Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 14 Feb, 2023

By Sarah Cottle

Today is Tuesday, February 14, 2023, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly.

In this edition of Insight Weekly, we take a look at funding risks as the age of cheap funding ends. European banks face holes in interest income, reduced liquidity and higher deposit and financing costs; many banks are enduring costlier funding as depositors focus more on certificates of deposit and away from non-interest-bearing accounts; and nine out of 13 investment banks, broker/dealers and capital market companies included in the S&P Global Market Intelligence analysis reported lower EPS year over year and five recorded EPS declines quarter over quarter.

While 62.4% of U.S. adults either had a job or were seeking one in January, slightly up from 62.3% in December 2023, that figure remains below the pre-pandemic rate of 63.3% in February 2020. According to the U.S. Bureau of Labor Statistics, the lower labor participation rate means that there are roughly 2.3 million fewer adults working than otherwise would be.

U.S. private equity and venture capital deals in Japan surged in 2022 with deals valued at $13.31 billion from $8.12 billion in 2021. In comparison, U.S. investments in China in 2022 dropped 76% year over year to $7.02 billion from $28.92 billion, according to reporting from S&P Global Market Intelligence.

The Big Number:

Trending

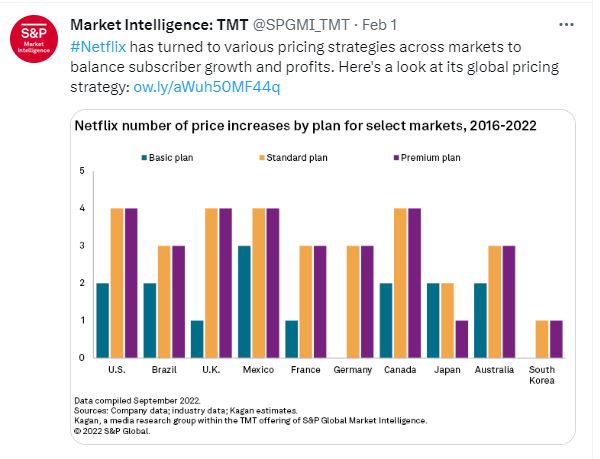

—Read more on S&P Global Market Intelligence and follow @SPGMI_TMT on Twitter

Data That Delivers

When markets are unpredictable, get transparent insight with our integrated ecosystem of data, analytical solutions, and delivery channels. We help clients navigate market volatility, achieve their digital transformation goals, and automate workflows.

Explore the S&P Global Marketplace to find fundamental and alternative datasets available seamlessly via Cloud, Data Feed, API Solutions, and Capital IQ Pro, along with expert analysis you won´t find anywhere else.

Additional Insights from S&P Global Market Intelligence

Increase your competitive edge with essential insights delivered straight to your inbox. We offer complimentary newsletters on a wide variety of topics to help you stay on top of what’s moving the markets, separating the immaterial from the invaluable. Review our newsletters and sign up here.

IHS Markit is now part of S&P Global.

Written and compiled by Alex Virtucio

Theme