Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 15 Mar, 2022

Highlights

* Much higher inflation due to the ruble devaluation could raise costs for Russian miners, but margins are forecast to increase in local currency terms.

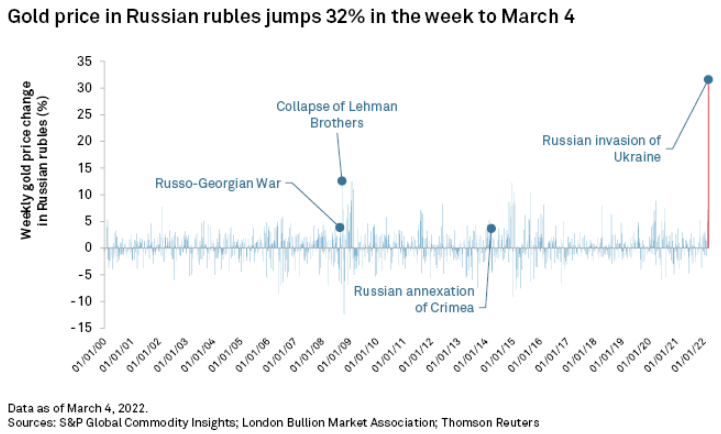

* Gold prices denominated in Russian rubles jumped 32% in the week to March 4.

* Strong technical fundamentals of many Russian gold mines mean they should continue to deliver strong performances into 2022, barring any mining-focused sanctions.

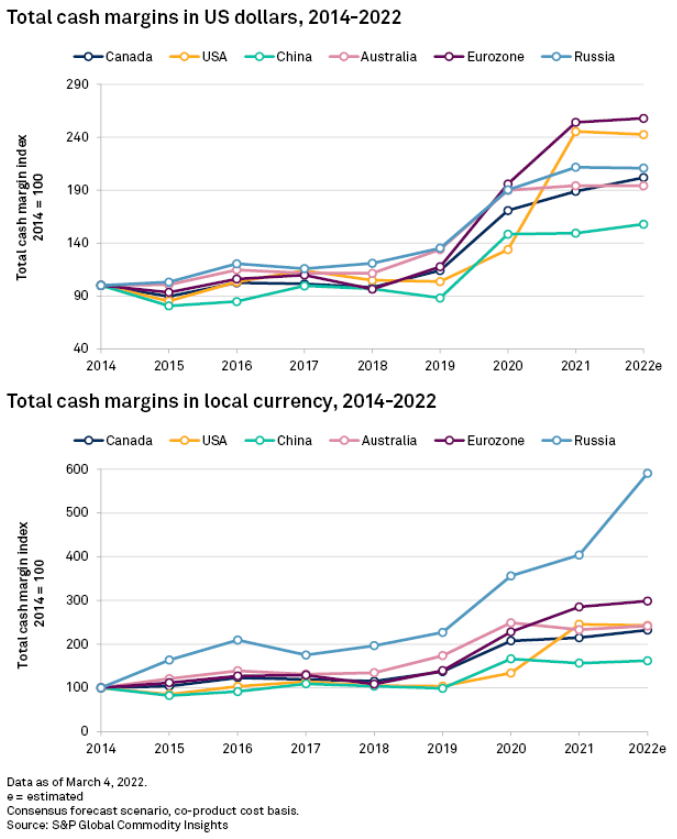

Gold prices have risen on the back of market uncertainty around the Russian invasion of neighboring Ukraine, increasing 8.7% month over month. Coupled with the devaluation of the Russian ruble, gold margins are expected to increase for Russian gold miners this year. Total cash margins of primary Russian gold operations in local currency are estimated to increase 46.3% year over year in 2022. Between Feb. 23 and March 4, the value of Russian currency decreased from 80.95 rubles to 108.19 rubles per U.S. dollar, because of international sanctions being imposed after the invasion.

* Much higher inflation due to the ruble devaluation could raise costs for Russian miners, but margins are forecast to increase in local currency terms.

* Gold prices denominated in Russian rubles jumped 32% in the week to March 4.

* Strong technical fundamentals of many Russian gold mines mean they should continue to deliver strong performances into 2022, barring any mining-focused sanctions.

