Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — May 9, 2025

By Keith Nissen

As of March 2025, a meaningful slice of US consumers reported spending less at retail stores and online compared to last year. Some Americans are cutting back their restaurant dining, cinema attendance and even online video subscriptions.

➤ Survey data shows that three out of 10 Americans have reduced their spending at retail stores and are dining out at restaurants less frequently than a year ago. Older adults (55+) were most likely to indicate reduced retail store spending and fewer restaurant visits.

➤ When it comes to dining out at restaurants, older Americans tend to be cutting back, while younger adults are eating out more frequently.

➤ Reduced consumer spending may also cause a decline in online video subscriptions and cinema attendance. Survey data shows, however, that the use of free online video services will not necessarily benefit much from these spending cutbacks as usage remains fairly stable.

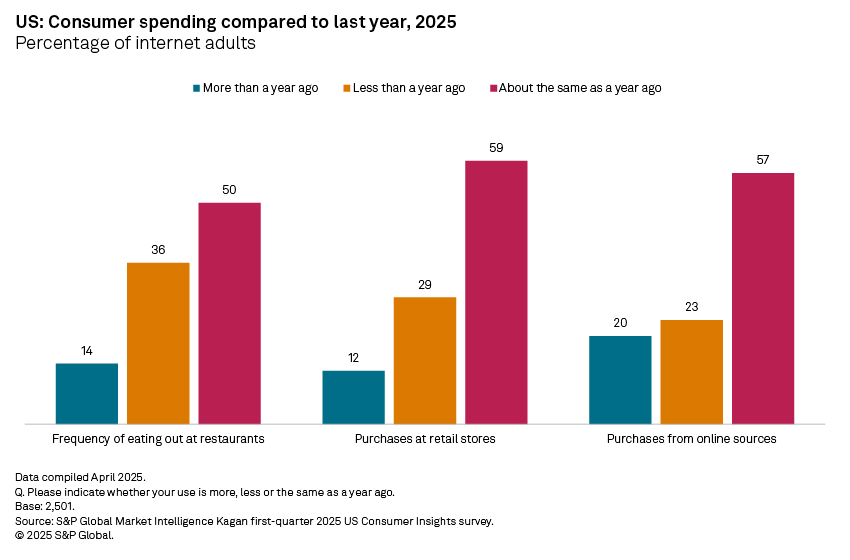

The S&P Global Market Intelligence Kagan first-quarter 2025 Consumer Insights survey asked respondents to assess how their behavior in 2025 has compared to last year. For instance, 29% of total internet adults said they were spending less this year at retail stores compared to only 12% citing increased year-over-year spending. With regard to online purchases, 23% said they were spending less in 2025, while 20% reported a higher level of spending this year. Over one-third (36%) indicated they were dining out at restaurants less frequently this year, more than double the 14% that have increased their restaurant visits.

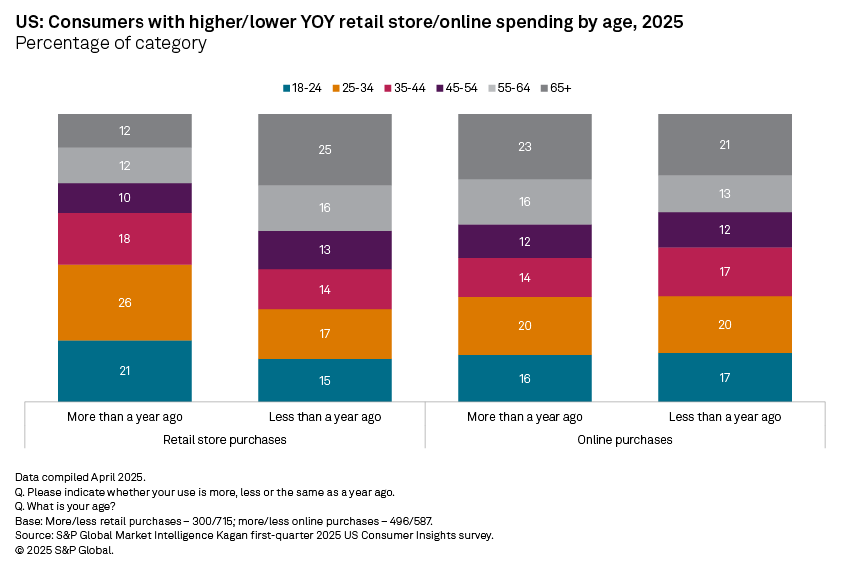

Among those spending more at retail stores in 2025 than last year, nearly half (47%) were young adults, ages 18-34. Older adults, aged 55 and above constitute approximately one-quarter (24%) of those with increased retail spending this year. Those spending less at retail stores in 2025 were slightly skewed toward older 55+ adults (41%) with 32% in the 18-34 age bracket.

