Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 22 Feb, 2024

By Tony Lenoir and Adam Wilson

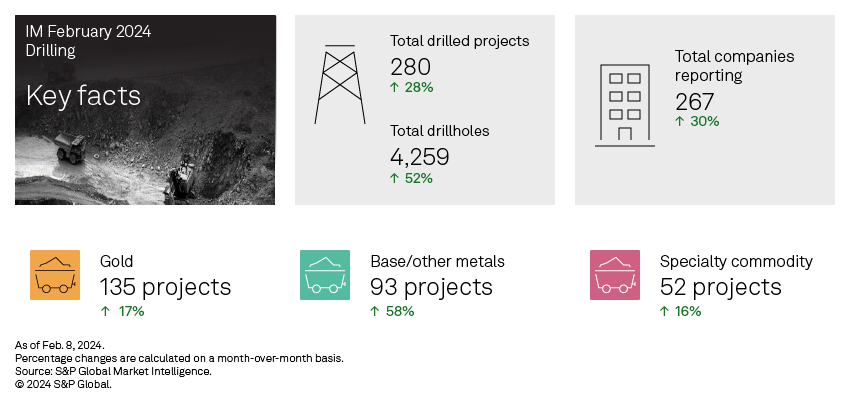

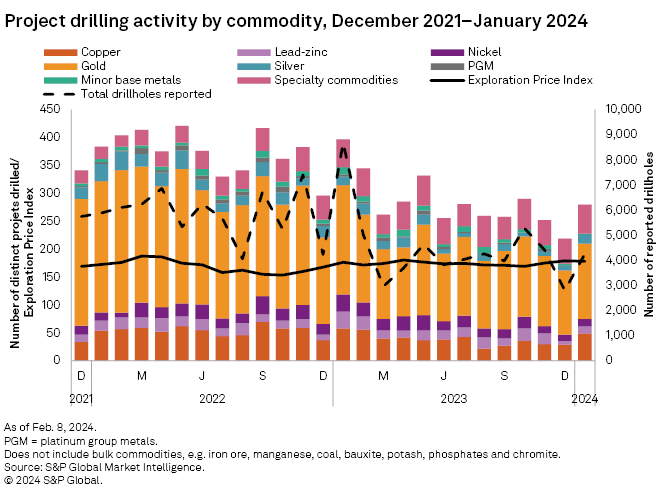

After a slow end to 2023, January started 2024 with a bang, seeing a significant boost across all drilling metrics. Drilling increased among all project stages in January, with late-stage increasing 44% to 121 projects, minesite up 40% to 49 and early-stage up 10% to 110. Both projects drilled and drillholes also saw month-over-month increases in January, but those metrics were down year over year, falling 29% and 51%, respectively, compared to January 2023.

Access January drill results data in the accompanying Excel spreadsheet.

Projects reporting drilling jumped 28% in January after two consecutive months of declines at the end of 2023. Increases were seen in gold, copper, nickel, lead-zinc, silver and specialty metals, with only small declines in platinum group metals and minor base metals projects. Drillholes reported in January soared, up 52% after a 45-month low in December 2023. All metals saw increases in holes drilled, with the exception of the platinum group metals, which dropped slightly.

