Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — May 22, 2025

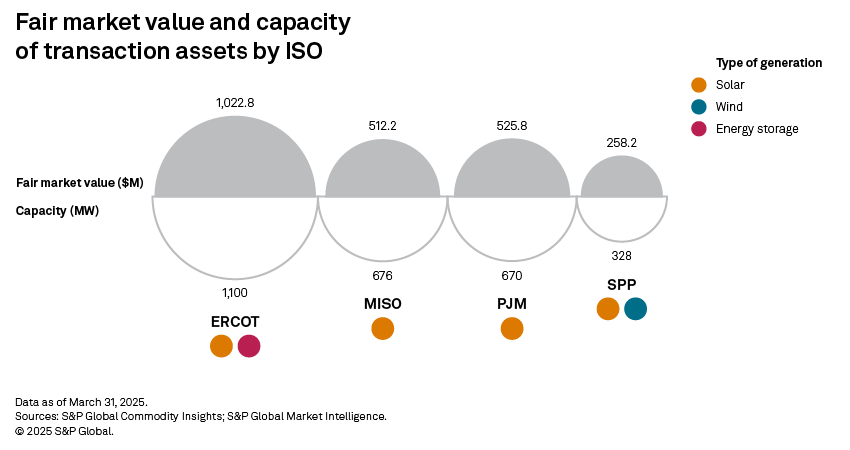

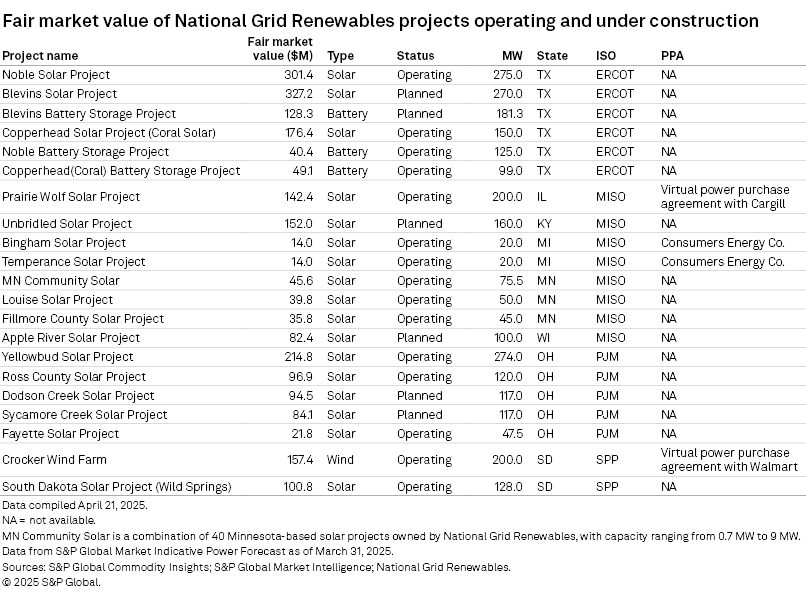

In a $1.74 billion transaction announced in February 2025, Brookfield Asset Management Ltd. is buying National Grid Renewables LLC, including about 3 GW of projects online or under construction. The portfolio includes three solar and battery projects in Electric Reliability Council of Texas Inc., solar projects in Midcontinent Independent System Operator, PJM Interconnection LLC and Southwest Power Pool, and one wind project in SPP.

Brookfield's purchase is part of a broader trend in recent asset transactions within the energy sector. Ørsted A/S sold a 50% interest in renewable projects to Energy Capital Partners LLC. Capital Power Corp. recently purchased gas plants in the PJM market, and Constellation Energy Corp. has acquired the portfolio of Calpine Corp. The S&P Global Q1 2025 Market Indicative Power Forecast values the operating and under-construction projects slightly higher than this market result. The asset valuations are available in the S&P Global Market Intelligence Power Evaluator analysis tool.

In May 2024, National Grid PLC announced its intention to sell National Grid Renewables LLC. This raise of $1.74 billion will increase National Grid's bottom line. The Brookfield sale price appears to be in line with the fundamental drivers of renewable asset value in each of these markets, reflecting strong solar and battery revenue in ERCOT, and strong solar value in MISO, PJM and SPP, and wind value in South Dakota (SPP). The price may reflect a discount based on investors taking a more critical view of the renewables sector in light of a tougher macroeconomic outlook.

