Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 21 Sep, 2021

By Atif Hussain

Exclusive features and news analysis of key sectors and markets. Subscribe on LinkedIn >

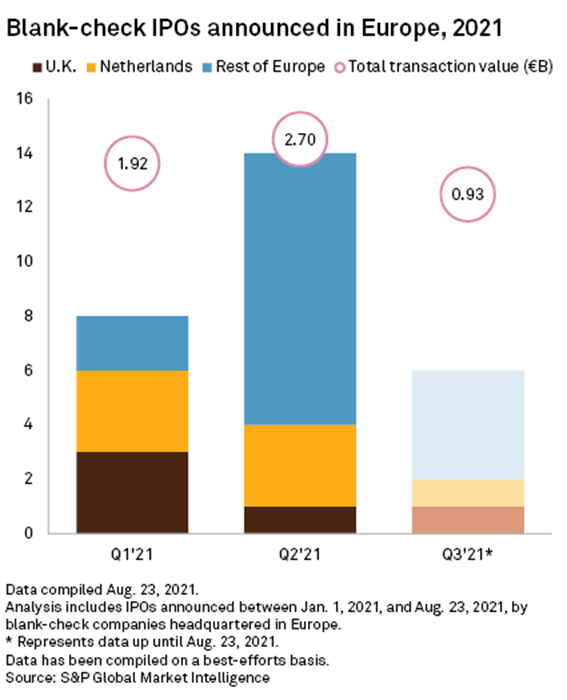

In this edition, we take a close look at private equity-backed special purpose acquisition company IPOs in 2021, which have already soared past 2020’s entire tally. As of Aug. 23, there have been 80 private equity-backed SPAC IPOs, nearly double the 44 figure from last year. The U.S. has continued to dominate the global SPAC scene in 2021, but London is making efforts to ease competition rules to pry away SPAC listings, a move that could open the door for more offerings of such type. Additionally, close to three dozen SPACs have disclosed deals in the clean-tech sector this year.

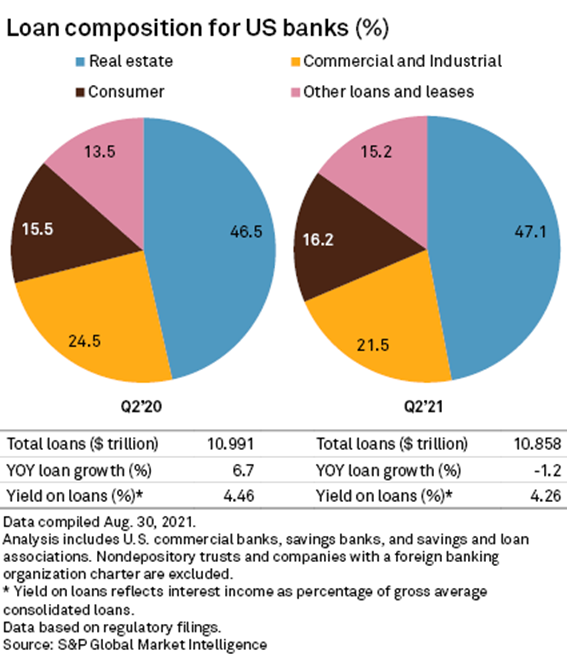

U.S. banks continued to put more cash to work in the bond market in the second quarter, but many institutions are proceeding with caution and remain hesitant to invest at low yields, fearing higher interest rates lie around the corner. Many banks expect higher rates due to heightened inflation and the Federal Reserve's eventual tapering of asset purchases in the bond markets.

The London Metal Exchange three-month copper price rebounded to $9,534 per tonne Sept. 10, after a broad sell-off in mid-August saw the price drop to $8,784 per tonne.

PE-backed SPACs in 2021 soar past last year's tally

The number of private equity-backed special purpose acquisition company IPOs across the globe in 2021 through Aug. 23 is nearly twice the amount of such offerings in all of 2020.

—Read the full article from S&P Global Market Intelligence

Clean-tech SPACs keep rolling in as sector seeks to prove itself

Close to three dozen special purpose acquisition companies have announced mergers in the clean-tech sector so far this year, although the market has slowed in recent months.

—Read the full article from S&P Global Market Intelligence

Changes to UK SPAC rules open door for more listings

Tighter rules stopped London from becoming a major center for listings of special purpose acquisition companies during the height of their popularity earlier this year but the tide may turn due to recent change in the U.K. regime.

—Read the full article from S&P Global Market Intelligence

Deep Dives

In-depth features looking at the impact of major news developments in key industries.

Financials

Mid-tier banks gain deposit share as money center rivals hold back on growth

Big banks' efforts to put a cap on large accounts appears to have pushed some deposits downstream, but poaching primary relationships could still be a challenge for regionals.

—Read the full article from S&P Global Market Intelligence

Banks slow to invest in bonds, fearing the reaper of higher rates

Banks' securities portfolios are slowly shifting toward longer-dated bonds as excess liquidity appears likely to stick around longer than originally anticipated.

—Read the full article from S&P Global Market Intelligence

Banks turn to M&A for piece of home improvement spending spree

U.S. banks are targeting growth in home-improvement financing through acquisitions, as they look to tap a market offering high returns, limited risks and a COVID-fueled demand boom.