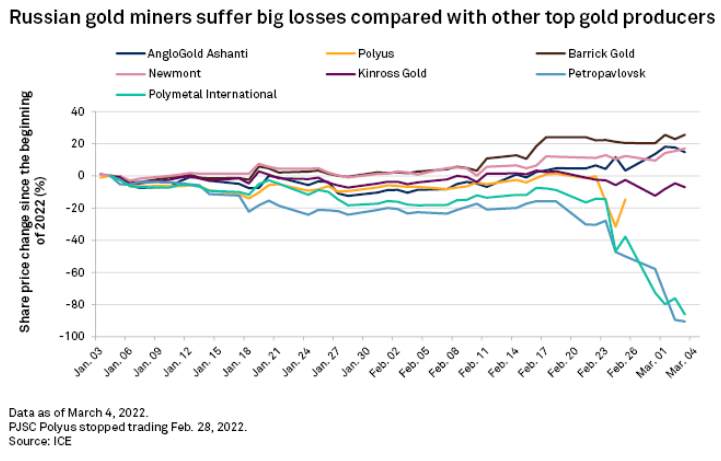

* £4.3 billion was wiped off the value of Russia-based, London-listed miners after Russia's invasion of Ukraine, as investors moved to companies with projects in more geopolitically stable jurisdictions.

In 2021, Russia produced an estimated 9.87 million ounces of gold, making it the world's third-largest gold producer. Significant gold mines include PJSC Polyus' Olimpiada, Kinross Gold Corp.'s Kupol and Nord Gold PLC's Gross. Since 2017, an increasing number of Russian mines have shifted to the lower quartiles of the cost curve on a total cash cost, coproduct basis, with Olimpiada regularly appearing in the 10 lowest-cost gold mines rankings.

The Russian Central Bank raised its key interest rate from 9.5% to 20% Feb. 28, in an attempt to raise deposit rates as a countermeasure to inflationary risks. This puts a squeeze on day-to-day spending in the country, as local costs such as labor, fuel and materials become more expensive. Despite this, we expect most mine sites to continue operating and to absorb these price hikes. As gold prices remain buoyant, mines will continue to benefit from elevated cash margins. The Bank of Russia has confirmed it will resume buying gold on the domestic market. This should enable Russian gold miners to keep operating with the buyer of last resort. This has happened previously, when international sanctions were imposed after Russia annexed Crimea in 2014; the Bank of Russia increased its domestic gold purchases in this manner.

As Russian stocks crash, investors look for safe assets

While current developments do not suggest blanket sanctions directed towards the country's mining sector, markets have reacted negatively to Russia-focused mining companies listed on the London Stock Exchange. Gold miner Polymetal International PLC and steel company Evraz PLC will be removed from the FTSE 100 index March 21 in the first review of 2022.

The share price of Petropavlovsk PLC has also declined significantly, and, along with Polymetal, both companies have had a combined £4.3 billion wiped off their market capitalization in a span of a week. On the back of this drop in share value, BlackRock Inc. has increased its stake in Polymetal to 10%. This lends weight to the view that, over the long term, many of these companies' assets are low-cost, long-life operations. With the drop in share prices, some of the impacted miners have taken to using share buyback schemes to increase the equity held by the company's board and therefore its voting power. Most investors, however, have sought refuge with other gold miners operating in safer locations, enabling them to take advantage of rising gold prices.

International mining companies acting to prevent investor backlash

Toronto-based Kinross Gold Corp. announced March 2 that it is suspending production activity at its underground Kupol gold and silver operation, located in the remote Chukotka region in the Russian Far East. For 2022, Kinross previously announced Kupol guidance at around 350,000 gold-equivalent ounces, with further reduced volumes projected in 2023 due to production deferrals as the operation continues to transition into mining narrower vein systems. At this stage, Kinross has not provided adjusted guidance for Kupol, considering the Ukraine conflict; it has, however, stated that feasibility activities at its Udinsk project in Khabarovsk Krai are also to be suspended. Solway Investment Group Ltd. has also indicated that it will pull out of all its Russian operations, including Kurilgeo.

