Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 28 Jul, 2021

Subject line: Earnings learnings; Duke Energy hits back; PE activity surges

Exclusive features and news analysis of key sectors and markets. Subscribe on LinkedIn >

In this edition, we take a closer look at how companies across various sectors are faring at the halfway mark of a tumultuous year. Many are expected to report year-over-year revenue and profit growth, aided by favorable prior-year comparisons and stronger economic conditions in the first part of 2021. However, with uncertainty around issues ranging from COVID-19 variants to inflation, analysts remain cautious on the outlook for future growth.

Duke Energy has been the subject of Elliott Investment Management’s attention, a position no company wants to find itself in. The activist investor last week reiterated its concerns over the utility company’s leadership team, citing “anemic EPS growth and poor returns for shareholders as a result of avoidable operational, investment and strategic setbacks." In an interview with S&P Global Market Intelligence, Duke CFO Steven Young defended the company’s track record and said there is no strategic sense in Elliott’s proposals.

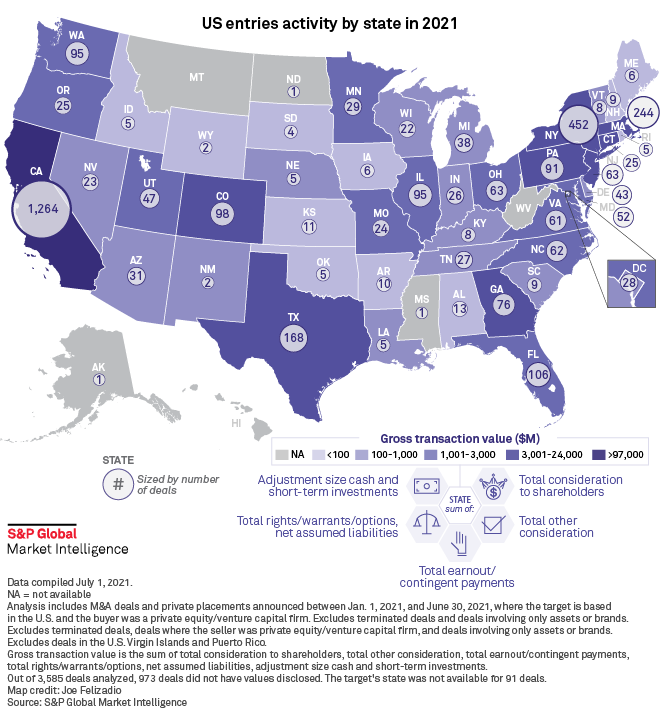

U.S. private equity activity reached a five-year high in the first half of 2021, with some 3,585 deals worth more than $200 billion recorded, Market Intelligence data shows. Fundraising also rose during the period, leaving $984.6 billion of dry powder to be invested in U.S. businesses.

Big US bank earnings outperform, but growth concerns prevail

There has been a lot of good news in second-quarter reports so far, but markets appear to be looking for signs of a stronger bounce in lending volumes.

‐ Read the full article from S&P Global Market Intelligence

Midstream sector's ESG push under spotlight for Q2 earnings

According to analyst consensus, the 11 major North American pipeline companies analyzed by S&P Global Market Intelligence should mostly record year-over-year increases in adjusted EBITDA and revenues.

‐ Read the full article from S&P Global Market Intelligence

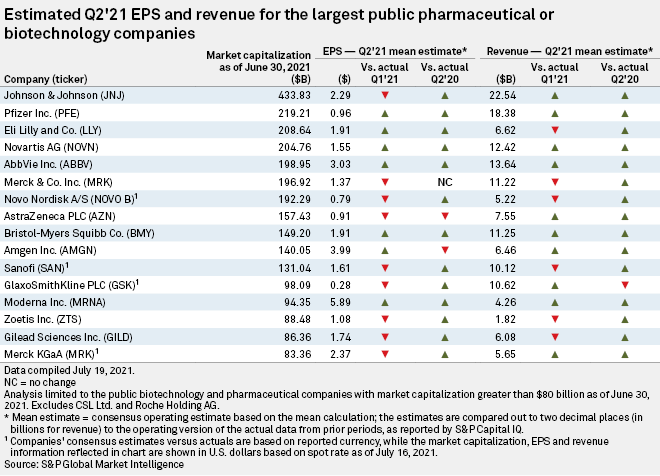

Biopharma's Q2'21 forecast reflects slow COVID recovery with pockets of revenue

The outlook for second-quarter earnings in the biopharmaceutical sector shows a potential uptick from the same quarter a year ago, according to industry analysts, but experts remain cautious as the global economic recovery continues.

‐ Read the full article from S&P Global Market Intelligence

Deep Dives

In-depth features looking at the impact of major news developments in key industries.

Financials

2021 banking legislation focuses on mortgages, transparency, inclusion

An analysis of bills and legislations shows that lawmakers also concentrated on pandemic relief during the first half of the year.

