Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — May 5, 2025

By Tony Lenoir

Balancing out power-intensive global operations and decarbonization commitments amid rapid, AI-fueled expansion, the top four US hyperscalers continue to drive the corporate-tied clean energy market, accounting for more than 61% of the total tracked by S&P Global Commodity Insights.

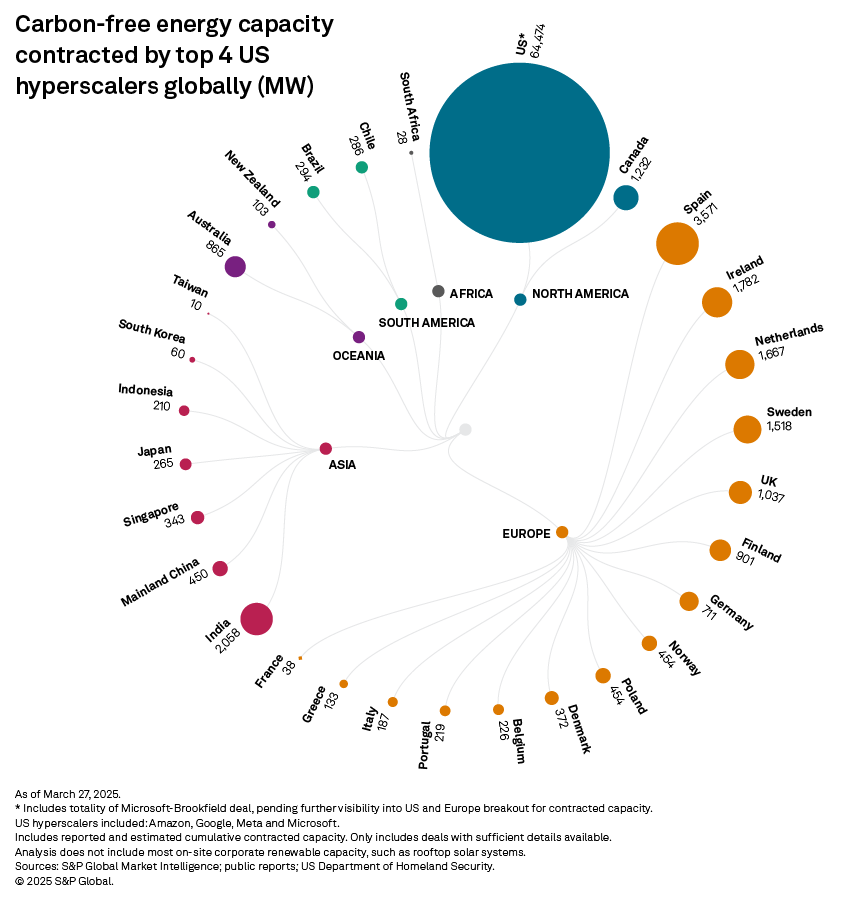

Overall, Amazon.com Inc., Google (Alphabet Inc.), Meta Platforms Inc. and Microsoft Corp. have accumulated a combined clean energy portfolio of more than 84 GW across 29 world markets. Even when discarding the Microsoft-Brookfield Renewable Corp. deal — which involves renewable capacity across the US and Europe, but without a disclosed split — US-based capacity makes up at least 64% of the tracked contracted total for the group of four. Attributing the totality of the Microsoft-Brookfield deal to US projects brings the figure to 77%.

Clean energy contracted by the top four US hyperscalers — Amazon, Google, Meta and Microsoft — makes up most of the total tracked for the technology and web services category, which itself accounts for the bulk of US corporate procurement.

Headquartered in the US but with operations worldwide, the group has secured carbon-free energy capacity across six continents, including at least 66% in North America. US-based power projects in deregulated states are favored, with a strong preference for solar capacity. Overall, clean energy procurement in deregulated states represents 61% of the tracked hyperscaler-tied total in the US.

With corporate America's green energy commitments increasingly colliding with the fast-growing hyperscale datacenter demand for reliable power round the clock, the group aggressively moved toward nuclear in 2024, striking multiple high-profile deals for uranium-generated electrons — developments expected to contribute to a nuclear revival in the US.

Looking deeper into deals with known power project locations shows the US footprint of clean energy projects that have offtake agreements with the listed hyperscalers is growing. It now encompasses 34 of the 50 US states — versus fewer than 30 in our update from a year ago — with the hyperscaler carbon-free energy portfolios surpassing 1 GW in 15 states. Continuous datacenter expansion outside traditional hubs for the sector suggests this list could continue to grow.

Nearly 27% of this US clean energy capacity is contracted with projects based in Texas, where the group operates 23 datacenters, and is developing and planning an additional 15 server-housing facilities based on 451 Research data. Texas has the largest carbon-free generation fleet in the US, boasting more than 86 GW of combined biomass, energy storage, geothermal, hydro, nuclear, solar and wind capacity — nearly 48% of the state's overall generation capacity mix.

