Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 1 Dec, 2023

By Jessica Fuk

Amid the growing dominance of Amazon.com Inc.'s Prime Video and Netflix Inc., market fragmentation among numerous players remains a challenge in Japan's over-the-top industry. U-NEXT's (USEN-NEXT HOLDINGS Co.Ltd.) acquisition of Premium Platform Japan Inc.-owned Paravi marked the first major M&A transaction in the market. However, further consolidation moves are necessary for U-NEXT or any other player to gain a market presence comparable to that of the two global streaming giants.

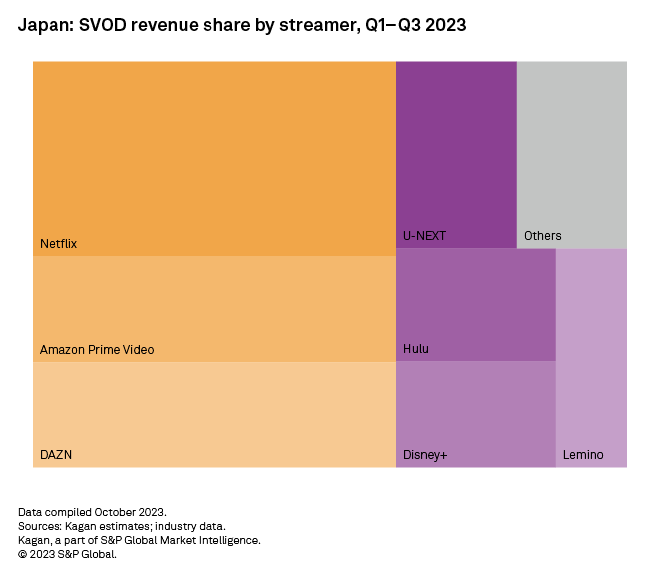

➤ Achieving a sizable subscription base is not the end of the story, as global streamers accounted for over two-thirds of Japan's total subscription revenue in the first three quarters of 2023.

➤ Market fragmentation provides room for consolidation but could also be a hurdle, as it involves various companies that can be rivals in other related businesses.

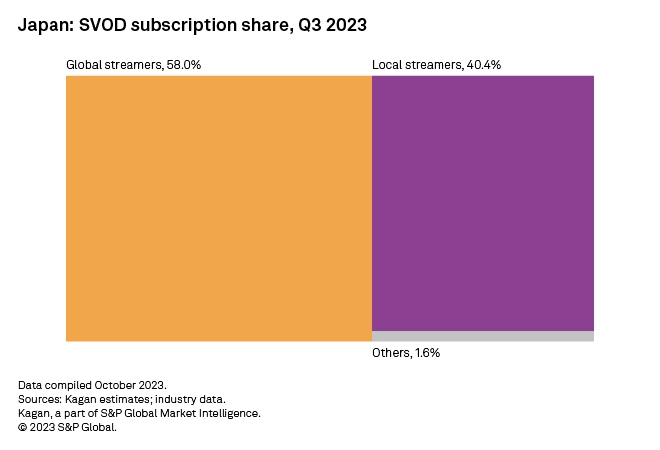

Prime Video and Netflix account for nearly half of Japan's total SVOD subscriptions and subscription revenue as of the third quarter of 2023. Together with DAZN Group Ltd. and Disney+ of Walt Disney Co., international streaming services add up to 58% of the market's total subscriber base. Kagan estimates that the rest is split among other companies, with 11 major local platforms totaling slightly over 40%.

The situation is even more challenging when it comes to revenue share. Subscriptions to international online video services tend to be priced higher when compared to local platforms. DAZN's entry pack is priced at ¥980 per month, while Netflix's ad-supported tier costs ¥790 per month. Yet our model indicates over 95% of DAZN and Netflix's subscribers still opt for the premium tiers as of September 2023. Both companies are projected to have the highest average revenue per subscription (ARPS) in Japan since 2021. Netflix contributed to nearly 30% of the market's total subscription revenue in the first three quarters of 2023.

U-NEXT's ARPS is the highest among local services. Following the merger, former subscribers of Paravi now pay the original monthly subscription fee of U-NEXT, which is ¥1,089. An entry subscription to other local platforms ranges from ¥500 to ¥900 per month, and the simple "one fee for all" structure is still the most widely adopted in Japan. NTT Docomo Inc. is the only local operator that has recently raised prices but did not follow the path of global competitors to diversify its pricing structure. Local streamers could be reluctant to raise prices as most of them struggle with subscription growth and are concerned that price hikes could lead to increased churn.

Platforms would have to improve their offerings to justify price hikes. U-NEXT has been confident with its premium pricing because of its variety of premium content, including premium sports, general entertainment and anime. Players with a smaller subscriber base and revenue could find it harder to expand their investment in content. Some have actively sought out collaboration with content providers and competitors to utilize windowing to minimize content acquisition costs.

Content cost saving could be one of the most important synergies to be considered for consolidation. Before the merger, U-NEXT tended to specialize in foreign content and anime and valued Paravi's robust collection of Japanese drama and variety programs that came from previous owners Tokyo Broadcasting System Television Inc., TV TOKYO Holdings Corp., Wowow Inc. and eight of their affiliated local broadcasters.

The number of broadcasters behind the ownership and operation of Paravi was the highest among other local platforms. The success of the U-NEXT-Paravi deal indicates the willingness of the local broadcasters to cooperate with U-NEXT, whose background lies in technology, on distributing content digitally. As a result of the consolidation, TBS now owns 20% of shares in U-NEXT.

Summing up the subscriber bases of Lemino and d anime store, NTT DOCOMO owns the largest subscription share among other local players in the market. Telco rival KDDI Corp. has a 50% share in TELASA, but the market share of TELASA is fairly small. Major broadcaster services include HJ Holdings, Inc.-operated Hulu, TELASA, ABEMA of AbemaTV Inc., FOD Premium, NOD and TV Tokyo Biz. While Hulu, TELASA and ABEMA are jointly owned with other parties, FOD Premium, NOD and TV Tokyo Biz are owned-and-operated services of Fuji Television Network Inc., NHK (Japan Broadcasting Corp.) and TV Tokyo respectively.

Similar to the U-NEXT-Paravi deal, consolidation between services with different backgrounds could be more likely. Given the examples of Hulu and Paravi, it is also not uncommon for local broadcasters to unite and cooperate on a single platform. Perhaps more of a struggle for broadcasters would be finding a way to balance SVOD growth and revenue generated from coproduction and syndication deals with the global streaming giants.

Blog