Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Dec 08, 2023

By Rajiv Biswas

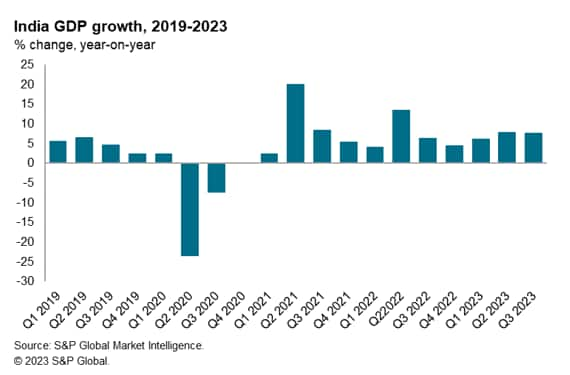

As 2023 draws to a close, India is set be the fastest growing economy in the G20 grouping of large nations. After rapid economic growth of 7.2% in the 2022-23 fiscal year, India's GDP growth rate in the fiscal year 2023-24 is forecast to be 6.9%. GDP growth remained buoyant in the July-September quarter of 2023, at 7.6% year-over-year (y/y), after growth of 7.8% y/y in the April-June quarter.

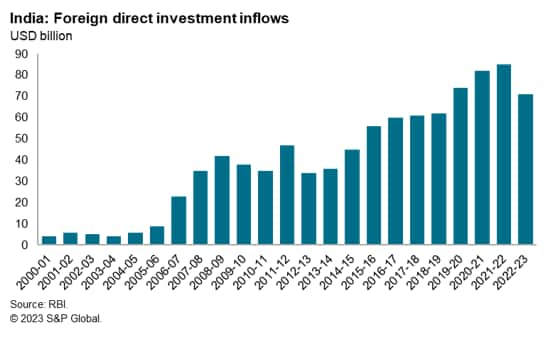

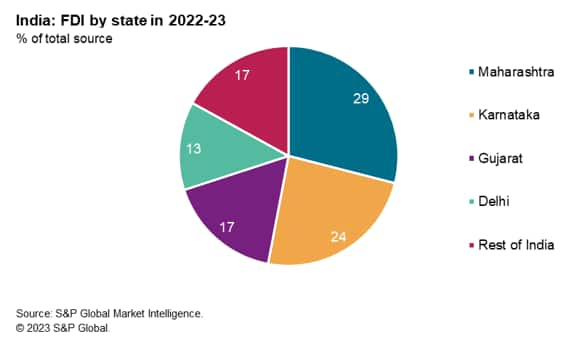

Rapid growth in the size of the domestic consumer market has made India an increasingly attractive location for multinationals across a wide range of industries, with foreign direct investment inflows (FDI) having reached a new record high of USD 85 billion in the 2021-22 fiscal year. In FY 2022-23, the state of Maharashtra accounted for the largest share of total FDI inflows, at 29% of the total. Karnataka accounted for a further 24% of FDI inflows, while Gujarat and Delhi were also major recipients of FDI inflows.

The Indian economy grew at a pace of 7.6% y/y in the July-September quarter of 2023, compared with growth of 7.8% y/y in the April-June quarter of 2023, according to data released by India's National Statistical Office.

Manufacturing output rose by 13.9% y/y in the July-September quarter measured at constant prices, while construction output was up by 13.3% y/y.

For the first six months of fiscal year 2023-24 from April to September, manufacturing output measured at constant prices rose by 9.3% y/y, while construction output rose by 10.5% y/y. Financial, real estate and professional services rose by 9.0% y/y.

Latest data on key economic indicators continue to show strong momentum in many sectors of the economy. Steel consumption rose by 19.5% y/y in the July to September quarter, while production of cement was up by 10.2% y/y. Sales of commercial vehicles increased by 6.9% y/y in the July-September quarter, while passengers handled at airports rose by 22.7% y/y.

