Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

28 Mar, 2018

Insurance

By Ben Dyson and Husain Rupawala

Swiss Re AG took the biggest hit to underwriting performance from the 2017 natural catastrophes of the world's biggest four reinsurers, while Hannover Re got off relatively lightly, data from S&P Global Market Intelligence shows.

Hannover Re, Swiss Re, Munich Re Co. and Scor SE all reported combined ratios, which show claims and expenses as a percentage of premiums, higher than the 100% breakeven point in the second half of 2017 because of claims from the natural catastrophes, meaning all four made an underwriting loss.

But not all of the reinsurers suffered equally. Catastrophe claims contributed 40.97 percentage points to Swiss Re's second-half combined ratio of 130.86%. At the other end of the spectrum, catastrophe claims only added 18.80 points to Hannover Re's combined ratio, meaning that, unlike its competitors, it was only just over the 100% mark at 103.12%, and it remained profitable overall in the period.

U.S. exposure tells

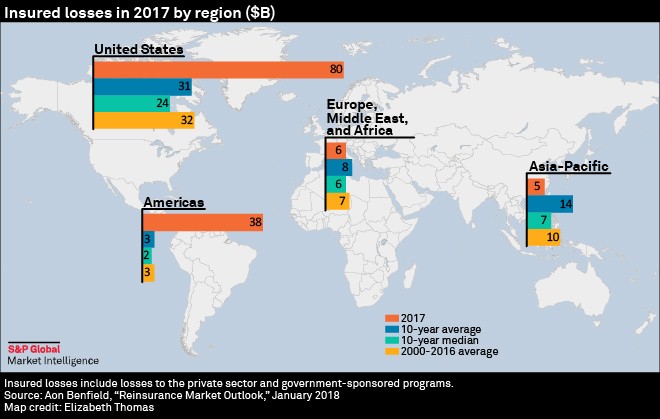

The reason for the difference in hits across the big four was exposure to the U.S., where the bulk of the insured losses came from, as well as how much retrocession — insurance for reinsurers — they bought to protect themselves, according to analysts.

"Hannover Re has a lower market share in the U.S. and, like Scor, is a much bigger purchaser of retrocession," said Sanford C Bernstein analyst Thomas Seidl.

Helvea analyst Daniel Bischof agreed, saying that "One main difference here is that Munich and Swiss are mainly net writers and do not buy a lot of retrocession, which is not the case for Scor and Hannover Re."

Although there were differences, analysts also said the big four, and the reinsurance industry as a whole, coped well with the catastrophe losses, despite it being a record year. 2017 was the most costly year for natural catastrophe insurance claims since 1970, according to data from Swiss Re's Sigma research unit. Insured losses came in at $131.01 billion, according to the Sigma figures, just higher than 2011's $131.00 billion, and also an increase on 2005's $129.73 billion.

The market was hit by a series of disasters in the second half of the year, most notably hurricanes Harvey, Irma, and Maria. Most global reinsurers were hit by the natural catastrophes, with Lloyd's of London, for example, pushed to a £2.00 billion full-year loss and a 114% combined ratio.

Solvency strength

The bill may have been big, but the big four's solvency ratios remained above 200%, and despite the catastrophe blows in the second half, all four made a profit at group level for the full year — though much smaller than 2016's profit.

Bischof said: "None of them canceled a dividend. None of them canceled any extraordinary capital management measures like the special dividend at Hannover Re and the buybacks at Swiss Re, Munich Re, and Scor. That shows that the balance sheets are extremely strong."

Part of the reason reinsurers in general coped well, Seidl said, was that the bulk of the loss was made of up of three midsized catastrophes — hurricanes Harvey, Irma, and Maria — which meant that the burden was split roughly 50/50 between the primary insurance market and the reinsurance market. Furthermore, alternative forms of reinsurance, including catastrophe bonds, helped take the sting out of the U.S. windstorm exposures, in particular for the reinsurers.

"If it had been just one event above $100 billion, then the reinsurance share would be a lot higher, and we probably would have seen a different impact, not only on reinsurance but also on alternative capital," said Seidl.

Strong capital positions often mean that mergers and acquisitions are on the cards, and French insurer Axa's planned acquisition of XL Group has whetted the market's appetite for big deals. But analysts expect the big four reinsurers to restrict themselves to small "bolt-on" deals that add specialisms or allow them to build up in areas other than their core reinsurance business.

For example, Munich Re CEO Joachim Wenning told analysts on March 15 that his company's main area of interest for acquisitions was primary insurance — something that could be added either to its Ergo primary insurance unit or its specialty risk business.

Seidl said: "[M&A] is unlikely because reinsurance is a global business distributed predominantly and increasingly by global brokers, so it just means the big companies in particular see any business they want to see."