Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 26 Jul, 2022

By Keith Nissen

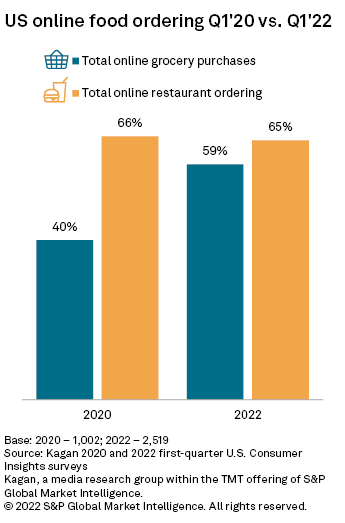

While pandemic-related lockdowns sped up an already-advancing trend in online food ordering in 2020 — for both groceries and prepared restaurant meals — U.S. consumers in 2022 are still ordering up Sunday dinner by pointing and clicking, despite a return to nearly normal shopping conditions.

Kagan's 2022 U.S. Consumer Insights survey results show that respondents ordering groceries for either pickup or delivery have shot up nearly 20 percentage points over the past two years. And while the proportion of those who place online orders with restaurants for delivery has remained essentially static during that time, 65% of total internet adults remains a respectable number.

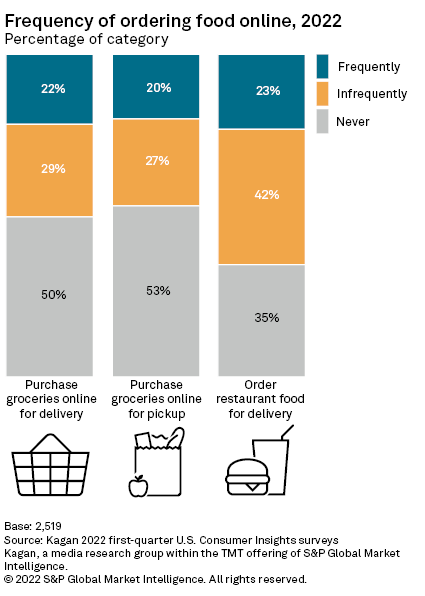

So, who are these hungry consumers, and how often are they shopping online for meat and potatoes? For this exercise, let us first look at the frequency with which folks are ordering food online. A fairly steady 20% to 23% are either ordering groceries (for pickup and delivery) or restaurant meals frequently — at least once per week. Most people ordering their food online, however, are still doing so infrequently.

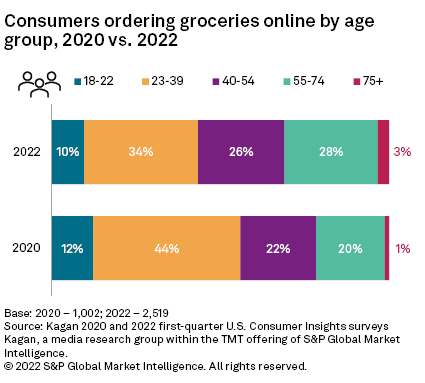

Looking at online grocery ordering by age group reveals that the largest shifts over the past two years have taken place with the youngest and the oldest respondents. While the percentage of those under 40 years of age has eroded from 56% of online food orderers in 2020 to just 44% in 2022, those aged 55 and older have increased a notable 10 percentage points to 31% in the latest survey.

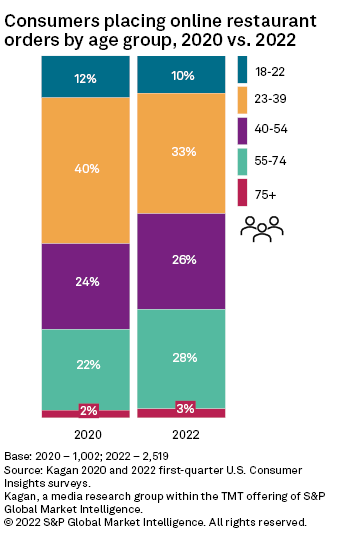

Meanwhile, the age make-up of those looking for food deliveries from their favorite restaurants did not change as significantly over the two survey waves, but the share of respondents under the age of 40 decreased from a majority (52%) of consumers placing online restaurant orders in 2020, to 43% in 2022.

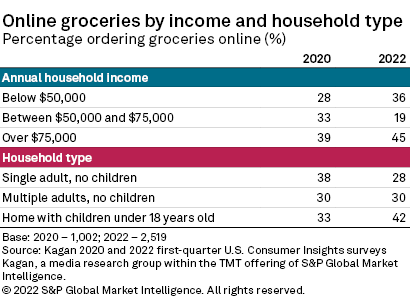

When it came to household income and make-up, notable shifts took place between the 2020 and 2022 survey waves in all households bar those with multiple adults and no children, which stayed the same at 30% of those ordering groceries online. The biggest increase was in the homes with children segment: up 9 percentage points from 2020 to 2022. A view by household earnings showed that online food ordering increased both in those homes earning below $50,000 and in those with incomes of above $75,000, as respondents in homes with incomes in between dropped 14 percentage points.

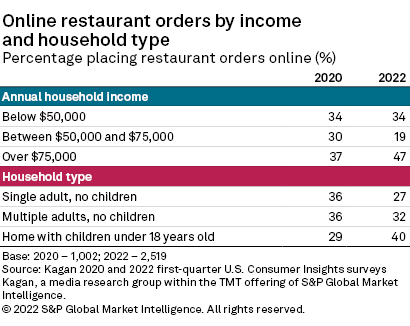

Interesting, but not surprising, was the increase in online restaurant orders from households making over $75,000 per year. While this segment increased a little over 10 percentage points from 2020 to 2022, households from the middle ground, between $50,000 and $75,000, decreased by that much. As with online grocery ordering, households with children ordering restaurant fare picked up at a pretty good clip while those without children declined.

As people in the U.S. continue to return to routines similar to those followed pre-pandemic, some practices spurred by lockdowns and fear of infection continue to thrive, likely due to newly found convenience and opportunity for savings.

Data presented in this article and the associated Excel file was collected from Kagan's U.S. Consumer Insights surveys conducted in March of 2020 and 2022. The surveys totaled 1,002 (2020) and 2,519 (2022) internet adults. The margin of error for the 2020 wave was +/- 3.0 percentage points at the 95% confidence level, while the 2022 survey had a margin of error of +/- 1.9 percentage points at the 95% confidence level. Percentages are rounded to the nearest whole number.

Consumer Insights is a regular feature from Kagan, a media research group within S&P Global Market Intelligence's TMT offering, providing exclusive research and commentary.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.