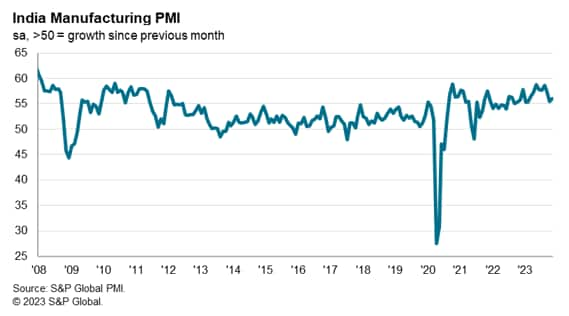

Picking up from October's eight-month low of 55.5 to 56.0 in November, the seasonally adjusted S&P Global India Manufacturing Purchasing Managers' Index (PMI) indicated a stronger improvement in operating conditions.

November data showed another substantial increase in overall levels of new work received by Indian goods producers.

With total new sales rising, demand conditions remaining positive and input supply relatively improving, Indian manufacturers scaled up production volumes. Output expanded sharply and at an above-trend pace.

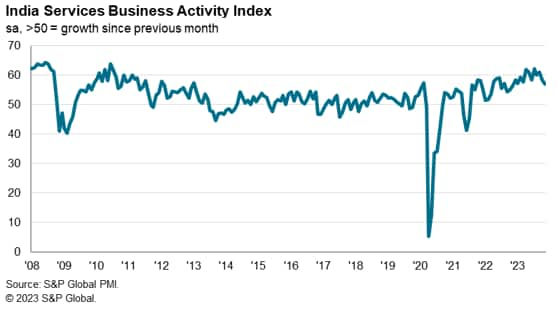

Despite moderating from 58.4 in October to 56.9 in November, the seasonally adjusted S&P Global India Services Business Activity Index continued to signal expansionary conditions for service sector output. The rate of expansion was also considerably stronger than its long-run average.

India's exports of goods and services in October 2023 rose by 9.4% y/y. However, India's exports of goods and services for the April-October 2023 period showed a modest contraction of 1.6% y/y, due to a decline in merchandise exports of 7.0% y/y in the April-October period. The decline of merchandise exports was mitigated by strong growth in services exports, which rose by 6.2% y/y over the same period.

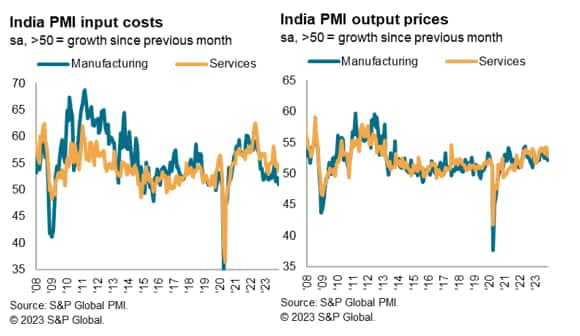

A key feature of the November Manufacturing PMI survey results was a substantial easing of manufacturing input price pressures. Although average purchasing costs rose again, the rate of input price inflation eased to the lowest in the current 40-month sequence of increases. November PMI survey data also showed that the overall rate of input price inflation for the service sector softened to an eight-month low and was below its long-run average. Consumer Services firms recorded the highest rate of input cost inflation, while the strongest upturn in selling prices was evident in the Finance & Insurance category.

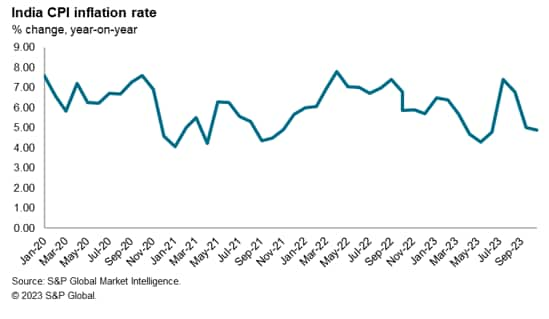

The latest statistics on India's consumer price index (CPI) showed that the headline CPI inflation rate fell sharply to 4.9% y/y in October compared to 5.0% y/y in September and 6.8% y/y in August.

The September CPI data has brought India's CPI inflation rate further within the Reserve Bank of India (RBI's) inflation target for CPI inflation of 4% within a band of +/- 2%.

Factors contributing to the moderation in the headline CPI inflation rate were a further contraction in the fuel and light subindex and further easing of the food and beverages CPI subindex.