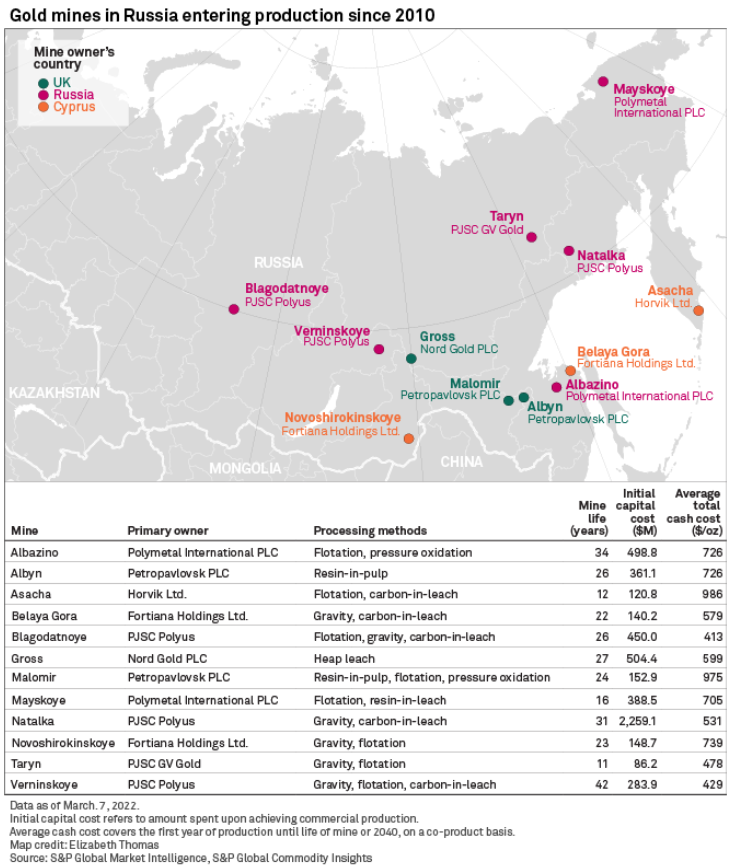

12 gold mines opened in Russian Far East since 2010

Mining in Russia is complicated by the vast land area, the lack of infrastructure and the presence of complex geologic orebodies. Still, the country has consistently produced long-life and low-cost assets. Since 2010, S&P Global Commodity Insights has recorded 12 new mines coming online, most of which should be producing into the 2030s. The total capital invested in commissioning these mines is $5.4 billion, with all the mines located in the Russian Far East.

The Russian government has incentivized development of the Far East region through a Mineral Extraction Tax holiday for two years after commercial production, then stepped increases back to the original level of 6%. Mines can also receive a 10-year minesite corporation tax holiday from the start of commercial production. For mines to qualify for these incentives, they must develop regional infrastructure such as the construction of new roads and power lines to the mine site and regional hubs. The scheme is also open to already operating mines if any expansion project meets the criteria in itself. Nordgold, Polymetal and Polyus have all taken advantage of the scheme for new and operating mines.

In addition to the tax incentives, mines in the region utilize economies of scale to ensure lower costs of operation in the region by processing complex mineralogy ores in centralized processing hubs. Petropavlovsk and Polymetal have built pressure oxidation plants, referred to as POX, to process gold concentrate from multiple operations producing refractory sulfide ores. This saves on expensive installation of POX plants at each mine site, as well as the need to transport ore to China for processing using less environmentally friendly methods. Another solution for sulfide ore processing is bio-oxidation, referred to as BIOX, which is primarily used by Polyus at Olimpiada. The mine has four BIOX reactors installed to support the continued expansion of the mill, with the ability to process 15 million tonnes in 2022. With the high throughput of these operations, the costs are reduced on a dollars-per-ounce basis, as shown by Olimpiada being one of the lowest total cash cost mines in 2021, at $404/oz Au paid.

As the situation in Ukraine develops, and further actions are taken by the U.S and Western Europe, we can foresee Russian mines being further isolated from these markets. It is unknown at time of writing how far these sanctions will go and what will be the effects on Russian operations for 2022 and beyond. Nevertheless, we expect a sustained high gold price will further benefit Russian gold mines if they can still operate at full capacity.

As of March 8, US$1 was equivalent to 129.67 rubles.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Research

Research

Location

Products & Offerings

Segment