Ohio is a distant second, with capacity contracted by the top four US hyperscalers coming in at 4.5 GW, or 9.7% of the total, with known US locations. Particularly, the Columbus area in the state is among the fastest growing datacenter markets in the US. According to 451 Research, these hyperscalers operate 29 datacenters in the state, where they also have a nonnegligible pipeline. That said, Microsoft's recently announced intentions to slow or pause some of its datacenter development projects notably affect a $1 billion facility in Ohio. Even with this announcement, however, planned projects point to sustained datacenter momentum in the state.

Download the 2025 corporate carbon-free energy report and its Excel companion.

Home to the largest and densest US datacenter market, Virginia ranks third with a tracked 2.8 GW — only 6% of the known US footprint. Virginia, like Texas and Ohio, is a deregulated state. Deregulated markets generally offer greater flexibility for corporate offtakers to procure renewable power directly from the power generators. Virginia, however, has only 13.6 GW of operating carbon-free energy capacity and 16 GW in planning. For perspective, this compares to a combined operating and planned 278.2 GW in Texas.

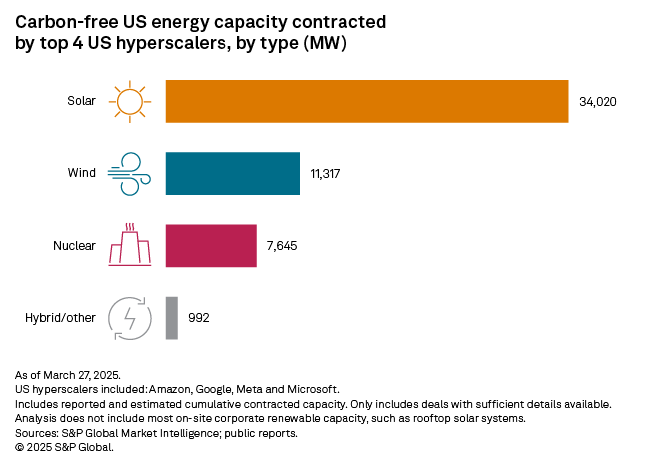

Contracted solar capacity dominates across the US footprint, accounting for 63% of the total. Wind is far behind, at 21%. Of note, the share of nuclear in the mix jumped in 2024, rising from nil as of our February 2024 update to 14.2% as of this inventory, reflecting the power-intensive datacenter space's major pivot toward the technology, which offers baseload, carbon-free energy round the clock.

Overall, about a dozen datacenter/nuclear deals have been announced in the last 12 months. A few stand out for their innovative approach and the potential pathway they offer for future collaboration between the two sectors.

Amazon's acquisition of a Talen Energy Corp. datacenter campus powered by the Susquehanna Nuclear plant in Pennsylvania, announced in March 2024, is one of them. At $650 million for up to 960 MW, the transaction's magnitude speaks to the enormous power needs of datacenters. It also illustrates the rise of innovative approaches to powering server-housing facilities, including massive behind-the-meter arrangements that bypass the grid.

The 20-year nuclear energy power purchase agreement (PPA) between Microsoft and Constellation Energy Corp., announced Sept. 20, 2024, was another watershed moment, particularly for the nuclear space, as it entails restarting a reactor retired for years. At the time of the announcements, some estimates suggested Microsoft had agreed to pay over $100/MWh as part of the deal. This compares to estimates hovering around $60/MWh for the average renewable PPA, underscoring the willingness of hyperscalers to pay significant premiums for reliable clean power available round the clock.

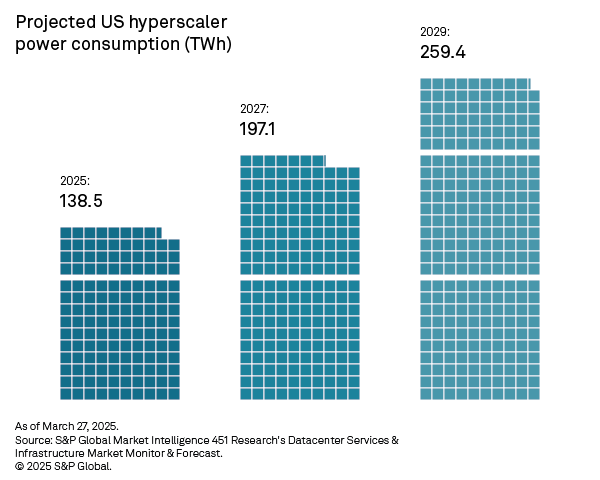

With 451 Research now anticipating annual US hyperscale energy demand to rise at a 19% compound annual growth rate from 2024 levels through 2029 to nearly 260 TWh, the probability of sustained momentum in yearly clean energy PPAs seems high, given the top four US hyperscalers' self-imposed carbon reduction targets. As of writing, Amazon, Google, Meta and Microsoft remained committed to meeting those green power objectives.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Adam Wilson contributed to this article.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

Data visualization by Joseph Reyes and Chris Allen Villanueva. Cartography by Leigh Lunas.

For wholesale prices and supply and demand projections, see the S&P Global Market Intelligence Power Forecast.