Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Feb 21, 2023

Eurozone business activity growth accelerated to a nine-month high in February, reflecting an improved performance of the service sector and a return to growth of manufacturing output. Growth has been buoyed by rising confidence as recession fears fade and inflation shows signs of peaking, though manufacturing has also benefitted from a major improvement in supplier performance.

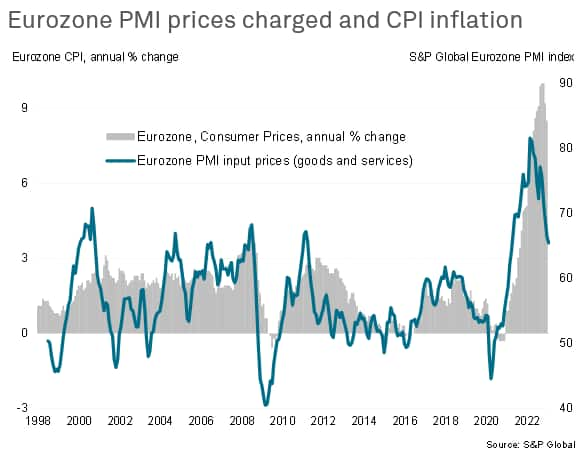

Input cost inflation meanwhile cooled further, notably in the manufacturing sector. However, the survey hints at persistent elevated price trends in the service sector which, alongside accelerating output growth, will encourage a further hawkish stance among ECB policymakers.

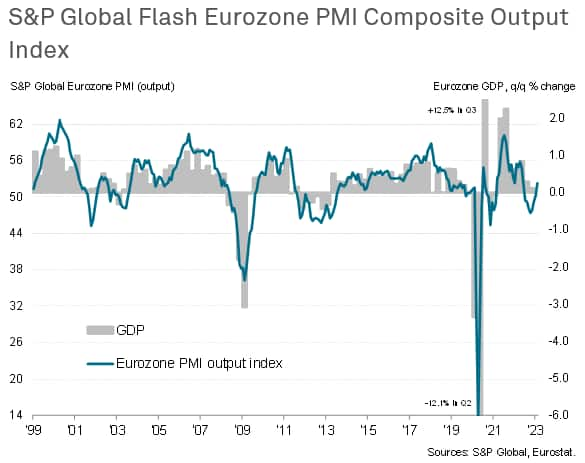

The seasonally adjusted S&P Global 'flash' Eurozone PMI® Composite Output Index, based on approximately 85% of usual survey responses, rose for a fourth successive month in February, climbing to 52.3 from 50.3 in January to indicate the strongest expansion of business activity since last May.

February's PMI is broadly consistent with GDP rising at a quarterly rate of just under 0.3%.

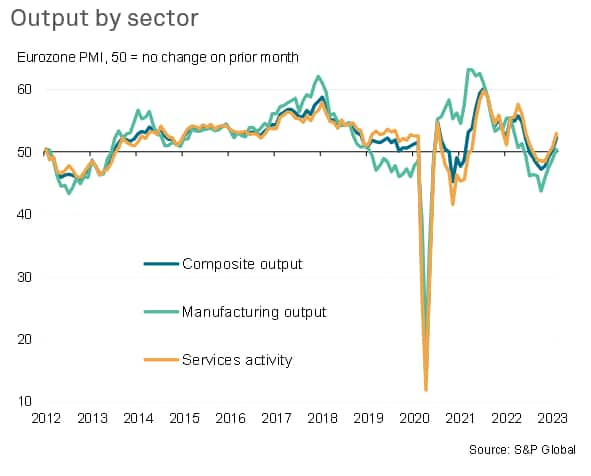

February's upturn was led by the service sector, where business activity rose for a second consecutive month. The respective seasonally adjusted index rose from 50.8 in January to 53.0 to register the strongest expansion since last June. Manufacturers meanwhile eked out a modest gain in production, the factory output index up from 48.9 to 50.4 in February to signal the first increase in production since last May.

A key change in the services sector was the revival of growth in financial services activity, albeit with real estate remaining in decline, as well as resurgent tourism & recreation and media activity. Transportation broadly stabilised after seven months of decline, industrial services gained momentum and IT services enjoyed a surge in activity.

On the manufacturing side, chemical & plastics and basic resources remained the main areas of weakness while food & drink, household goods and industrial goods manufacturing showed further signs of recovery. Auto making likewise continued to pull out of the slump seen last year.

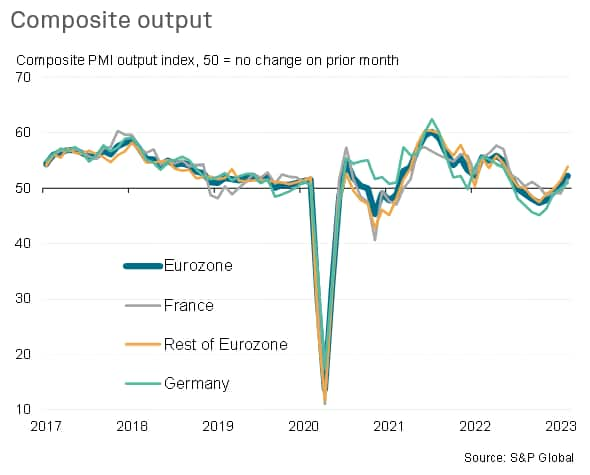

Within the euro area, both France and Germany returned to growth for the first times since last October and last June respectively. The composite PMI for France rose from 49.1 to 51.6, albeit with growth confined to the service sector. The composite PMI for Germany meanwhile edged up from 49.9 to 51.1 reflecting a second successive monthly rise in service sector activity and the first expansion of manufacturing output since last May.