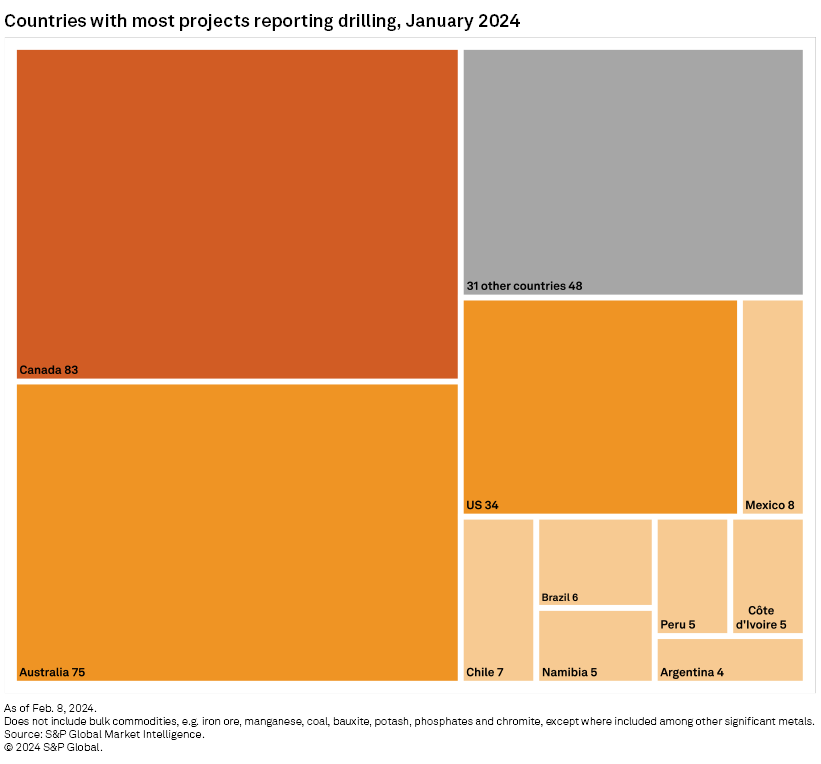

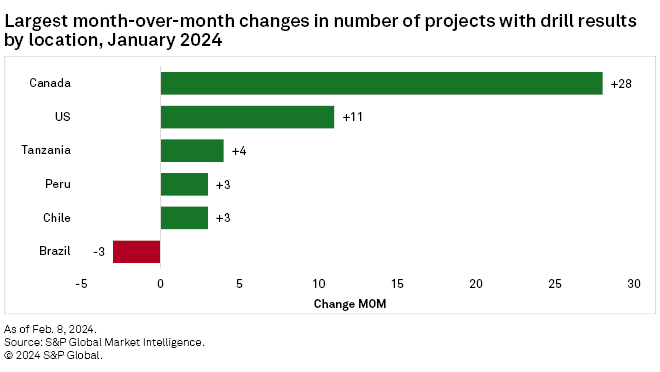

Canada overtook Australia in project count for the first time since January 2023, jumping a staggering 51% to 83 projects. Australia kept steady with 75 projects reporting, and the US saw a substantial increase month over month, up 48% to 34 projects reporting.

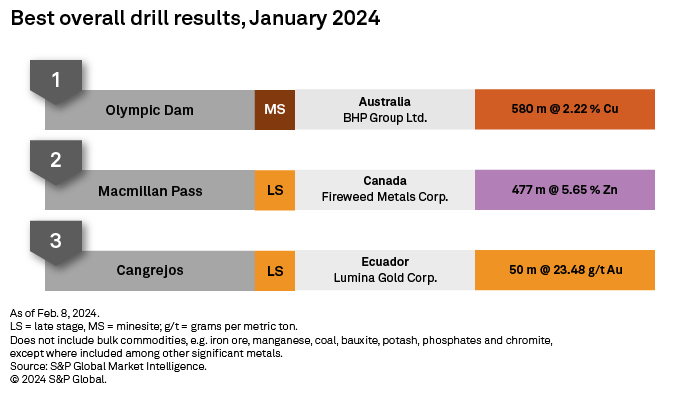

January's top result came from Australian Securities Exchange-listed BHP Group Ltd.'s Olympic Dam copper mine in South Australia, which reported an intersect of 580 meters grading 2.22% copper. Results from recent exploration activity at the mine show that mineralization above 1% copper grade continues 2 km along strike and more than 1 km in depth. The extent of mineralization has not yet been discovered, and further drilling will be required for an updated estimate of mineral resources.

TSX Venture Exchange-listed Fireweed Metals Corp.'s Macmillan Pass zinc project in the Yukon turned in January's second-best result. The company reported its best results to date from the Boundary Zone area of the project, with the highlight being an intercept of 477 meters grading 5.65% zinc. Step-out holes continue to increase the extent of known mineralization and support the interpretation of a continuous high-grade feeder zone. Assays are pending for 19 more drillholes from the Boundary Zone, the Tom deposit and the Jason deposit.

Rounding out the top three results is TSX Venture Exchange-listed Lumina Gold Corp.'s Cangrejos gold project in Ecuador. The company announced results from its 2023 drilling campaign in support of the ongoing feasibility study, including an intersect of 50 meters grading 23.48 grams per metric ton of gold.

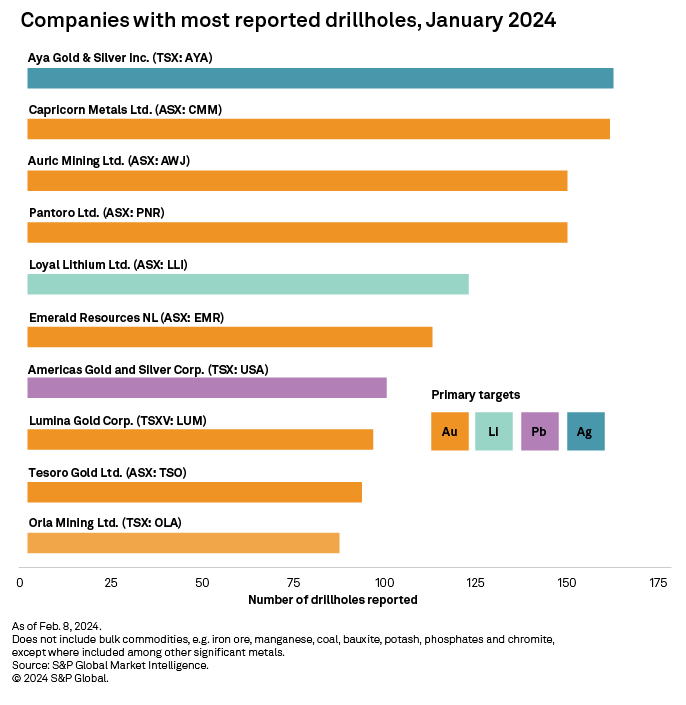

TSX-listed Aya Gold & Silver Inc. reported the most drillholes in January, with 156 holes between its Zgounder mine and Boumadine project, both in Morocco. Aya — the only TSX-listed pure silver mining company — is based in Canada and operates solely in Morocco, where its Zgounder mine is under expansion and its Boumadine project is in the prefeasibility stage of development.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.