High energy prices were an important factor contributing to India's CPI inflation pressures in 2022 but have eased during 2023. This has been helped by some moderation in world oil prices during late 2022 and the first half of 2023, as well as the impact of base-year effects owing to the spike in world oil prices in the second quarter of 2022. In October, the fuel and light subindex contracted by 0.4% y/y, after having declined by 0.1% y/y in September 2023. This compared with a rise of 4.3% y/y in August. The recent decline in the fuel and light subindex was helped by increased government subsidies for LPG cylinders for qualifying households, which helped to constrain fuel costs for households.

The food and beverages CPI subindex rose by 6.2% y/y in October, compared with 6.3% y/y in September, significantly lower compared with the increase of 9.2% y/y in August and 10.6% y/y in July.

An important factor that has contributed to the significant slowdown in the food and beverages CPI subindex in recent months has been a sharp easing of the inflation rate for the vegetables CPI subindex, which rose by 2.7% y/y in October, following a rise of 3.4% y/y in September after having surged by 26.1% y/y in August and 37.3% year over year in July. However, prices for pulses continued to show a strong increase, rising by 18.8% y/y in October after rising by 16.4% y/y in September. A key concern for the Indian government has also been rapid rises in rice prices, with the overall cereals subindex up by 10.7% y/y, similar to the increase of 11.0% y/y in September.

The RBI in its October Monetary Policy Statement maintained its projected CPI inflation rate for the current fiscal year (2023-24) at 5.4%, the same rate as the year-over-year projection made in the August Monetary Policy Statement. This represents a significant moderation from the 6.5% rise in CPI inflation in fiscal year 2022-23. The near-term trajectory of CPI inflation was projected in the RBI October Monetary Policy Statement at 6.4% y/y for the July-September quarter, 5.6% y/y for the October to December quarter of fiscal 2023-24, moderating to 5.2% y/y in the January-March quarter of 2024.

However, the RBI also noted some risks to food production from the impact of the skewed south-west monsoon so far, as well as upward pressures on food prices due to a possible El Niño event. The renewed upturn in world oil prices since July and risks of escalating conflict in the Middle East has also added some additional upside risk factors to the inflation outlook.

Helped by strong economic growth conditions, residential property prices rose by an estimated 7% in 2022 and were estimated to have risen by around 3.4% y/y in the July-September quarter of 2023, according to the All-India Home Price Index of the Reserve Bank of India. Despite moderate monetary policy tightening by the Reserve Bank of India in 2022 and early 2023, residential property price rises were boosted by post-pandemic pent-up demand as well as rising construction costs. Residential property markets in New Delhi, Bangalore, and Pune were among the leaders in terms of price gains in 2022. During 2023, Delhi housing prices rose by an estimated 4.6% y/y in the July-September quarter of 2023, while housing prices rose by an estimated 2.4% y/y in Mumbai.

Net new foreign direct investment into India has risen very rapidly in recent years, with FDI reaching a new record level of USD 85 billion in the 2021-22 fiscal year, after inflows of USD 82 billion in the previous 2020-21 fiscal year. Although FDI inflows moderated to USD 71 billion in the 2022-23 fiscal year, this compares with FDI inflows of just USD 4 billion in the 2003-04 fiscal year.

The sustained large FDI inflows over the past decade have helped to reduce India's external account vulnerability and have contributed to boost India's FX reserves.

A key contributor to strong FDI inflows over the past decade has been technology related FDI, which has become an important source of investment. The Computer Software and Hardware sector was the largest recipient of foreign direct investment equity inflows in the 2021-22 fiscal year, at around 25% of the total inflows. US technology firms have been a key source of recent FDI inflows into India.

Infrastructure investments have also been an important sector for FDI inflows. A large FDI deal in 2020 was the USD 3.7 billion investment by Singapore's GIC and Canada's Brookfield Asset Management in the acquisition of Tower Infrastructure Trust, which owns Indian telecom towers assets.

In the 2020-21 fiscal year, FDI from Saudi Arabia also rose sharply, reaching USD 2.8 billion. Saudi Arabia's Public Investment Fund acquired a USD 1.5 billion stake in Jio Platforms and a USD 1.3 billion stake in Reliance Retail in 2020.

Reliance Retail also received investment from other foreign firms in 2020, with Singapore's GIC and TPG Private Capital having invested a combined amount of USD 1 billion, while US private equity firm Silver Lake Partners also invested USD 1 billion.

