Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

19 Oct, 2016 | 10:00

By Kellsy Panno

Highlights

S&P Global Market Intelligence's 2016 Mobile Money survey illustrates bank app and branch usage trends in the U.S. Pacific region.

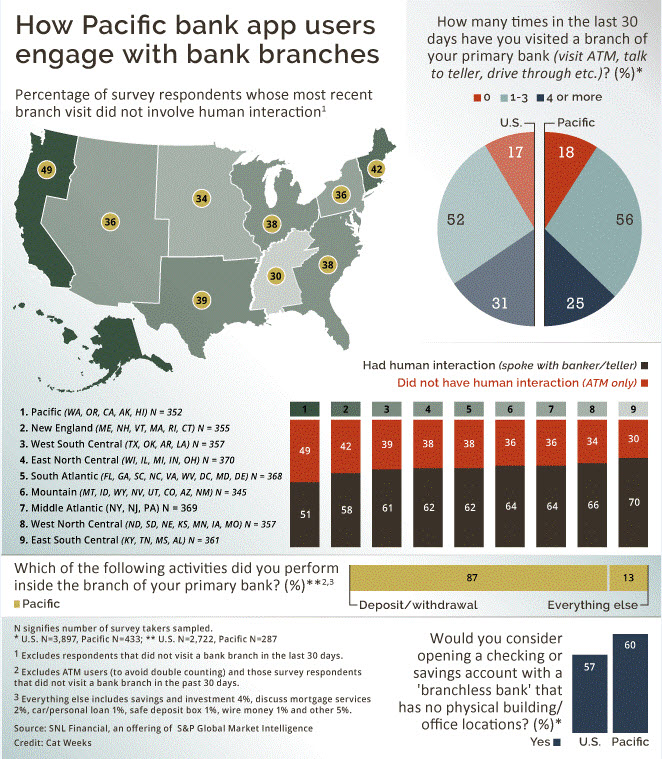

In the Pacific region of the U.S., consisting of California, Oregon, Washington, Hawaii and Alaska, mobile bank app users are embracing ATMs and smartphones for banking as traditional branches decline. And human branch attendants appear to be less important to bank app users in this region than in other parts of the country, according to S&P Global Market Intelligence's 2016 Mobile Money survey.

The nationwide survey of 3,897 mobile bank app users was fielded from Jan. 23 to Feb. 3 and included 433 respondents from the each of the nine U.S. census regions.

Pacific bank app users are among the most likely in the country to avoid bank branches; 18% of respondents had not visited a branch in the previous month at the time of the survey, compared to 17% among overall U.S. respondents. Only the Mountain region (which includes Montana, Idaho, Wyoming, Nevada, Utah, Colorado, Arizona and New Mexico) had fewer branch visits; 20% of respondents hadn't visited a branch in the last month at the time the survey was fielded.

Among survey takers who did visit a branch, Pacific respondents were more likely than the U.S. average to go one to three times per month. But visiting four times or more per month was less common in the Pacific compared to the U.S. overall.

Respondents in the Pacific region had a particular penchant for ATMs as a substitute for in-branch transactions with a teller. Among Pacific bank app users who did visit a branch, 49% used only an ATM and did not speak to a bank representative, the highest percentage of any region in the study.

Further underscoring the region's attitude toward bank branches and technology, Pacific survey takers were among the most open to branchless banking; 60% of respondents in the region would consider opening an account at a bank with no physical branch locations, compared to 57% among overall U.S. respondents.

Not surprisingly, traditional bank branches are declining in the Pacific. Between the beginning of the first quarter of 2015 and the end of the second quarter of 2016, there were more than twice as many branch closings as openings, according to SNL Financial data.

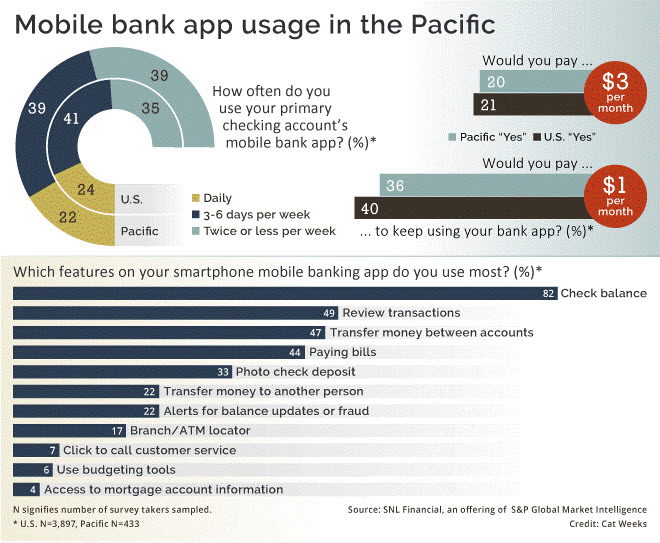

Bank app users in the Pacific region embrace technology but are less likely to be daily users of mobile bank apps compared to the overall U.S., possibly reflecting the higher average wealth of the region. The survey found daily usage was less common among customers with larger bank balances. In the Pacific, 41% of respondents reported earning $75,000 or more per year, compared to 33% among overall U.S. respondents, and 49% said they had $10,000 or more in their combined checking and savings accounts, relative to 43% in the U.S. overall.

Lower frequency of bank app usage may help explain why survey takers in the Pacific are less inclined to pay for bank apps compared to the U.S. average. Among Pacific bank app users surveyed, 20% were willing to pay $3 per month for their current bank app, compared to 21% in the U.S. overall, while a respective 36% and 40% would pay $1 per month.

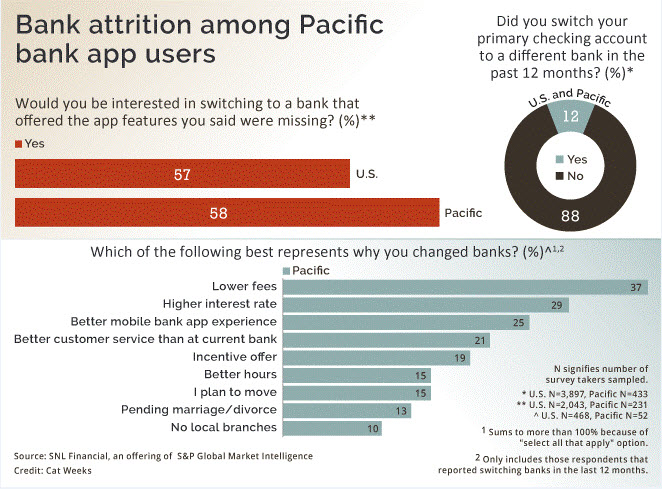

Pacific bank app users are no more prone to bank attrition than overall U.S. respondents; 12% of bank app users in both groups reported switching their bank account in the previous 12 months.

Among the 52 Pacific respondents who did switch banks, fees and interest rate considerations were the prime motivation, but technology also was a factor; 25% said a better mobile bank experience influenced their decision, compared to 23% of U.S. respondents.

Among those Pacific survey takers who did not change banks, 58% said they would be willing to switch to an institution that offered mobile bank app features they did not have in their current bank app. The top features reported missing from bank apps by Pacific respondents were budgeting tools, person-to-person money transfer, click-to-call customer service and photo check deposit.

S&P Global Market Intelligence's Mobile Money survey was conducted Jan. 23 to Feb. 3 across a nationwide random sample of adults 18 years and older, with n=3,897 U.S. mobile bank app users, surveyed online. Survey results have a margin of error of +/- 1.6 percentage points at the 95% confidence level. SNL Financial is an offering of S&P Global Market Intelligence.