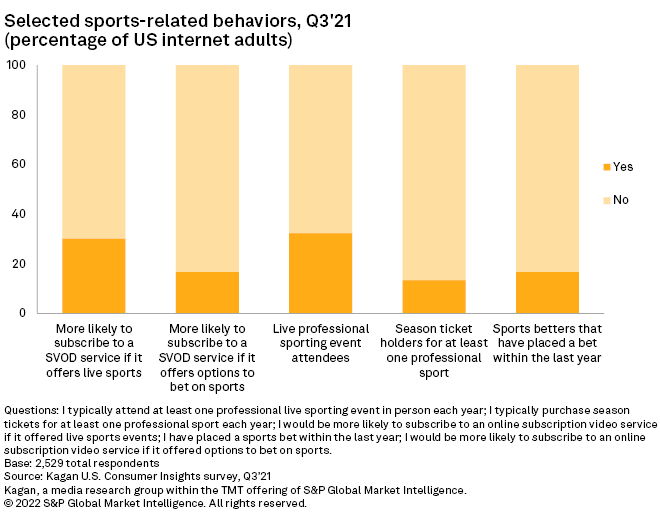

Respondents were also asked several additional sports behavior questions, including attending live games, buying season tickets and placing bets on sports as well as whether live sports availability or the ability to bet increased the appeal of SVOD services. Just under one-third of respondents reported attending live professional sports events or that they were more likely to subscribe to an SVOD service with sports while other behaviors were less common. Just 13% of respondents were season ticket holders, while 17% had placed a sports bet in the last year or said they would be more likely to subscribe to an SVOD service if it offered the option to bet on sports.

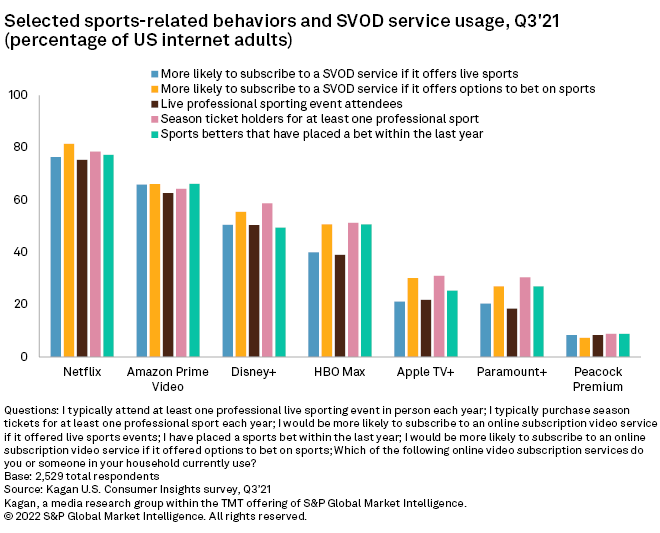

Drilling down into engaged sports fans that responded in the affirmative for those behaviors reveals both a strong appetite for SVOD services as well as potential growth opportunities for services including Apple TV+, Paramount+ and Peacock Premium. Netflix is already used by about 75% to 82% of respondents that engage in the various behaviors, and Prime Video and Disney+ are also widely used by roughly two-thirds and by more than half of their respective respondents.

Among the three services that are not as widely used — Apple TV+, Paramount+ and Peacock Premium — Peacock could realize the most upside from live sports availability. Subscribers to Peacock Premium can tap into a range of live sports spanning football, soccer, golf, tennis, motorsports, wrestling and the Olympics and have benefited from NBCU's decision to shutter NBC Sports Network and move some sports programming to Peacock and USA Network.

For additional survey data on a wide range of sports behaviors and services, please see the following report: US Sports viewing trends, Q3'21.

Data presented in this article was collected from Kagan's Q3'21 U.S. Consumer Insights survey conducted in September 2021. The survey totaled 2,529 internet adults with a margin of error of +/- 1.9 percentage points at the 95% confidence level. Percentages are rounded up to the nearest whole number.

For more information about the terms of access to the raw data underlying this survey, please contact support.mi@spglobal.com.

To submit direct feedback/suggestions on the questions presented here, please use the "feedback" button located above, directly under the title of this article. Note that while all submissions will be reviewed and every attempt will be made to provide pertinent data, Kagan is unable to guarantee inclusion of specific questions in future surveys.

Consumer Insights is a regular feature from Kagan, a group within S&P Global Market Intelligence's TMT offering, providing exclusive research and commentary.

To submit direct feedback/suggestions on the questions presented here, please use the "feedback" button located above, directly under the title of this article. Note that while all submissions will be reviewed and every attempt will be made to provide pertinent data, Kagan is unable to guarantee inclusion of specific questions in future surveys.

Consumer Insights is a regular feature from Kagan, a group within S&P Global Market Intelligence's TMT offering, providing exclusive research and commentary.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.