The 2025 age distribution among those spending more or less from online sources appears to be more uniform than for retail store spending. Approximately four in 10 (39%) of those indicating increased online spending this year were older 55+ adults; very similar to the 36% of younger 18-34 year-olds who expected higher online spending in 2025. The age distribution for those spending less online in 2025 closely mirrored that of the increased online spenders.

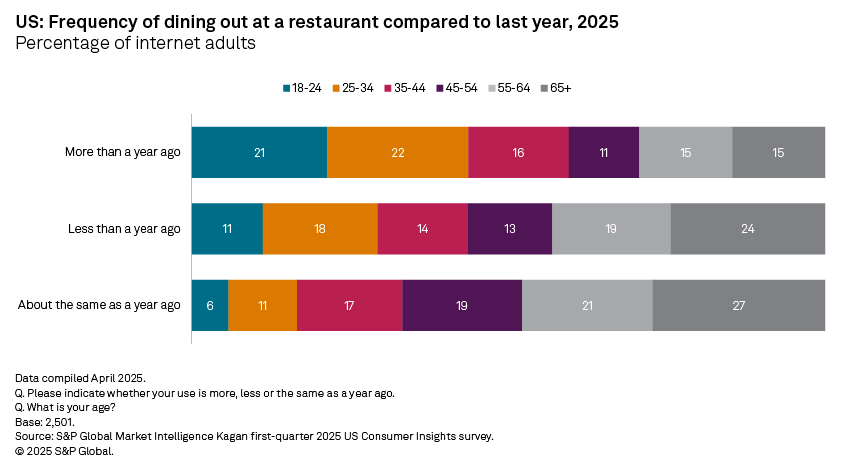

When it comes to dining out at restaurants, the survey data shows that older Americans tend to be cutting back, while younger adults are eating out more frequently. The data reveals that 43% of those who said they are spending less at restaurants in 2025 were adults aged 55 and older. Similarly, 43% of those with increased restaurant visits year over year were young adults (18-34).

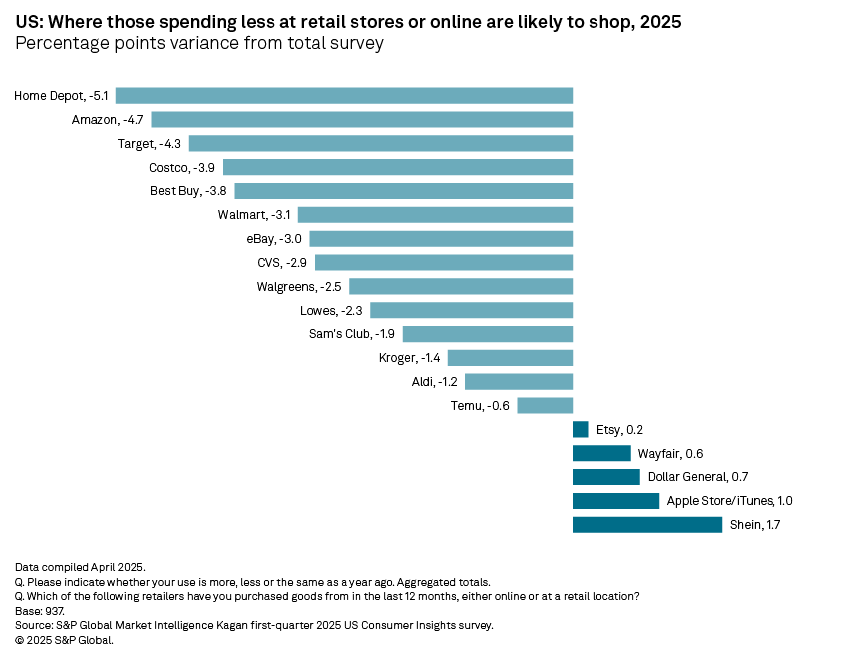

When US consumers cut their retail store and online spending, which retailers will continue to get their money? To assess this, the following chart depicts the percentage point variance between the retailers used by those with reduced spending in 2025 and the overall survey. For example, the survey found that 32% of those with reduced 2025 spending shop at the Home Depot, compared to 37% of the total survey sample, yielding a negative five percentage point variance. Reduced consumer spending has the potential to impact nearly all retailers, ranging from e-commerce giants like Amazon to big box retailers (Target and Costco), drug stores and the home improvement sector.