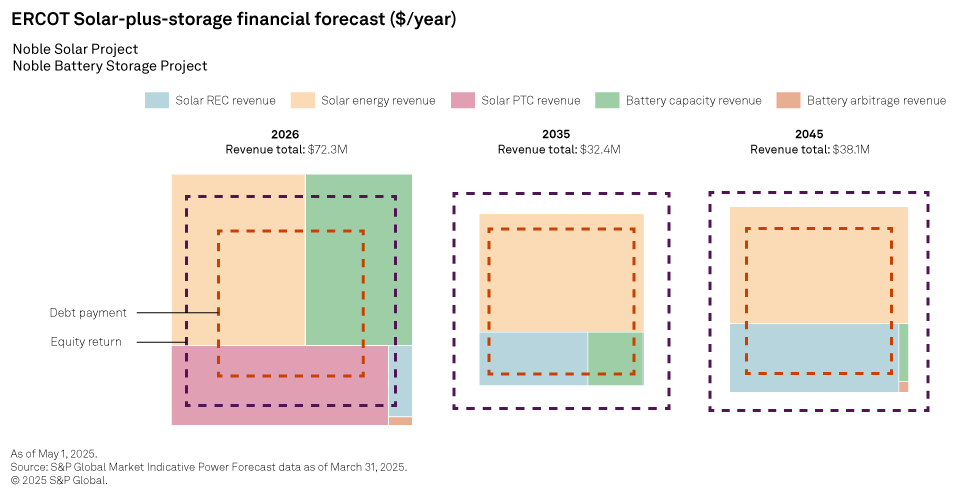

Due to anticipated increases in datacenter load, forecast prices continue to rise in ERCOT. Moderate solar penetration relative to load growth maintains robust solar capture prices in ERCOT, keeping these assets valuable even as solar expands. Between solar energy revenue and renewable energy credit (REC) revenue, hybrid projects in ERCOT are able to meet minimum returns for the project. Additional revenue streams push the returns to meet targeted equity returns. Assuming the solar project utilizes the production tax credit (PTC), this boosts returns for 10 years after construction. Batteries contribute by discharging during hours of high prices and high scarcity values, no matter what time of day those hours occur. Solar project valuations are sensitive to the projected capacity factor of the project. The three solar and battery projects in ERCOT, Blevins Battery Storage Project, Blevins Solar Project, Copperhead Solar Project (Coral Solar), Copperhead(Coral) Battery Storage Project, Noble Battery Storage Project and Noble Solar Project, provide $1 million toward the portfolio valuation.

Solar project valuations in MISO are also strong. Solar and wind generation is growing in MISO, from a combined generation share of 23% in 2026 to 54% in 2045. The solar energy prices remain strong, with net energy revenue able to meet the threshold return value across the 20-year forecast. Returns from the MISO capacity market, REC revenues and the PTC provide an upside exceeding equity returns when all revenue streams are combined. Two solar projects in Michigan, Bingham Solar Project and Temperance Solar Project, have power purchase agreements with Michigan utility Consumers Energy Co. The Prairie Wolf Solar Project has a virtual PPA with Cargill Inc. These contracts likely produce a steady stream of revenue that further supports the transaction's valuation, whereas our valuations assume the projects are merchant. The additional MISO solar projects included in this transaction are Unbridled Solar Project, Fillmore County Solar Project, Louise Solar Project and multiple small solar projects in Minnesota totaling 75 MW, for a total of 670 MW and an estimated valuation of $500,000.

Five Ohio solar projects connected in PJM also bring a market value of $500,000 to the transaction. We forecast a higher generation share of solar in parts of Ohio, and this increases curtailment and reduces energy earnings at Fayette Solar Project. The rest of the projects meet debt payments with only energy revenue a large majority of the time. REC revenue, capacity revenue and PTC revenue combine to boost earnings over the equity return.

The portfolio includes the Crocker Wind Farm with a virtual PPA with Walmart Inc. and the South Dakota Solar Project (Wild Springs), both connected to SPP. Both projects easily meet minimum debt returns and exceed equity returns when the PTC revenue is included.

The valuation total from the Market Indicative Power Forecast is $2.3 billion, while the transaction price implies a value of $1.735 billion — 25% lower. Uncertainty in the macroeconomic view may drive the difference. The fundamental value drivers of this transaction include strong solar plus storage value in ERCOT and strong returns for solar projects in MISO and PJM.

Data visualization by Rameez Ali and Joseph Reyes.

For US-generating asset valuation and prospecting, see Power Evaluator.

Data visualizations by Chrisallen Villanueva.This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

Theme

Location

Products & Offerings

Segment