Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

7 Feb, 2023

Short sellers continued to place wagers against consumer discretionary stocks in January, even as inflation appears to be cooling, while a bank focused on cryptocurrency leads the list of most-shorted U.S. stocks.

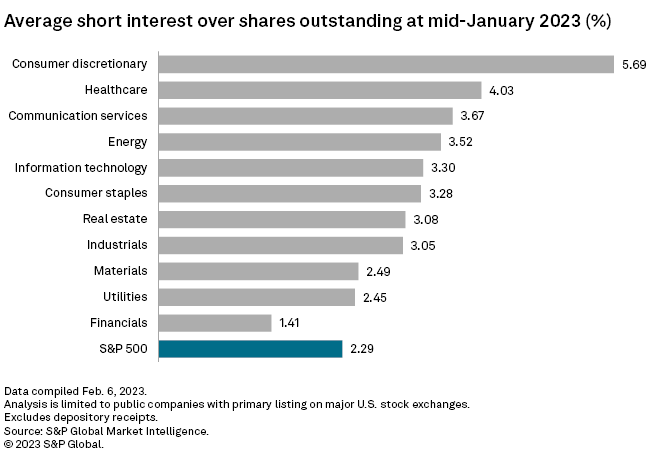

Short interest in consumer discretionary stocks, the most-shorted sector in 2022, was at 5.69% in mid-January, roughly where it has been since November 2022, according to the latest S&P Global Market Intelligence data. Short interest, which measures the percentage of outstanding shares held by short sellers, averaged 2.29% for the S&P 500 at the end of last year.

Consumer discretionary has been the most-shorted sector in U.S. equities since inflation climbed near 40-year highs and sellers assumed demand would decline as prices rose. Healthcare, the second most-shorted sector, had short interest of 4.03% as of mid-January, its highest level since October 2022.

Most shorted

Eleven of the 30 most-shorted stocks on major U.S. exchanges in this period were consumer discretionary stocks. Within that sector, Carvana Co., Bed Bath & Beyond Inc. and EVgo Inc. were the three most-shorted companies.

Those companies also made the top five most-shorted U.S. stocks overall. Cryptocurrency-focused bank Silvergate Capital Corp., which has been hit hard by the collapse of FTX Trading Ltd., was the most-shorted stock as of mid-January with 62% short interest.

Sector breakdown

Short interest in consumer staples stocks fell to 3.28% in mid-January, its lowest point in at least a year. Consumer staples was the most-shorted sector in late spring of last year but has fallen sharply from 7.7% in May 2022.