Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 30 Sep, 2024

By Iuri Struta

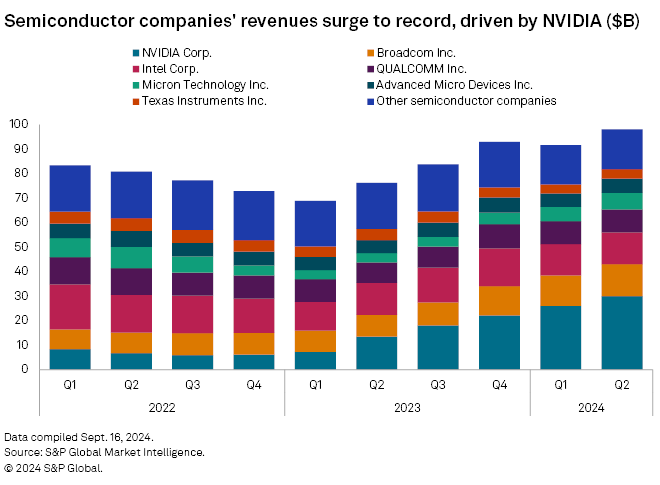

Large semiconductor company revenues surged to a record high in the second quarter, and further growth remains on the horizon.

Revenues for companies in the S&P Semiconductors Select Industry Index approached the $100 billion mark during the quarter, according to data from S&P Global Market Intelligence.

While the lion's share of the increase was largely driven by demand for NVIDIA Corp.'s AI chips, the second quarter showed signs of modest recovery in other semiconductor end markets, such as industrial applications and the internet of things.

"My confidence has increased since last quarter that indeed Q2 was the cyclical bottom," Analog Devices Inc. CEO Vincent Roche said on the company's August earnings call. Roche pointed to the recovery in the industrial segment in particular.

Yet some semiconductor companies are still struggling to clear inventory. The makers of automotive chips, for instance, are grappling with a glut of inventory amid decreased demand for vehicles.

The uneven nature of the recovery was noted by executives at Texas Instruments Inc., which reported a sequential revenue increase in the second quarter. Texas Instrument's year-over-year declines, however, remain significant.

"Our results continue to reflect the asynchronous behavior across our end markets that we've seen throughout this cycle," Texas Instruments CEO Haviv Ilan said on the company's most recent earnings call. While the automotive segment reported declines, the company saw growth in demand for chips to power personal electronics, communication equipment and enterprise systems.

Intel Corp., once the leading chipmaker by revenue, faces significant challenges from a slower-than-expected recovery in the personal computer market and intensified competition.

"Business performance in the first half of 2024 was disappointing relative to our forecast," S&P Global Ratings analysts Andrew Chang and David Tsui said in a research update. "While personal computer and data center end markets reached the bottom of the cycle in mid-2023, the sales rebound in Intel's core markets have been tempered in the first half of 2024 and pressure will likely last through the rest of the year."

Intel is aiming for a recovery with the launch of an artificial intelligence PC and a PC product refresh cycle. It faces competition in the PC market from rivals such as Advanced Micro Devices Inc.

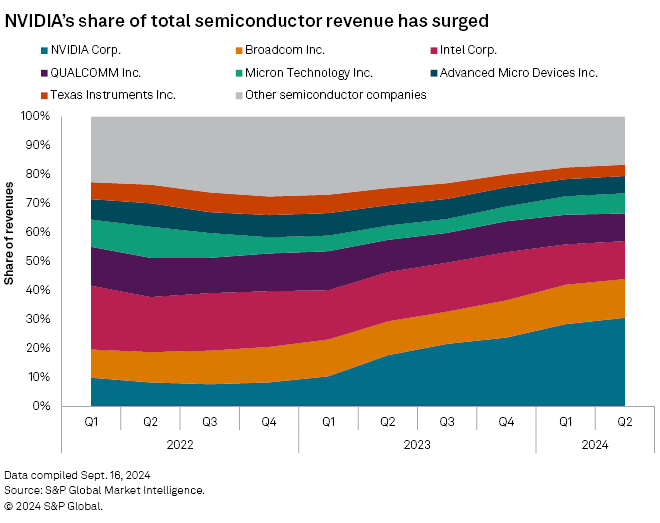

NVIDIA's dominance in the semiconductor industry is significant. The Santa Clara, Calif.-based chip company represented 10% of total revenue in the S&P 500 Semiconductors Select Industry Index in the first quarter of 2022. Just over two years later, NVIDIA commanded about one-third of the industry index's revenue, and the company's market share is poised for further growth.

At a recent Goldman Sachs conference, NVIDIA CEO Jensen Huang said that its customer relations are strained due to demand consistently outpacing supply. This sentiment was echoed by Oracle Corp. CEO Larry Ellison, who mentioned in an earnings call that he and Tesla Inc. CEO Elon Musk "begged" Huang for more GPU chips during a recent dinner conversation.

Given these dynamics, semiconductor revenues are expected to continue setting new records in the upcoming quarters, fueled by NVIDIA's growth and the recovery of non-AI semiconductor segments.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.