Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 15 Feb, 2023

By Xiuxi Zhu and Fed Mendoza

Asia-Pacific multichannel operators have become hybrid providers, with both traditional multichannel and virtual multichannel or over-the-top subscription offerings launched in recent years, according to Kagan's 2022 survey of OTT partnerships and virtual multichannel services. The study also noted the increasing popularity of online video-streaming services and dwindling traditional pay TV subscriptions. Many telcos without their own pay TV services have also launched streaming video platforms to compete with both multichannel operators and third-party OTT providers.

As of November 2022, Kagan has identified 32 VMC or OTT services launched by telco or pay TV operators across 15 markets in Asia-Pacific.

Slowing traditional pay TV growth

Telco and pay TV operators' active participation in the online streaming market is growing while many of the region's top operators continue to lose traditional multichannel customers. Our market-level forecasts show the number of pay TV subscribers will continue to plummet over the next 10 years across Asia-Pacific's most advanced video markets, such as Australia, Hong Kong, Singapore, Japan and New Zealand. Meanwhile, India, Indonesia, Pakistan, the Philippines and Thailand, the major emerging markets in South and Southeast Asia, are expected to experience steady growth throughout the forecast period.

Telco and pay TV operators can easily create synergy by offering their own OTT or VMC services as demand for streaming services continuously expands. Some mature multichannel markets, such as Singapore, Australia and New Zealand, have seen self-run online streaming businesses offset traditional TV losses, create new revenue streams and reduce subscriber churn.

Multichannel operators transition to streaming video in mature markets

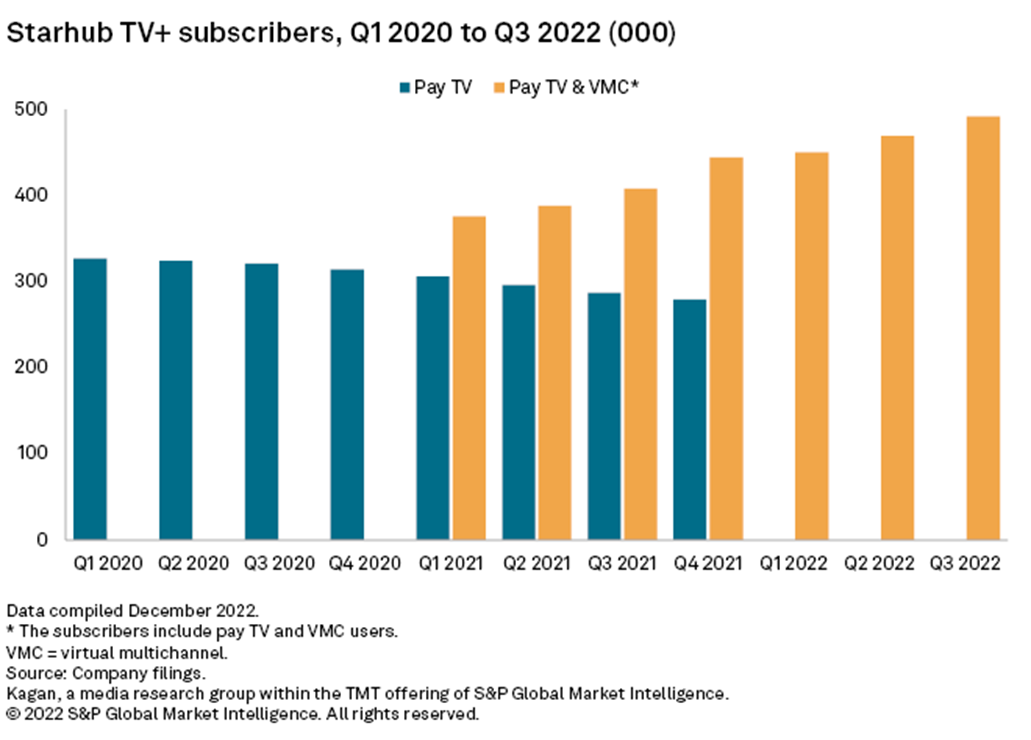

Singaporean telco StarHub Ltd. transformed its IPTV service TV+ and TV+ Pro into a VMC platform in September 2020, allowing users to watch streaming content and linear channels across TV, mobile and web without a requirement to use Starhub's internet connection.

The availability of linear channels and video-on-demand content on all platforms helped attract more users to Starhub's streaming business despite continuous losses of pay TV users through the end of 2021.

