Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 28 Feb, 2023

By Sarah Cottle

Today is Tuesday, February 28, 2023, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly.

In this edition of Insight Weekly, we reexamine the impact of the Russia-Ukraine war across sectors as the conflict passes the one-year mark. The war has created rifts between Russian and European banking systems, increasing risks for lenders on both sides. Western banks' exposures to Russia have declined to their lowest level in almost two decades, while sanctions have caused major Russian lenders' withdrawal from several European markets. Many countries plan to regionalize their supply chains for crucial metals and minerals because of trade bans with Russia. Europe's restricted access to Russian fossil fuels has pushed the continent toward renewable energy sources. Foreign private equity and venture capital investment in Russia dropped 93.1% year over year to $42.9 million in 2022, according to S&P Global Market Intelligence data.

European insurers are facing difficulties in assessing the cost of the Russia-Ukraine war. Companies are unable to calculate the extent of claims by clients in different markets. Political risk, aviation and marine markets are among the most affected business lines.

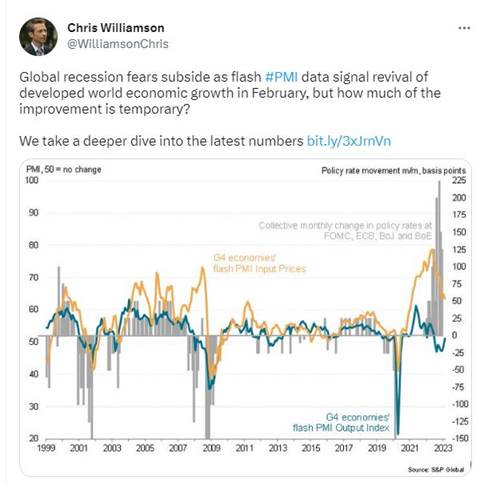

Economic growth rebounded across the U.S., U.K., eurozone and Japan in February, allaying fears of near-term recessions, according to the latest provisional S&P Global PMI survey data. The service sector drove the expansion, with business activity rising for the first time in eight months. Manufacturing continued to lag, but the rate of contraction in output has cooled.

The Big Number

Trending

—Read more on S&P Global Market Intelligence and follow @WilliamsonChris on Twitter

Data That Delivers

When markets are unpredictable, get transparent insight with our integrated ecosystem of data, analytical solutions, and delivery channels. We help clients navigate market volatility, achieve their digital transformation goals, and automate workflows.

Explore the S&P Global Marketplace to find fundamental and alternative datasets available seamlessly via Cloud, Data Feed, API Solutions, and Capital IQ Pro, along with expert analysis you won´t find anywhere else.

Additional Insights from S&P Global Market Intelligence

Increase your competitive edge with essential insights delivered straight to your inbox. We offer complimentary newsletters on a wide variety of topics to help you stay on top of what’s moving the markets, separating the immaterial from the invaluable. Review our newsletters and sign up here.

IHS Markit is now part of S&P Global.

Written and compiled by Waqas Azeem

Theme