By source of origin of FDI inflows, Singapore, Mauritius and United Arab Emirates were three of the four top sources of FDI inflows into India in FY 2022-23, alongside the USA. This highlights the growing importance of India's bilateral economic and investment relationships with global financial hubs in emerging markets, in addition to strong ties with advanced economies like the USA, Japan, EU and UK.

In FY 2022-23, the state of Maharashtra accounted for the largest share of total FDI inflows, at 29% of the total. Karnataka accounted for a further 24% of FDI inflows, while Gujarat and Delhi were also major recipients of FDI inflows.

The rapid growth in numbers of Indian unicorns (start-ups that have achieved a valuation of over USD 1 billion) over the past five years has also become a major focus for foreign direct investment inflows into India. By mid-2023, there were an estimated 108 Indian unicorns, with 44 of these having reached unicorn status within the 2021 year and 21 in the 2022 year, according to Invest India, the National Investment Promotion & Facilitation Agency.

After two years of rapid economic growth in 2021 and 2022, the Indian economy has continued to show sustained strong growth during the 2023 calendar year. The near-term economic outlook is for continued rapid expansion in 2024, underpinned by strong growth in domestic demand.

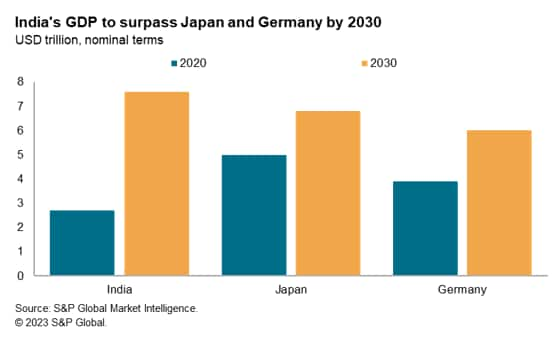

The acceleration of foreign direct investment inflows into India over the past decade reflects the favourable long-term growth outlook for the Indian economy, helped by a youthful demographic profile and rapidly rising urban household incomes. India's nominal GDP measured in USD terms is forecast to rise from USD 3.5 trillion in 2022 to USD 7.3 trillion by 2030. This rapid pace of economic expansion would result in the size of the Indian GDP exceeding Japanese GDP by 2030, making India the second largest economy in the Asia-Pacific region. By 2022, the size of Indian GDP had already become larger than the GDP of the UK and also France. By 2030, India's GDP is also forecast to surpass Germany.

The long-term outlook for the Indian economy is supported by a number of key growth drivers. An important positive factor for India is its large and fast-growing middle class, which is helping to drive consumer spending. The rapidly growing Indian domestic consumer market as well as its large industrial sector have made India an increasingly important investment destination for a wide range of multinationals in many sectors, including manufacturing, infrastructure and services.

The digital transformation of India that is currently underway is expected to accelerate the growth of e-commerce, changing the retail consumer market landscape over the next decade. This is attracting leading global multinationals in technology and e-commerce to the Indian market.

By 2030, 1.1 billion Indians will have internet access, more than doubling from the estimated 500 million internet users in 2020. The rapid growth of e-commerce and the shift to 4G and 5G smartphone technology will boost home-grown unicorns like online e-commerce platform Mensa Brands, logistics startup Delhivery and the fast-growing online grocer BigBasket, whose e-sales have surged during the pandemic.

The large increase in FDI inflows to India that has been evident over the past five years is also continuing with strong momentum evident even during the pandemic years of 2020-2022. India's strong FDI inflows have been boosted by large inflows of investments from global technology MNCs such as Google and Facebook that are attracted to India's large, fast-growing domestic consumer market, as well as a strong upturn in foreign direct investment inflows from manufacturing firms.

Overall, India is expected to continue to be one of the world's fastest growing economies over the next decade. This will make India one of the most important long-term growth markets for multinationals in a wide range of industries, including manufacturing industries such as autos, electronics and chemicals to services industries such as banking, insurance, asset management, health care and information technology.

Access the India Manufacturing PMI and India Services PMI press releases.

Rajiv Biswas, Asia Pacific Chief Economist, S&P Global Market Intelligence

© 2023, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location