‐ Read the full article from S&P Global Market Intelligence

European, US investment banks aim to cash in on GCC's 'excellent growth outlook'

Saudi Arabia and the United Arab Emirates accounted for two-thirds of M&A activity in the wider Middle East and North Africa region in the first half of 2021.

‐ Read the full article from S&P Global Market Intelligence

Asian banks' crypto-asset push calls for harmonized regulations across markets

DBS Group recently established a digital exchange and launched an initial offering of tokenized securities. South Korea's Woori Bank, Shinhan Bank, NongHyup Bank and KB Kookmin Bank are also reportedly building crypto-asset custodial services.

‐ Read the full article from S&P Global Market Intelligence

Insurance

As US wildfire threat grows, insurance capacity shrinks

Through July 19 the National Interagency Fire Center in 2021 has recorded 35,086 fires, which have burned about 2.5 million acres

‐ Read the full article from S&P Global Market Intelligence

As disasters multiply, container ship insurers face troubled seas

Claims involving large container ships are rising along with the size of vessels, marine insurance experts say. Work is underway to reduce the range of risks.

‐ Read the full article from S&P Global Market Intelligence

Credit and Markets

Delta variant fears infect markets but symptoms may be short-lived

Fears over the coronavirus strain caused steep declines in U.S. stock indexes, led to a rally in government bonds, jolted the VIX and strengthened the dollar.

‐ Read the full article from S&P Global Market Intelligence

US likely hit peak inflation as consumers switch from buying goods to services

Inflation will likely be "sticky" as it declines, not falling back to the Federal Reserve's target any time soon, experts say.

‐ Read the full article from S&P Global Market Intelligence

Energy and Utilities

Calif. power grid faces 'precarious transition period' amid gas outages

California is relying on older natural gas-fired generation during periods of high demand, but several critical gas units have faltered during recent heat waves.

‐ Read the full article from S&P Global Market Intelligence

Duke Energy CFO says activist's proposals lack 'financial or strategic benefits'

"[W]e have just not seen anything at this point that makes sense for us," Duke Energy CFO Steven Young told Market Intelligence regarding Elliott Investment Management's calls for leadership and strategy changes at the utility.

‐ Read the full article from S&P Global Market Intelligence

Private Equity

US private equity deal-making in H1 sets 5-year record

Some 3,585 deals with a gross transaction value of $201.29 billion were recorded in the first half, according to Market Intelligence data.

‐ Read the full article from S&P Global Market Intelligence

IT secures over a third of EU private equity, VC entries in H1'21

The sector accounted for 38% of total number of entries during the period with 1,023 deals having gross transaction value of €15.40 billion.

‐ Read the full article from S&P Global Market Intelligence

Technology, Media and Telecommunications

Zoom's Five9 deal sets stage for long-term growth past pandemic – analysts

Analysts say that to continue growing and compete on a larger playing field, Zoom must evolve from a pure-play video-conferencing provider to an all-purpose communication and collaboration platform — and the Five9 deal helps it do exactly that.

‐ Read the full article from S&P Global Market Intelligence

Leveraged Finance

Leveraged loans fuel Q2 LBOs at fastest pace since global financial crisis

More than a third of the buyout volume in the first half of 2021 involved tech companies.

‐ Read the full article from S&P Global Market Intelligence

The Week in M&A

United Community Banks looking to catapult growth with back-to-back M&A deals

Citizens Financial says 'stay tuned' for deal announcements

M&A activity ticks up YOY across insurance industry in H1'21

Bank M&A still off the table at Synovus, CEO says

Pinnacle Financial Partners capitalizing on M&A wave to bolster organic growth

The Big Number

Trending

‐ Read the full article from S&P Global Market Intelligence and follow @camillanaschert on Twitter

[Webinar] Beyond ESG with Climate Stress Testing: Getting Practical at Banks & Insurers

[Webinar] Global Credit Risk Trends 2021 and Beyond

Fundamentals Approach to Detect Early Signs of Private Company Credit Deterioration

Go Beyond Fundamentals to Uncover Early Signs of Private Company Credit Deterioration

Taking Loss Given Default Estimation to the Next Level: An Aspiration for All Creditors, Not Just Banks

Check out other weekly newsletters highlighting our exclusive features and analysis:

ESG Insider: News and insights into environmental, social and governance developments driving change in business and investment decisions.

Policy Intel: Explore exclusive news and research on policy and regulatory developments in the U.S. and around the globe.

Essential Healthcare: Our guide to the week's top headlines in pharmaceuticals, biotech, hospitals, medtech and more.

Private Equity Pulse: Need-to-know investments. Sharp insight. Private Equity Pulse offers our top picks of global private equity news stories.

NEXT: Stay up-to-date on how technology is reshaping the future of industries across global markets.