Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

11 Jul, 2016 | 07:00

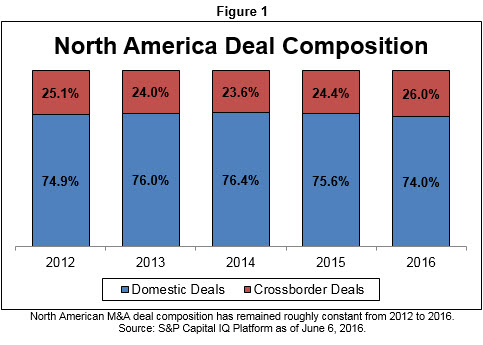

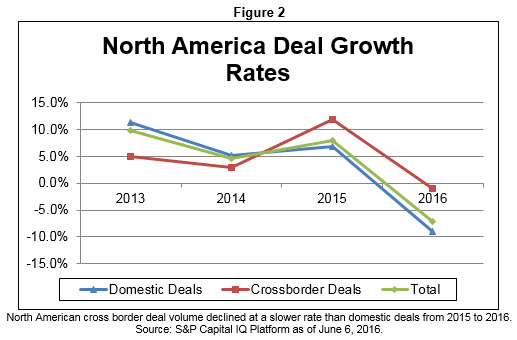

With total merger and acquisition activity slowing down in North America, we wanted to analyze the effect on domestic and crossborder mergers and acquisitions. According to Figure 1 below, crossborder deals have consistently represented only 24.6% to 26.0% of M&A deal volume in North America over the last 5 years. However, in Figure 2, we can see that while all deal volume is falling from 2015 to 2016, crossborder deal volume is declining at a slower rate than domestic deals. With the world becoming more interconnected through trade and globalization, one implication is that crossborder deals are likely to increase in 2016 and into the future.

Learn more about the tools and products used in this analysis, and discover additional blog posts on mergers and acquisitions.