However, it was the rest of the eurozone as a whole that reported the strongest performance, the composite index up from 51.4 to a nine-month high of 53.9 thanks to broad-based growth of manufacturing and services.

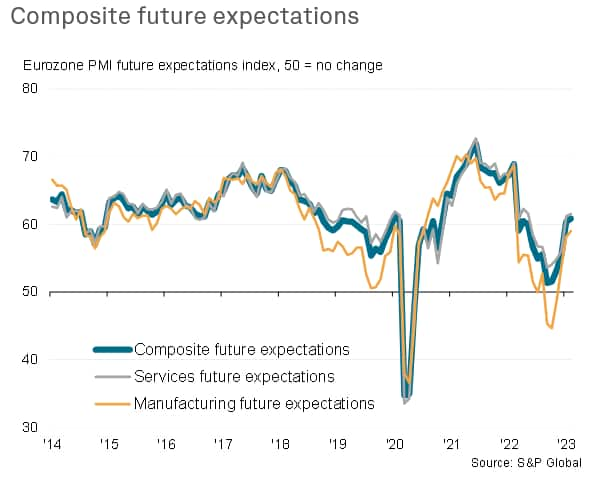

Optimism about the year ahead also nudged higher in February, rising to a one-year high, though was merely in line with the survey's long-run average. Future sentiment has nevertheless improved considerably in both manufacturing and services since late last year, attributed by survey respondents to fewer concerns over the possibility of a deep recession, reduced worries around energy supply and prices, as well as signs of a peaking of inflation and improved customer enquiries.

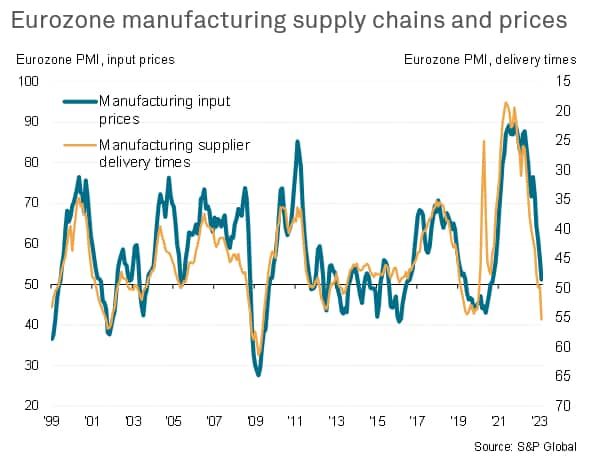

In manufacturing, the renewed growth of output was also often linked to improved supply chains, with average supplier delivery times shortening for the first time since January 2020, and to the greatest degree since May 2009. An especially marked improvement in supplier performance was recorded in Germany, where a survey record shortening of lead times was reported.

Improved supplier performance was commonly linked to fewer supply chain shortages, in addition to facilitating higher output, helped take pressure off industrial input prices which rose only modestly in February and at the slowest rate since September 2020.

Softer manufacturing cost inflation also often reflected weak demand for inputs, with purchasing by factories dropping sharply again in February as firms remained focused on inventory reduction.

In contrast, service sector firms reported a further steep rise in average input costs, the rate of inflation of which edged higher in February to remain among the steepest recorded over the history of the survey, albeit down from last year's peaks.

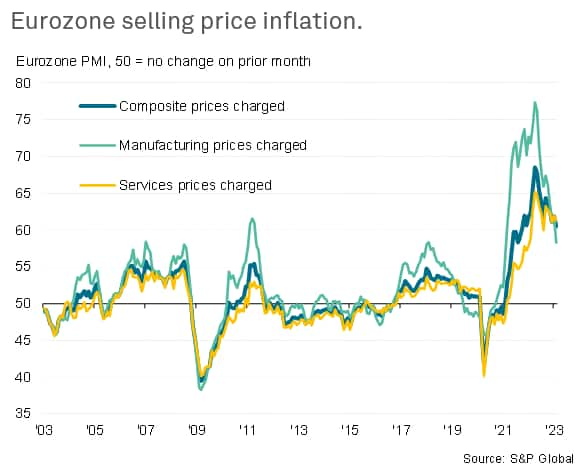

Average prices charged for goods and services meanwhile continued to rise sharply, increasing at solid rates in both manufacturing and services as firms sought to pass higher costs on to customers, including in many cases greater staff costs.

Although in both manufacturing and services, the rate of selling price inflation moderated compared to January - with manufacturing output price inflation notably down to a two-year low - to register the softest overall increase in prices charged for goods and services since October 2021, both rates remain elevated by historical standards.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location