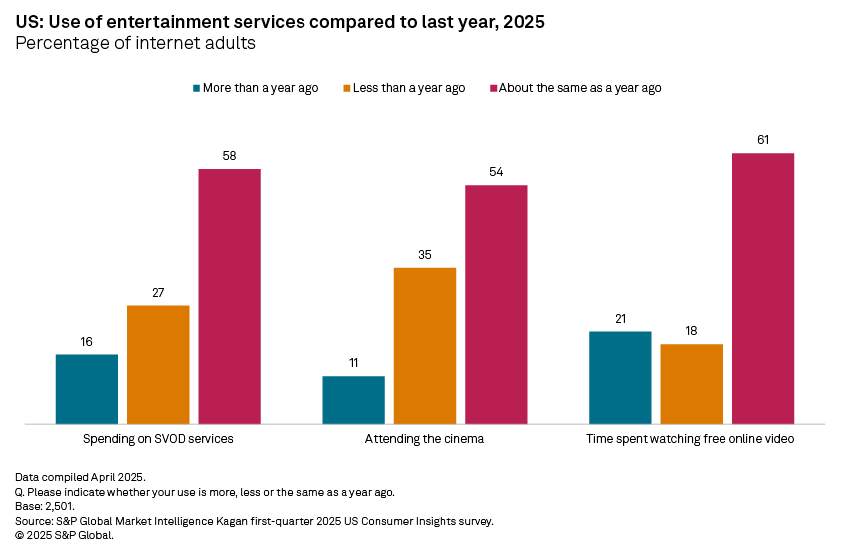

The entertainment sector is not immune to economic pressures that reduce consumer spending. The survey found that 27% of US internet adults have fewer online video subscriptions (SVOD) in 2025 than last year, while 16% have subscribed to additional SVOD services. Over one-third (35%) said they have been attending the cinema less in 2025, more than three times (11%) those that are seeing more movies this year. Time spent watching free online video appears to be fairly stable with 21% having more viewing hours in 2025, compared to 18% with fewer viewing hours.

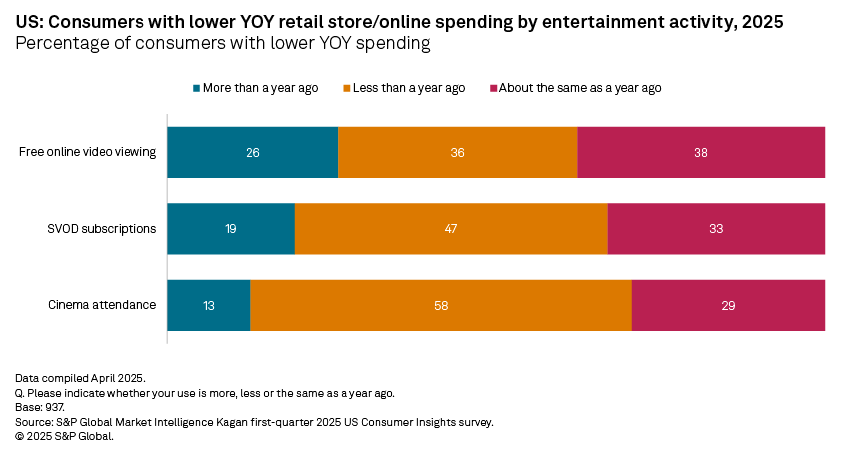

Among those spending less at retail stores or online in 2025, 58% said they were also attending the cinema less often, and approximately half (47%) have fewer SVOD subscriptions than last year. Yet, 36% of these reduced spenders said they also are spending less time watching free online video, significantly more the 26% that reported having more free online video viewing hours this year. This suggests that free online video services will not necessarily benefit greatly from consumers spending less on SVOD services and in-theater movies.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Economics of Networks is a regular feature from S&P Global Market Intelligence Kagan.

The Kagan first-quarter 2025 US Consumer Insights survey was conducted in March 2025. The survey consisted of approximately 2,501 internet adults with a margin of error of +/-1.9 ppts at the 95% confidence level. Survey data should only be used to identify general market characteristics and directional trends.

Consumer Insights is a regular feature from S&P Global Market Intelligence Kagan.