—Read the full article from S&P Global Market Intelligence

Florida bank buyers pay up after consolidation wave leaves fewer targets

Lenders seeking to expand through acquisitions in the state are paying higher valuations amid a shortage of potential partners.

—Read the full article from S&P Global Market Intelligence

Loan-to-deposit ratios at US banks drop further, reaching lowest level on record

The aggregate loan-to-deposit ratio at U.S. banks has declined dramatically through the pandemic and reached its lowest level in decades, hitting 58% in the second quarter.

—Read the full article from S&P Global Market Intelligence

Insurance

GEICO excludes 'distorted' 2020 data in supporting latest round of rate hikes

The nation's No. 2 private auto insurer and several of its peers continue to employ different methods of addressing unprecedented 2020 results in formulating actuarial indications to support future rate changes.

—Read the full article from S&P Global Market Intelligence

Heavy losses persist in Fla. residential insurance market, total $529M in H1'21

Net income losses persist for insurers operating in the Florida residential property market, and some are receiving capital contributions to boost their policyholder surpluses.

—Read the full article from S&P Global Market Intelligence

Credit and Markets

US debt ceiling fight could cause markets to tumble, delay Fed taper

Congress has yet to reach a deal on raising the debt ceiling, and the impasse might rattle markets and force the Federal Reserve to wait to begin reducing its monthly bond purchases.

—Read the full article from S&P Global Market Intelligence

Energy and Utilities

Oil, gas capital raises in August: Total inches up to $4.35B on debt offerings

Through August, most of the represented oil and gas sectors again pulled in lower capital raises compared to the same period a year earlier.

—Read the full article from S&P Global Market Intelligence

LNG growth helps support US gas pipeline construction through 2026

Of the 45 pipeline projects projected to come online over the next five years, at least 16 are tied to natural gas liquefaction terminals on the Gulf Coast, with six terminals expected to begin commercial service in 2024 alone.

—Read the full article from S&P Global Market Intelligence

Healthcare

Cost of Care: Biotech VCs fret over 'thumb on the scale' Medicare reform plans

Life science venture capitalists have voiced concerns that U.S. lawmakers' proposals to cut patient costs by reforming Medicare's prescription drug coverage might discourage key investment in the sector.

—Read the full article from S&P Global Market Intelligence

COVID-19 therapy developers top highest-paid US biopharma CEOs of 2020

Sorrento Therapeutics CEO Henry Ji took home $163.8 million primarily in options, while Regeneron Pharmaceuticals CEO Leonard Schleifer received over $135 million, mostly in stock.

—Read the full article from S&P Global Market Intelligence

Real Estate

Green bonds growing as a share of REIT debt issuance

Debt offerings with proceeds earmarked toward investments in sustainable real estate properties have grown in popularity in 2020 and 2021, and may offer a pricing advantage over conventional bonds.

—Read the full article from S&P Global Market Intelligence

PE zombie funds reinvented for 'crown jewel' strategy

The market for general partner-led secondaries has heated up in the wake of the pandemic, but one unhappy party in a chain of relationships could lead to a failed sale.

—Read the full article from S&P Global Market Intelligence

Technology, Media and Telecommunications

Netflix dives into UK reality TV ahead of new competitors' arrivals

The addition of unscripted content could be the tipping point for younger fans of the genre to subscribe to the streamer.

—Read the full article from S&P Global Market Intelligence

US coal stocks boom as free cash expected to flow on higher prices

Coal demand has been rebounding from lows hit during the start of the COVID-19 pandemic, and the additional free cash flow offers an opportunity to reduce debt in a sector with looming environmental and social challenges.

—Read the full article from S&P Global Market Intelligence

The Week in M&A

JPMorgan Chase open to more acquisitions to fill in product gaps

Read full article

Home Bancshares CEO expects more growth in Texas after Happy Bancshares deal

Read full article

HSBC targets wealthy Asia market, is confident it can handle regional challenges

Read full article

Amid plunging margins, securities services industry faces further consolidation

Read full article

Lumen's $7.5B asset deal drives media, telecom M&A activity in August

Read full article

The Big Number

Trending

Read more on the S&P Global Market Intelligenceand follow @BrianJScheid on Twitter.

S&P Capital IQ Pro. A single platform for essential intelligence.

Do you need a single source of industry intelligence? Discover the S&P Capital IQ Pro platform. Bringing together an unrivaled breadth and depth of data, news, and research, combined with tech-forward productivity tools. All in one platform that powers your edge.

Live and On-Demand Webinars:

Essential Regulator’s Toolkit: Demystifying Complexities in Digital Transformations

Watch now

University Essentials: From Crisis to Resilience – Navigating Sustainable Recovery

Register now

Additional Insights from S&P Global Market Intelligence

Check out other weekly newsletters highlighting our exclusive features and analysis:

ESG Insider: News and insights into environmental, social and governance developments driving change in business and investment decisions. Click here to subscribe.

Policy Intel: Explore exclusive news and research on policy and regulatory developments in the U.S. and around the globe. Click here to subscribe.

Essential Healthcare: Our guide to the week's top headlines in pharmaceuticals, biotech, hospitals, medtech and more. Click here to subscribe.

Private Equity Pulse: Need-to-know investments. Sharp insight. Private Equity Pulse offers our top picks of global private equity news stories. Click here to subscribe.

NEXT: Stay up-to-date on how technology is reshaping the future of industries across global markets. Click here to subscribe.