As an early streaming adopter, Australian pay TV and broadband operator Foxtel Cable Television Pty Ltd. launched two OTT platforms that cater to customers with different viewing preferences. Kayo, launched in November 2018, is a sports streaming service, whereas Binge, launched in May 2020, is a multi-genre entertainment service with movies, drama, reality shows, sitcoms and documentaries, among others. As of the third quarter of 2022 … …

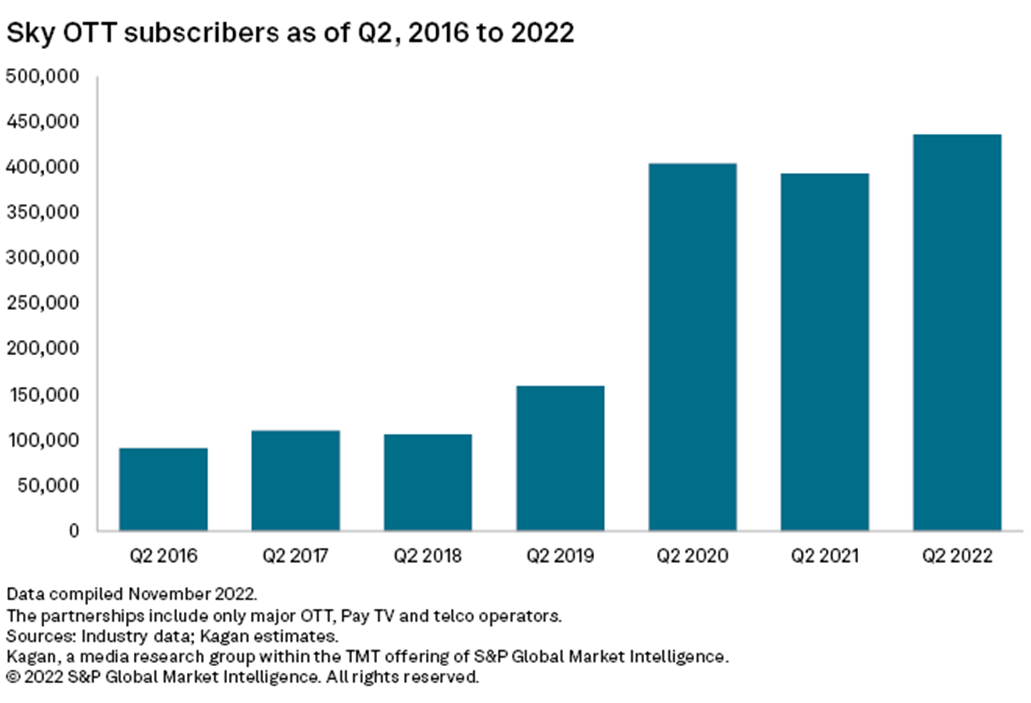

In New Zealand, direct-to-home incumbent Sky Network Television Ltd.'s streaming customer base spiked in the second quarter of 2020 following the company's acquisition of Spark's Lightbox service, which merged into Sky's existing Neon OTT platform. As one of the pioneers of streaming video, Sky has benefited from the rapid growth of VMC/OTT services in recent years. As of the second quarter of 2022, Sky reported 436,388 streaming subscribers comprising users of Neon, Sky Sport Now, RugbyPass and retransmission.

OTT allows mobile operators to compete with pay TV incumbents in emerging markets

The popularity of VMC indicates that viewers still want linear TV content when it is available but prefer more choices of streaming platforms. This trend gives telcos (including mobile operators) without pay TV businesses a chance to step into the streaming market, especially in regions where fixed broadband, multichannel and online streaming penetrations are relatively low, such as India, Indonesia and Vietnam.

For example, India's mobile penetration is estimated to reach 89% in 2022 and over 100% in 2031, while its OTT penetration as of year-end 2021… …

Telcos globalize local OTTs

While most pay TV operators and telcos focus on their home markets and often bundle streaming services with their multichannel offers, South Korea carrier SK Telecom Co. Ltd.'s Wavve and Hong Kong telco PCCW Ltd.'s Viu operate more independently from traditional businesses and aim for regional and global expansion with their pure OTT services.

Viu successfully gained viewers across Southeast Asian and Hong Kong markets with abundant offerings of South Korean content. Recently, it started to invest more in content production to strengthen its regional presence in competition with global players such as Netflix Inc.

SK Telecom-backed Wavve, the second-most-popular streaming platform in South Korea after Netflix, hopes to grow further globally as well. It acquired the U.S.-based South Korean content streaming portal Kocowa in December 2022 to start its global business through Kocowa's distribution in more than 30 regions, including the U.S., Canada, Mexico and Brazil.

Other than releasing their own online streaming platforms, most telcos and multichannel providers have also inked partnership deals with OTT business owners to tap into the emerging online streaming market.

Already a client? Click here to read the full report, including detailed data of telcos’ self-run OTTs and specifics of the strategies.

Clients can Read our research on the partnership with OTTs.

Global Multichannel is a service of Kagan, a group within S&P Global Market Intelligence's TMT offering.

Already a client? Read the full report here

Blog

RESEARCH